For enterprises managing thousands of transactions, GST invoice reconciliation has traditionally been a complex challenge. Hours spent matching invoices, coordinating with suppliers on discrepancies, and ensuring accurate Input Tax Credit (ITC) claims often lead to delayed filings and compliance risks.

The GSTN portal has introduced the Invoice Management System (IMS) seemingly to address these pain points. This comprehensive invoice management solution transforms how businesses handle GST compliance by creating a seamless verification channel between suppliers and recipients. Businesses can further strengthen accuracy and control by using a unified invoice management software designed for automated GSTR validation and reporting.

Understanding the Invoice Management System for Enterprise Operations

The Invoice Management System (IMS) is a transformative invoice management software integrated into the GSTN portal. While initially announced for October 1, 2024, the system became operational for taxpayer action from October 14, 2024. This invoice management solution allows businesses, as recipients of supplies, to review and take action on invoices uploaded by their suppliers in GSTR-1 returns.

The IMS under GST serves as a real-time verification mechanism, enabling accurate invoice matching and ensuring businesses claim the correct Input Tax Credit. For large enterprises processing high volumes of transactions, this represents a fundamental shift from retrospective reconciliation to proactive invoice management.

Three Core Actions in the Invoice Management System

On the IMS dashboard, taxpayers can take one of three primary actions on each invoice:

Accept: Accepting an invoice results into confirming an invoice validates that details match your records. The corresponding ITC becomes available in your GSTR 2B and auto-populates into your GSTR 3B. This action streamlines the flow of legitimate credit claims through your invoice management system for enterprise operations.

Reject: Flagging an invoice as Reject in case of incorrect or disputed invoices prevents the ITC from appearing in your GSTR 2B and GSTR 3B. This feature of the invoice management software helps maintain data accuracy and prevents incorrect credit claims.

Pending: Deferring a decision keeps the invoice out of the current month’s GSTR 2B while maintaining it in the IMS dashboard. You can accept or reject it in a future tax period, up until the timeline prescribed in Section 16(4) of the CGST Act expires. This flexibility is crucial for enterprises requiring additional verification time.

It is important to understand that not all documents flow through the IMS for action. Records such as RCM invoices, documents from GSTR 5/6, ICEGATE documents (to flow from November 2025 onwards), and documents where ITC is ineligible due to Place of Supply rules or Section 16(4) time limits will not appear in the invoice management solution but will flow directly to relevant sections of your GSTR 2B.

The primary objective of this invoice management system is to reduce errors, optimize resource allocation, and give businesses greater control over their ITC claims before finalizing returns.

The Default Status Principle: Streamlining Enterprise Invoice Management

For enterprises handling thousands of invoices monthly, the most critical feature of the IMS under GST is its default status mechanism. Taking action on every invoice appearing on your dashboard is not mandatory.

If a recipient takes no action on an invoice, the system treats it as “deemed accepted” when GSTR 2B is generated for that period. This design prevents the invoice management system for enterprise from becoming an overwhelming compliance burden. It ensures that ITC for undisputed invoices flows through automatically, allowing your teams to focus exclusively on exceptions requiring rejection or pending status.

This approach seems to have been learnt from the failure of the original GSTR 1, 2, and 3 return system, which was scrapped partly because it required mandatory manual action on every invoice. The current invoice management solution is designed to facilitate, not obstruct, ITC flow for legitimate transactions.

Dynamic GSTR 2B and GSTR 3B: The New Compliance Paradigm

The invoice management software introduces unprecedented flexibility in finalizing your ITC. On the 14th of the subsequent month, a draft GSTR 2B is generated based on actions taken in the IMS up to that point.

However, there is a critical precondition: your GSTR 2B will not be generated if the previous period’s GSTR 3B remains unfiled. This reinforcement of sequential return filing is a major operational consideration for enterprise tax teams.

It is also to be noted that invoices reported by the supplier in their GSTR 1A would be reflected in the GSTR 2B of the subsequent months even if the recipient has taken an “Accept” action on such invoices.

Recomputation Feature: Real-Time ITC Management

The draft GSTR 2B is not final. You can modify your actions on invoices at any time after the 14th, right until you file your GSTR 3B for that tax period. For example, moving an invoice from ‘Rejected’ to ‘Accepted’ remains possible throughout this window.

If you make changes after the draft GSTR 2B generation, you must use the “recompute GSTR 2B” button on the IMS dashboard. This action updates your GSTR 2B with the latest decisions, ensuring correct ITC figures are auto-populated into your GSTR 3B.

According to the advisory from November 12, 2024, while ITC is auto-populated in GSTR 3B basis the GSTR 2B, taxpayers are currently allowed to edit these details before filing. This flexibility during the initial phase of IMS implementation allows businesses to correct inadvertent mistakes within the invoice management system for enterprise.

September 2025 Updates: Enhanced Functionalities in the Invoice Management Solution

Based on an advisory dated September 23, 2025, several new functionalities have been introduced, effective from the October 2025 tax period, giving taxpayers enhanced control within the IMS under GST.

