AI in e-invoicing: Introduction

In UAE, e-invoicing has been a vital move towards digitization. E-invoicing efficiency would reduce cyberattacks and tax curbing and ensure the smooth working of tax administration and business. However, with changing technology, having digital e-invoicing is not enough. Your e-invoice must be smart as well. AI in e-invoicing solutions brings this smartness, where businesses have not only a paper invoice in digitized form but also interactive insights and dashboards, security enhancement, VAT compliance, multi-language conversions, payment cycle analysis, optimizing invoice delivery, auto approvals, error and fraud detection and so on.

Current market dynamics indicate a thriving growth trajectory for the e-invoicing sector, primed to hit AU$ 71.57 billion (Approx AED 166.04) by 2030. This surge is driven by growing government initiatives and regulations encouraging e-invoicing to counter cyber threats and fraud. Specifically, The United Arab Emirates (UAE) is implementing a phased e-invoicing mandate commencing in July 2025.

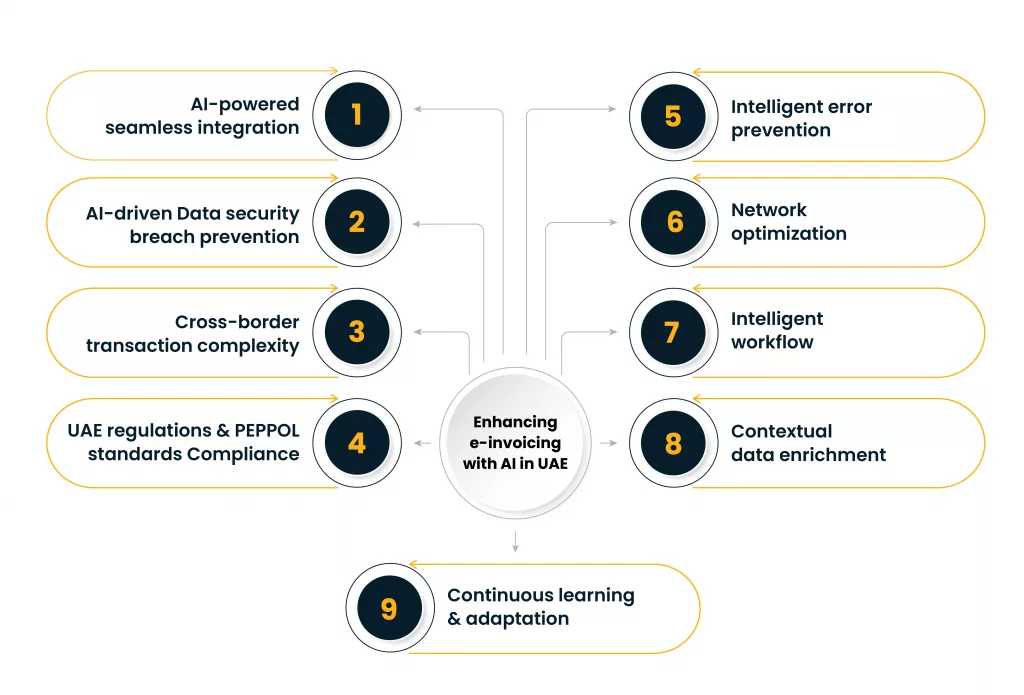

Enhancing e-invoicing with AI in UAE

e-invoicing automation facilitates basic processes like automated invoice submission, compliance, integration, workflow, etc., and is streamlined; AI in e-invoicing addresses complex situations and offers predictive capabilities and benefits that enhance e-invoicing efficiency with the PEPPOL framework. Here is the role of AI in UAE e-invoicing.

AI-powered seamless integration

Moving towards digitization is not easy, especially when business systems are well-designed for their specific needs but are not advanced enough to meet agility and flexibility, requiring seamless integration of AI-powered e-invoicing solutions.

It ensures easy integration of business e-invoicing solutions with PEPPOL access points and maps data fields from various invoicing formats to standardize as per PEPPOL with the help of ML algorithms. It can convert invoices generated in any format to the required PEPPOL format. AI can predict potential integration issues and automatically adjust configurations, minimizing downtime and ensuring a smooth flow of invoice data across the network.

AI-driven Data security breach prevention

Organizations in the Middle East that extensively deployed security AI and automation experienced lower data breach costs, with an average cost of SAR 26.54 million compared to those that did not, which incurred costs of SAR 38.85 million.

Data security is crucial due to the exchange of e-invoices over the network to the government for reporting as well as to customers. Any security breach, anomalies, and errors would leak information related to critical business transactions to competitors, alter e-invoices or other documents while transmission, intrusion or unauthorized access, etc.

AI can identify all these unusual traffic and patterns and automate encryption management, ensuring that data remains protected during transmission. By learning from threat intelligence, AI can proactively block emerging cybersecurity threats and mitigate insider risks by detecting suspicious internal behavior and safeguarding invoice data throughout the e-invoicing process.

