With fast-evolving GST compliance regulations, businesses are under constant pressure to stay compliant with all the amendments and updates to avoid penalties and fines while also keeping operations efficient and error-free.

Over the years, Cygnet.One has been consistently ahead of the curve, rolling out new features, updates, and new functionalities on time after a thorough understanding of all new amendments and the practical challenges faced by businesses during their implementation and operation, ensuring businesses don’t just keep up with changes but turn them into smart compliance.

Features Introduced by Cygnet.One in GST Compliance Solution

- End-to-end automation of 180-day ITC lapse reversal and reclaim

- Functionality to reduce ITC added in the IMS module.

Let’s understand the regulatory requirements, challenges faced by businesses, solutions, and benefits of the new features.

1. End-to-end automation of 180-day ITC lapse reversal and reclaim

Requirement as per Law

As per the proviso to Section 16(2) of the CGST Act, 2017, if the recipient fails to pay the amount towards the value of supply along with tax payable (except when supply is charged under RCM) to the supplier of goods or services or both within 180 days from the date of issue of invoice by the supplier, an amount equal to the Input Tax Credit (ITC) availed by recipient shall be paid by him along with interest u/s 50.

The recipient shall be entitled to avail ITC on payment of the value of goods or services or both, along with tax payable to the supplier.

Interpretation: A recipient can avail ITC on the purchase of goods or services or both, but will have to reverse ITC along with interest of 18% if the amount towards the value of the purchase and tax thereon is not paid to the supplier within 180 days from the date of invoice. However, the recipient can reclaim ITC after payment to the supplier. In case of partial payment, ITC can be availed to that extent only.

Challenges faced by businesses in the implementation of the above provision

- Businesses, particularly large enterprises, deal with numerous invoices on a daily or monthly basis. Reconciling each invoice with its payments manually is challenging.

- Manually monitoring the deadline of 180 days for each invoice can be error-prone.

- Keeping records of partial payments of invoices, calculations, and reversal of proportionate ITC to the extent of non-payment, along with interest, creates complications.

- Post ITC reversal, keeping track of payments, reclaiming of ITC requires proper documentation, calculation, and reporting, thereby increasing workload and additional vigilance.

- Interest liability calculations will be from the data of ITC availment till the date of actual payment, which requires effective calculations, adding to the compliance risk of miscalculations.

- Communication gaps between accounts payable, tax, and procurement teams can create compliance errors, missed deadlines, and a lack of payment and ITC tracking.

Cygnet.One’s Automation to overcome challenges

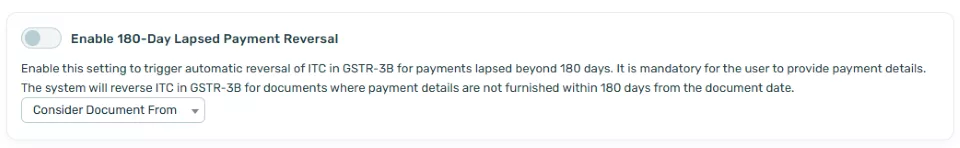

The GST compliance solution will provide end-to-end automation for compliance with the 180-day provision after enabling the option for 180-days lapsed payment reversal.

For invoices older than 180 days, the solution automatically calculates the Input Tax Credit (ITC) that needs to be reversed under Table 4B(2) of GSTR-3B. In cases where only partial payment has been made, the system intelligently computes the proportionate ITC reversal and then automatically reclaims the credit under Table 4A(5) of GSTR-3B once the full payment is completed. The system will automatically calculate interest on lapsed amounts to be reversed. This ensures accurate compliance without manual effort.

How businesses can leverage this feature

a) Partial Payments on 180+ Day Invoices: The system automatically calculates proportionate ITC reversal in 4B(2) and reclaims it once full payment is completed.

b) Filing GSTR-3B under Circular 170: Maintains a complete history of both original and amended documents, ensuring accurate section-level reporting.

c) Audit Support: Auditors can retrieve exact auto-population logic, payment status, and ITC claim/reversal/reclaim history for past returns.

d) Finance Team Oversight: Finance managers can quickly identify purchase invoices older than 180 days with pending payments.

e) Compliance Readiness: Reports highlight overdue cases, interest liability, and complete reversal/reclaim history, equipping managers for audits and timely corrective action before filing GSTR-3B.

