Looking for a direct, GSTN-approved IRP to handle your invoice authentication with maximum reliability?

Cygnet IRP offers a robust, high-speed, and secure e-invoicing infrastructure with built-in fallback mechanisms for uninterrupted compliance.

e-Invoicing under GST requires businesses with ₹5 crore+ turnover to digitally generate e-Invoices. Validated invoices get a unique IRN and QR code, enabling auto-population of GSTR-1, faster generation, reduced reconciliation effort, and improved ITC visibility.

Cygnet Tax is what we do EVERYDAY

Try it First Hand!

E-Invoice against me API

Seamless data sync between Portal and IRP/NIC

Store e-Invoices for Over 48 Hours

The presence of a IRP fallback with real time uploads

Value created by Cygnet

We are living the trust with…

Value created by Cygnet

We are living the trust with…

1.7

Billion+

E-invoices generated already

250

+

Successful ERP integrations

600

+

Corporate clients trust our capabilities

24 x 7

Uninterrupted support for seamless operations

Trusted by many Clients

Where the real magic happens!

A Unified Platform

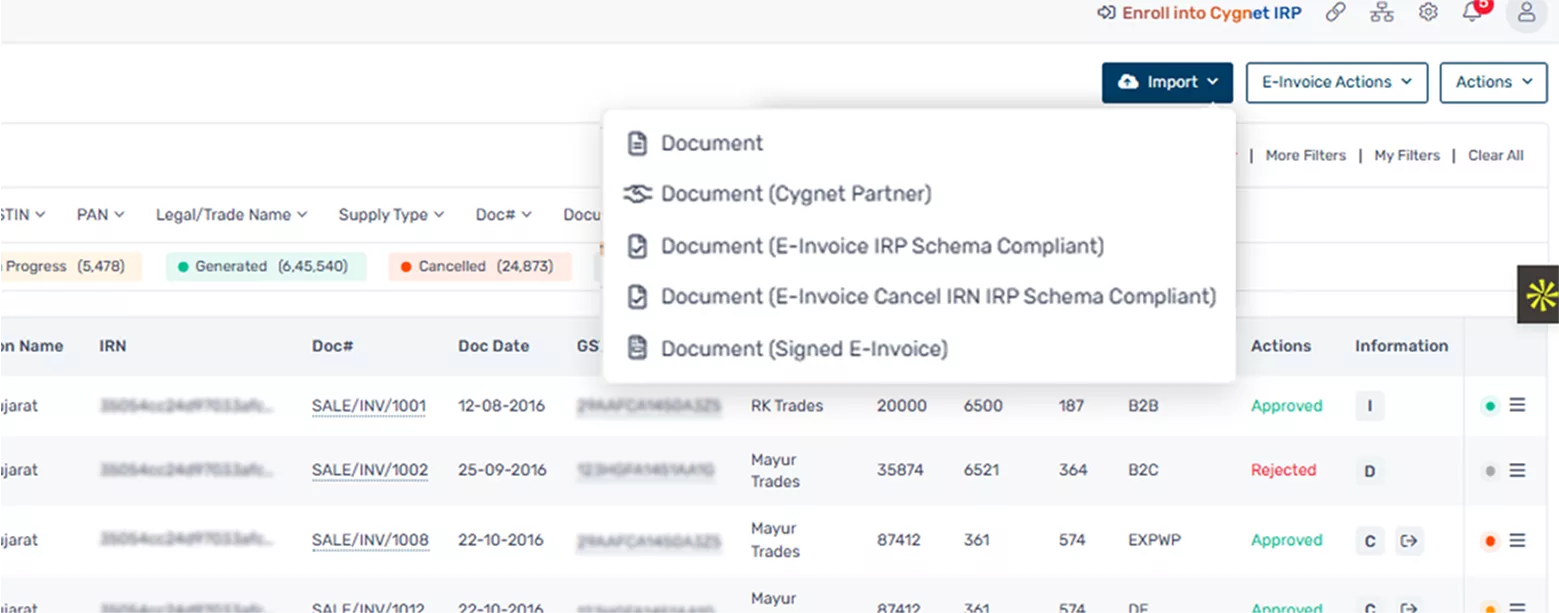

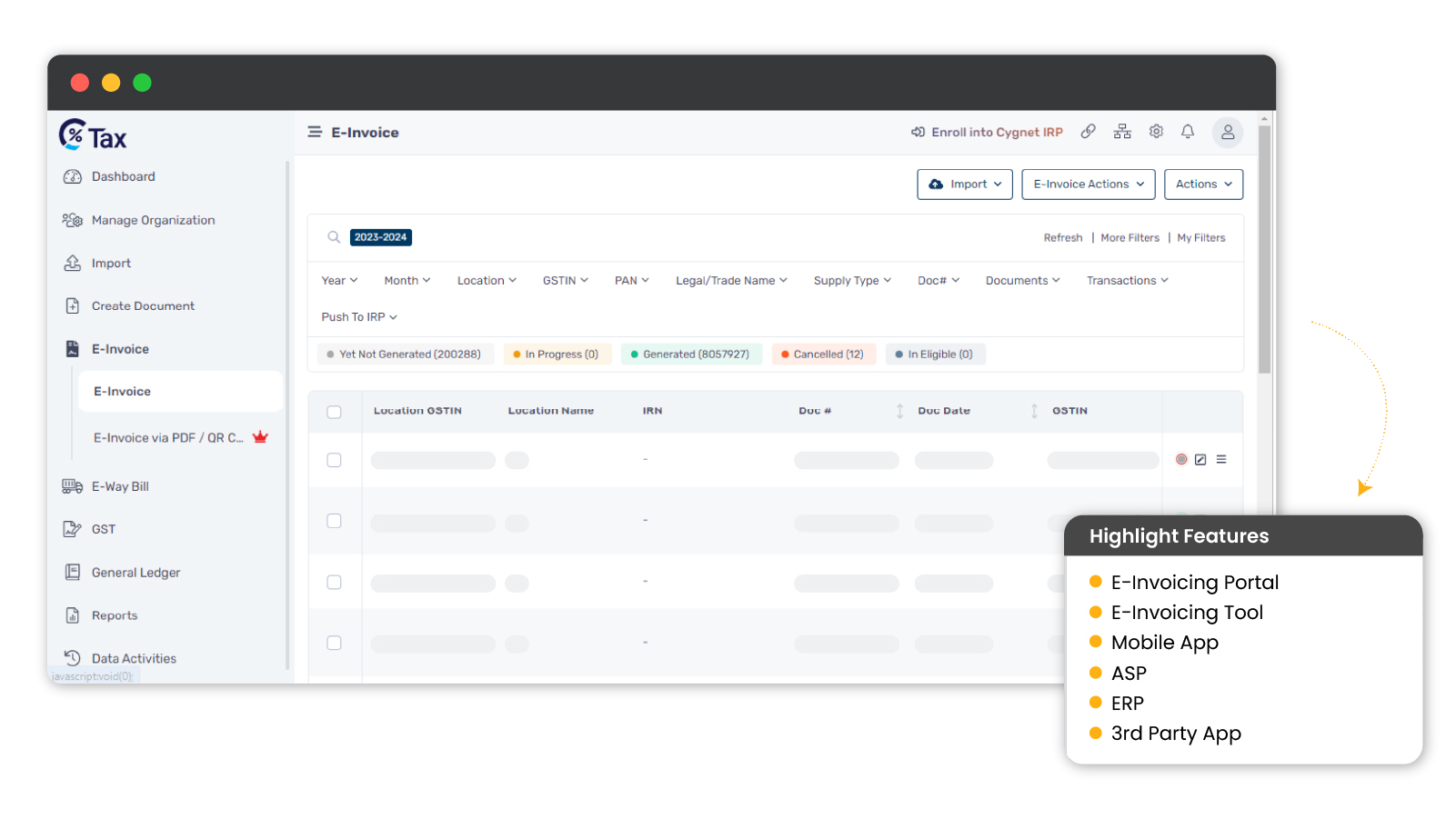

e-Invoice

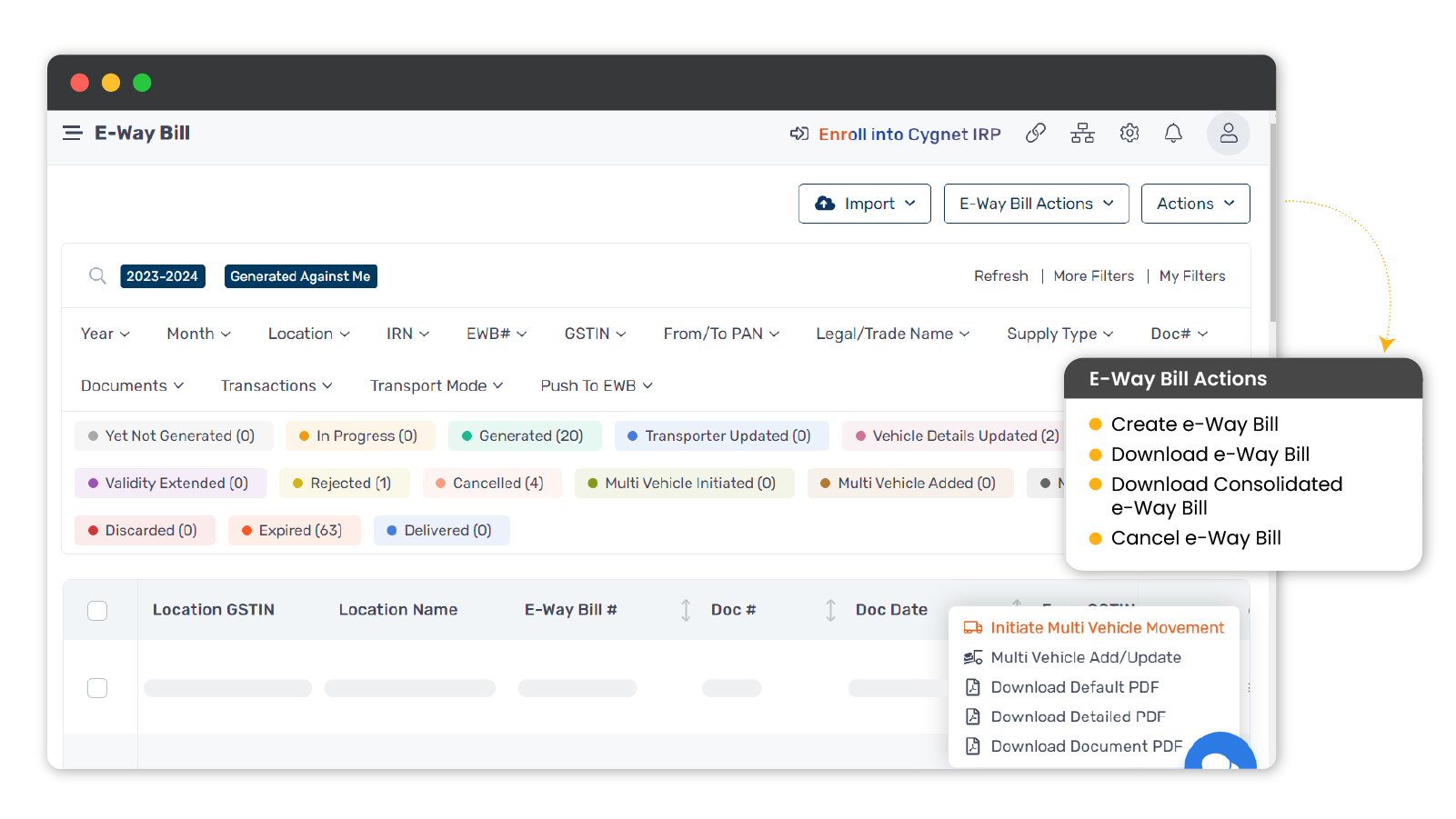

e-Way Bill

GST Returns

Our Accreditations

With tax authorities across the globe

FAQs

Yes. Cygnet offers pre-built connectors and APIs for major ERPs including SAP, Oracle, Tally, Microsoft Dynamics, and Zoho. Our integration works for both on-premise and cloud ERP setups, with flexible options like real-time API and secure SFTP batch processing.

Once invoice data is validated in Cygnet’s platform, it is sent to the IRP for authentication. The IRP generates a unique Invoice Reference Number (IRN) and embeds a QR code into the invoice. Cygnet then returns this validated invoice to your ERP in JSON and/or PDF format, ready for dispatch to customers and linked with GSTR-1 and e-way bill modules

Cygnet’s e-invoicing platform is built for high-volume enterprises and can process millions of invoices per day with 99.99% IRN uptime, thanks to our multi-IRP fallback mechanism. The system is fully scalable to handle seasonal spikes or month-end peaks without delays.

Cygnet’s e-invoicing solution is available in both cloud and on-premise models. Cloud – Ideal for faster deployment, automatic updates, and scalability. On-Premise – Suitable for businesses with strict data residency or security policies.

