Overview

Since the introduction of GST in India, the GST Council has made substantial efforts to ease the compliance and taxation process by eliminating complex regulations and laws with clarifications, amendments, and updates. One such process is the distribution of ITC under the Input Service Distributor Mechanism, where ITC related to common services is to be distributed among various attributable recipients, registered under same PAN, in a prescribed manner.

This blog will explain what ISD in GST is, ISD mechanism, registration, distribution process, applicability, non-applicability, etc.

Input Service Distributor (ISD) under GST: Meaning

An Input Service Distributor is a taxpayer who receives tax invoices towards receipt of input services, including services liable under RCM for or on behalf of a distinct person (i.e., a person having different GSTN under the same PAN) and liable to distribute ITC in respect of such invoice among such distinct person in the prescribed manner.

Simply put, an ISD in GST is a central registration that receives invoices for common services and then distributes ITC proportionally to the respective branches via ISD invoices.

Let’s take an example to understand the concept more clearly.

Let’s say a company in Gujarat has branches in Maharashtra, Rajasthan, and Madhya Pradesh. All of these receive annual maintenance services for their hardware, but the invoice is raised only to the Gujarat location.

However, Gujarat alone cannot take ITC of the entire amount for the services equally received by other branches. In such a case, the Gujarat location will issue ISD invoices and distribute ITC to other branches proportionately.

Further, the Gujarat location, in addition to regular registration, would also have to be registered as an ISD under GST to allocate ITC among branches.

Need of ISD Mechanism

ISD is the office of recipients of services with multiple branches within the state or outside. When all these branches receive common services, the central office prefers to have invoices made in its name to follow the centralized invoice-maintaining system and avoid multiple billing.

Now, when it comes to availment of ITC, as per section 16, ITC can be availed only by the registered person receiving goods or services, after payment of tax and filing of return, and if he is in possession of invoice.

In the current case, the central office has an invoice while services are received by all the branches, which makes them ineligible to avail of ITC even if the transaction is valid. To avoid this situation, an ISD mechanism was introduced, where the ISD will be able to distribute ITC to all the branches in a prescribed manner even if the invoice is in the name of ISD.

Non-Applicability of ISD

ITC cannot be distributed for input and capital goods such as raw materials or machinery; it has to be claimed by the branch that uses it, making it ineligible to distribute as per the ISD mechanism.

Registration

The taxpayer required to distribute ITC under ISD Mechanism will be required to register under clause (viii) of section 24, i.e., compulsory registration under GST as ISD by filing FORM GST REG -1.

Registration for ISD is mandatory in the distribution of ITC related to common services, irrespective of the turnover limit.

Document generation under ISD Mechanism

For the purpose of distributing ITC to the branches, ISD has to issue ISD invoices as per rule 54(1) of the CGST Act, 2017, clearly stating that the invoice is issued just for the distribution of ITC.

Further, ISD taxpayers must issue ISD credit notes to reduce the ITC distributed earlier to their registered recipient units.

Return filing

Every ISD must file a return in FORM GSTR-6 containing details of invoices on which ITC is received and details of ISD invoices or ISD credit notes based on which ITC is distributed to branches.

Details of Services received by ISD shall be available in FORM GSTR-6A, which can be reconciled before uploading purchase data in FORM GSTR-6.

The input tax credit availed in a month shall be distributed in the same month. The due date of filing GSTR-6 is 13th of the succeeding month.

Further, an ISD shall separately distribute both the amount of ineligible and eligible input tax credit.

Recent Changes & Mandatory Rules (Applicable from 1 April 2025)

As per Notification No. 16/2024 – CT dated 6 August 2024, the ISD mechanism becomes mandatory from 1 April 2025.

Key highlights include:

- Mandatory ISD registration for any taxpayer distributing ITC on common services.

- Distribution to be done only through ISD invoices following Rule 39 of the CGST Rules.

- Separate GSTR-6 return filing required every month by the ISD entity.

- Pro-rata allocation based on turnover among eligible GSTINs.

- Distribution of both eligible and ineligible ITC to be shown separately in GSTR-6.

This move ensures uniformity and eliminates ad-hoc distribution practices, providing clarity and audit readiness.

Standard Structure of an ISD Invoice

As per Rule 54(1) of the CGST Rules, an ISD invoice must clearly specify that it is issued “for distribution of Input Tax Credit.”

