Key Features of IMS

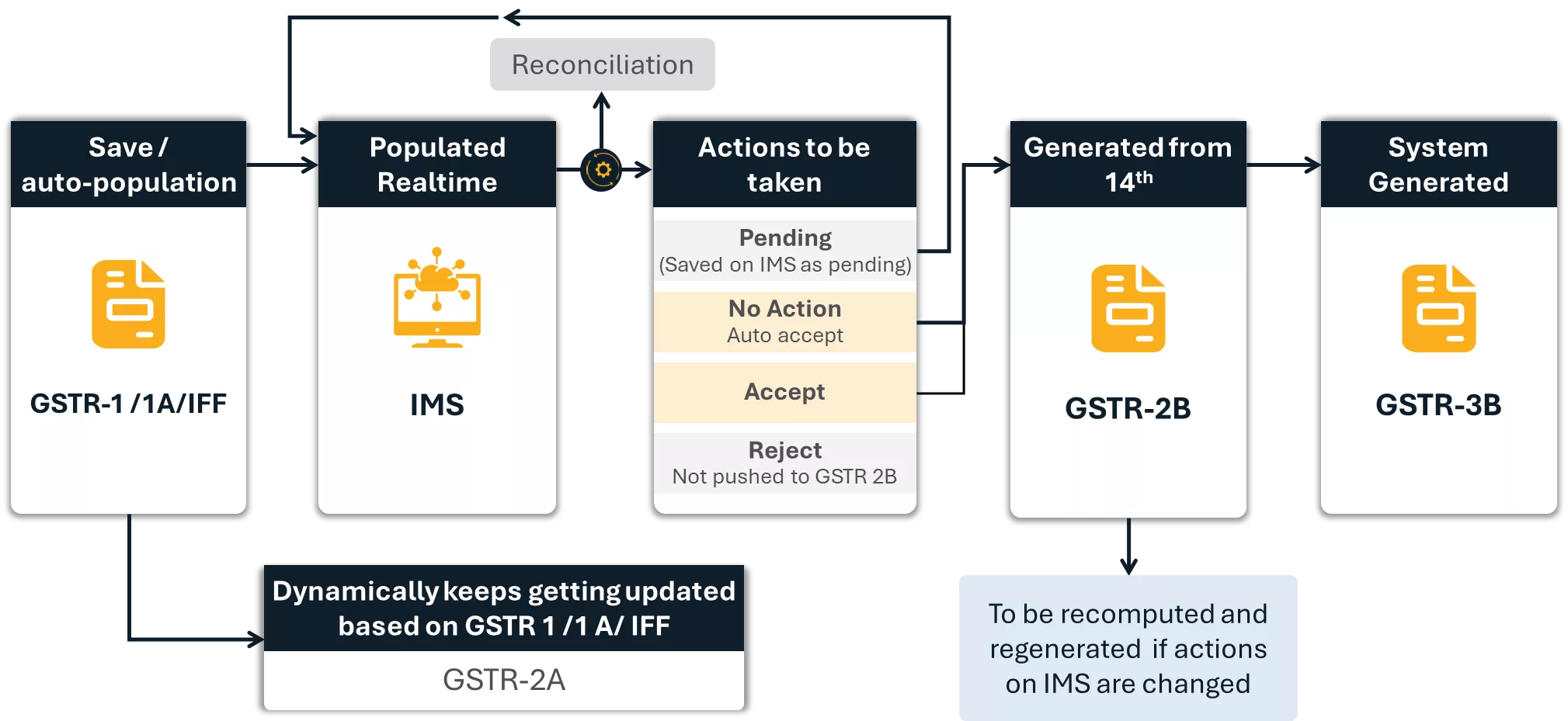

Real-time GSTR-2B Preview

Sequential GSTR-2B Filing

Built-in Reconciliation Tools

User-Friendly Interface

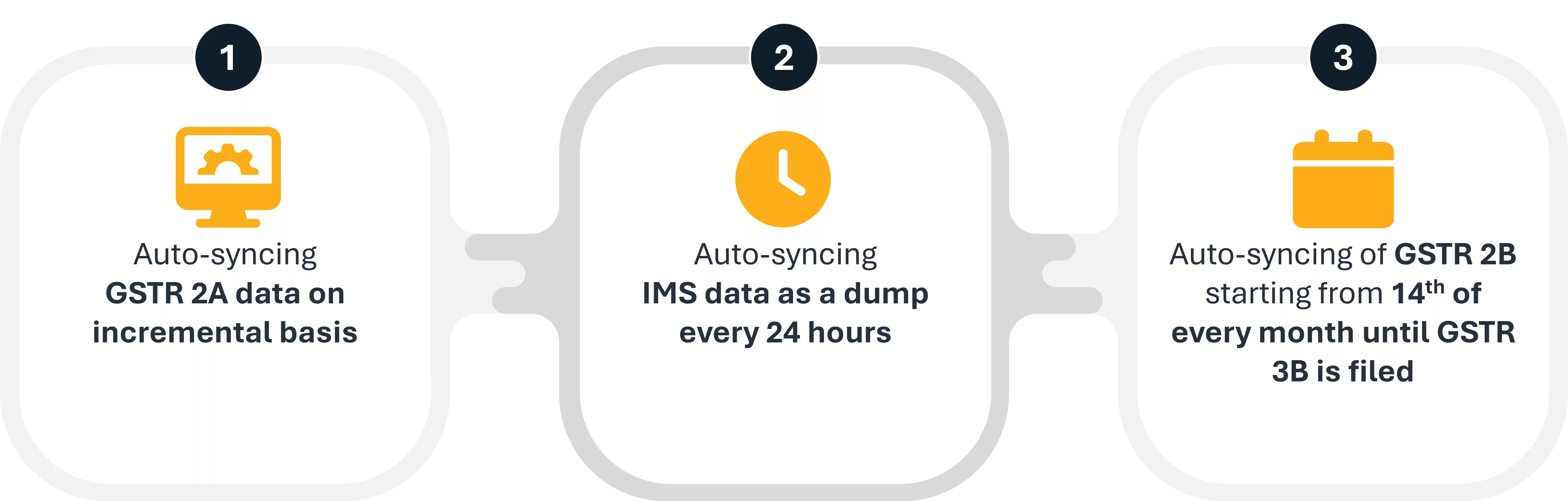