1. Limited Pending Status for Credit Notes

Previously, credit notes could not be kept in pending status. The updated invoice management system for enterprise now allows taxpayers to keep certain records, including credit notes and their amendments, in ‘Pending’ status for one tax period. This provides valuable additional verification time for these specific documents.

2. Partial ITC Reversal Declaration

A significant addition to the invoice management solution allows taxpayers to declare the exact amount of ITC requiring reversal for a given credit note. This addresses situations where ITC was only partially availed on the original invoice or not availed at all. Instead of a full reversal, you can now limit the reversal to the actual credit amount claimed, improving accuracy in GSTR 3B reporting.

3. Optional Remarks for Improved Supplier Communication

To improve communication between businesses and suppliers, taxpayers can now add optional remarks when rejecting or pending an invoice. These remarks are visible to suppliers in their IMS supplier’s view, helping them understand the reason for the action and facilitating quicker corrections. This feature transforms the invoice management system for enterprise into a true collaboration platform.

Clarifying Common Misconceptions About the IMS Under GST

With any major GST update, misconceptions can circulate. This section clarifies the current reality of the invoice management software based on official provisions and advisories.

Misconception 1: Mandatory Action Required for GSTR 2B Generation

Invoices with no action are deemed accepted. Your GSTR 2B generates automatically on the 14th, provided your previous GSTR 3B has been filed. This “deemed acceptance” principle is a core design choice of the invoice management solution, ensuring ITC flow for undisputed transactions without creating administrative burden.

Misconception 2: GSTR 3B is Now Non-Editable Based on GSTR 2B

While a non-editable GSTR 3B clearly seems to be the long-term vision of the government, the series of advisories proposing this change have been repeatedly deferred. Recent amendments to Sections 38 and 39 of the CGST Act provide the legal enabling framework, but procedural implementation is pending via changes to GST Rules. Currently, taxpayers can still edit both liability and ITC fields in GSTR 3B before filing.

Understanding these realities helps enterprises plan their invoice management system for enterprise implementation without falling prey to premature compliance concerns.

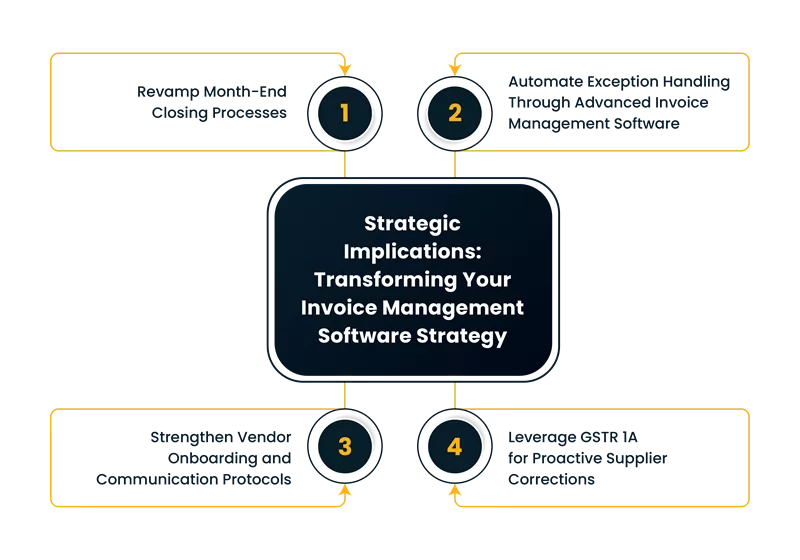

Strategic Implications: Transforming Your Invoice Management Software Strategy

The IMS under GST is not merely a new feature but a foundational shift requiring a strategic response. Enterprises should adapt their processes now to stay ahead of regulatory evolution.

Revamp Month-End Closing Processes

With a dynamic GSTR 2B that can be recomputed, reconciliation can no longer be a post-mortem activity performed after the 14th. It must become a real-time or near-real-time process throughout the month. Your invoice management solution should integrate with your ERP systems to enable continuous monitoring rather than periodic batch reconciliation.

Consider implementing daily or weekly reconciliation cycles where your team reviews new invoices appearing in the IMS. This approach prevents the accumulation of unresolved discrepancies and reduces the risk of missing the GSTR 3B filing deadline due to last-minute discoveries.

Automate Exception Handling Through Advanced Invoice Management Software

The “deemed acceptance” rule means your team’s focus must shift from bulk verification of all invoices to a system of flagging and resolving only exceptions. Those invoices marked for rejection or pending status require attention. However, the flip side of this “feature” is that all exceptions that get missed out get auto accepted. Auto acceptance of invoices in the IMS in respect of cases where these invoices ought not to have been accepted may also lead to commercial and other issues.

Thus, enterprises should implement automated alerts and workflows that:

- Flag invoices exceeding predefined thresholds for review

- Identify invoices from suppliers with historical discrepancy patterns

- Highlight invoices where HSN codes or tax rates appear inconsistent with purchase order data

- Track pending invoices approaching the Section 16(4) deadline

This exception management transforms your invoice management system for enterprise from a compliance tool into a strategic asset.

