Understanding ViDA

ViDA is a European Commission initiative (introduced in December 2022) focused on modernizing and digitizing how organizations manage their Value Added Tax (VAT) obligations. It promotes standardized protocols and cutting-edge digital technologies to:

- Streamline tax compliance.

- Reduce errors and enhance transparency.

- Create a more efficient VAT system for businesses.

Status on ViDA

-

Dec 2022

First proposal launched

-

2024-2025

Member States prepare and update national systems for adopting the new reporting and invoice standards

-

Jan 2028

Mandatory Digital Reporting Requirements(DRR) come into effect for all businesses, replacing periodic VAT reporting for cross-border transactions.

The Three ViDA Pillars

The Three ViDA pillars may be summarized as below

- Real-time digital reporting for intra-Community transactions

- Based on the European e-invoicing standard EN 16931.

- Platforms facilitators will become responsible for collecting and remitting VAT

- Introduction of deemed supplier regime

- Single Vat registration across all EU countries to reduce vat compliances

- Introduction of “Import one stop shop” (IOSS)

Additional Features

400+ Algorithmic Error Filters

Updates in Sync with the Law

Multi Organization & Multi Division

Complete Audit Trail

GL Reconciliations

Data Management

Reports & Dashboards

About VAT automation & compliance

Smarter & faster compliance management, way better efficiency!

