The Invoice Management System (IMS) facility was made available to taxpayers from 1st October 2024 on the GST portal. IMS allows matching taxpayers’ records or invoices received with the supplier’s data to avail the correct input tax credit (ITC).

As soon as the supplier saves any invoice, credit, or debit note in GSTR-1/GSTR-1A/IFF, the same shall flow to the IMS dashboard of the buyer to review the genuineness of the transaction and accept, reject, or keep it pending. Only the accepted or deemed accepted (when no action is taken) documents will flow to GSTR-2B.

While the GST dashboard’s IMS facilitates real-time invoice tracking and ITC compliance, relying solely on it without technology integration is not advisable. Manual processes and limited features can lead to inefficiencies and errors, especially for businesses managing large transaction volumes. GST-compliant invoice management tool can help streamline reconciliation and reduce risks of mismatches effectively.

In this blog, we will explore the features of the IMS dashboard available on the GST portal, practical challenges with IMS, and how Cygnet’s IMS module facilitates better compliance requirements.

Features of Invoice Management System as provided under the GST dashboard

The IMS has the following features:

- Real-time Invoice Management

The invoice, credit note, or debit note is reflected in the IMS dashboard as soon as the supplier saves the details on GSTR-1/GSTR-1A/IFF for the buyer to review and take action, ensuring a real-time update on ITC availment and invoice data.

- Three Action Options

The taxpayer has three action options, i.e., accept, reject, or keep the invoice pending for future review and action. Only upon accepting the invoice, the invoice data will flow to GSTR-2B for ITC availment.

- The taxpayer can also choose to take no action, which shall be considered deemed acceptance, and the data will automatically flow to GSTR-2B. Single dashboard for document management

The IMS dashboard serves as a single platform for managing invoices, credit notes, debit notes, and amended documents. Any discrepancies found while verifying IMS data can help the supplier and buyer communicate and resolve them before filing GSTR-3B.

- Supplier and recipient view

As a supplier, a taxpayer can monitor rejected invoices and credit notes using the “Supplier View” in the IMS dashboard. This provides live data, including details of recipient actions on documents.

As a recipient, a taxpayer will have an “inward supply” view to see all the specified documents saved or filed by their respective supplier. The recipient will be able to access these documents and take action.

- Download Excel Sheet

IMS allows users to download all transactions in an easy Excel format for offline verification and reconciliation. This is helpful for companies with a large volume of transactions.

- Easy invoice amendment

The supplier can get a real-time update on invoices rejected by the buyer to rectify GSTR-1 before filing or amendment through GSTR-1A, ensuring there is no delay in ITC availment for buyers.

- Pending option availability

Earlier, the pending option was not available for a credit note, upward amendment to CN, Downward amendment to CN if the original was rejected, downward amendment to invoices/DN if the original document was accepted, and GSTR-3B was filed.

Now, effective from July 2025, the GST department has made the Pending option available for the following documents:

- Credit notes

- Credit note amendment (except for downward CN where ITC has already been adjusted)

- B2B invoice downward amendment (if the original invoice is accepted and ITC claimed)

- Debit note – Downward amendment

- ECO documents- Downward amendment

This will help businesses get better control over ITC availment and provide time to verify transactions before taking any action to avoid taking incorrect action.

- ITC reduction declaration field

This helps buyers to specify the exact amount of ITC required to be reversed, ensuring only the ITC liable for reversal is accepted, reducing disputes for partial amendments.

- Optional Remarks

This helps buyers to place remarks for rejecting or while selecting a pending option to justify their action and for their future reference.

An IMS has been introduced to ease businesses’ operations, reshape the GST compliance process, facilitate transparency between trading parties, reduce the number of mismatch notices, provide real-time insights and updates on invoices, and ensure audit readiness.

However, there are many challenges faced by businesses in complying with IMS, particularly due to limitations of the IMS portal and a lack of knowledge of IMS. Let’s explore those challenges.

Challenges in complying with Invoice Management System without tech-driven software

- Restriction to view up to 500 invoices makes it difficult for businesses dealing with a high volume of transactions.

- Lack of automated reconciliation of the purchase register with IMS data and invoices received.

- Identification of non-compliant vendors and following up on missing invoices or incorrect filing increases ITC blockage risk.

- The GST portal provides basic reports and summaries; there is no deep analytics, audit logs, or exception-based view.

- Tracking changes in invoices over time manually is difficult.

- For businesses with multiple GST registrations, managing invoice compliance without a centralized view is chaotic

- The GST portal doesn’t support internal approval workflows or access control based on roles

- Difficulty identifying and managing discrepancies and raising debit/credit notes manually.