A standard ISD invoice should include the following:

- Name, address, and GSTIN of the ISD

- Consecutive serial number (unique for the financial year)

- Date of issue

- Name, address, and GSTIN of the recipient unit

- Amount of credit distributed with tax breakup (CGST, SGST, IGST)

- Reference to the original supplier invoice on which ITC is being distributed

- Signature or digital signature of the authorized signatory

An ISD Credit Note must also be issued to reduce credit previously distributed, wherever applicable.

Taxability of supply of Service by HO (Head office) to BO (Branch Office)

There are 3 different scenarios clarified by the GST council vide circular No. 199/11/2023-GST dated 17th July 2023. Let’s evaluate the said circular:

- Can the HO avail ITC on common input services procured from a third party and allocate it to BOs through tax invoices under section 31, allowing the BOs to claim ITC? Or is it mandatory for the HO to distribute ITC via the ISD mechanism for services procured for both HO and BOs or exclusively for BOs?

When the HO procures common input services from a third party that are attributable to both the HO and its BOs or exclusively to one or more BOs, the HO has two options for distributing ITC:

- ISD Mechanism: The HO can distribute ITC using the ISD mechanism as outlined in Section 20 of the CGST Act and Rule 39 of the CGST Rules, 2017. However, the HO must register as an ISD if it chooses this option, as required by the law.

- Tax Invoices: Alternatively, the HO can issue tax invoices under Section 31 of the CGST Act to the relevant BOs for the common input services. The BOs can then claim ITC, provided they actually received the services and are in compliance with the law Sections 16 and 17 of the CGST Act.

It’s important to note that if the HO distributes ITC via ISD or issues tax invoices, the distribution or invoicing must only be done if the services were actually provided to the BOs.

- Is the HO required to issue invoices to BOs for internally generated services under Section 31 of the CGST Act to be provided by HO to BO, and must the HO include all cost components, such as employee salaries, in the service valuation when full ITC is available to the BOs?

When the HO supplies services to BOs, the value of these services should be determined under Rule 28 of the CGST Rules, read with Section 15(4) of the CGST Act. According to Rule 28(a), the value is generally the open market value. However, if the BO is eligible for full ITC, the value declared in the invoice by the HO is considered the open market value, regardless of whether all cost components, like employee salaries, are included.

If the HO does not issue an invoice for certain services provided to the BO, the value of those services can be deemed Nil, and this Nil value is treated as the open market value in accordance with the second proviso to Rule 28.

- For internally generated services provided by the HO to BOs, when full ITC is not available to the BOs, is the HO required to include the salary costs of its employees involved in providing these services when calculating the taxable value of the supply to the BOs?

For internally generated services provided by the HO to BOs, the salary costs of HO employees involved in providing these services are not mandatorily required to be included in the taxable value of the supply, even if full ITC is not available to the BOs.

Conditions for Distribution of ITC

The Input Service Distributor (ISD) can distribute credit to recipients under the following conditions:

1. Documentation:

Credit can be distributed only if it’s backed by a specific document, such as an ISD invoice or ISD credit note, as the rules require.

2. Limit on Distribution:

The amount of credit distributed cannot be more than the available credit.