Strengthen Vendor Onboarding and Communication Protocols

Your ability to claim ITC is now directly tied to your supplier’s filing discipline and your capacity to communicate discrepancies efficiently. Robust vendor communication channels are no longer optional but essential components of your invoice management solution.

Consider establishing:

- Dedicated vendor portals where suppliers can view their invoice status in your IMS

- Automated email notifications when invoices are rejected or kept pending

- Regular vendor training sessions on GSTR 1A procedures to help suppliers correct discrepancies before your GSTR 3B filing to ensure that you will be able get correct ITC in the subsequent month at least.

- Vendor performance scorecards tracking timely and accurate GSTR 1 filing

These measures create a collaborative ecosystem where your invoice management system for enterprise extends beyond your organization’s boundaries.

Leverage GSTR 1A for Proactive Supplier Corrections

The introduction of GSTR 1A allows suppliers to amend their GSTR 1 after filing but before you file your GSTR 3B. This creates a critical window for correcting discrepancies without waiting for the next tax period.

Enterprises should establish protocols where:

- Rejected or pending invoices in your invoice management software trigger immediate communication to suppliers

- Suppliers are guided through the GSTR 1A filing process to make necessary corrections

- Your team monitors supplier GSTR 1A submissions and takes action on the IMS to be rest assured that the correct ITC flows in the subsequent months.

This proactive approach to using GSTR 1A maximizes assurances to correct ITC claims while maintaining compliance, making your invoice management solution truly effective.

Technology Integration: Building a Robust Invoice Management System for Enterprise

To fully leverage the IMS under GST, enterprises need technology infrastructure that extends beyond the GSTN portal. Your invoice management software strategy should encompass several layers of integration.

1. ERP System Integration

Your invoice management solution should seamlessly integrate with your ERP system to enable:

– Automatic comparison of supplier IMS data with your purchase registers

– Real-time flagging of mismatches in invoice amounts, tax rates, or HSN codes

– Automated suggestions for accept, reject, or pending actions based on predefined business rules

– Consolidated reporting showing ITC positions across multiple GSTINs for large enterprises

2. Analytics and Reporting Capabilities

Advanced invoice management software should provide analytics that help you:

- Identify suppliers with consistently high error rates requiring additional onboarding

- Track trends in invoice rejections and pending decisions across tax periods

- Monitor your organization’s ITC utilization efficiency compared to eligible ITC

- Generate predictive insights on potential ITC claims for better cash flow planning

These analytics transform your invoice management system for enterprise from a compliance tool into a strategic decision-making asset.

3. API-Based Automation

The GSTN provides APIs for accessing IMS data through GSPs. Enterprises should consider procuring invoice management solutions that:

- Automatically pull invoice data from the IMS dashboard at regular intervals

- Apply machine learning algorithms to match the invoices from the Purchase register and classify invoices for accept, reject, or pending actions

- Execute bulk actions on the IMS portal based on system recommendations, subject to manual approval thresholds

- Maintain audit trails of all actions taken for internal compliance reviews

This level of automation is essential for enterprises processing thousands of invoices monthly through their invoice management system.

Preparing for Future Changes: The Evolution of IMS Under GST

While the current invoice management solution provides significant flexibility, the regulatory direction points toward a more automated, rigid system. Understanding these anticipated changes helps enterprises prepare their invoice management system for enterprise accordingly.

Anticipated Regulatory Changes

The amendments to Sections 34, 38, and 39 of the CGST Act create the legal framework for:

- Mandatory action on invoices within specified timelines

- Non-editable GSTR 3B based on GSTR 1, GSTR 1A and GSTR 2B data

- Loss of credits due to delay or inaction in the IMS

The final procedural step will be notification of amendments to Rules 60 and 61, and introduction of new Rule 67B, which will formally codify the IMS process and its link to GSTR 3B. When implemented, these changes will make your invoice management software capabilities even more critical for compliance.

Building Future-Ready Capabilities

To prepare for these changes, enterprises should:

- Invest in scalable invoice management solutions that can handle increased processing volumes

- Train tax teams on the technical aspects of IMS under GST and GSTR 1A procedures

- Document current reconciliation processes and identify automation opportunities

- Establish governance frameworks that define approval hierarchies for IMS actions

- Create contingency plans for managing large volumes of pending invoices as deadlines approach

Organizations that build these capabilities now will transition smoothly when mandatory timelines are implemented, while those waiting for final notification may face significant compliance challenges.

Conclusion: Embracing the Invoice Management System for Strategic Compliance

The Invoice Management System represents a fundamental transformation in GST compliance, moving from retrospective reconciliation to proactive invoice management. For enterprises, this invoice management solution offers the opportunity to reduce errors, optimize ITC claims, and build more collaborative relationships with suppliers.

While key features like mandatory action timelines and non-editable GSTR 3B are not yet enforced, the legal framework clearly indicates the regulatory direction.

Enterprises should view this transitional period as a strategic opportunity. By actively using the invoice management system for enterprise operations, familiarizing teams with GSTR 1A procedures, strengthening vendor communication processes, and investing in integrated invoice management software, businesses can turn compliance requirements into competitive advantages.