The benefits businesses can get from this feature

a) Automated Rule 37 Compliance: Seamless ITC reversal as per the 180-day rule, directly mapped to GSTR-3B (4B(2)/4A(5)).

b) Early Risk Visibility: Countdown to Day 180 with clear payment status indicators (paid, partial, unpaid).

c) Accurate ITC Handling: Ensures precise full or proportionate reversals and automatic reclaim once payment is completed.

d) Built-in Interest Computation: Automatically calculates interest on lapsed amounts to be reversed.

e) Comprehensive Audit Trail: Line-item tracking of claims, reversals, and reclaims with exact dates and amounts.

f) Smart Reporting: Generates Payment Lapsed, Reversal, and Reclaim reports with drill-down history for audit clarity.

g) Error-Free Compliance: Eliminates manual tracking, ensuring accuracy and transparency in GSTR-3B preparation.

h) Enhanced Monitoring: Automated logic for compliance checks with custom filters and Excel export for flexible business reporting.

2. Functionality to reduce ITC has been added in the IMS module

Requirement as per Law

The Invoice Management System is a new feature in the GST Portal where a recipient of an invoice can accept, reject, or keep pending invoices issued by the supplier. This will allow the matching of recipients’ records with invoices issued by suppliers in GSTR-1 to avoid errors in claiming ITC.

Challenges faced by businesses in the implementation of the above provision

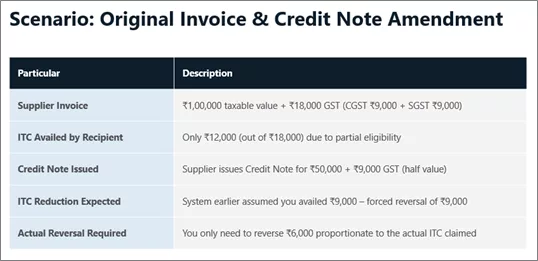

- Multiple cases where full ITC reversal was not required during credit note amendments. Below mentioned is one of such scenarios.

- Lack of flexibility in the IMS dashboard for such partial reversals.

Cygnet.One’s solution to overcome challenges

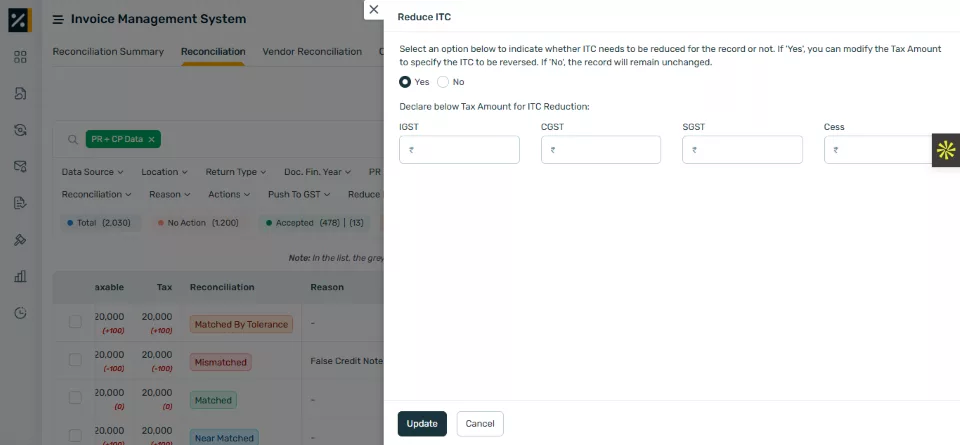

- User can now specify the ITC amount to be reversed.

- Flexibility to declare partial or no ITC reduction based on actual availed ITC.

- Optional Remarks while rejecting or keeping record pending to help the taxpayer review in the future.

The benefits businesses can get from this feature

a) Greater Flexibility: Allows users to declare full, partial, or no ITC reversal depending on the actual ITC availed.

b) Improved Accuracy: Eliminates unnecessary full reversals during amendments, ensuring precise tax reporting.

c) User Control: Empowers taxpayers to directly specify the ITC amount to be reversed, reducing dependency on rigid system logic.

d) Transparency in Compliance: Optional remarks provide clear documentation for audit trails and internal reviews.

e) Efficiency in Workflow: Minimizes manual corrections and rework in the IMS dashboard.

f) Audit Readiness: Maintains a clear record of decisions made, improving clarity during audits and reconciliations.

Conclusion

With these new features, Cygnet.One continues to transform GST compliance into a smarter, automated, and hassle-free process. By addressing real-world challenges with timely solutions, businesses can achieve greater accuracy, reduce risks, and stay fully compliant with evolving GST regulations.

Simplify GST Compliance with Cygnet.One

Experience seamless automation, real-time compliance tracking, and audit-ready reports. Stay ahead of every GST update with Cygnet.One’s intelligent solution.

Book a Demo