Powerful Features to Enhance Your Financial Operations

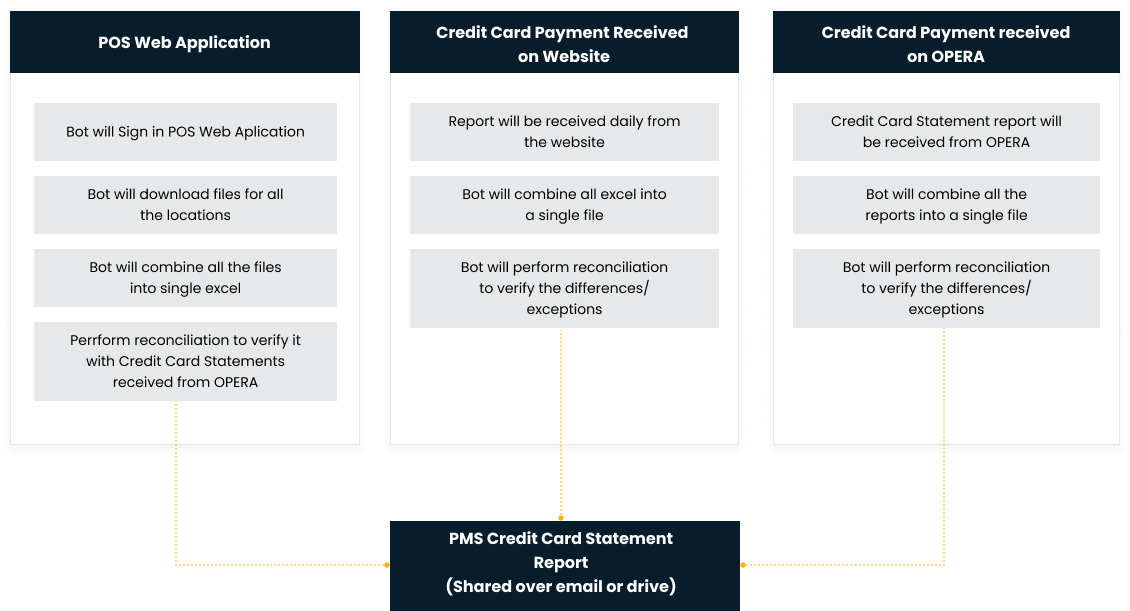

- Automated Reconciliation: Perform reconciliations with zero manual intervention.

- Flexible Configuration: Adapt to your business’s evolving needs.

- Scalability: Easily integrate new data sources and add new locations.

- Comprehensive Audit Trail: Maintain detailed records for compliance and audits.