In today’s fast-paced & competitive business environment, procurement, finance, and sales teams are under increasing pressure to move faster, stay compliant, and improve partner experiences. Whether it’s onboarding a new distributor for nationwide product rollout or bringing a customer onboard with the proper documentation and credit checks, time, precision, and transparency are everything.

However, the reality is far from ideal. Manual processes, decentralized data, and fragmented communications continue to plague onboarding cycles, whether it’s customer onboarding or channel partner onboarding, like dealers and distributors. The result? Lost opportunities, delayed go-lives, compliance risks, and frustrated partners.

This blog unpacks how organizations can bridge the gap between old-school onboarding and the digital future, starting with a deep dive into where things stand today and where they can go tomorrow, especially when it comes to optimizing customer onboarding and channel partner onboarding strategies.

Current Dealer-Distributor Onboarding Process

Procurement teams often initiate by collecting physical documents from distributors—trade licenses, GST registration, bank details—and hand over them through a lethargic, multi-layered verification system. Delays in approvals, courier-based dispatches, and a lack of visibility disrupt the process.

Process Breakdown:

- Document Collection: Manual KYC and compliance documentation

- Verification: Outdated, non-standardized manual checks

- Approval: Email-based approvals lack audit trails

- Agreement Signing: Physical signatures that delay execution

- Storage: Decentralized, physical document repositories

Current Customer Onboarding Process

Sales and finance teams often face similar blockages when onboarding customers. From form submissions to due diligence, the journey lacks transparency, automation, and real-time validation.

Process Breakdown:

- Submission: Paper forms or static PDFs

- Validation: Manual data entry and KYC

- Internal Routing: Approvals via Excel trackers or email

- Documentation: Physical contracts or scanned PDFs with no signing traceability

- Visibility: Customers receive little to no updates on onboarding status

These inefficiencies continue to derail streamlined customer onboarding and delay revenue recognition.

Loopholes in Current Processes

The gaps in these workflows go beyond incompetence—they can impact bottom lines, brand reputation, and compliance outcomes.

Key Challenges:

- No audit trail or validation logic

- Risk of human error and compliance breaches

- Delays leading to partner churn or stalled sales cycles

- Lost or misplaced documents and contracts

- Siloed document storage and poor tracking

Process Gaps by Industry Segment

Retail: Delays in inventory planning due to incorrect distributor onboarding.

Pharma: Manual compliance checks increase audit risk.

Manufacturing: Supplier onboarding errors affect production timelines and tax credit eligibility.

FMCG: Lack of standardized onboarding disrupts supply chains and campaign rollouts.

Real Estate: In-person customer KYC verification slows down unit bookings.

Ideal Onboarding Processes

Modern onboarding journeys highlight automation, compliance, and seamless integration.

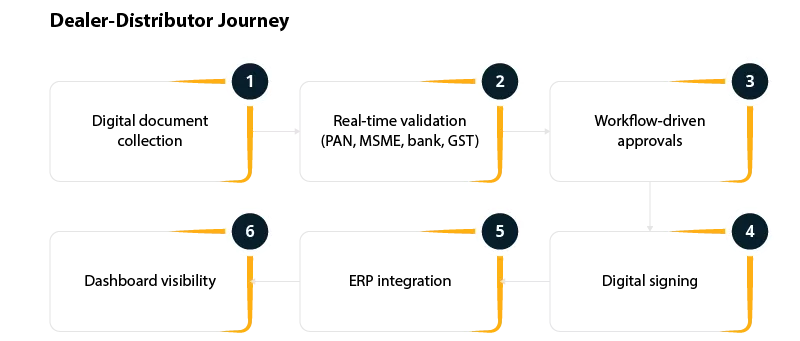

Dealer-Distributor Journey

Digital document collection: Collect personal identification (PAN, Aadhaar), GST, bank, and business documents through a secure digital channel.

Real-time validation: Ensure one-click real-time validation of PAN, MSME registration, bank details, and GST details.

Workflow-driven approvals: Application and documents route through a predefined path and authority for internal approvals.

Digital signing: Digital signing of contracts, reducing manual errors, and ensuring fast-track processing.

