The Challenges Enterprises Face

High volume of notices with no centralized tracking

Limited visibility for leadership on overall litigation exposure

Missed compliance dates

Manual errors and audit risks

Transform your tax operations with our business first platforms

LMS Benefits That Go Beyond Just Compliance

-

Mitigates risks of delayed replies even during employee turnover.

-

Enables seamless collaboration with legal experts and consultants.

-

Reduces compliance costs by avoiding penalties and fees.

-

Saves time with centralized, easily accessible data.

-

Minimizes human errors and ensures accuracy in notice preparation.

Unlock Business Potential with Cygnet's Comprehensive Solution Suite

GST Compliance Suite

Facilitating advanced reconciliation to minimize litigation and Integrate litigation management system to extract necessary data for notice replies effortlessly.

Managed Services

Tax experts/Consultants offer legal advice and assistance in preparing replies

and documents.

Driving Measurable Value for Businesses.

100%

business continuity with ITC insight and CFO dashboards

250+

successful ERP integration

90%

faster process cycle

24x7

support and expert advice

FAQs

A GST Litigation Management System (LMS) is a digital platform that enables businesses to centrally manage GST-related notices, assessments, and appeals. It helps organizations track deadlines, store documentation, assign responsibilities, and maintain an audit trail, ensuring timely and accurate responses while minimizing litigation risks.

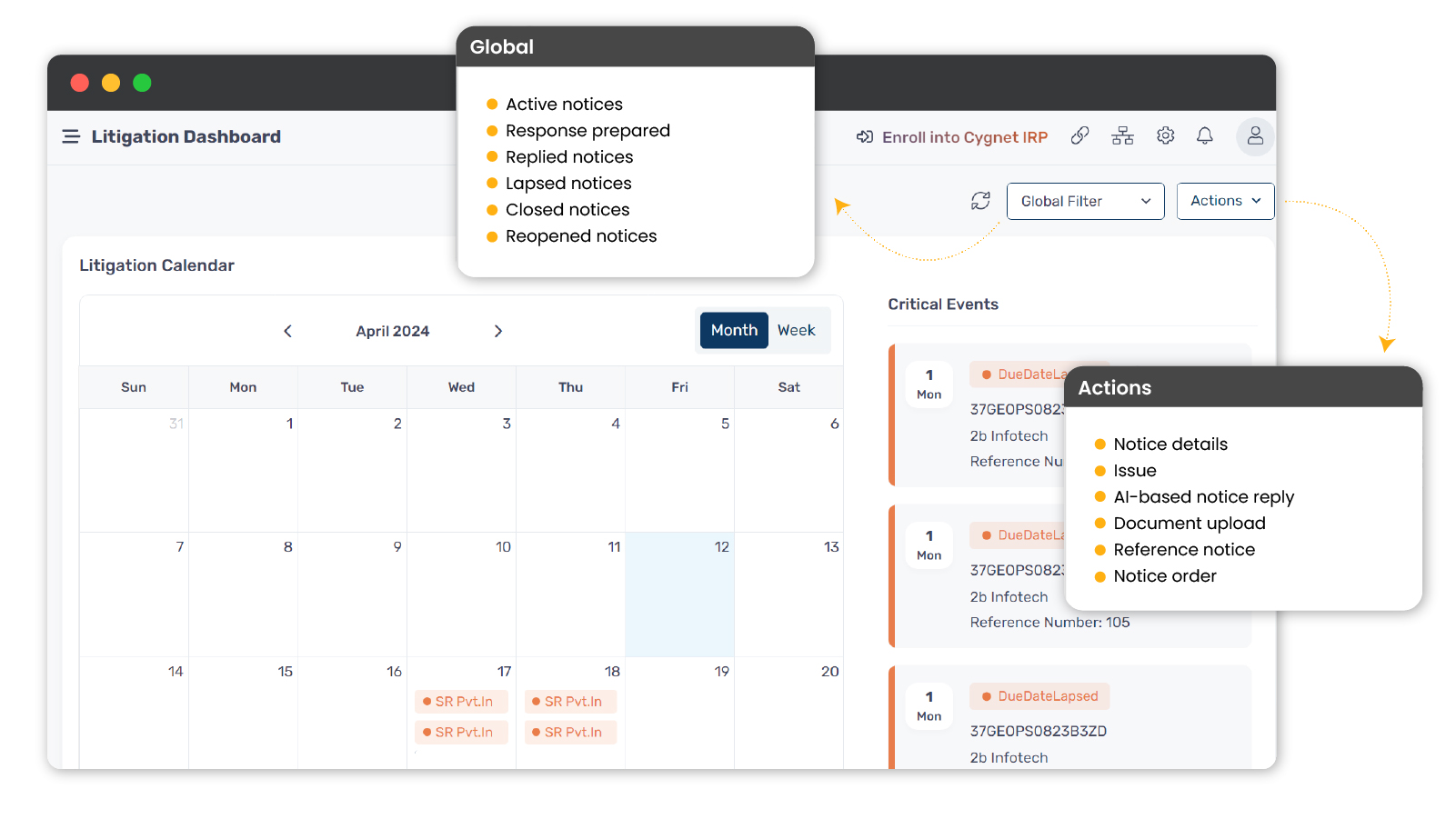

Cygnet LMS integrates directly with the GSTN system via secure APIs to automatically fetch notices in real-time. Every new notice is synced, categorized, and routed to the right stakeholders, ensuring that no compliance communication is missed or delayed.

Yes. Cygnet LMS is built for cross-functional collaboration. Legal, tax, and finance teams can tag notices by department, entity, or business unit, assign responsibilities, add internal comments, and track progress on a single dashboard — reducing duplication and improving accountability.

Absolutely. Cygnet LMS not only tracks open and closed notices but also helps enterprises map contingent liabilities, estimate financial exposure, and generate reports for auditors and management. This ensures better visibility of potential risks and supports informed decision-making.

Yes. Cygnet LMS is designed to support multi-entity, multi-location enterprises. With a unified dashboard, CFOs and tax leaders can monitor litigation across subsidiaries, group companies, or business units — ensuring governance at scale with entity-level granularity.