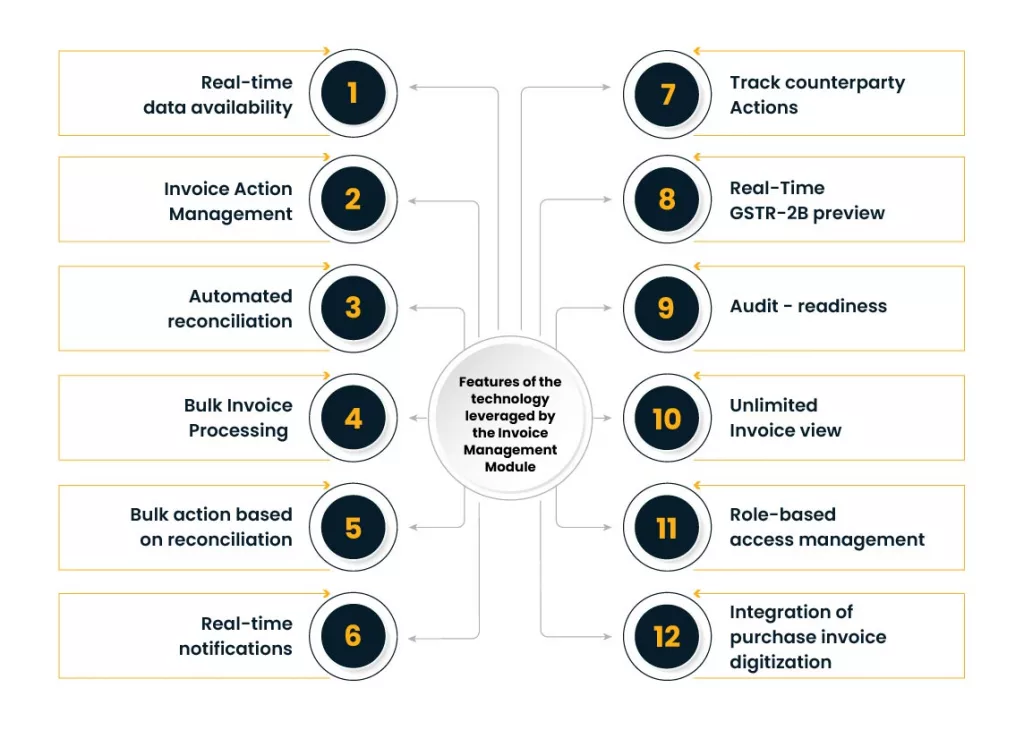

Features of the technology leveraged by the Invoice Management Module

Real-time data availability

The IMS module integrates with the GST portal and fetches invoice data in real time that includes B2B invoices, credit notes, debit notes, together with amendments uploaded by suppliers via GSTR-1, GSTR-1A, and IFF.

This ensures that businesses can access all of the latest supplier data and allows for timely ITC processing immediately.

Invoice Action Management

The system allows users to take specific actions on invoices: accept, reject, or mark as pending.

- Accept: Accepted invoices are included in the “ITC Available” section of GSTR-2B, making them eligible for ITC claims and auto-populating in GSTR-3B.

- Reject: Rejected invoices are listed in the “ITC Rejected” section of GSTR-2B, excluded from ITC claims, and suppliers are notified to make amendments.

- Pending: Invoices marked as pending are deferred to a future tax period, excluded from the current GSTR-2B until an action is taken, subject to the ITC deadline under Section 16(4) of the CGST Act.

This functionality provides businesses with precise control over which invoices qualify for ITC, ensuring compliance with GST regulations.

Automated reconciliation

The IMS module automates reconciliation by syncing supplier-uploaded invoices with the recipient’s purchase registers, GSTR-2B, and GSTR-3B. It matches details like invoice numbers, dates, GSTINs, and tax amounts to ensure accuracy in ITC claims and GST return filing. This reduces manual errors and streamlines compliance.

Bulk Invoice Processing

The IMS module allows for bulk actions since it enables users to accept, reject, or mark multiple invoices as pending all at once.

This is particularly useful for businesses in handling a large volume of invoices monthly, as it reduces manual effort and processing time.

Bulk action based on reconciliation

The IMS module facilitates bulk action based on the outcome of reconciliation, which can be categorized as matched, mismatched, partially matched, or matched by tolerance, etc.

This allows businesses to process invoices efficiently by applying actions to groups of invoices with similar reconciliation status.

Real-time notifications

When an invoice gets rejected, the supplier gets notified by the IMS module. This can help them amend the invoice via GSTR-1 or GSTR-1A immediately.

This function eases communication for recipients with suppliers and also helps to resolve discrepancies quickly.

Track counterparty Actions

The IMS module helps to trace counterparty actions taken on invoices

Recipients can see if suppliers have uploaded invoices, credit, or debit, and suppliers can track recipient actions (accept, reject, or pending). This ensures transparent communication and helps resolve disputes or mismatches.

Real-Time GSTR-2B preview

The IMS module data is auto-synced to get updated details in GSTR-2B every 24 hours or on demand, starting from the 14th of each month till the date of GSTR-3B filing.

Audit-readiness

The IMS module maintains action logs, time-stamped, and can trace and maintain an audit trail of each action taken, which makes it audit-ready whenever required.

Unlimited Invoice view

Unlike the IMS dashboard as provided in the portal, where one can view a maximum of 500 transactions, here the IMS module provides unlimited invoice views irrespective of the number of transactions.

Role-based access management

The IMS module enables role-based access management, ensuring restricted access to only assigned tax or IMS compliance personnel, and ensuring no action is taken by unauthorized employees.

Integration of purchase invoice digitization

Integrating purchase invoice digitization streamlines the process of capturing and recording purchase invoices and ensures accurate and automated invoice data entry in ERP, minimizing manual errors and ensuring timely record keeping of all invoices without missing any invoices. This reduces the mismatches due to incorrect or missed purchase invoice data.

Looking Forward

The IMS revolutionizes invoice processing by enabling real-time invoice management, accurate ITC availment, and transparent communication between trading parties.

Technology-driven IMS modules aid by offering automated reconciliation, bulk processing, and seamless ERP integration.

By leveraging these advanced features, businesses can ensure GST compliance, reduce errors, and achieve audit-readiness efficiently.