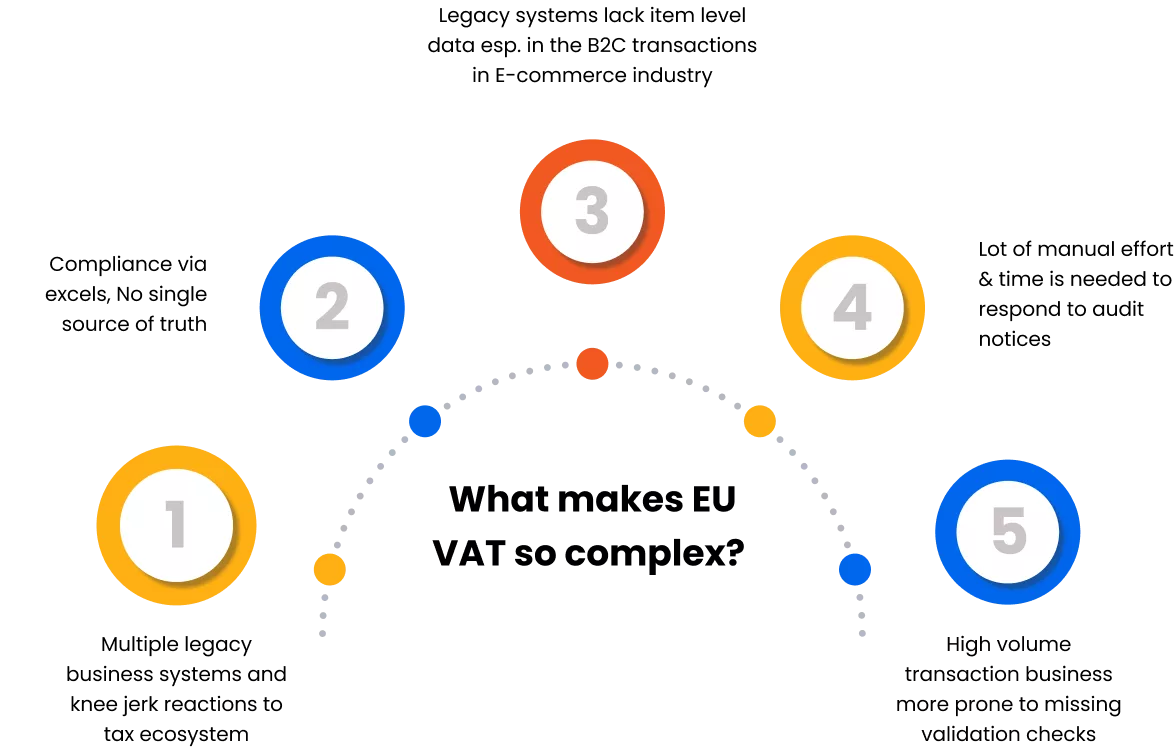

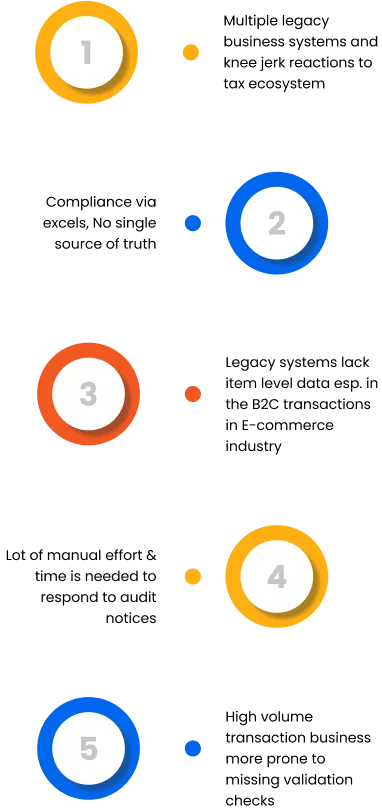

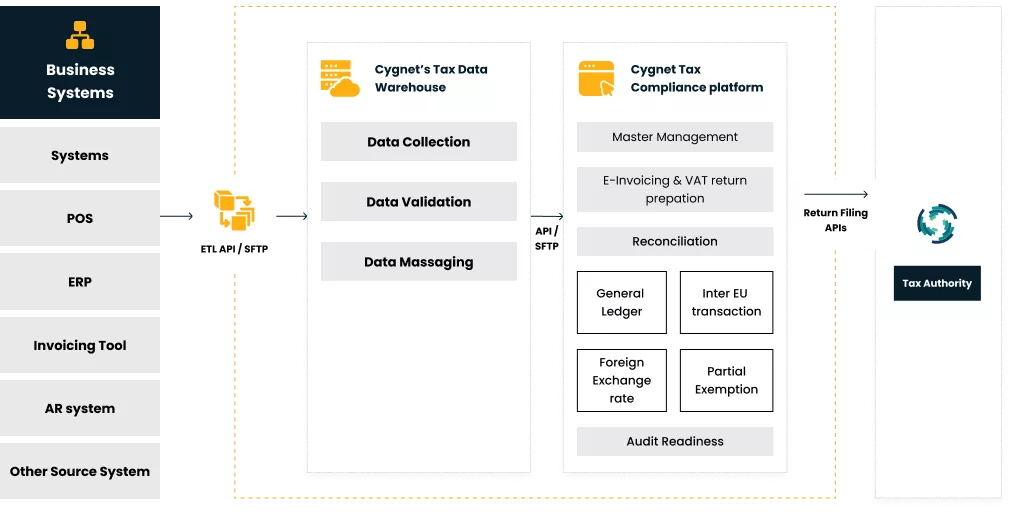

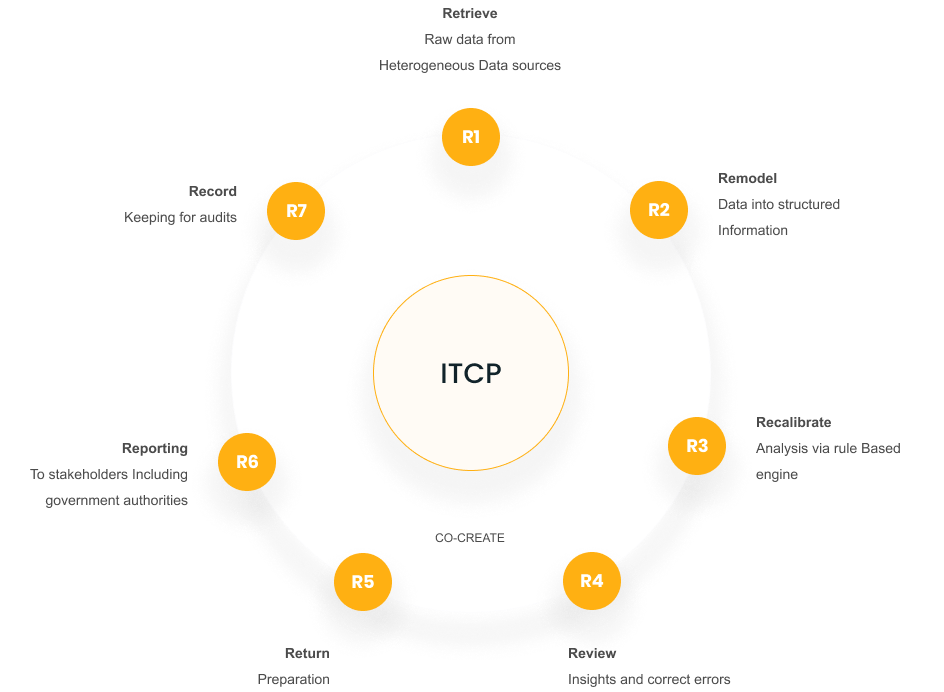

Corporations and accounting firms operating in the UK, Europe, and further afield are required to navigate a dynamic indirect tax regulatory landscape. Businesses incur significant costs managing VAT return compliance processes and data validation. Our TaxTech Indirect Tax Compliance Platform helps all sizes of businesses to achieve compliance by providing a centralized, scalable, and automated solution to accurately prepare and file VAT returns in the UK, EU, and further afield.

Cygnet One's Indirect Tax Software Solution

is built and supported by our expert tax professionals

The software is updated regularly for tax and system logic ensuring full compliance with current legislation and delivering a comprehensive automated cloud-based solution that is fast, accurate, and easy to use.

Highlights of Indirect Tax Compliance platform

Our Accreditations

With tax authorities across the globe

FAQs

The VAT in the Digital Age (ViDA) proposal by the European Commission mandates real-time digital reporting, platform economy rules, and single VAT registration across the EU. It aims to simplify cross-border VAT compliance and reduce fraud by 2028.

Our platform currently supports 25+ EU countries, including Germany, France, Netherlands, Italy, Spain, Poland, and more — offering both detailed and summary return formats per country-specific requirements.

Yes. Cygnet.One is ViDA-ready with DRR capabilities such as EN 16931-compliant e-invoice validation, intra-community transaction reporting, audit trails, and readiness for near real-time exchange with tax authorities.

Our solution integrates invoice generation, validation, and exchange directly with VAT return preparation and submission — eliminating data silos, reducing errors, and ensuring compliance through one platform.

Yes. Our platform integrates seamlessly with leading ERPs like SAP, Oracle, Microsoft Dynamics, and more via APIs or connectors, enabling end-to-end automation without disrupting existing finance workflows.

Cygnet.One continuously updates its rule engine to reflect evolving tax regulations and ViDA-aligned mandates. This ensures you stay compliant without manual intervention.