Auto actions based on reconciliation

Data archival in portal

Key Features of IMS

Real-time GSTR-2B Preview

Sequential GSTR-2B Filing

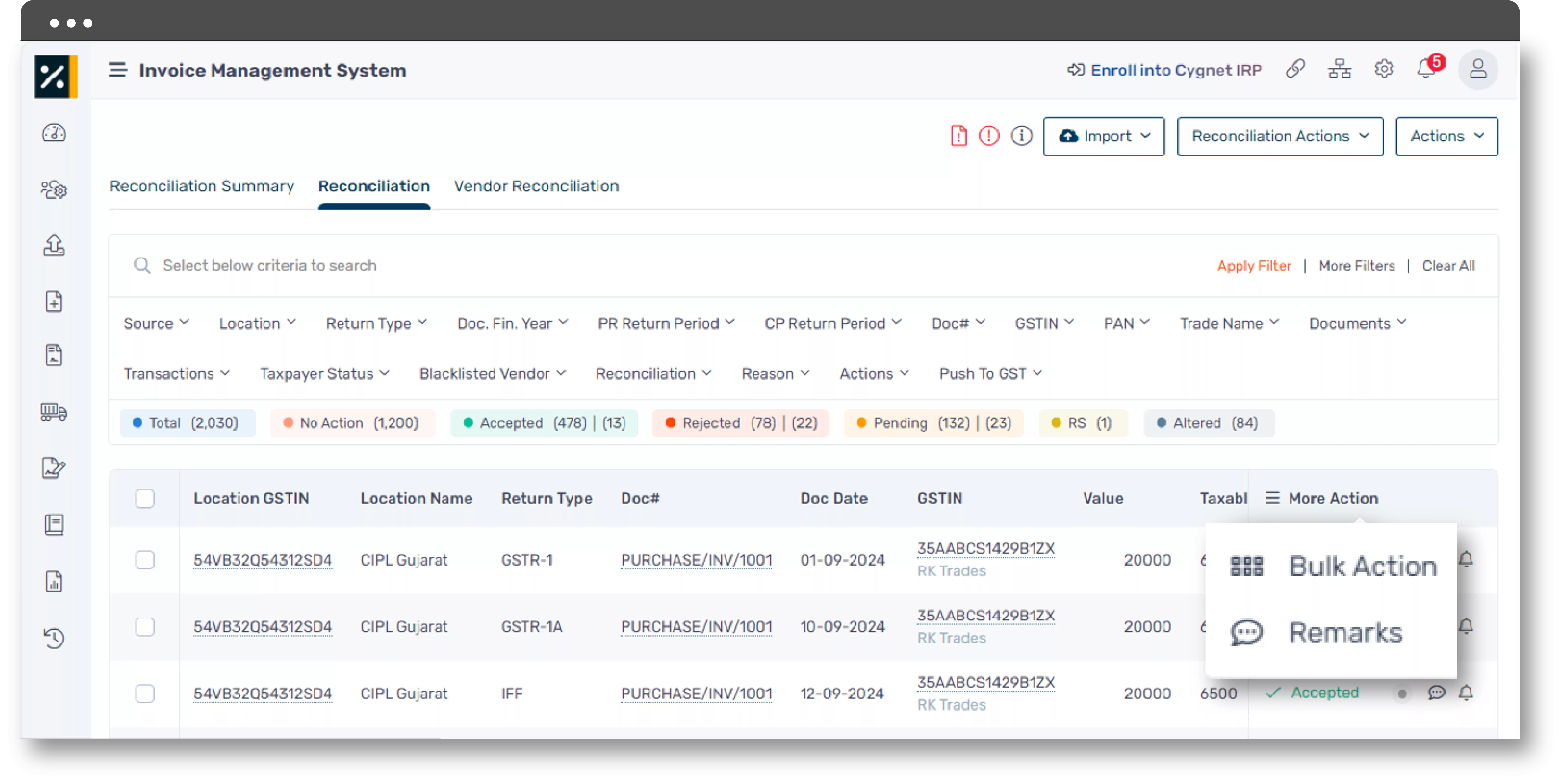

Built-in Reconciliation Tools