ERP Integration: Ensure real-time sync of approved contracts into a core ERP system for operational access.

Dashboard visibility: Real-time insights into onboarding status and current partner dealer activity.

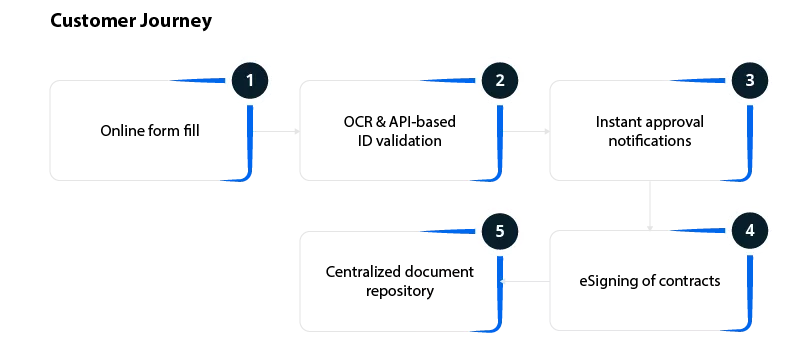

Customer Journey

Online form submission: Customer can start onboarding with online form fill-up and submission through the self-service portal

OCR and API-based ID validation- Real-time and automated identity and other documents verification through OCR and government (Aadhaar, PAN) API integration.

Instant approval notifications- Instant notification to customers on successful document verification.

e-Signing of contracts- e-signing of contracts to avoid manual errors and accelerate the onboarding process.

Centralized document repository- Seamless integration with a centralized document repository for storage and easy retrieval of all records.

Digital-first channel partner onboarding can accelerate go-to-market readiness while digital customer onboarding drives better engagement and faster sales closure.

Market Research Insights

Veridion Report (2025): Supplier onboarding in India costs companies up to ₹28 lakh per supplier using manual workflows. Automation reduces the cost to under ₹2 lakh, improving turnaround times by over 70%.

McKinsey India Operations Insight: Inefficient onboarding and procurement practices contribute to 20–30% higher operational costs, especially in Indian manufacturing and infrastructure sectors.

Fenergo / Forrester Study (India BFSI): Onboarding institutional clients in India can take between 2 and 34 weeks, costing up to ₹20 lakh per client, depending on complexity. Manual documentation and compliance checks are the top delays.

Cygnet BridgeFlow Solution – Transforming Onboarding

For Dealer-Distributor Onboarding:

- Pre-built industry-specific onboarding workflows

- PAN, MSME, Section 206AB, GSTIN, and bank verification APIs

- Automated eStamping and signing via Cygnature

- Real-time scorecard generation using GST/MCA data

- Seamless ERP sync with audit logs

For Customer Onboarding:

- OCR + API-based document verification (PAN, Aadhaar, DL)

- Remote contract signing with full blockchain audit trail

- Dynamic onboarding forms with conditional logic

- BI dashboards for compliance, risk scoring, and onboarding timelines

These solutions bring uniformity and control to both customer onboarding and channel partner onboarding journeys.

Redbull reimagined its distributor onboarding by implementing Cygnet BridgeFlow. As a result:

- Cut onboarding time by 60%

- Eliminated manual errors

- Achieved 100% audit compliance

- Scaled distributor network without increasing operational overhead

Best Practices for Onboarding Success

- Define workflows with clearly assigned responsibilities

- Integrate onboarding with ERP/CRM for a single source of truth

- Automate KYC validations and compliance checks

- Implement digital signatures for every agreement

- Set up dashboards to track onboarding status and SLA adherence

Conclusion

BridgeFlow a vendor onboarding solution, empowers procurement, finance, and sales teams to shift from reactive onboarding to a proactive, intelligence-driven method. Whether you’re onboarding a high-value distributor or bringing a new customer into your ecosystem, BridgeFlow ensures faster turnaround, reduced risk, and higher partner satisfaction. With customer onboarding and channel partner onboarding now key to business scalability, the future of onboarding isn’t just digital—it’s intelligent, secure, and built for scale.