Introduction: Why GST Compliance Still Challenges Enterprises

The Goods and Services Tax (GST) was intended to simplify India’s indirect tax system, yet it’s compliance for the organizations still remains a significant challenge for many. The reality after GST’s rollout has been described as a “perplexing maze” rather than a straightforward path, with multiple issues like input tax credit (ITC) disputes, frequent notices, and delayed refunds continuing to burden businesses.

Even after investing heavily in their own compliance, companies across sectors are still nagged with payment delays, ITC restrictions, mismatches between GSTR-2B and GSTR-3B, and compliance notices. These are the kind of problems that can cripple operations and cash flow. A GSTN approved GST filing software can help resolve through automation, reconciliation, and timely filings.

In this guide, we try and break down the key components of GST compliance along with outlining common challenges with solutions and explain how the right GST software tools can streamline the process for your team.

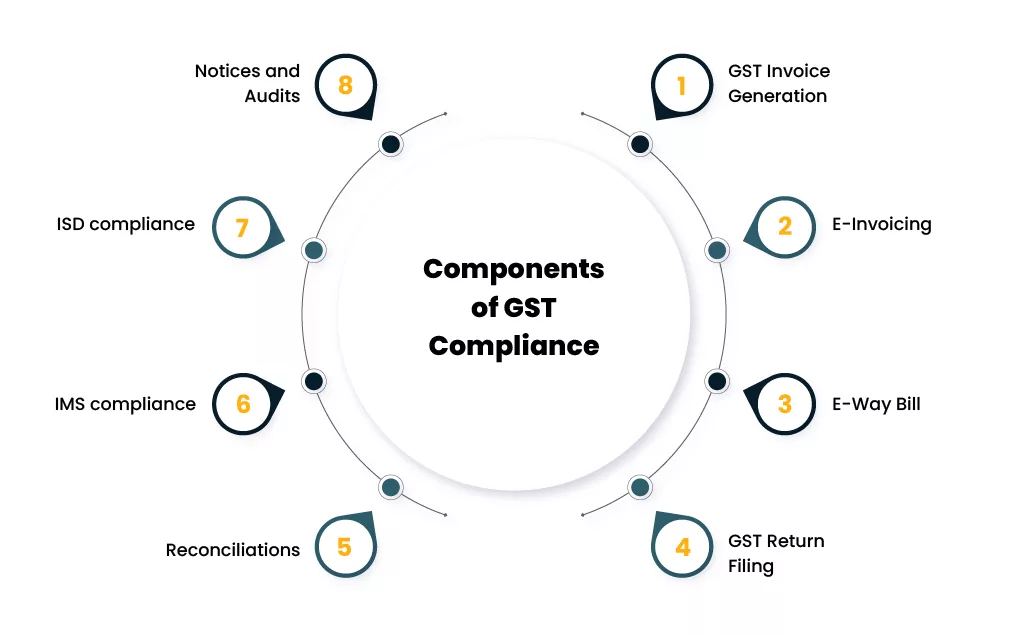

Components of GST Compliance

Achieving GST compliance involves several key tasks across operations. To better understand the scope and framework of GST compliance in India, it’s important to consider how invoicing, e-invoicing, and reconciliation all connect within the GST ecosystem.

- GST Invoice Generation: Issuing invoices which are GST-compliant for all sales and services is fundamental for having a holistic compliance system. Each invoice must carry the required details as per rule 46 of CGST Rules such as GSTINs, item descriptions, HSN/SAC codes, tax rates, etc., and they need to be valid and accurate.

- E-Invoicing: For those businesses which are above a certain turnover threshold, which is ₹5 crore, e-invoicing is mandatory. Every invoice in such cases must be reported through the government portal within 30 days for businesses with AATO 10 crores, to generate a unique Invoice Reference Number (IRN) and QR code. E-invoicing helps integrate your invoices into the GST system in real-time, in turn reducing manual data entry errors.

- E-Way Bill: When the moving goods are above a Rs 50000 value , an electronic waybill must be generated before setting up the goods in transit. The e-way bill ensures that each shipment has corresponding GST documentation.

- GST Return Filing: Businesses need to periodically file the GST returns, which generally are GSTR-1 & GSTR-3B. These returns are filed monthly/quarterly, along with an annual return, GSTR-9, which is to be filed once each year. Large sized enterprises (above ₹5 crore turnover) must also submit a reconciliation statement in GSTR-9C. Further there are many other returns required based on businesses’ specific need.

- Reconciliations: Matching your GST records with counterparties’ records is a significant part of compliance. For example, input credit claims should align with suppliers’ reported sales.

- IMS compliance: IMS ensures that invoices reported by suppliers match those claimed by recipients. This system supports automated ITC validation and reduces fraud. Businesses must regularly reconcile GSTR-2A/2B with their purchase records to avoid credit denial.

- ISD compliance: For organizations operating across multiple business units, ISD compliance ensures proper distribution of input tax credit on common services like rent, audit, or IT support to respective GSTINs. It centralizes credit allocation, minimizes errors, and improves credit utilization efficiency.

- Notices and Audits: Some of the times, tax authorities may issue GST notices or conduct lawful audits if they find inconsistencies in the filings. This is why companies must have a process to track and respond to GST notices promptly.