User-Friendly Interface

Auto actions based on reconciliation

Data archival in portal

Our USPs

Set default IMS actions based on reconciliation buckets

Bulk actions based on reconciliation

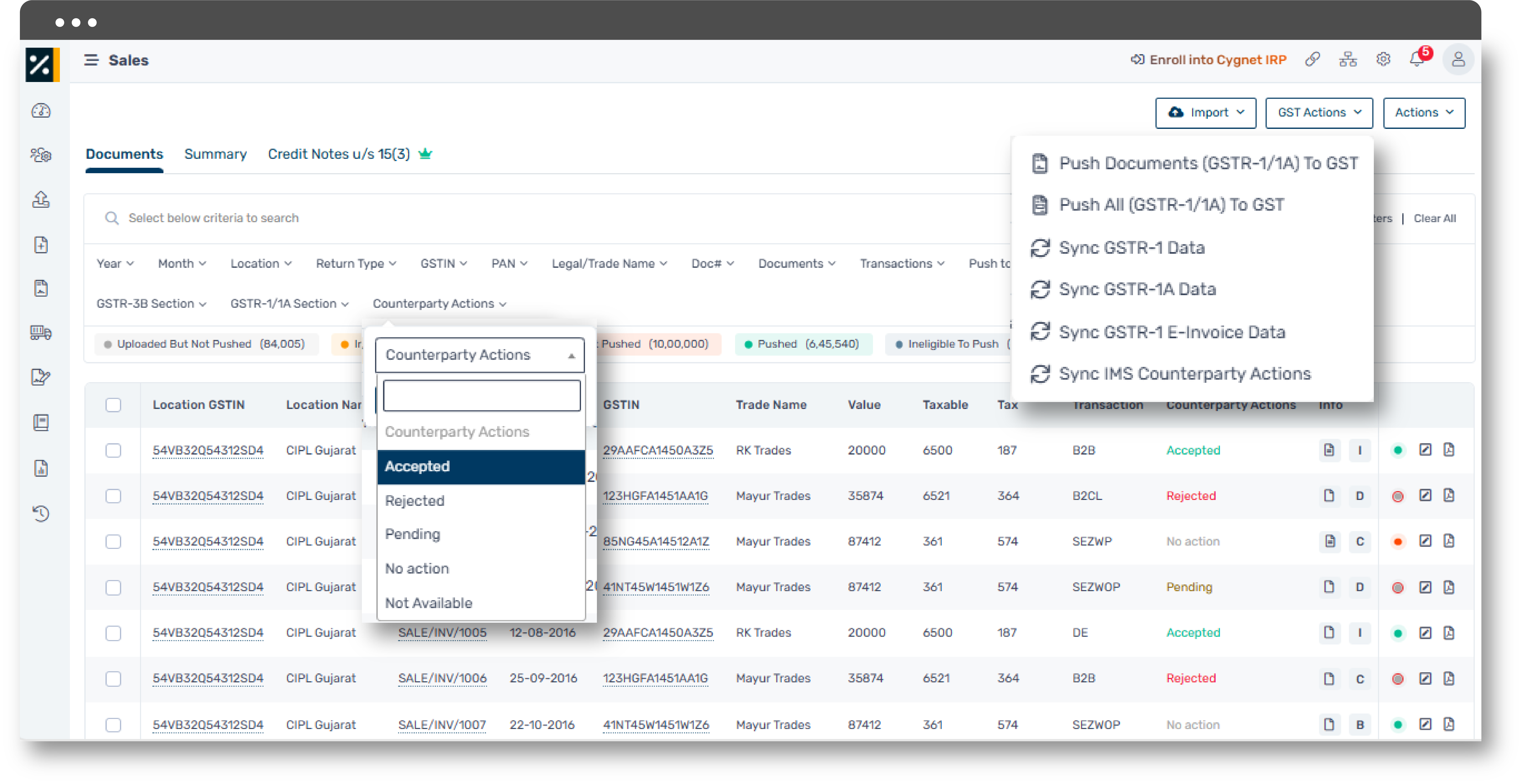

