Bank statement analysis is an essential tool for credit management. It allows you to track your income, expenses, and spending habits over a set period. Bank statement helps to identify top transactions, recurring transactions, month-wise transactions, returns transactions, EOD balances, running EMIs and categorization of transactions for easy underwriting & straight-through processing. By analyzing your bank statements regularly, you can identify areas where you are overspending or where you could be saving more money.

One of the key benefits of bank statement analysis is that it helps you understand your personal and business financial health. You can see how much money is coming in each month and how much is going out on bills, groceries, entertainment, etc., from personal statements. Also, you can understand and segregate your inflow in business income, investment income, rent, dividend, interest etc., with Cygnet BSA. This understanding will give you the information needed to make informed decisions about your finances.

By reviewing every line item on your bank statement carefully, you can detect any errors or fraudulent activity early on. Catching these issues quickly can help prevent them from negatively impacting your credit score or causing financial harm down the road.

Furthermore, banks use this data for straight-through processing (STP) as well for banking surrogate programmes. If they see consistent patterns such as late payments, overutilization of assigned limits, amongst other red flags within their review process, then that adversely affects credit eligibility. Analyzing bank statements regularly should become a part of the routine for setting financial goals, budgeting effectively, monitoring spending, and detecting errors & frauds to eventually improve the chances for better credit options available.

What is the main purpose of a bank statement?

Bank statement analysis is an essential aspect of credit management for financial institutions. It enables a comprehensive evaluation of a customer’s financial situation and creditworthiness. In today’s digital era, relying solely on traditional credit scoring methods is insufficient, making bank statement analysis even more crucial.

Advancements in fintech have facilitated the efficient analysis and interpretation of vast amounts of data contained within bank statements. By leveraging fintech solutions, banks and financial institutions can conduct more thorough analyses while minimizing manual labor and errors. This empowers them to make informed decisions when assessing loan applications and effectively manage credit risk. Thorough bank statement analysis offers numerous benefits. It provides insights into a borrower’s repayment capacity and financial management history, reducing exposure to bad debt. Early identification of red flags allows lenders to mitigate risks promptly. As a result, credit risk management becomes more efficient, leading to faster approvals, reduced paperwork, and improved customer satisfaction.

To stay ahead in the evolving financial landscape, it is imperative for banks and financial institutions to embrace fintech solutions that streamline the bank statement analysis process. By doing so, they can enhance their credit risk management strategies and make well-informed decisions that drive sustainable lending practices.

What are the features of bank statements?