Common GST Compliance Challenges

Despite best efforts, enterprises often encounter common GST compliance challenges. Some of the key hurdles in the compliance include:

- Complex Return Processes: Handling numerous returns with strict deadlines for each of the filings like GSTR-1, GSTR-3B, etc. can be cumbersome. In larger sized organizations with high transaction volumes, preparing accurate returns on time can feel like an endless cycle, where any mistake may lead to cascading corrections or fines.

- Data and Record Accuracy: Keeping every invoice, credit note, and transaction record error-free is difficult. Even minor mistakes or missing documents can throw off tax calculations or ITC claims. Many businesses struggle to maintain perfectly accurate records at all times, increasing the risk of mismatches and compliance issues.

- ITC Reconciliation Gaps: Discrepancies between a company’s purchase records and its suppliers’ filings (e.g. GSTR-2B vs GSTR-3B) are common. These mismatches can can cause delays or denial of credits, which is why understanding maximizing input tax credit under GST through systematic reconciliation is essential for compliance accuracy.

- Frequent Rule Changes: GST rules and formats are updated regularly. Companies that fail to monitor the latest notifications and adapt their processes risk non-compliance due to outdated practices. Keeping up with frequent changes,

–such as new e-invoicing thresholds or revisions in return forms–is an ongoing challenge. - Multi-State Compliance Burden: Businesses operating in multiple states (with several GST registrations) face added complexity. Every state’s registration requires separate filings , ISD compliance and record-keeping, which makes consolidation labour intensive task. Ensuring consistent compliance procedures across all locations requires significant coordination.

- Resource Constraints: Continuous compliance to the GST rules and regulations requires great amounts of time and expertise. Mid-sized firms may lack a full-fledged tax compliance team, and juggling return filing, with reconciliations and audits with day-to-day work strains limited resources. With no trained staff or external support, errors and delays become more likely, along with lapses in compliance.

The initial move to tackle and fix these problems is spotting them. Businesses need to come up with ways to cut down on the chances of things like outdated info wrong credit claims, and late paperwork. These slip-ups can lead to penalties or audits.

Solutions to address GST compliance issues

To tackle the above said challenges, enterprises can adopt several best practices listed below:

- Structured Record-Keeping: The idea is to implement a good system for maintaining GST records such as invoices, e-way bills, payment receipts, etc., and review them regularly. Documentation, which is organized and up to date prevents last-minute scrambles and errors during return filing. Strong record-keeping also makes audits and reconciliations smoother by ensuring all data is readily available.

- Frequent reconciliation: Reconcile your data frequently rather than having to wait for year-end or audits. For eg., monthly match your purchase register with IMS entries and GSTR-2A/2B and verify that sales reported in GSTR-1 align with your ledger. Regular reconciliations so as to catch mismatches early, and thus, giving you time to correct discrepancies before they escalate into notices.

- Stay Updated and Train Teams: Making it a priority to stay informed about GST rule changes and deadline updates will also prove useful. By using compliance calendars along with subscribing to GST bulletins or consulting domain experts; using these things, we can keep abreast of new requirements in this field. You can also train your finance/tax team whenever regulations evolve, so that your internal processes and software remain compliant with the latest rules.

- Fix compliance as a part of your Routine: Start to treat the GST compliance thing as an ongoing process rather than last-minute project. Assign dedicated and qualified personnel/advisors to supervise compliance throughout the year, establish standard procedures across all branches to ensure uniform practices.

By implementing the above discussed solutions, organizations can drastically reduce their burden of GST compliance. The final goal the companies should set is to move from reactive compliance to proactive compliance.

Choosing the right GST compliance software

Technology can prove, and is proving to be a game-changer for GST compliance. When choosing a GST software solution, we can consider the following factors:

- Comprehensive Features: The software must manage all GST duties, including but not limited to tax calculations, invoicing, e-way bill creation, yearly returns, GSTR-1, GSTR-3B, and all return submissions, as well as ITC reconciliation.

- Integration & Scalability: Select software that automatically retrieves transaction data by integrating with your accounting or ERP system to reduce the need for human data entry.

- Ease-of-use and support: A friendly user interface is very important as your team can adopt & use the tool easily, if it is easy to learn and implement into your current workflow.

- Security and Reliability: Check and see if the program has strong data security measures in place so as to keep the private tax information safe. Choose a reputable, well-known supplier, with renowned security measures; these businesses usually provide strong security and dependable service.

Choosing the right GST compliance tool can make it very easy for you to adhere to the rules. A reliable tool lets your team focus on analysis instead of paperwork by doing calculations automatically, which in turn cut down on manual work, and check for errors right away. In short, the software should be like a compliance partner that helps you be more accurate and productive.

Conclusion

GST compliance is complicated, but with the right set of tools and proper plans, it becomes a manageable part of running a business. Using automation and the right GST compliance software together makes workflows better, cuts down on mistakes made by people, and makes sure that filings are always on time.

In the end, being proactive about compliance not only keeps you from getting fines and audits, but it also builds a good reputation with tax authorities, customers, and partners. Following the best practices in this guide and using modern tools, finance and tax professionals can turn GST compliance from a constant problem into a regular task. This will free up the business to focus on growth and strategic goals.