As the UAE moves towards digitization, e-invoicing has been the most crucial step by the Ministry of Finance (MOF) or Federal Tax Authority (FTA) to minimize VAT evasion, adopt automation, increase efficiency, and help policymakers get relevant data to make policies based on business requirements.

By 2026, Phase-1 of the mandatory implementation of e-invoicing will go live; therefore, integrating e-invoicing systems in UAE businesses with their existing ERP systems or any other financial or accounting systems to ensure seamless data flow without errors or anomalies is paramount. Integrating e-invoicing systems in UAE with your accounting system is crucial for optimizing financial operations. It simplifies processes, minimizes manual errors, speeds up payment cycles, and provides greater transparency in financial transactions. A successful integration guarantees smooth data flow between e-invoicing platforms and accounting software, maximizing efficiency and accuracy.

Brief on e-invoicing framework for seamless system integration in UAE

The UAE government is set to establish its own PEPPOL Authority, adopting the PEPPOL PINT format to simplify cross-border trade and align with global e-invoicing standards. On 14th February 2024, the UAE introduced the CTC e-invoicing framework. It will implement a “Decentralized CTC and Exchange Model” (DCTCE), starting with a 4-corner model and transitioning to a 5-corner model. This allows trading parties to exchange e-invoices directly without requiring pre-clearance from the Ministry.

The system will rely on Peppol PINT and Accredited Service Providers (ASPs) or e-invoicing agents. ASPs will validate invoice details and forward them to customers and the Federal Tax Authority (FTA), which acts as the fifth corner. Notably, pre-clearance from the FTA won’t be necessary, streamlining the process and ensuring international compliance.

Need for UAE e-invoicing system integration with accounting and financial system

The need for integrating e-invoicing systems in UAE with accounting, financial systems, or ERP platforms has become increasingly vital as compliance with e-invoicing regulations will be mandatory. Here are the key reasons why integration is essential:

- Seamless and automated workflow- Integrating e-invoicing solutions with ERP or accounting systems helps in the automated workflow of invoice management across the organizations. From invoice generation, sending to customers, reporting to FTA, final payment, etc., to data entry, verification, invoice approvals, reconciliation, etc., it is automated with minimal human intervention. This would help reduce payment cycles, invoice reporting delays, or other operational bottlenecks, enhancing productivity and efficiency.

- Regulatory Compliance– With the implementation of PEPPOL’s 5 Corner model, businesses will need to submit e-invoices to FTA, which shall be used to verify the details of turnover, tax payment, and input tax credit reported by the taxpayer. With e-invoicing integration in UAE with ERP, the data entry will be generated automatically with the generation of the e-invoice, thereby reducing errors in tax reporting and enhancing compliance.

- Enhanced accuracy and reduced errors- Manual transmission andManual data entry of e-invoices information without validation is porn to errors and disrupts financial reporting. Integrating the e-invoicing system with the accounting system would automate the data transfer across the organization and will help in automated data entry and accounting, thereby reducing errors and improving accuracy due to minimal human intervention.

- Enhanced auditing and reporting– UAE e-invoicing system integration records audit trails to verify and cross-check the data flow and recording; any error can be flagged by the system for human review. Further automated data flow will help in quicker and more accurate record reconciliation, simplifying auditing and financial reporting. Automated records facilitate smoother audit processes and faster generation of financial reports.

- Improved Financial forecast– e-invoicing integration in UAE with accounting and financial software provides real-time data synchronization of invoice details, payment, and financial transactions, helping with the updation of financial data on real-time across various organizational departments directly and giving better visibility into cash flow, VAT receipt, and payment, receivables, payables and giving insights on overall financial health and forecast facilitating more informed decision making.

