E-Way Bill is an electronic way bill for the movement of goods.

When an e-Way bill is generated a unique e-Way bill number (EBN) is allocated and available to the supplier, recipient, and the transporter.

This document is required to be generated online for goods transportation irrespective of whether such transportation is inter-state or intra-state. It captures consignment, vehicle, transporter, and route details and must accompany goods in transit as per GST rules.

Current challenges faced by Enterprises

- Manual EWB generation delays dispatches

- Lack of integration between ERP (SAP/Oracle/Tally) and NIC portal

- Missed validity alerts causing compliance risks

- Transporters struggling with real-time updates

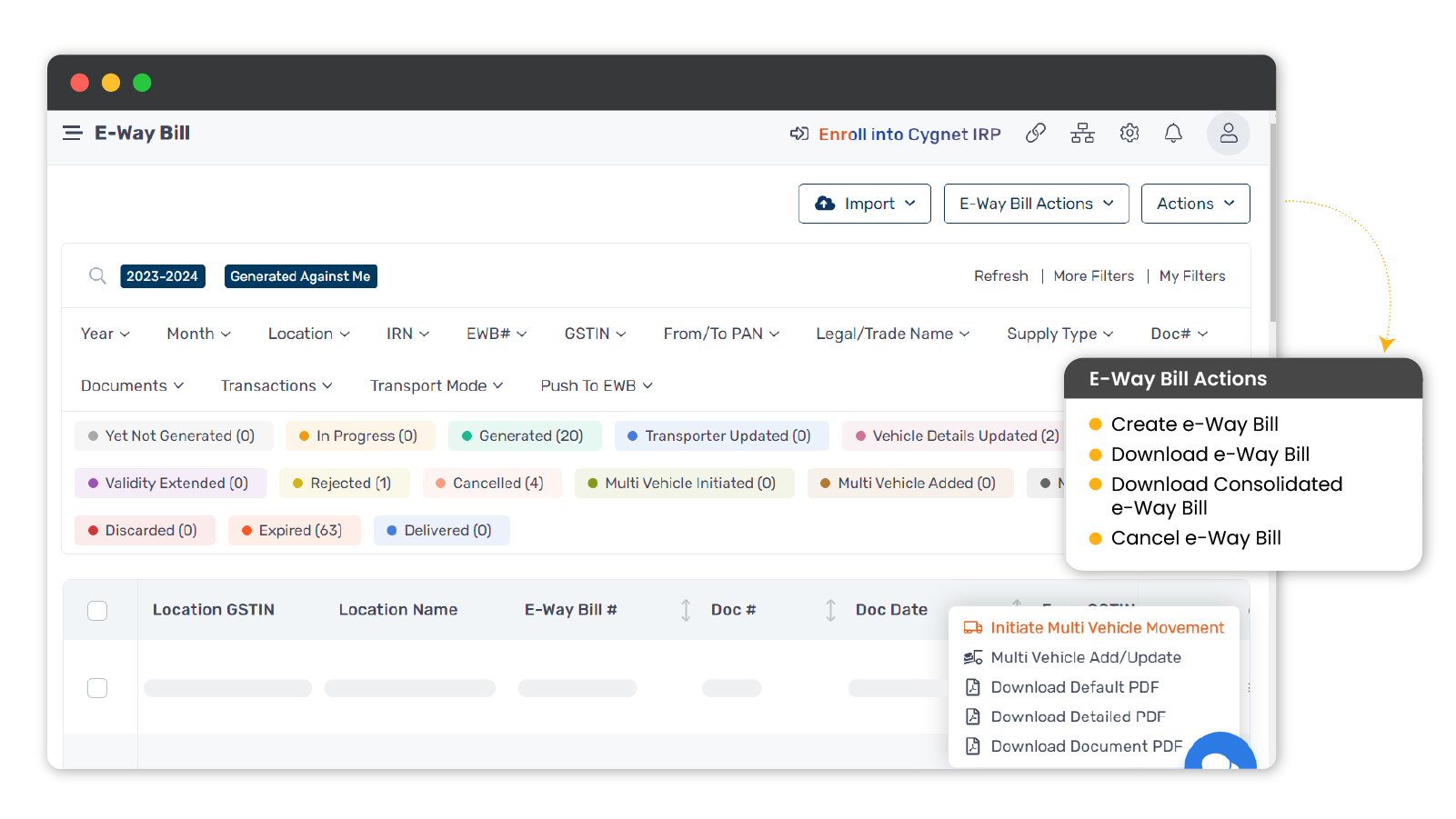

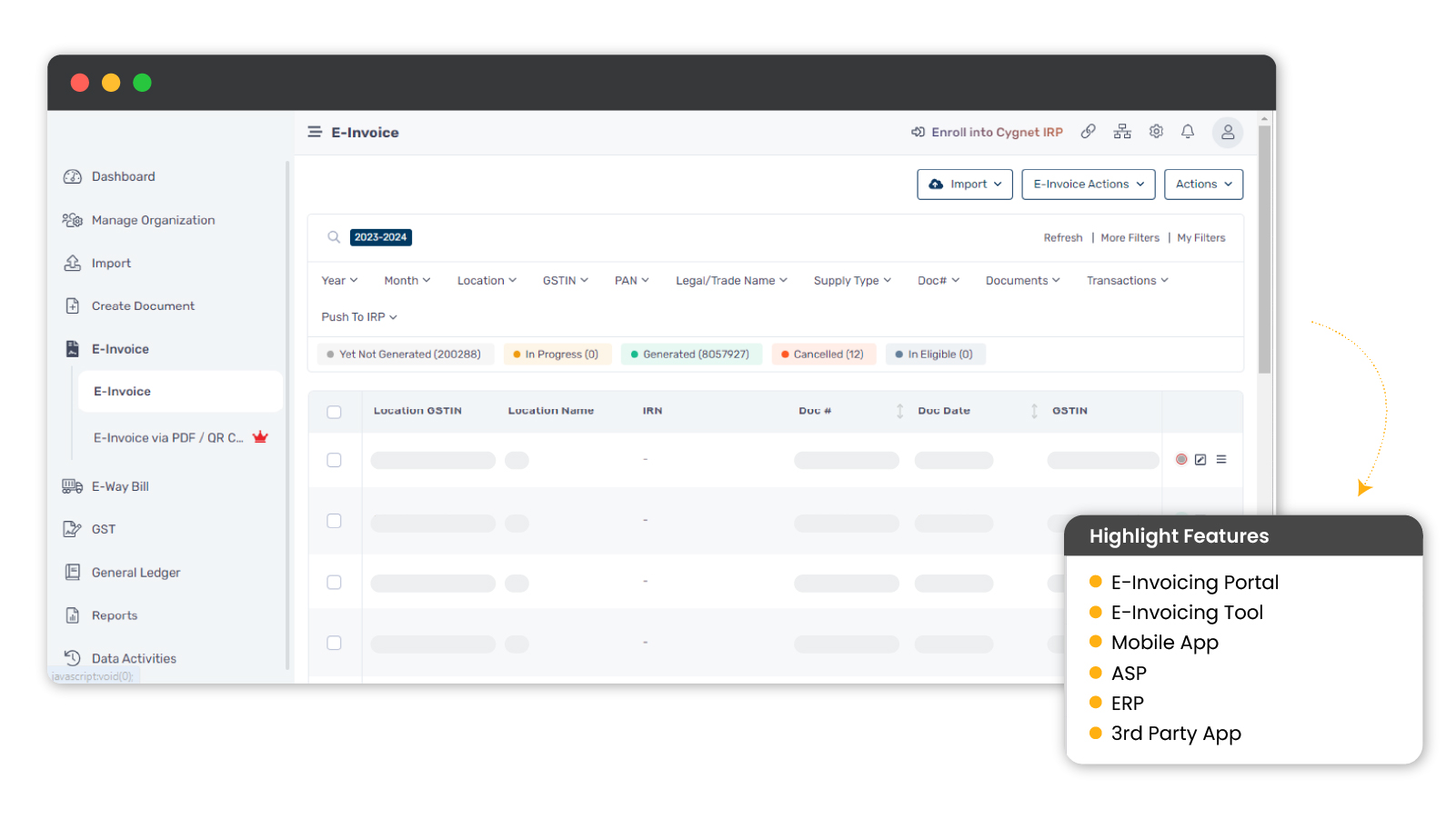

Cygnet.One e-Way Bill solution A scalable and GST-compliant solution that automates the entire lifecycle of an e-Way Bill for enterprises.

- Seamless integration of ERP, e-Way bill solutions, and NIC

- Bulk as well as consolidated e-Way bill generation for multiple consignments

- Modify or cancel EWBs with audit-ready logs

- Time-saving auto-correction of errors

- Track real-time e-Way bill status

- Transporters can update via web or mobile

- Role-based access control and single sign-on (SSO)

- Cloud & on-premise deployment options

Why Choose Cygnet.One e-Way Bill?

Enterprise-ready

Handles millions of transactions per month

NIC Portal + more

Everything NIC offers plus bulk ops, validations, and dashboards

Always compliant

Automatic updates with NIC/GST changes

Proactive alerts

Expiry & exception notifications to prevent penalties

Audit assurance

Complete trail of every action for compliance officers.