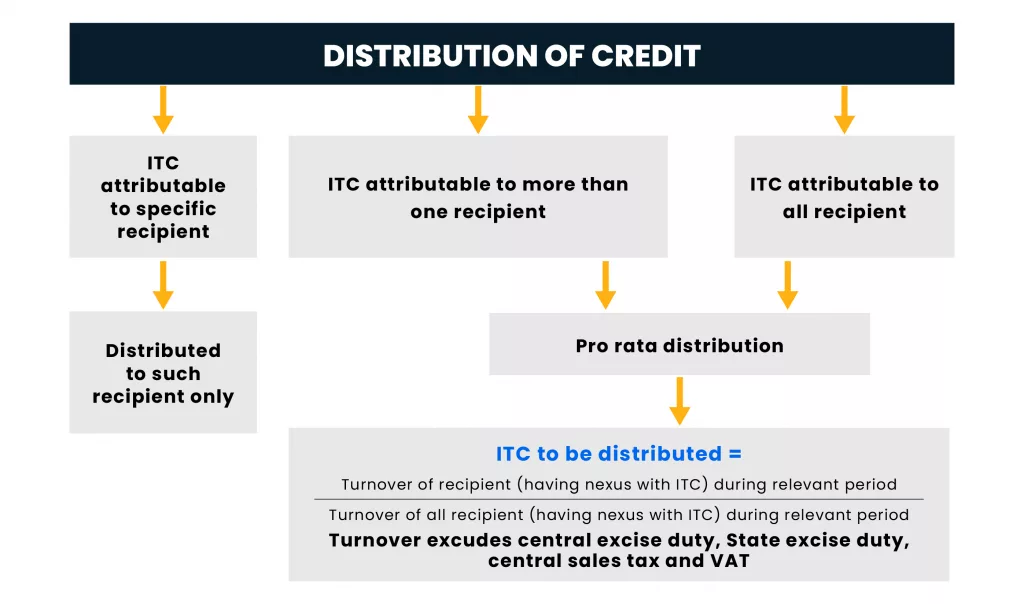

3. Attribution of Credit:

- If the credit is for services used by a specific recipient, it should only be distributed to that recipient.

- If the credit is for services used by multiple recipients, it should be distributed among those receiving the services based on their respective total turnover in a State or Union territory during the relevant period.

- If the credit is for services used by all recipients, it should be distributed among all those recipients based on their respective turnover in a State or Union territory during the relevant period.

4. Pro Rata Distribution:

For services used by multiple recipients, the credit should be divided among them in proportion to their turnover compared to the total turnover of multiple recipients receiving services for the relevant period.

5. Relevant period:

If the recipients of ITC have turnover in their States or Union territories in the financial year before the year in which the ITC is to be distributed, that financial year will be used as the basis for distribution.

However, if some or all recipients do not have any turnover in the previous financial year, then the turnover from the last quarter for which details are available, prior to the month of ITC distribution, will be used instead.

