While we have briefly discussed the UAE e-invoicing mandate in our previous blog, we shall dive into the UAE e-invoicing guide for the latest updates, announcements, compliances, regulations, objectives, and strategic moves to be future-ready for all UAE e-invoicing compliance.

UAE e-invoicing: Overview

What is e-invoicing as per UAE regulations?

e-invoicing is part of UAE’s e-billing system project to build an electronic billing system across the country to automate the filing of VAT returns, reduce tax evasion, and improve UAE tax compliance. e-invoice is a structured form of data with a standard format and is generated and exchanged electronically between trading parties and reported to the UAE Federal tax authority.

What’s not considered an e-invoice?

Any unstructured invoice format like scanned copies, word files, PDFs, images, email, etc though in digital form is not considered an e-invoice.

UAE e-invoicing: Primary Objective

The objectives for the implementation of e-invoicing in UAE:

- Maximum tax compliance and easy-to-business.

- Reducing tax evasion and gap.

- Reduction of processing time, cost, and paper usage results in optimum operations and sustainability.

- Reduce human intervention by going digital.

- Utilizing big data to improve the UAE economy.

- Increased transparency and enhanced user experience.

Important announcements on UAE e-invoicing compliance

| Date | Announcements |

| 24th October 2024 | Launch of UAE e-invoicing portal by MOF Provided valuable insights into the e-invoicing system Released FAQs for better understanding Updated guidance on July 2026 implementation of B2B and B2G e-invoicing mandate. |

| 29th October 2024 | MOF and FTA updated VAT law to include provisions for e-invoicing |

| 30th October 2024 | MOF issued Federal Decree-Law No. 16 of 2024 (amending provisions of the VAT Law) and Federal Decree-Law No. 17 of 2024 (amending provisions of the Tax Procedures Law) to include key updates related to e-invoicing. |

The MoF is expected to release the e-invoicing technical requirements and data dictionary soon, outlining the System’s functionality.

Main Implementation timeline

| Timeline | Implementation |

| Q4 2024 | Developing SP’s accreditation requirement and procedure Developing UAE’s data dictionary |

| Q2 2025 | Issuance of e-invoicing legislation |

| July 2026 | Phase-1 to go live for reporting |

The implementation of e-invoicing compliance will be in a phased manner where businesses will start complying with e-invoice at their required phase giving sufficient time and prior notice for them to integrate e-invoicing software in their business workflow in advance of their requirements coming into mandate.

How would e-invoicing in the UAE work?