Value created by Cygnet

We are living the trust with…

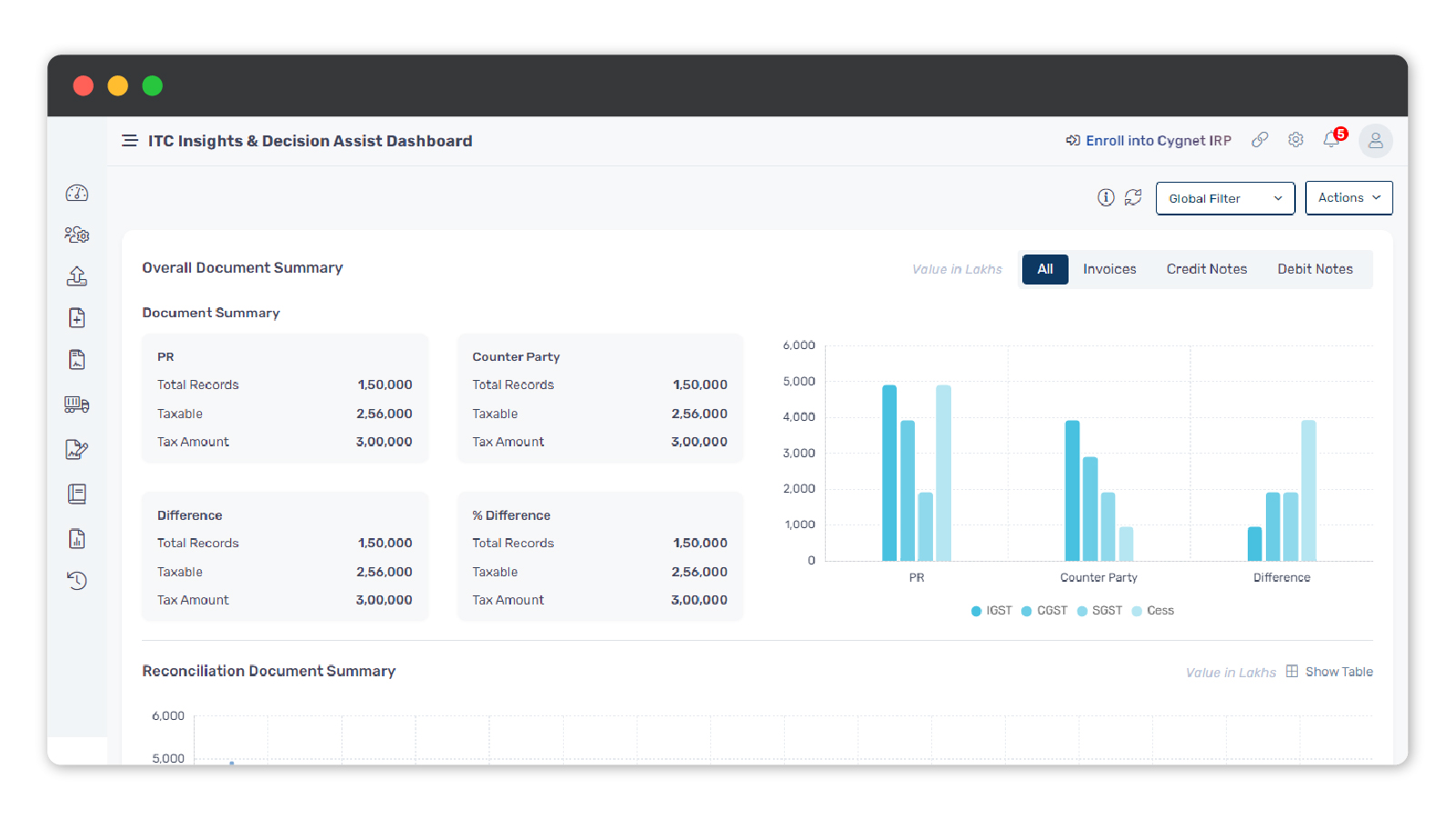

3-Way Reconciliation

between e-way bills and returns leading to minimum notices

HSNMaster

will fetch the required HSN in seconds

0.75seconds

to generate an E-way bill

24x7

Uninterrupted support

Trusted by many Clients

Where the real magic happens!

Generate e-way bills instantly within a few clicks!

FAQs

Any registered taxpayer or transporter moving goods worth ₹50,000 or more.

Yes, multiple invoices can be combined into one consignment.

Yes, we support SAP, Oracle, Tally, Dynamics, Zoho, and custom ERPs.

Our platform automatically adapts to NIC/GST changes under AMC.

Resources

6 Digit HSN Code for e-Way Bills Starting From 1st…

Read the blog to know what is HSN code is and how it is related to e-Way Bills.

Accelerated e-Way bill generation for a consumer goods corporation

Accelerated e-Way bill generation for a consumer goods corporation

Reduced man-hours by automating e-Invoice and e-Way bill generation for…

Reduced man-hours by automating e-Invoice and e-Way bill generation for a sugar manufacturer.