Journey of an Invoice under GST (India) – Powered by Cygnet Tax

phase 1

phase 2

phase 3

phase 4

phase 5

phase 6

phase 7

phase 8

phase 9

1. Invoice Created in ERP

Transaction initiated in the source system (ERP, POS, etc.)

2. Tax Determination

- Auto-classifies goods/services (HSN/SAC)

- Applies correct GST type (CGST/SGST/IGST)

- Handles reverse charge, exemptions, TDS/TCS logic

3. e-Invoice Generation (via IRP)

- Invoice details pushed to Govt. portal (IRP)

- IRN and QR code fetched and embedded

- GSTR-1 auto-updated

4. e-Way Bill Generation

- If applicable, e-Way Bill auto-generated via NIC portal

- Merged with e-invoice (for transportation compliance)

5. Invoice Sharing with Buyer

- Legally valid invoice sent with IRN & e-Way Bill reference

- Buyer system can auto-validate and post

6. GST Return Preparation

- GSTR-1 pre-filled from invoice data

- Reconciliation-ready GSTR-2A/2B mapped for ITC validation

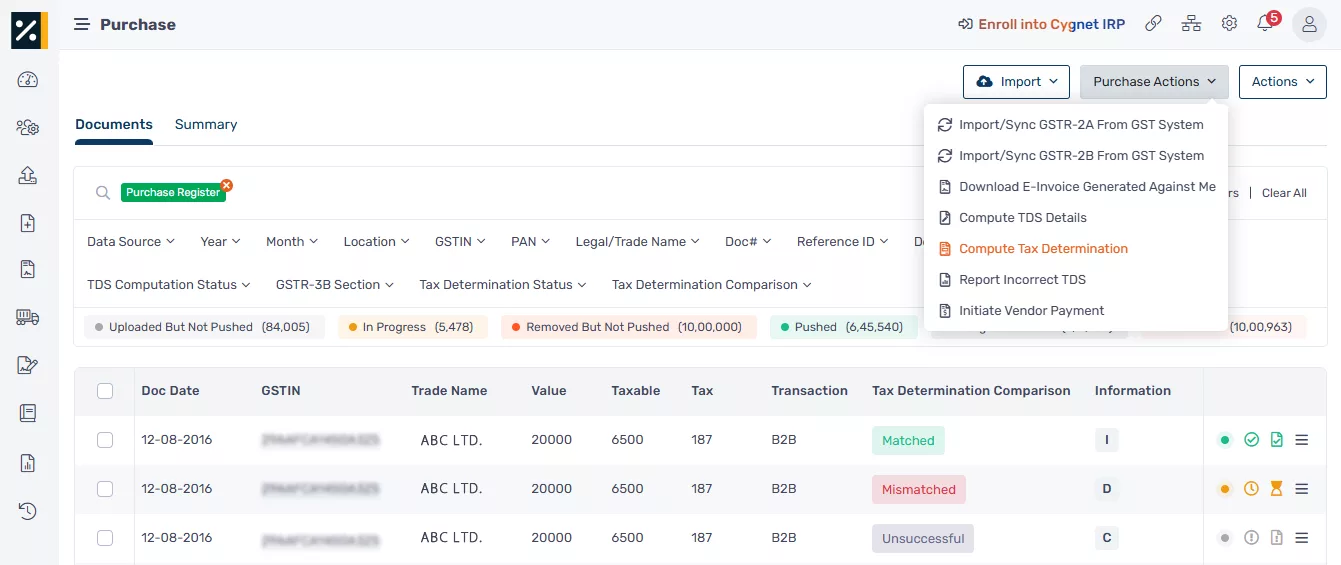

7. Intelligent Matching & IMS Actions

- Match vendor invoices, flag mismatches

- Take action on ITC eligibility or reversal (IMS engine)

8. Return Filing & Tax Payment

- File GSTR-1, 3B, 9/9C, and other forms via portal/API

- Track liabilities, ITC, and cash ledger balances

9. Audit-Ready Logs & MIS

- Dashboards, logs, and audit trails maintained

- Data archived for compliance, notices, or future audits

Without tax determination, you risk misclassification, incorrect GST rates, and errors in returns, leading to penalties, denied ITC, or audit red flags.

Streamline taxes with accuracy and compliance

Up-to-date accuracy

Stay compliant and avoid penalties with automated tax calculations and instant updates tailored to GST tax rates, ensuring precise indirect tax determination.

Minimize risk

Protect your bottom line and maximize control by eliminating financial inaccuracies. Our precision tax calculation system ensures you never overpay or underpay.

Best practice content

Drive every calculation and decision with the latest indirect tax content, vetted by industry tax experts and regularly updated to latest compliance and regulatory standards.

Seamless integration

Integrate smoothly into your operations with pre-built ERP integrations and robust API capabilities.

GST compliance begins with intelligent Tax Determination

Our solution classifies goods and services (HSN/SAC), determines the right tax rate (CGST, SGST, IGST), and maps jurisdictional rules, place of supply, and exemptions with precision.

- Correct tax break-up on invoices

- Reverse charge & TDS/TCS applicability

- Seamless alignment with return forms like GSTR-1 & GSTR-3B

- Accurate ITC claim validation during purchase reconciliation.

Power your compliance journey with AI-led Tax Determination