As the business expands, the need for financial resources escalates. In the dynamic landscape of today’s markets, effective financial management is paramount for sustained success. Despite the meticulous strategies and plans devised by the management and CFOs to ensure the efficient utilization of the company’s financial assets, the reality often necessitates the acquisition of external funding from banks and financial institutions.

Acquiring funds from a financial institution or bank comes with associated costs and expenses intricately linked to the company’s capital, reputation, and creditworthiness. Institutions extending financial support typically conduct a comprehensive credit assessment, assigning a credit score to the borrower. This credit evaluation is vital for any financial institution to evaluate the creditworthiness before extending funds to the company to eliminate the risk of default by the borrowers.

This blog aims to deepen your understanding of credit assessment, exploring its essential factors or components and elucidating the best practices financial organizations offering funds can adopt.

What is Credit Assessment?

A credit assessment credit evaluation, or credit check, evaluates or checks the borrower’s solvency or creditworthiness before lending money. The purpose is to assess borrowers’ repayment capacity based on their financial history, credit behaviour, and overall financial health.

Credit assessment helps identify, assess, and mitigate credit risk. This method involves various tools and techniques for evaluation, such as credit rating models, financial health assessment, financial statement analysis, background checks, evaluation of collaterals, etc.

For practical credit assessment, five key factors or components, also known as 5Cs, need to be examined and evaluated by any financial institution or bank before lending money. These are Capital, Collateral, Character, Capacity, and conditions. Let’s have a glance at it in detail.

Key Factors or Components of Credit Assessment

- Capital – Borrower’s financial statements are examined to quantify the value of assets, retained earnings, and personal investment in their business to safeguard the funds to be lent. A borrower’s personal fund invested in a business can give the borrower a sense of ownership in running the business. The higher value of capital can assure the lenders as an alternate mode of repayment of funds in case the businesses’ regular income or revenue is interrupted.

- Collateral- Anything pledged or mortgaged by the borrower as security for availing a loan is considered Collateral. Financial providers prioritize lending to a borrower who provides collateral as it is a secured loan compared to unsecured loans where collaterals are not provided. This assures the funds can be repaid by selling this collateral if the borrower defaults. Businesses provide business assets, invoices, etc., as collaterals, while individuals provide FDs, homes, vehicles, etc., as collateral to avail of loans. The higher the collateral value, the higher the security of funds offered.

- Character- The borrower’s reputation to ascertain his intentions to repay the loan is crucial. A borrower’s character can be examined by credit history or credit score on repayment patterns, default made, etc., provided by credit agencies like CIBIL. Further, Stability in business or employment, market reputation, personal background, work background, financial responsibility, etc., also play a crucial role in character assessment.

- Capacity- The capacity assessment can describe the borrower’s capacity to repay the loan demanded along with the interest in relation to monthly revenue or income. Most financial providers measure it with a debt-to-income ratio. Businesses’ cash flow statements are reviewed to check the capacity, and individuals ‘ monthly income and stability are reviewed. This assures financial providers that the borrower can repay the funds.

- Conditions- Lenders assess the industry and market conditions in which the borrower operates. Economic factors, market trends, and industry competition can impact a company’s ability to repay debt. The condition specifies the borrower’s need to demand a loan. Further, the interest rate, loan amount, and tenure are also based on the conditions of the credit assessment.

Challenges in credit assessment

Credit assessment is a crucial process for lenders to evaluate the creditworthiness of borrowers and make informed lending decisions. However, there are several challenges faced in the credit assessment of borrowers. Some of these challenges include:

- Incomplete or inaccurate information: Borrowers may, at times, provide incomplete or inaccurate information at the time of application for a loan, which is a significant source of credit assessment to detect risk and make informed decisions before providing loans.

- Regulatory changes: Many regulatory changes from the government, RBI, etc, create challenges for the finance providers to implement such regulations on time in their credit assessment process.

- Limited Credit History: Individuals or businesses with limited credit histories, such as young adults or start-up companies, may challenge traditional credit assessment models that rely heavily on historical data.

- Lack of skilled personnel: Credit assessment requires experts in risk assessment, data analysis, statistical modelling, etc. Finding and retaining such qualified personnel is sometimes difficult for finance providers.

- Rapidly changing market conditions: Market conditions can impact borrowers’ ability to repay debt. Economic downturns, recessions, or unexpected events can lead to financial instability for borrowers, making it difficult for lenders to assess credit risk accurately.

- Behavioural Factors: Behavioural factors, such as sudden changes in spending habits or financial behaviour, may not be immediately reflected in traditional credit reports, making it challenging for lenders to identify potential risks.

- Changing Technologies: The rapid evolution of technology introduces challenges in assessing the impact on various industries and businesses. Lenders must stay updated on technological advancements to evaluate their implications on borrowers.

- Dynamic Financial Conditions: The financial conditions of businesses and individuals can change rapidly. A credit assessment that relies solely on historical data may not capture the current financial health of the borrower.