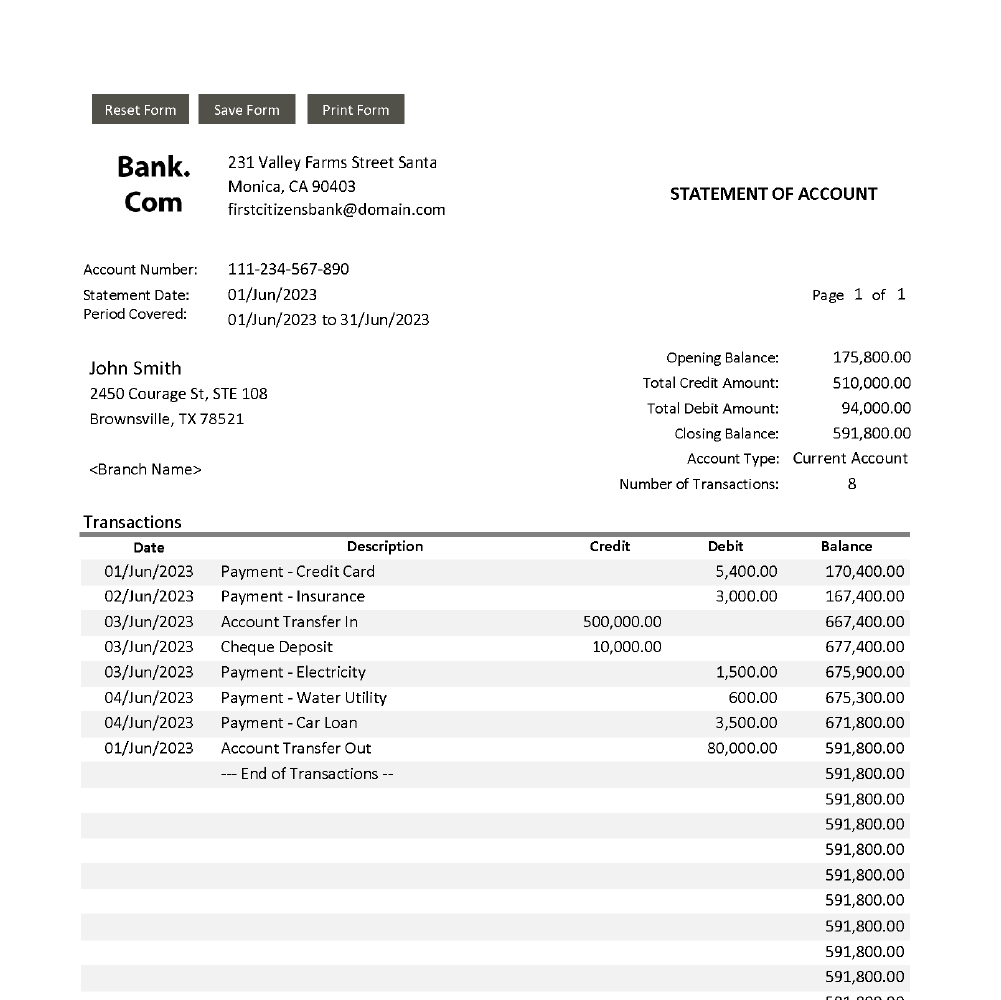

A bank statement is a document that summarizes all the transactions made by an account holder during a given period. It includes several features like the name and account number of the customer and details of each transaction made such as date, amount, description, and balance after each transaction.

Bank statements are usually generated monthly or quarterly, depending on the bank’s policies. Some banks provide e-statements that are similar to paper ones but available online instead of in print format.

Another feature of bank statements is that they include information about any fees charged by the bank such as overdraft fees or ATM fees. This helps customers keep track of their expenses and avoid unnecessary charges.

Bank statements also show deposits made into an account including direct deposits from employers or other sources like Social Security payments. If there are any discrepancies between what you believe should be on your statement versus what appears, it’s important to contact your bank immediately for clarification.

Understanding these features can help you make better use of this valuable financial document to manage your finances effectively and improve credit management processes. Cygnet’s BSA can process and provide enhanced analysis with the best latency, irrespective of the source, on a real-time basis.

What is the summary of a bank statement?

A bank statement is a document that summarizes the financial transactions of an account holder. It typically covers a specific period, such as a month or a quarter, and shows all the inflows and outflows of funds during that time.

The summary section of a bank statement provides an overview of the account activity for the period covered by the statement. This section usually includes information such as opening balance, closing balance, deposits received, withdrawals made, fees charged, and interest earned.

The opening balance is the amount available in the account at the start of the period. The closing balance is what remains after all transactions have been posted to the account. Deposits are any funds credited to your account during this time frame while withdrawals refer to any payments made from your account.

Fees on bank statements are charges levied by banks for providing services or maintaining accounts while interest earned refers to money paid into an account by banks annually based on monthly balances held in savings accounts with them.

Cygnet BSA computes the balance at the end of each transaction, and the same gets verified with extracted balance. This comparison will help in arresting tampering. Also, it identifies suspicious transactions, irregular transfers to parties, data duplicity, and equal debit- credits.

Understanding how to read and understand these summaries can help individuals better manage their finances by identifying areas where they may be overspending or underutilising their resources.

How do you analyze a bank statement?

Analyzing a bank statement is the process of reviewing and understanding all transactions that have taken place in an account over a certain period. The first step to analyze a bank statement is to check if there are any errors or discrepancies, such as duplicate charges or incorrect amounts.