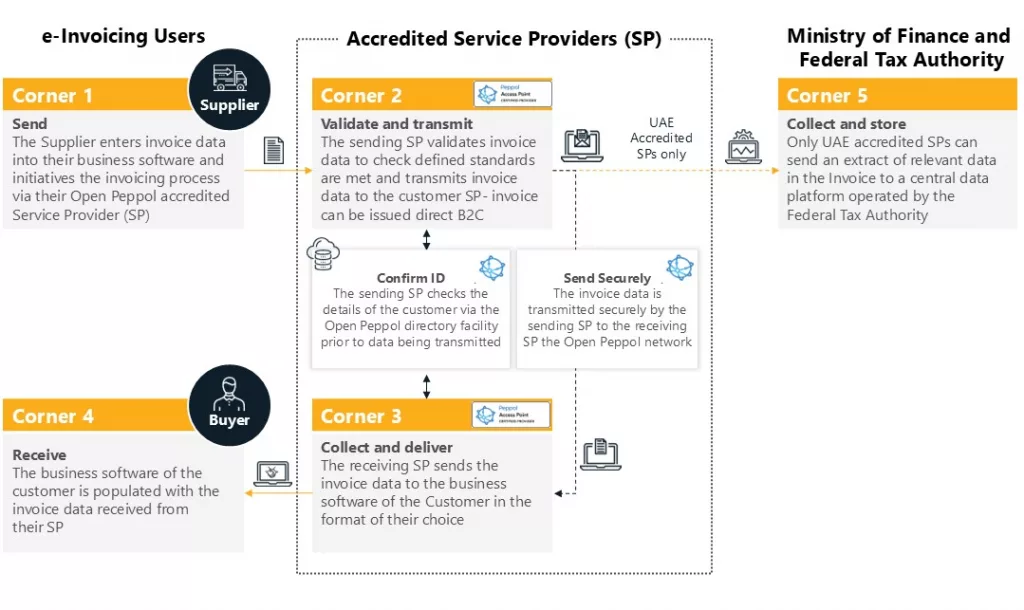

As announced by the FTA the UAE e-invoicing compliance with work on DCTCE (Decentralized continuous Transaction control and exchange) 5 corner model consisting of supplier, receiver, supplier’s ASP, Receiver’s ASP, and FTA’s portal, utilizing PEPPOL network and the workflow of e-invoice transmission is as under:

5 Corners

Corner-1 The supplier

Corner-2 Supplier’s accredited service provider (ASP).

Corner-3 Receiver’s ASP

Corner-4 Receiver

Corner-5 MOF and FTA

The workflow:

Step -1 The supplier shall generate the e-invoice.

Step-2 The supplier shall send an e-invoice to its ASP.

Step-3 The supplier’s ASP will validate the information of e-invoice and convert it into standard format as required by regulations.

Step-4 The supplier’s ASP will send the e-invoice to the receiver’s ASP.

Step-5 The receiver’s ASP shall collect and verify the e-invoice and send it to the receiver.

Step-6 The Supplier’s ASP shall send an e-invoice to the UAE authority’s central portal to report tax-related data.

Step-7 Supplier’s ASP provides acknowledgment of receipt of invoice as given by receiver and authority to the supplier.

E-invoicing readiness UAE: Steps to be followed for compliance

Understand regulations: It is vital to understand the e-invoicing standards and regulations to understand the structured data standards and digital formats to be followed.

Evaluate your system: Evaluate your system to identify gaps and obsolescence and replace them before implementing an e-invoicing solution to support e-invoicing formats and requirements.

Select correct ASP: Evaluate and select the correct ASP based on authority’s and businesses’ requirements which can seamlessly handle validation and verification of e-invoices and easy transmission through the PEPPOL network on a real-time basis and at the same time give add-on features and benefits as per businesses specific requirements.

Integrate systems: Integrate your e-invoicing and accounting system with ASP and FTA’s e-invoicing portal to ensure smooth transmission.

Testing the process: To ensure accurate and error-free transmissions conduct test submissions to comply with regulatory requirements.

Training and monitoring: Train the employees with the new e-invoicing process and systems and keep monitoring the process workflow to ensure there is no error or defect in it.

Challenges in UAE e-invoicing compliance

Real-time reporting- FTA requires businesses to transmit and report e-invoices on a real-time basis which requires robust and updated infrastructure that can require heavy initial cost and data and also be able to handle data transfer without any delay making it challenging for businesses.

Invoice Tampering- Fraudulent alterations made in transaction details such as amount, dates, tax rate, supplier information, etc can lead to tax evasion or reporting discrepancies, revenue leakage, etc. Invoice tampering can not only hinder data integrity but also compromise audit and reconciliation requiring robust mechanisms to avoid the risk of tampering.

Integration issue- To streamline the entire business process businesses need to integrate their accounting systems, tax filing solutions, FTA portal, and e-invoicing solutions which can automate the data workflow therefore any integration issue will create errors and obstruct business processes.

Security concerns- UAE is one of the major countries dealing with cybersecurity attacks and has to be very conscious and alert of their security measures otherwise leakage of sensitive business data can hinder the company’s market reputation and competitive advantages.

Regulatory compliance- Businesses have to not only comply with e-invoicing regulations but also have to comply with VAT. FTA and MOF want to streamline the entire taxation process to ease tax filing and reduce tax evasion therefore businesses have to ensure their e-invoicing solution are integrated with VAT return filing solutions.

Benefits of UAE e-invoicing compliance

Adoption of advanced technology- With e-invoicing implementation businesses have to adopt advanced technology and integration of their entire workflow which would help them streamline their process in the long term.

