Forecast Accuracy

Manual Effort Reduction

Data Sources Used

Compliance Readiness

Overview

A leading financial services organization faced challenges with traditional forecasting methods for key performance indicators (KPIs) such as revenue, expenses, and profitability, compounded by poor data quality, fragmented data sources, and market volatility. To improve forecast accuracy and regulatory compliance, the organization deployed an AI-powered predictive modelling solution on Microsoft Azure. By addressing core issues in data governance and enabling real-time analytics, the new system strengthened risk management, supported data-driven decision-making, and maintained operational agility in an increasingly dynamic environment.

The Business Need

For financial institutions, forecasting isn’t just about strategy—it’s about survival. This organization needed to overhaul its traditional forecasting methods, which failed to account for the intricate, non-linear relationships in economic data and the speed of change in global financial markets.

- Inability to forecast KPIs (revenue, expenses, profitability) with confidence

- High dependency on manual analysis and static models

- Difficulty navigating uncertain economic conditions and regulatory demands

- Inconsistent data quality across business units, leading to unreliable insights

- Siloed data sources that limited visibility and slowed down reporting cycles

- Lack of real-time data integration, hindering timely and informed decision-making

Building a Scalable AI Solution Using Microsoft Azure

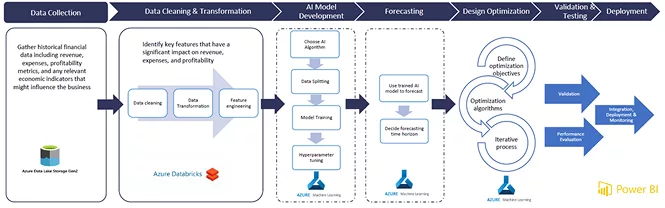

To address these needs, Cygnet.One implemented a comprehensive, AI-driven financial forecasting pipeline, leveraging a suite of Azure services and tools:

The solution began by collecting high-quality historical data (revenue, expenses, profitability, economic indicators) using Azure Data Lake Storage Gen2 for scalable and secure ingestion. The data was processed in Azure Databricks, with cleaning, transformation, and feature engineering to extract meaningful patterns and enhance model accuracy.

Using Azure Machine Learning, a predictive engine was developed with AI algorithms, training/testing splits, and hyperparameter tuning. The model was deployed to forecast short- and long-term KPIs, offering customizable forecasts for evaluating financial scenarios.

Optimization algorithms were applied iteratively in Azure Machine Learning, balancing accuracy and efficiency. This was followed by robust model validation, testing, and ongoing monitoring to ensure long-term reliability and alignment with business goals.

The AI model was deployed in a production environment, with insights seamlessly integrated into Power BI dashboards. These visualizations provide easy access to key data and actionable insights, allowing leadership and finance teams to make informed decisions based on real-time data.

Architecture Diagram:

Driving Real Business Value with AI-Powered Insights

By implementing this AI-driven forecasting solution, the organization realized a significant improvement of 30–40% in forecasting accuracy, enabling more reliable financial planning. Real-time dashboards powered by Power BI accelerated decision-making across teams, while automated data processing reduced operational effort and manual intervention.

To address underlying data challenges, the solution introduced centralized data integration, improved data quality through validation and cleansing pipelines, and enforced consistent data governance practices across business units. These enhancements ensured trustworthy, consistent data inputs—critical for effective predictive modeling.

The transparency and consistency of the data-driven approach also strengthened regulatory compliance. Overall, the solution enhanced the organization’s agility and resilience, equipping it to better navigate economic fluctuations and financial uncertainties.

Tools & Technologies Used

Azure Data Lake Storage Gen2

Scalable financial data collection & storage

Azure Data Bricks

Data cleaning, transformation, feature engineering

Azure Machine Learning

AI model development , training, and optimization

Power BI

Real-time reporting and visualization

About the Client

This global financial services firm offers investment management, banking, and insurance solutions. With a commitment to innovation and compliance, the company continually invests in intelligent systems to enhance forecasting, mitigate risk, and deliver shareholder value.