August 2026

Pilot launch with 100 large VAT-

August 2027

Mandatory e-invoicing for all remaining small and medium VAT-registered taxpayers.

February 2027

Mandatory e-invoicing for all large VAT-registered companies.

To be announced

Rollout for government institutions and entities.

Our Accreditations

With tax authorities across the globe

Frequently Asked Questions

The pilot (first wave) is expected to begin in August 2026 with ~100 large taxpayers.

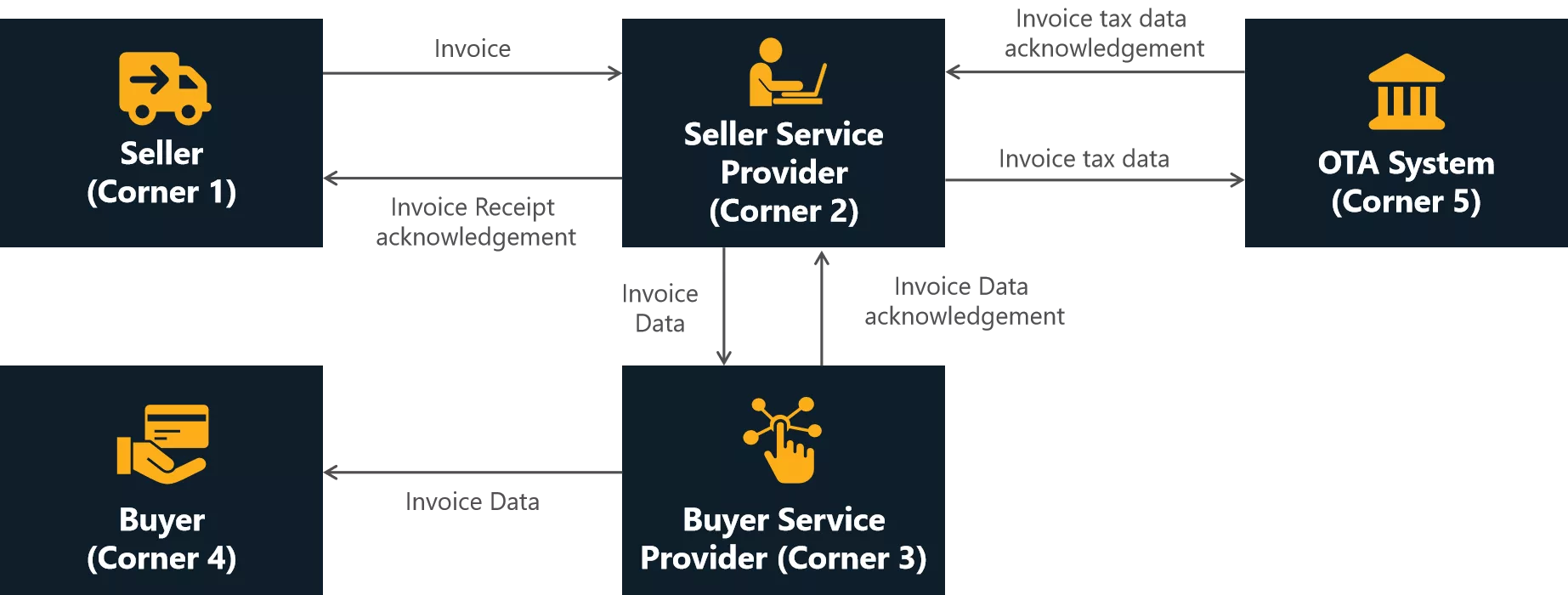

Oman plans to adopt a 5-corner (Peppol) model where accredited SPs validate, route, and report invoices to OTA.

- B2B (Business-to-Business): Standardized invoices between businesses.

- B2G (Business-to-Government): E-invoices for business transactions with government entities.

- G2B (Government-to-Business): Invoices from government entities to businesses.

- B2C (Business-to-Consumer): E-invoices for consumer transactions, particularly for simplified invoices.

