About VAT Automation & Compliance

Smarter, faster compliance—enhanced efficiency!

Businesses operating in the UK must navigate an evolving indirect tax landscape. Managing VAT return compliance and data validation can be costly and complex.

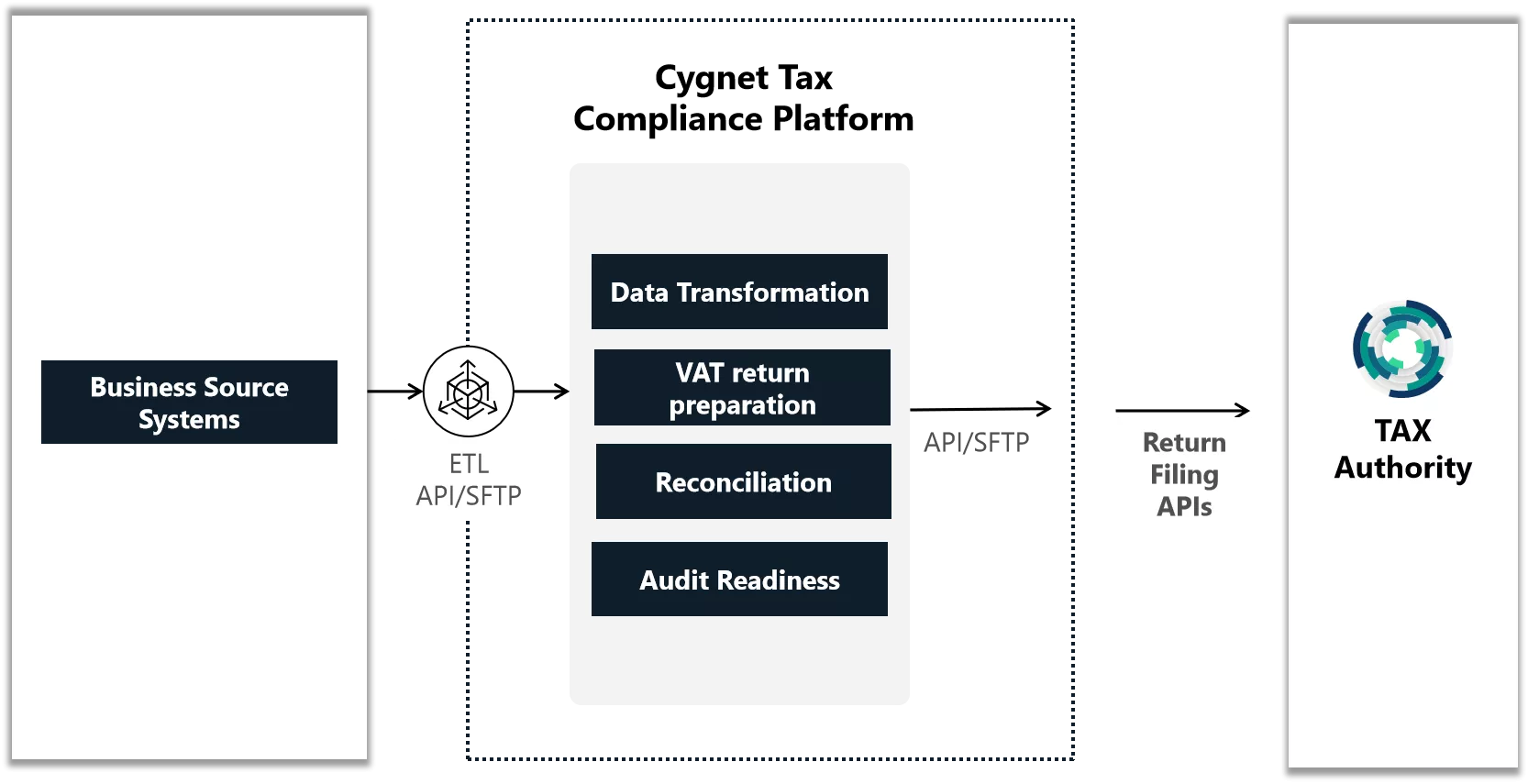

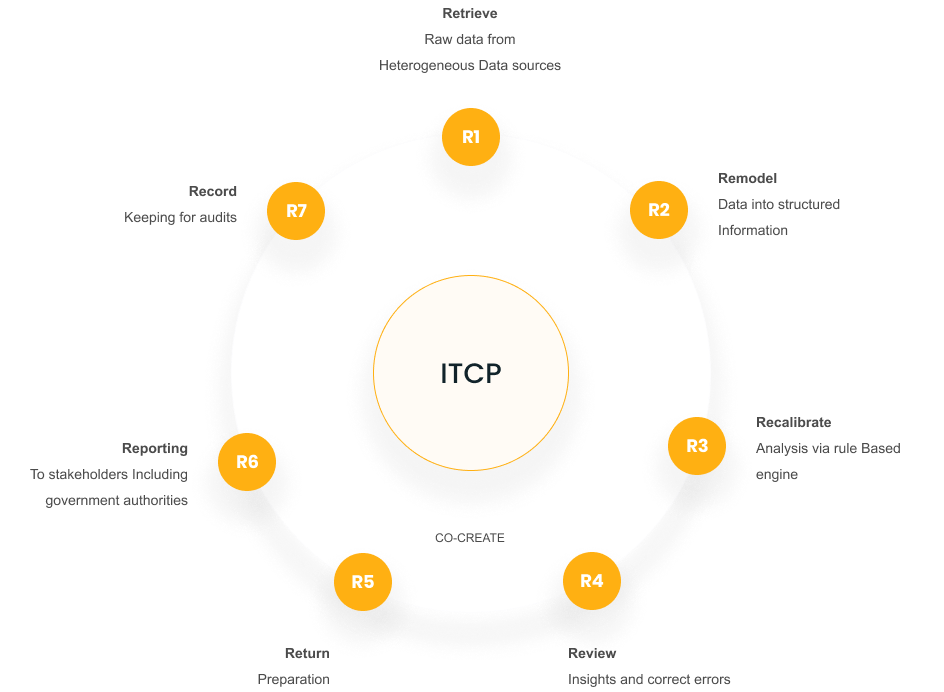

Cygnet Tax, an Indirect Tax Compliance Platform provides offers a centralized, scalable, and automated solution to streamline VAT return preparation and filing—ensuring accuracy and efficiency for businesses of all sizes.

Cygnet Tax MTD for VAT provides a seamless digital link between Cygnet Tax and HMRC, ensuring full compliance with Making Tax Digital (MTD) requirements. Our VAT filing solution enables businesses to efficiently manage VAT obligations while adhering to regional regulations.

Why Choose Cygnet.One?

A comprehensive end-to-end solution encompassing many features

Trusted by more than 1200 enterprises globally for tax compliance

95%+ client retention rate with a focus on accuracy & automation

Robust security & data privacy to protect financial information

24 x 7 support for uninterrupted services

Cygnet One's Indirect Tax Software Solution

is built and supported by our expert tax professionals

The software is updated regularly for tax and system logic ensuring full compliance with current legislation and delivering a comprehensive automated cloud-based solution that is fast, accurate, and easy to use.

Highlights of Indirect Tax Compliance platform

Modern challenges require modern solutions

Here’s how the VAT return solution will help to automate your tax processes

Improve data accuracy

Extract, clean, merge and use data from multiple source business systems, i.e., POS, ERPs, CMS, accounting systems, and others at transactional, summary, and line levels using SFTT/FTP, SSIS, API connectors, and more.

Intuitive data insights

The dashboard presents an in-depth view of statistics & insights related to VAT data and filing deadlines.

Efficient risks management

Detailed audit trail to ensure good governance and control of VAT management and processes.

Digital filing and submissions

From generating invoices to filing returns, link your system directly to regulatory authority.

Achieve improved security

Keep the data secured with VAPT, ISO 9001, ISO 27001, CMMI-3 certification and more.

Challenges

- Struggled with accurate VAT returns and EC sales list preparation.

- Faced data quality issues and low productivity across multiple systems.

- Needed an automated solution for error checking, validation, and consistency.

Solution & Impact

Automated data collation from multiple business systems.

Converted data into a ready-to-file VAT return and EC sales list.

Managed Services ensured error checks, validation, and 24/7 support.

80% increase in productivity and 40% reduction in operational costs.

Enhanced data accuracy, streamlining compliance for smoother operations.