Cashflow optimization- Many e-invoicing solutions provide add-on services like dashboards and insights on sales, purchases, VAT payment, ITC availment, etc. which can help in deciding the payment cycles, availability of ITC during tax payment, etc. to have cashflow optimization and no liquid cash is blocked in the process.

Cost reduction- Though the initial investment cost may be high but it would reduce man-hours due to automation, reduction in paper, postage, and storage costs, etc. which can impact the company’s working capital positively in the long term.

Improved cross-border transactions- The countries across are adopting the PEPPOL network to bring standardization, interoperability, and uniformity while having cross-border transactions where ASP would ensure the e-invoice is transferred in the required language having the required format in regulation to ensure no errors.

Improved compliance- The streamlined and automated process will ensure compliance with e-invoice generation and reporting on time as well as tax payments and tax credit claims helping businesses ensure efficient and improved tax compliance with minimal efforts reducing the penalties and fees for non-compliance.

Faster Processing- With seamless integration and streamlined workflow it is possible to achieve faster processing of the transaction whether it is generation, verification, transmission, reporting, or accounting each process gets elevated including payment approvals and payment release after verifying compliance needs and ensures no payment are stuck unnecessarily due to lack of proper processing.

Reduced errors- The automation in the process ensures that the workflow is carried out effectively with minimal human interventions thereby reducing errors occurred due to manual processing.

How cygnet can help in e-invoicing in UAE?

Cygnet offers a robust UAE e-invoicing solution designed to align with all regulatory requirements set forth by the MOF and FTA including amendments and updates in federal law to ensure VAT and e-invoicing compliance are met with minimum turnaround time.

UAE e-invoicing solution simplifies invoice generation, validation, and transmission, enabling businesses to comply effortlessly with government regulations. The platform provides real-time invoice transmission, ensuring accuracy and timely submission. It features easy integration with existing ERP and accounting systems, minimizing disruption to operations. Businesses can benefit from a comprehensive dashboard offering clear insights, monitoring, and reporting of e-invoicing processes.

Cygnet brings proven expertise in e-invoicing implementation across multiple global regions, including India, Saudi Arabia, Malaysia, and Kenya. Cygnet is a PEPPOL accredited service provider. With its deep experience in handling complex regulatory requirements, particularly in KSA & India, Cygnet is well-positioned to support businesses in the UAE with their e-invoicing compliance needs.

Cygnet’s solution automates workflows, reduces errors, and enhances operational efficiency, empowering businesses to embrace digital transformation while ensuring regulatory compliance and business continuity.

Conclusion

In conclusion, the UAE’s e-invoicing mandate is set to streamline tax compliance, reduce errors, and enhance transparency in business operations. By adopting this system, businesses can ensure smoother processes, real-time reporting, and greater regulatory adherence. However, successful implementation requires careful preparation, including selecting the right ASP, system integration, and ongoing monitoring.

Cygnet’s solutions offer comprehensive support, simplifying the transition and ensuring businesses stay compliant while optimizing operational efficiency. As the country progresses toward full e-invoicing adoption, businesses that embrace this digital shift will be well-positioned for long-term success.

FAQs

Currently, e-invoicing is not mandatory but it will soon be mandated probably from July 2026.

Initially e-invoicing apply to B2B and B2G transactions followed by B2C transactions in the later period.

E-invoices must be generated in digital formats like XML or JSON, adhering to structured data standards for consistency and interoperability. Commonly accepted formats include UBL (Universal Business Language) and PINT (Peppol Invoice Standard) under the Peppol framework.

For exports, if the foreign buyer is registered on the Peppol network, their end-point must be provided. If not, a dummy end-point will be used, and the invoice will be sent outside Peppol, such as via email. Overseas buyers are not required to register with a UAE service provider unless mandated by UAE VAT or Corporate Tax laws.

e-invoicing is exchanged in a machine-readable format providing insights on invoice analysis and financial position to help in making informed decisions.

Businesses should understand regulations and have ideal ASP and e-invoicing solutions supporting XML/JSON format.