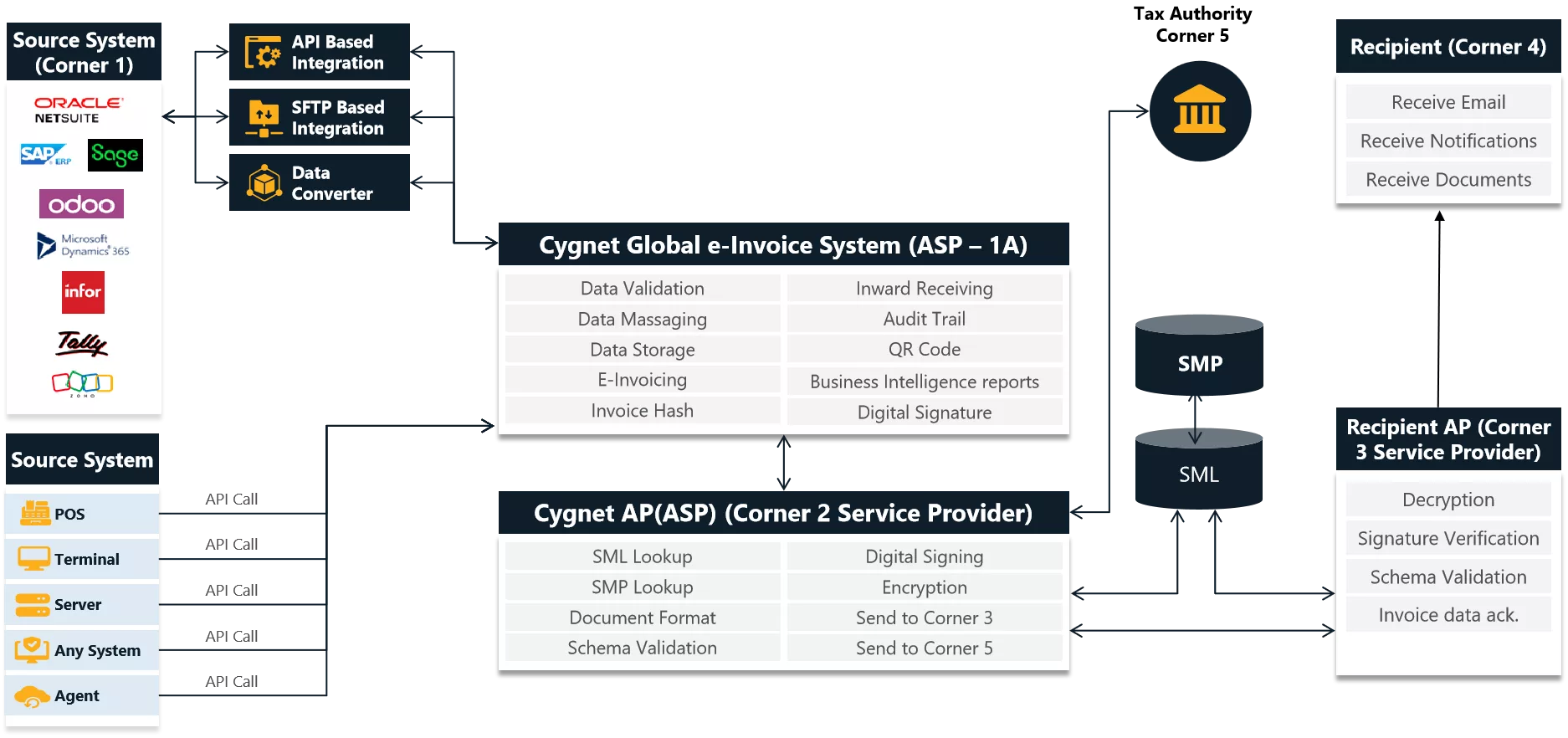

e-Invoices should be generated in XML or PDF/A-3 format and transmitted using API connectivity.

Yes, one can generate a debit or credit note instead.

Yes, penalties will be applied according to the regulations with a grace period before enforcement.

Invoices will be archived for 10 years (5 years in the system + 5 years in an electronic archive)

The Oman e-Invoicing solution enables VAT-registered businesses to comply with OTA’s mandate by issuing, validating, and reporting invoices electronically through accredited service providers.

Look for OTA accreditation readiness, Peppol/5-corner expertise, integration capabilities, SLAs, regional presence.