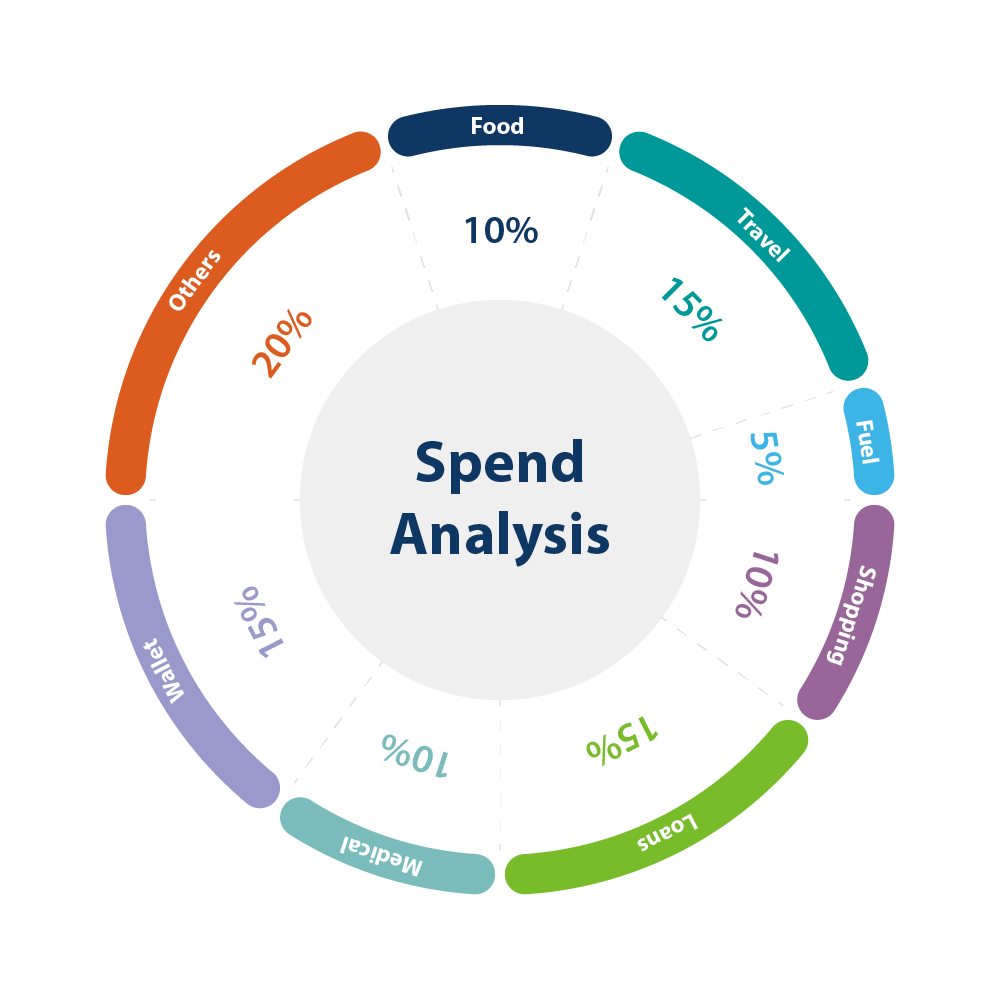

Next, it’s important to categorize transactions by types, such as income and expenses, and then further break down each category into subcategories for better analysis. This can help identify areas where spending could be reduced or increased.

One should also look at the frequency of deposits and withdrawals from the account. If there are irregularities in these patterns, it could indicate potential fraud or financial instability.

Another crucial aspect of analyzing a bank statement is identifying trends over time. By looking at multiple statements side-by-side, one can track changes in spending habits and identify areas where adjustments may need to be made.

Cygnet Bank Statement Analyzer provides month-wise inflow bifurcated into various transaction categories, identification of return transactions, scoring sheet, top transactions, recurring transactions, running EMIs etc. Easy identification of net inflow and surplus will help in curating various banking surrogate credit programmes. Using software tools can make the entire process more efficient by automating data entry and categorization.

What is a bank statement analysis for credit risk?

A bank statement analysis for credit risk is a process of examining an individual or business’s financial statements to determine their creditworthiness. The analysis involves reviewing bank statements, income and expense reports, balance sheets, and other financial documents.

The main objective of the analysis is to identify any potential risks associated with granting credit to the person or business in question. This includes assessing their ability to repay loans on time and determining the probability of default.

In addition, a bank statement analysis can help lenders understand how much debt a borrower has already taken on. This information can be used to calculate debt-to-income ratios which are important indicators of overall financial health.

Conducting a thorough bank statement analysis for credit risk helps lenders make informed decisions when it comes to lending money. By understanding the borrower’s current financial situation and potential future risks, they can set appropriate interest rates and loan terms that protect both parties involved in the transaction.