As highlighted in the recent announcement by the UAE Ministry of Finance, it’s crucial to grasp the overview of the e-Invoicing system and e-invoicing compliance set to be implemented in the coming year. While the MoF has outlined important details about the eInvoicing model to be adopted, there remain several unknows that will require further clarification soon.

To latest release, the UAE Ministry of Finance (MoF) has clarified certain aspects of the eInvoicing program. Here is what we know, along with our insights:

1. Objectives and goals for the country to implement einvoicing:

| e-invoicing solutions |

- Minimize VAT leakage – e-Invoicing is a proven mechanism that has helped countries reduce VAT leakages effectively. It is expected that governments will use the data from the e-Invoicing to increase tax revenue not only from VAT but also from Corporate Tax and excise tax.

- Increase efficiency – It streamlines processes, decrease processing time and promote reduced paper usage to support sustainability goals.

- Facilitate new policy-making decisions – By implementing eInvoicing, the UAE government will gain access to relevant data, enabling policymakers to gather deep insights and identify areas and sectors requiring government support, in this way the government will be able to provide tax relief or tax incentives with the data from the eInvoicing.

2. Key dates

3. Format

E-invoices must utlize the XML format. As we discussed in our recent article XML is the preferred format in most countries adopting eInvoicing due to its structured nature, which simplifies data interpretation and analytics.

Three of the main benefits using XML as a format for eInvoicing are:

- Standardization and Interoperability: XML provides a standardized format that ensures seamless compatibility and data exchange between various systems and platforms. This interoperability allows businesses to efficiently integrate their invoicing processes with partners, suppliers, and customers across different software applications.

- Structured and Flexible Data: XML’s structured nature ensures that data is clearly organized, making it easy to extract and process information automatically. Additionally, XML’s flexibility allows businesses to customize invoice formats according to specific industry requirements and regulatory standards, accommodating any necessary data fields.

- Efficiency and Accuracy: By automating the invoicing process, XML reduces the need for manual data entry, which minimizes errors and enhances accuracy. This leads to faster processing times and streamlined operations, ultimately improving cash flow and reducing administrative burdens.

4. Benefits for businesses (Pre-population of the VAT return)

A noteworthy benefit is the simplification of compliance processes for businesses. The UAE Tax Administration plans to use electronic invoicing data to pre-populate certain fields in VAT returns and cross-check information to streamline tax refunds.

The quality of the data shared with service providers is crucial, as the FTA will leverage this information to offer new services.

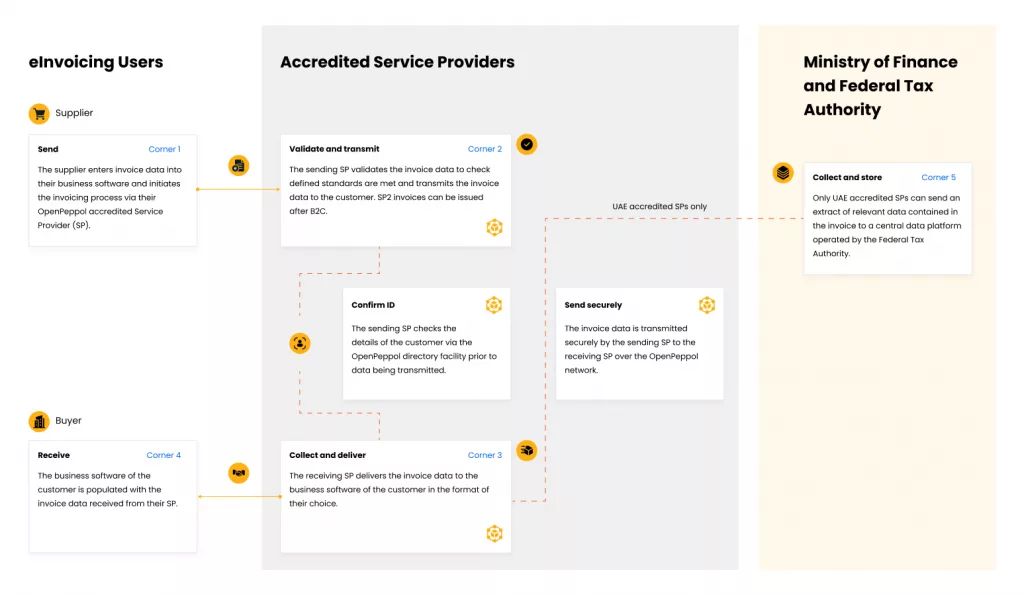

5. e-invoicing model exchange of the invoices

Currently, the model involves submitting tax data to the Ministry of Finance and the Federal Tax Authority (FTA), with validation provided by the Accredited Service Provider (ASP).

6. Validation of the tax data

The service provider will validate the tax data and report it to the Ministry of Finance (MoF) and the Federal Tax Authority (FTA).

7. Integrations

According to the MoF, all legal entities must integrate with the service provider, irrespective of their inclusion in a VAT group.

In our experience, such integrations often involve software, ERP systems, invoicing systems, and POS systems. Companies should focus on integrating the invoicing systems of legal entities involved in the eInvoicing program with the service providers, rather than isolating integrations by legal entity or VAT registration status.

8. Transactions covered

The eInvoicing model appears to cover all types of transactions, including those that are out of scope, exempt, self-billed, and even cross-border. However, for exports, the eInvoice must comply with the UAE PINT framework, with exchanges occurring via PDF outside the Peppol network.

Consequently, companies need to manage invoices in different formats (XML and PDF) and ensure control over them, as this data will be utilized by the Tax Administration to pre-populate future tax returns.

9. Identifier for business

As noted in the Q&A section, businesses participating in the eInvoicing program will use the Tax Registration Number (TRN) as their identifier. It appears that all businesses in the UAE are required to register with the Federal Tax Authority to receive their TRN.

Currently, it’s essential to obtain clarification from the Ministry of Finance or the FTA regarding which TRN businesses should reference.

10. Data security to be covered

As the UAE advances e-invoicing and data-sharing requirements, data security is essential for companies transitioning to this system. Protecting sensitive financial data is critical, as breaches can lead to serious legal, financial, and reputational risks. Here’s how e-invoicing solutions enhance data security and what businesses can do to protect their information:

- End-to-End Encryption

- Role-Based Access Control (RBAC)

- Audit Trails and Real-Time Monitoring

- Multi-Factor Authentication (MFA)

- Compliance with UAE’s Cybersecurity Regulations

What’s next

With the UAE’s decision to adopt the 5-corner model, the Ministry of Finance will release more information in due course. Here’s what we anticipate:

- The UAE will need to designate an entity and establish it as the Peppol Authority.

- The list of Approved Service Providers is expected to be published in June 2025.

- eInvoicing regulations, including UAE-specific PINT specifications, will be released in Q2 2025. It is important to note that within Peppol, each country must develop its own specifications to comply with its regulations.

- Further updates to VAT and Corporate Tax legislation are expected to align with the new eInvoicing system.

- The phases of implementation and the businesses targeted are expected to be announced in 2025.

- Phase 1 is slated to go live in June 2026.

Businesses can start proactively take steps very well in advance to be prepare for the upcoming eInvoicing mandate that will impact many areas of the businesses.

We are experts in electronic invoicing, ready to help your business seamlessly adapt to the new eInvoicing system. Our comprehensive consulting services cover every aspect of the transition, ensuring your operations align with the latest regulations and standards. From initial planning to full implementation, we manage the entire eInvoicing process, equipping your business with the tools and strategies needed for success in this evolving digital landscape.

Source: UAE Ministry of Finance