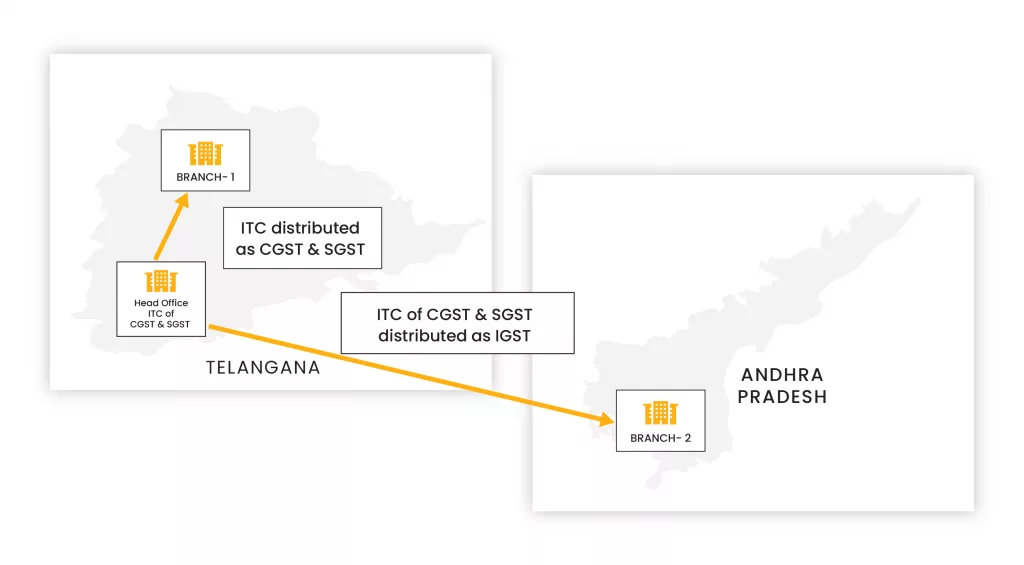

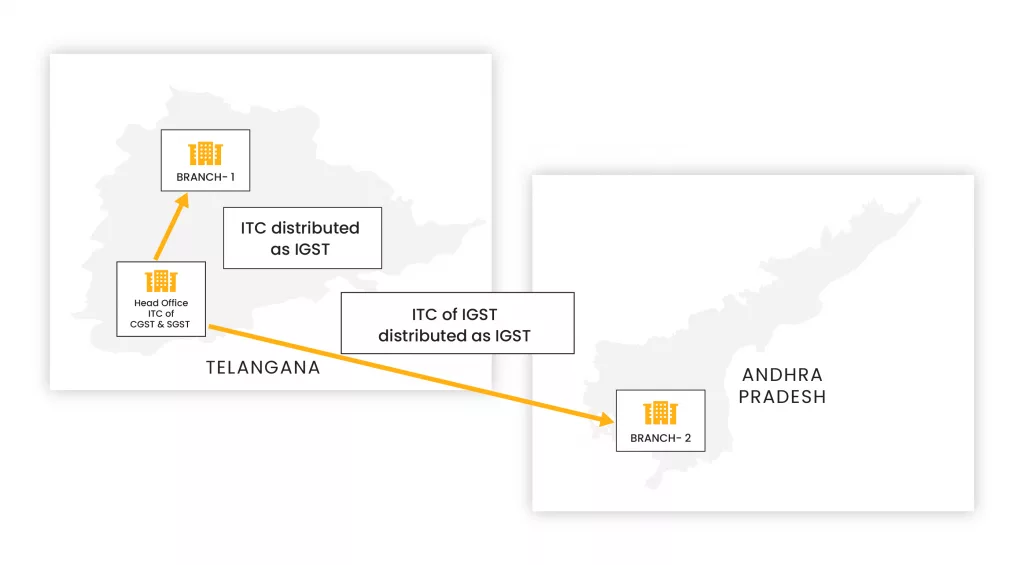

6. Distribution of IGST, CGST, SGST/UTGST by ISD

When ISD and recipient of ITC are in the same state.

- IGST shall be distributed as IGST.

- CGST shall be distributed as CGST.

- SGST/UTGST shall be distributed as SGST/UTGST.

When ISD and recipient are in a different state

The total of IGST, CGST and SGST/UTGST attributable to the recipient shall be distributed as IGST.

The value of IGST ITC is attributed as IGST only.

How do ITC be distributed under the ISD Mechanism?

To distribute the credit to a particular recipient (whether registered or not), including those making exempt supplies or unregistered for any reason, the amount to be given to each recipient (“C1”) is calculated using the formula:

C1 = (t1 / T) × C

- C = Total credit available for distribution.

- t1 = Turnover of the specific recipient (R1) during the relevant period.

In simple terms, the credit is distributed based on each recipient’s share of the total turnover among all who benefit from the service.

FAQs

1. Is it mandatory to follow the procedure of the ISD Mechanism as per section 20, read with rule 39 of the CGST Act?

The GST Council has prospectively mandated the procedure under the ISD in GST mechanism w.e.f 01-04-2025 for taxpayers willing to distribute ITC as per ISD mechanism.

2. Is the ISD Mechanism Mandatory?

Yes, as per the Notification No. 16/2024 – CT dated 06-08-2024, the distribution of ITC and registration under the ISD mechanism are mandatory from 1st April 2025.

3. Whether separate registration is required for ISD even if we have regular registration?

Yes. The ISD full form in GST is Input Service Distributor, and a separate ISD registration is compulsory even if the taxpayer already holds a regular GST registration. The ISD registration is specific to ITC distribution activities and cannot be combined with other business registrations.

4. Can we have multiple ISDs?

Yes, different taxpayer offices can have separate ISD registrations.

5. Can an ISD distribute ITC on goods or capital goods?

No. The ISD in GST mechanism applies only to input services. ITC on goods or capital goods such as raw materials, machinery, or fixed assets cannot be distributed through ISD; it must be claimed by the respective branch or unit that uses them.

6. What happens if ISD fails to file GSTR-6?

Failure to file GSTR-6 can delay ITC flow to recipient branches and may trigger compliance notices or penalties. Under what is ISD in gst, timely filing of GSTR-6 is crucial, as it reflects the distribution of ITC for a given month and ensures that the recipient GSTINs can claim the credits correctly.

7. What is the consequence of wrongly distributed ITC?

ITC can be recovered from the recipient along with interest.

Conclusion

ISD is crucial for the distribution of ITC; therefore, making it mandatory would ease the ITC distribution process and avoid multiple billing for the common services provided. With such amendments and clarifications, GST Council is paving the way for the smooth operation of the tax process across the business.