Both models support API and SFTP integration, multiple IRPs, and enterprise-grade security.

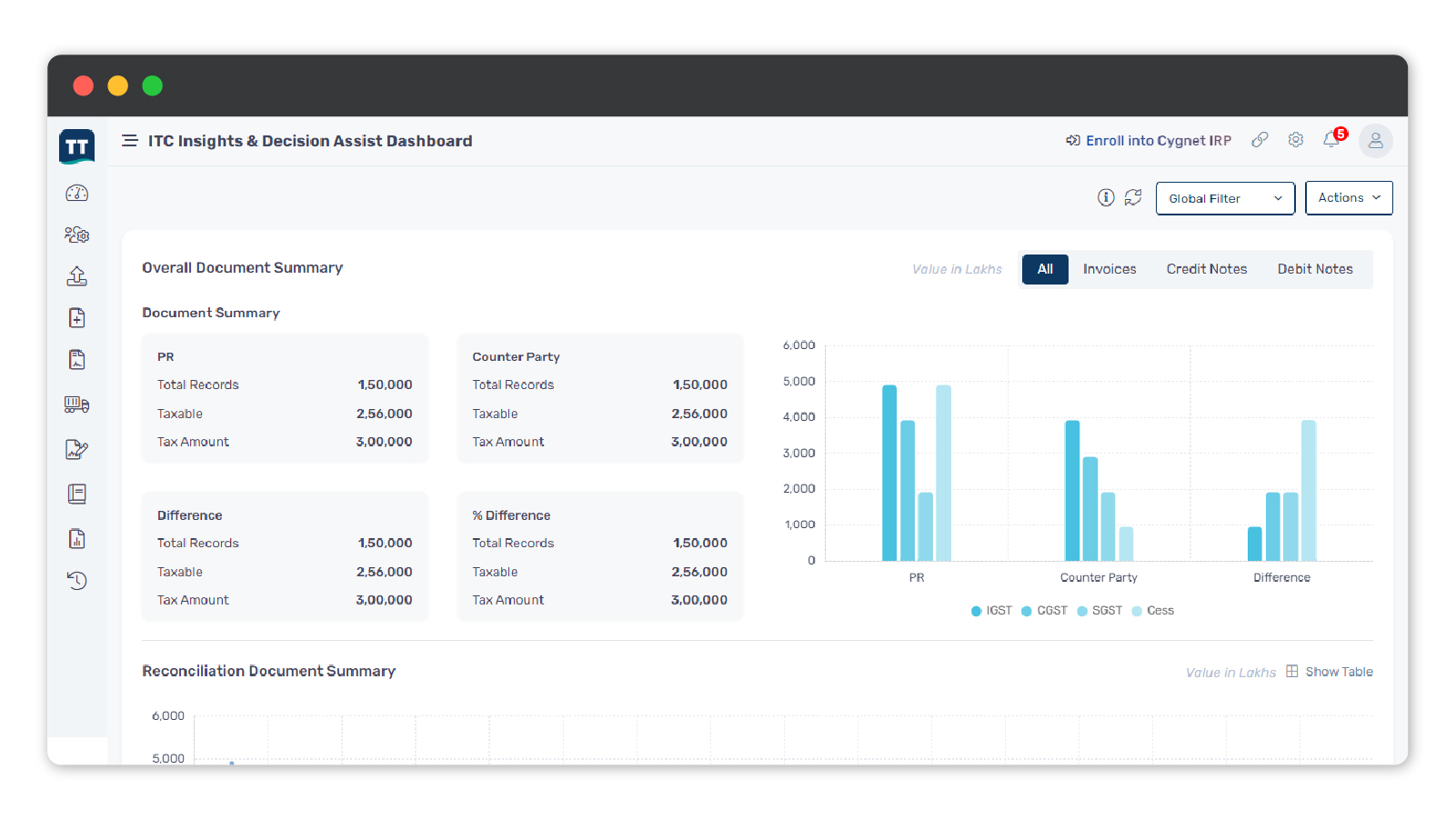

Yes. Our three-way reconciliation engine matches invoice data across IRN records, GST returns, and e-way bills to prevent mismatches, ITC loss, and compliance disputes.

Yes. Cygnet allows you to apply digital signatures to IRN-validated invoices for enhanced authenticity and legal compliance—particularly useful for exports and audit-heavy industries.