Features

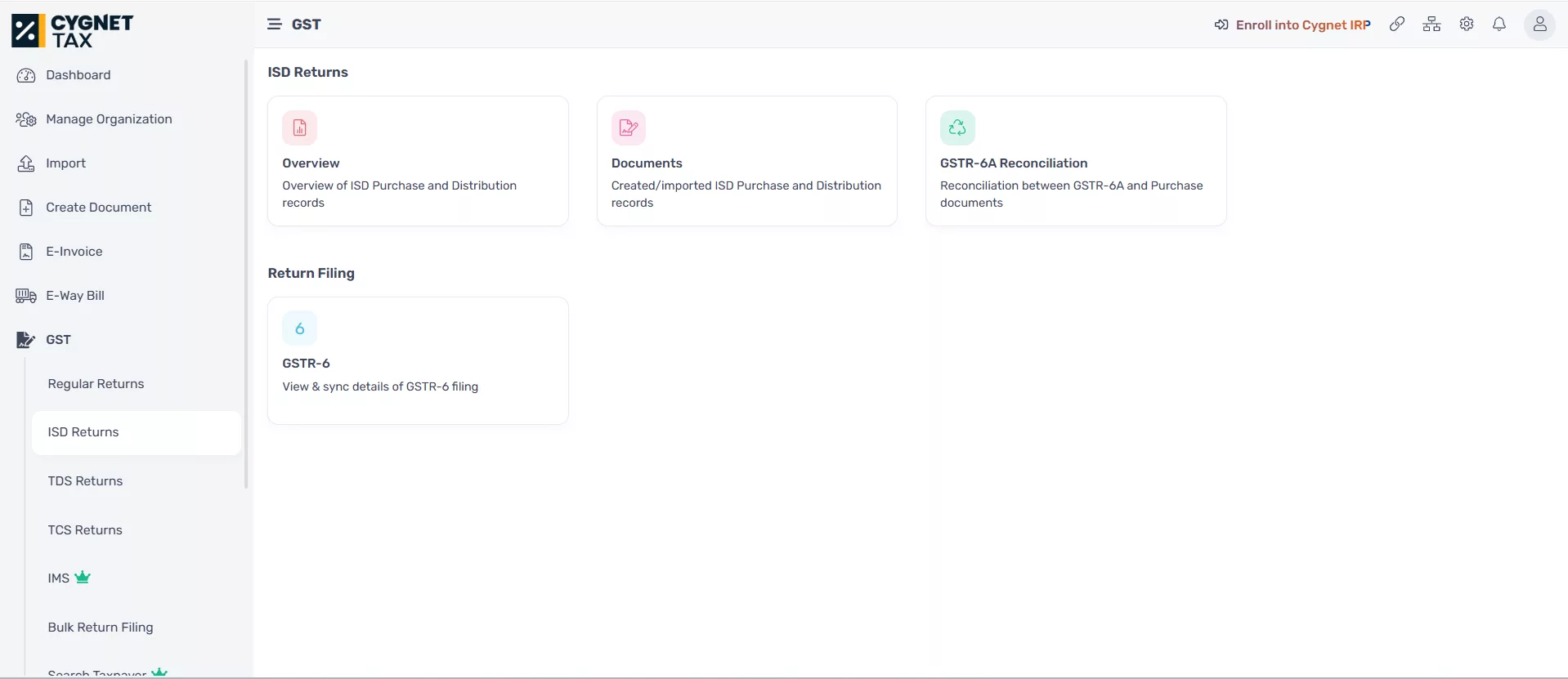

ISD invoice generation

Real-time ITC reconciliation

GSTR-6 automation

ERP/API integration

Here’s what you’ll achieve

Achieve up to 99.5% precision in GSTIN-level input credit mapping

Auto-aligns with GSTR-6 rules and reduces risk of audit triggers

Cut down filing cycle time by 60% with automation and validations

Eliminate spreadsheets—automate end-to-end allocation workflows

Get traceable audit logs with role-based access and dashboards

Seamless plug-in to SAP, Oracle, Tally & more for data continuity

Access Resources

Reduced man-hours by automating e-Invoice and e-Way bill generation for a sugar manufacturer

Reduced man-hours by automating e-Invoice and e-Way bill generation for a sugar manufacturer.

FAQs for Input Service Distributor (ISD)

Every question answered about Input Service Distributor (ISD). Read on to learn more.

e-Invoicing compliance Timeline

Electronic invoicing regulations are rapidly becoming the standard across the European Union (EU) and globally, driving procurement standardization. Countries such as France, Poland, Spain, and Ukraine are preparing to introduce their e-invoicing regulations starting in 2023 and continuing in the years to come.