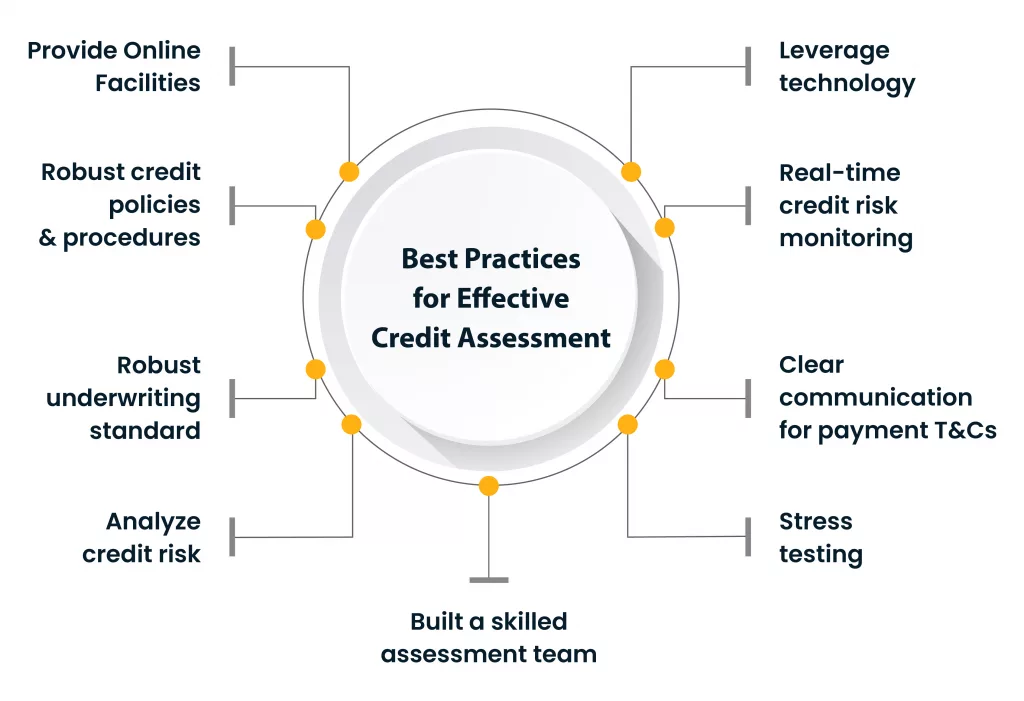

Best Practices for Effective Credit Assessment

There is a need to strategize and follow best practices for effective credit assessment to overcome the credit assessment challenges. Let’s look at some of the practices the financial providers can follow.

- Provide Online Facilities: Introducing online facilities such as application forms and mandating the required information will help avoid missing important information and make onboarding of customers smooth and effective. Further, all data stored in one place makes the credit risk analysis process more accessible.

- Analyze credit risk: The 5Cs, as mentioned above, help finance providers identify and analyze inherent risks associated with lending to a particular borrower. Considering it in credit assessment criteria provides a more holistic view of the borrower’s creditworthiness.

- Robust credit policies and procedures: Frame robust credit policies with well-defined creditworthiness criteria and guidelines for credit assessors, along with procedures for making decisions to safeguard against risk lending. It should also have terms of sale, credit collection process, credit limit extension or renewal criteria, etc.

- Robust underwriting standard: It provides well-designed guidelines for finance providers that help to ensure that only less risky and eligible borrowers are approved for loans and safeguard against risk, increase profits, and decrease adverse selections.

- Stress testing: Conduct stress testing to assess how well a borrower can withstand adverse economic conditions or unexpected events. This helps identify potential vulnerabilities in the borrower’s financial structure.

- Real-time credit risk monitoring: Implement a system for ongoing monitoring of borrowers throughout the loan term. Regularly review financial performance, industry conditions, and any significant changes that may impact the borrower’s repayment ability.

- Clear communication for payment T&Cs: Clear communication of payment terms and conditions is essential for credit assessment, ensuring transparency and mutual understanding between the lender and borrower, fostering a smooth and reliable credit relationship.

- Leverage technology: Utilize advanced technologies, such as artificial intelligence and machine learning, to automate and streamline credit assessments, enhancing efficiency and providing more accurate insights into borrower creditworthiness.

- Built a skilled assessment team: A team of expert personnel with continuous training and skill development for credit assessment should be built. Keeping teams updated on industry trends, regulatory changes, and new technologies enhances their ability to make informed decisions.

While this represents the prevailing and widely adopted process of credit assessment globally, it is essential to acknowledge that there could be exceptions in various countries due to current events, legal frameworks, economic conditions, and other variables that vary among nations. Let’s delve into the credit assessment process functioning in the Indian financial market for different sectors.

Other Credit Assessment Processes through an Indian Perspective

When we talk about credit assessment, we mainly work on the traditional and prevailing process of considering collaterals, market reputation or character, capacity, credit score, etc., but this scenario is limited to businesses already doing well in the market with good reputations. However, it is not viable to consider the above process when it comes to start-ups, MSMEs, agriculturists, or Individuals with limited or no collateral, market image, or credit score.

Now, to finance such sectors of the market, financers have evolved to different processes. If we talk about start-ups, MSMEs, which require loans to meet day-to-day crunches, to start or expand the business, do R&D on markets and products, etc., financers consider their business model, market ratio, opportunities, growth projections, the expertise of founders, etc. Further, financers can also analyze their bank transactions to evaluate total expenses against total revenue, type of income and expenses, etc., or may check the GST compliance score to understand whether the company is complying with the law without any penalties like timely return filing, payment of outward tax, accurate ITC availment, etc.

Further, for agriculturists, lenders consider the type of crop, fertility, and quality of the field where the seed of the crop is sowed, weather forecast, technological advancement in their activities, etc., to understand the probability of successful harvesting of healthy crops, again in the case of individuals seeking finances, their spending patterns, and source of income, education, future growth, etc. are analyzed to ensure their capacity to repay the loan. All these factors are vital for lenders to have an effective credit assessment process that is different from the traditional process being followed in the market.

Conclusion

In conclusion, a nuanced understanding of credit assessment is vital for lenders to make well-informed decisions. By adopting key practices such as thorough information gathering, diverse risk assessment criteria, and ongoing monitoring, financial institutions can navigate the complexities of credit assessment, mitigate risks effectively, and cultivate sustainable and mutually beneficial relationships with borrowers.