Cross-border transaction complexity

UAE being part of a global trade hub, businesses’ ability to handle cross-border transactions is crucial from multi-currency transactions, multi-language invoices, cross-border VAT rules, and real-time invoice exchange among various jurisdictions, ensuring businesses meet PEPPOL standards for international transactions.

AI helps automatically identify all these needs, whether it is a currency conversion, fetching exchange rate, or verification of cross-border transactions, regulations that are applied correctly, forecast currency fluctuation, or transaction settlement, ensuring robust compliance.

UAE regulations and PEPPOL standards Compliance

Regulatory changes are never static; therefore, having constant updates on government regulations and PEPPOL specifications is a bottleneck. AI can continuously monitor and keep updated on any new changes notified by FTA in e-invoicing. Further, AI can reconfigure rules and help businesses check each invoice against the latest UAE VAT and e-invoicing regulations to avoid huge fines and penalties.

Intelligent error prevention

While rule-based automation flags errors based on predefined parameters, an AI-powered e-invoicing solution learns from past mistakes and intelligently predicts the mistakes likely to occur in future transactions. It flags those errors or provides auto-correction without human oversight. In the UAE’s PEPPOL model, AI would verify the invoice and prevent errors before it is sent to the access point for transfer to the recipient or government.

Network optimization

In PEPPOL’s e-invoicing model, the supplier’s access point may be different from the receiver’s. In a business where multiple suppliers and customers have different access points, this may create inefficiencies in how e-invoices are transmitted without error. AI can optimize network traffic to help correctly identify counterparty access points without errors, speeding up the overall process without errors.

Intelligent workflow

AI facilitates workflow automation by orchestrating the invoice process to keep PEPPOL standards in the center. AI can automatically help prioritize high-priority invoices for approvals, vendor payments, vendor agreements, tax reporting due dates, and tax payments, processing them first and improving cash flow management. AI also routes invoices to the appropriate person requiring oversight or approval without needing them to pass through all the levels.

Contextual data enrichment

As PEPPOL requires standardization of specific data fields, AI can enrich and classify invoice data contextually. As such, AI can analyze past patterns in historical data in an attempt to fill out incomplete or vague information that would include a product description or tax codes for better compliance and consistency. With such intelligent enrichment, this leads to the efficient processing of invoices and more precise data, thus benefiting not just businesses but also regulatory authorities.

Continuous learning and adaptation

AI continuously learns from historical data, past patterns, and current rules and improves performance over a period of time. AI also identifies patterns and suggests optimization, like updating integration protocols, patch management, and adjusting data mapping to enhance e-invoicing efficiency. This adaptability allows businesses to stay compliant and maintain efficient invoicing operations without requiring constant manual oversight.

Benefits of AI for Efficient e-invoicing in UAE

People and businesses have recognized AI’s benefits in every field, and that’s why AI is considered a crucial part of any business process. Let’s understand how AI benefits e-invoicing in the UAE.

- By automating data entry, validation, and error correction, AI reduces manual processing costs, allowing teams to focus on strategic tasks rather than repetitive, error-prone work. This results in significant savings on operational overhead.

- AI-powered analytics deliver actionable insights from invoice data, enabling better decision-making and process optimization.

- AI helps quickly identify and address inefficiencies and helps remain competitive and agile in a dynamic market.

- AI reduces the complexities of international invoicing by automatically managing currency conversions, tax treatments, and compliance across different jurisdictions. Thus, it helps foster relationships with global partners.

- AI-driven fraud detection protects against data breaches and financial fraud, safeguarding sensitive invoice information. This robust security improves customer trust and reduces fraud’s financial and reputational impact.

- With real-time insights into payment timelines, AI enables businesses to forecast cash inflows more accurately and helps in better financial planning, resource allocation, and risk management.

- AI continuously adapts to regulatory changes, reducing non-compliance risk and associated fines. Businesses can trust that their e-invoicing practices align with the latest PEPPOL standards without dedicating resources to constant manual updates.

- AI’s predictive error correction and seamless data standardization minimize delays in invoice approvals and rejections, enabling invoices to move quickly through the system and lead to quicker payment cycles.

- AI-powered e-invoicing Solutions bring sustainability, stability, and security to business process workflows, helping businesses stay competitive in the market with changing technology needs and demands without heavy future investments.

Looking Forward

In conclusion, AI-powered e-invoicing solutions provide UAE businesses with a sustainable, secure, and adaptable framework, enhancing compliance and efficiency within the PEPPOL model. By automating complex workflows, improving data accuracy, and ensuring seamless cross-border transactions, AI helps businesses stay agile and compliant with evolving regulations. These AI-driven efficiencies reduce operational costs and risks and support smoother cash flows, allowing companies to remain competitive in an increasingly digital market.