e-invoicing integration in UAE

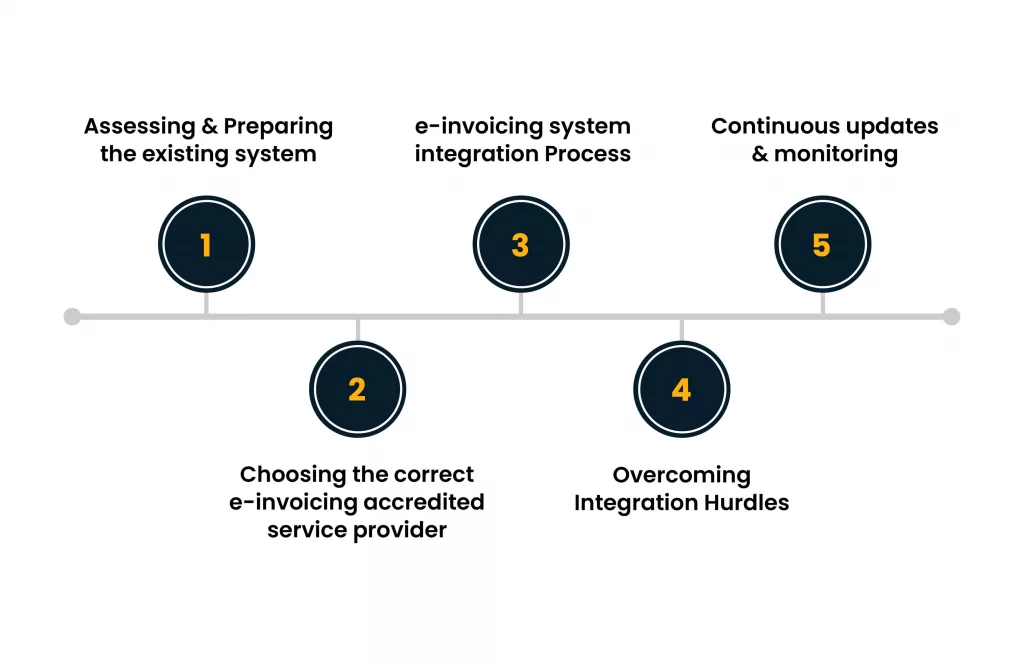

How to Seamlessly Integrate with Financial and Accounting Systems

Assessing and Preparing the existing system

The first and foremost step of system integration is reviewing the existing system to ensure that the accounting system is capable of integrating with the e-invoicing system and ensuring that the outdated systems are replaced. Many modern ERP solutions, like SAP, Oracle, and Microsoft Dynamics, have built-in capabilities that make integrating e-invoicing solutions much simpler, but the older ones require customization or additional middleware to facilitate integration.

Therefore, accessing the system’s flexibility to support external connections and API integration is crucial. This initial evaluation will help you determine the level of effort and resources required to make the necessary adjustments and prepare your systems for integration.

Choosing the correct e-invoicing accredited service provider

Once the system analysis is clear, it is vital to choose the ASP capable of integrating e-invoicing solutions with existing infrastructure and, at the same time, supporting UAE’s PEPPOL standard.

ASPs’ ability to integrate via APIs or ready-made connectors will reduce the efforts and requirements for customization. Further, the solution should be scalable, agile, and accurate to meet the business’s growing demand without hindering the UAE government’s compliance requirements, with minimal turnaround time for shifting to the amendments and new regulations to be complied with.

Look for providers that offer customizable solutions, robust data security measures, and strong customer support to ensure smooth implementation. Additionally, they should be experts and compliant with UAE’s VAT regulations and have a proven track record of helping businesses achieve efficiency, compliance, and scalability. Experience in providing e-invoicing services in other GCC countries, such as the Kingdom of Saudi Arabia, indicates the provider’s familiarity with regional compliance and operational nuances, enhancing reliability and expertise.

Apart from this, many other criteria must be considered while selecting an ideal ASP, such as the type of cloud facility offered for data storage, whether private, public, or hybrid, to match your business’s scalability and security needs. Security features that support role-based access and can handle multiple users securely protect sensitive financial data. Additionally, a user-friendly interface is vital for easy adoption and minimizing training time.

e-invoicing system integration Process

- Integration Strategy: Develop a detailed integration strategy that aligns with the UAE’s PEPPOL requirements. Ensure the strategy is implemented in a phased manner and covers every phase, from system assessment to post-implementation support. This strategy should outline roles and responsibilities and set realistic timelines for each stage of the integration process.

- Customizations: Communicate continuously with the service provider to ensure the customization required in the integration process is explained well based on business needs. Configure data fields, establish synchronization intervals and define mapping rules to ensure accurate data transfer.

- Data Mapping: Perform data mapping between the accounting system and e-invoicing solution to ensure automated workflow across the organization, FTA, and customers. Proper data mapping guarantees accurate information, minimizing errors and ensuring adherence to PEPPOL protocols.

- Quality Assurance and Testing: Prior to deployment, extensive testing must be performed, including end-to-end verification of data synchronization, invoice generation, and the entire workflow process within the PEPPOL framework. Address and resolve any detected issues to ensure a smooth and compliant transition.

Overcoming Integration Hurdles

- Resolving Data Discrepancies- Data inconsistencies may arise due to varying data structures during integration. Applying data validation and cleansing measures in line with UAE’s regulation and PEPPOL framework ensures data accuracy and regulatory compliance.

- Facilitating organizational change- Implementing the e-invoicing mandate as per UAE’s PEPPOL PINT framework would require structured change management. Educating teams on new workflows and emphasizing the system’s advantages helps foster acceptance and smooth integration.

- Overcoming technical barriers- Challenges such as system downtime or connectivity issues can affect integration. Implementing backup plans ensures seamless data flow and minimizes interruptions.

- Empowering team through training- Conducting training workshops and sessions to operate new solutions would bring confidence within the organization. Ensure the manuals, guides, and tutorials are available for self-learning and query solutions.

Continuous updates and monitoring

Once the integration is live, it is essential to continuously monitor and update the solution based on the new amendments notified by the government and ensure that the solution and the workflow are smooth and aligned with UAE’s requirements. Regular audits and checks can identify any issues before they become major problems. It’s also important to maintain a feedback loop with employees to address any operational challenges or suggestions for improvement. Quick support must be available either by the IT department or ASP’s support team to provide faster resolution to any technical concerns.

Conclusion

In conclusion, integrating e-invoicing systems with existing financial and ERP solutions is essential for UAE businesses to streamline operations, ensure compliance, and enhance efficiency. By following a clear integration strategy, selecting the right ASP, and addressing potential hurdles, businesses can fully leverage the benefits of automation while meeting the country’s regulatory requirements.