Tax Authority

Infocomm Media Development Authority (IMDA)

Applicability

E-Invoicing is applicable to newly incorporated businesses registering for GST.

Governing Laws

Not governed by a dedicated e-invoice law, but aligned with GST regulations under IRAS and the IMDA digital framework.

Dedicated E-Invoice Platform

No dedicated platform

Implementation Timeline

- May 1, 2025: Voluntary Phase, For any GST-registered businesses.

- November 1, 2025: Mandatory for newly incorporated companies from 1 may 2025 that are apply for

Voluntary GST registration. - April 1, 2026: Mandatory for All new voluntary GST registrants.

Storage and Archiving Requirements

Invoices must be archived for 5 years in original form, ensuring accessibility, readability, and audit

integrity.

E-Invoice Format

XML-based Peppol e-invoice Template (PINT SG)

Digital Signature Requirement

Not required

E-Invoice Model

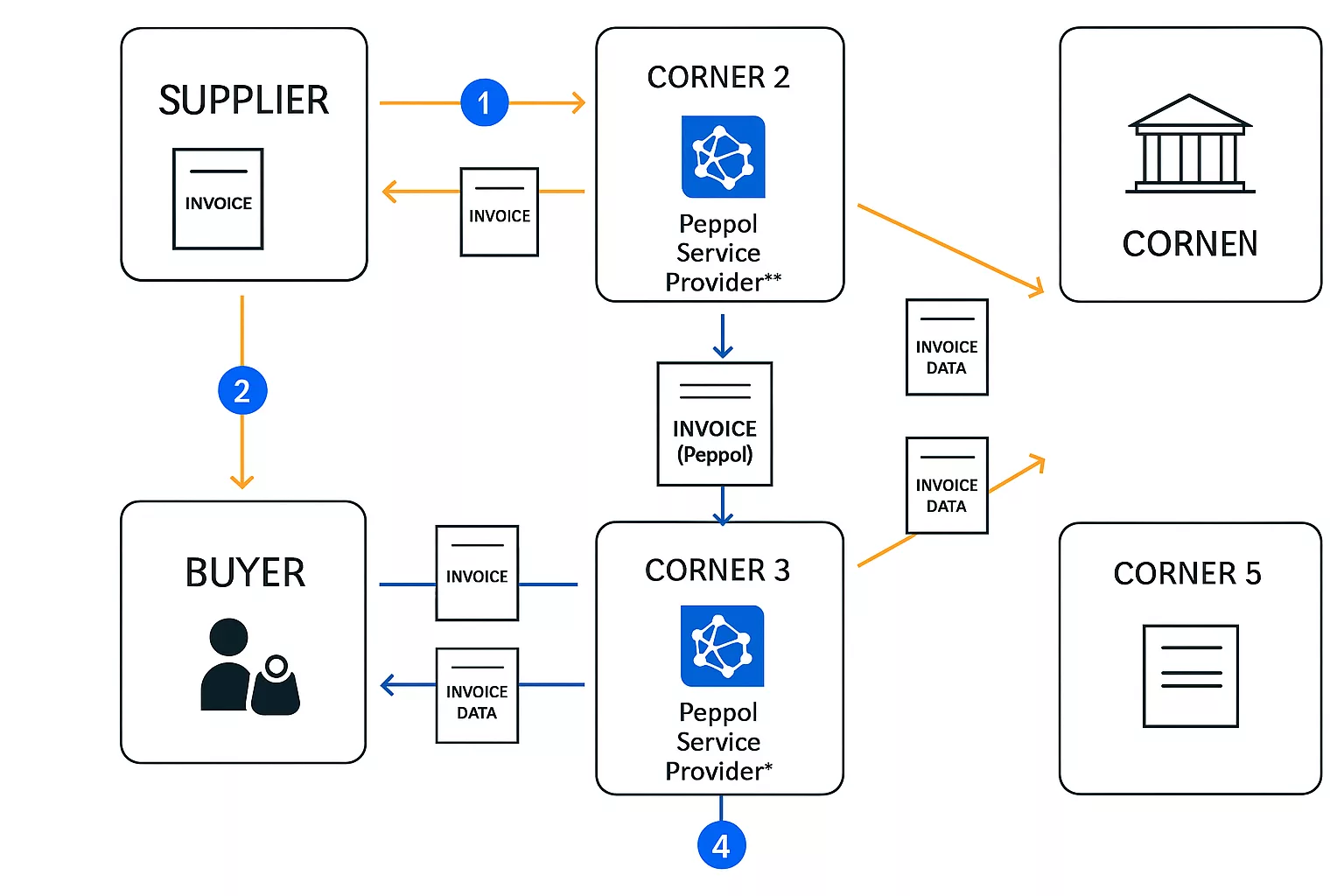

Peppol-based 5-corner model

Based on Peppol

Yes

Access Resources

AI + Data Analytics: The Intelligence for Smart Business Decisions

Discover how AI and data analytics can provide businesses with the intelligence needed to make smart decisions. Learn how to leverage these technologies for success.

Digital Insurance: How Insurance Industry Can Excel with Technology Innovation?

Unlock the future of digital insurance with cutting-edge technology! Explore the transformative impact of digital innovation on the insurance industry.

Build Smart Workflow with Intelligent Automation and Analytics

Unlock the future of digital insurance with cutting-edge technology! Explore the transformative impact of digital innovation on the insurance industry.