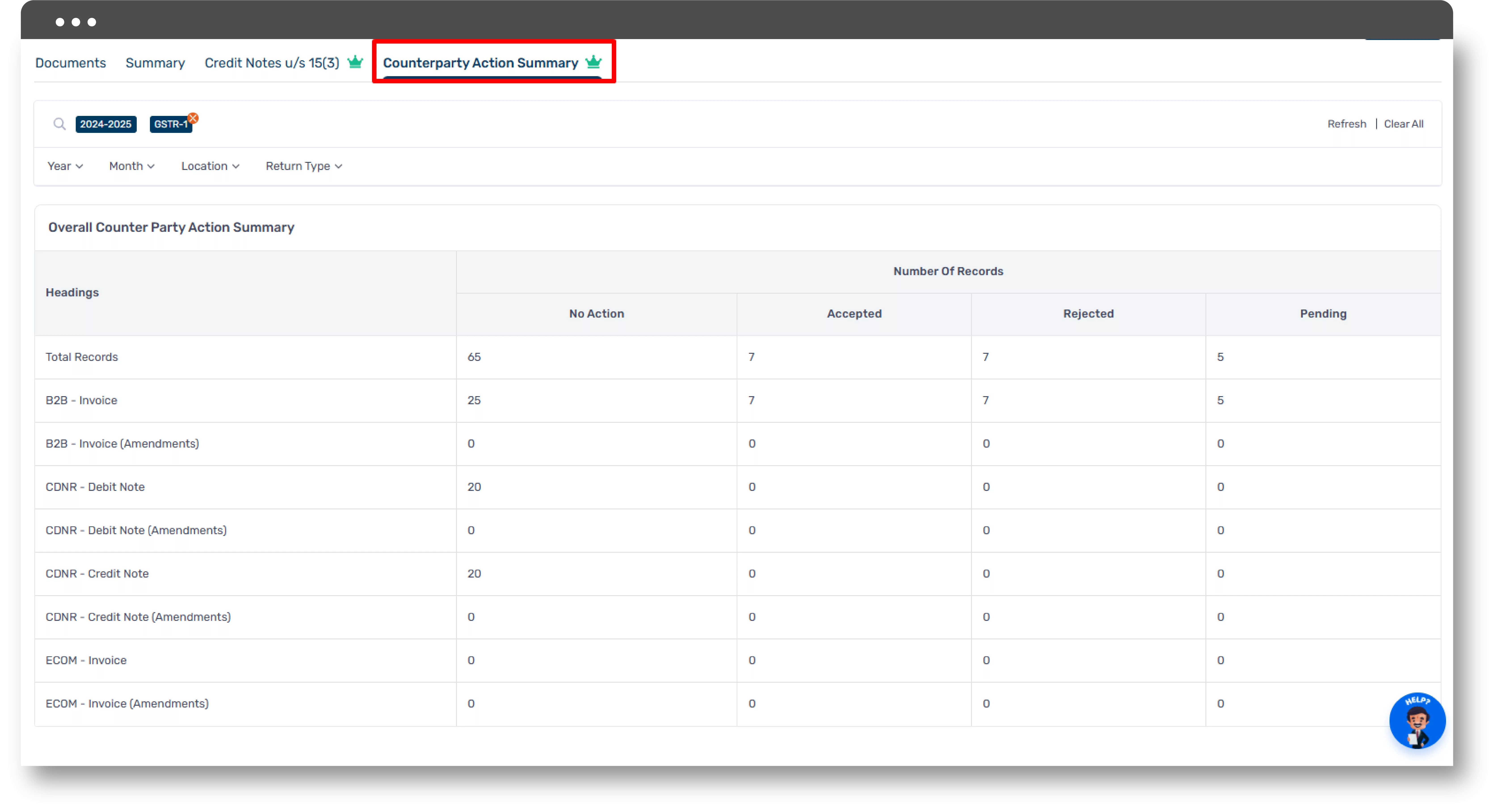

Real-time counterparty actions in your sales register on outward supplies

Track counterparty actions on e-commerce transactions with quick summary dashboard

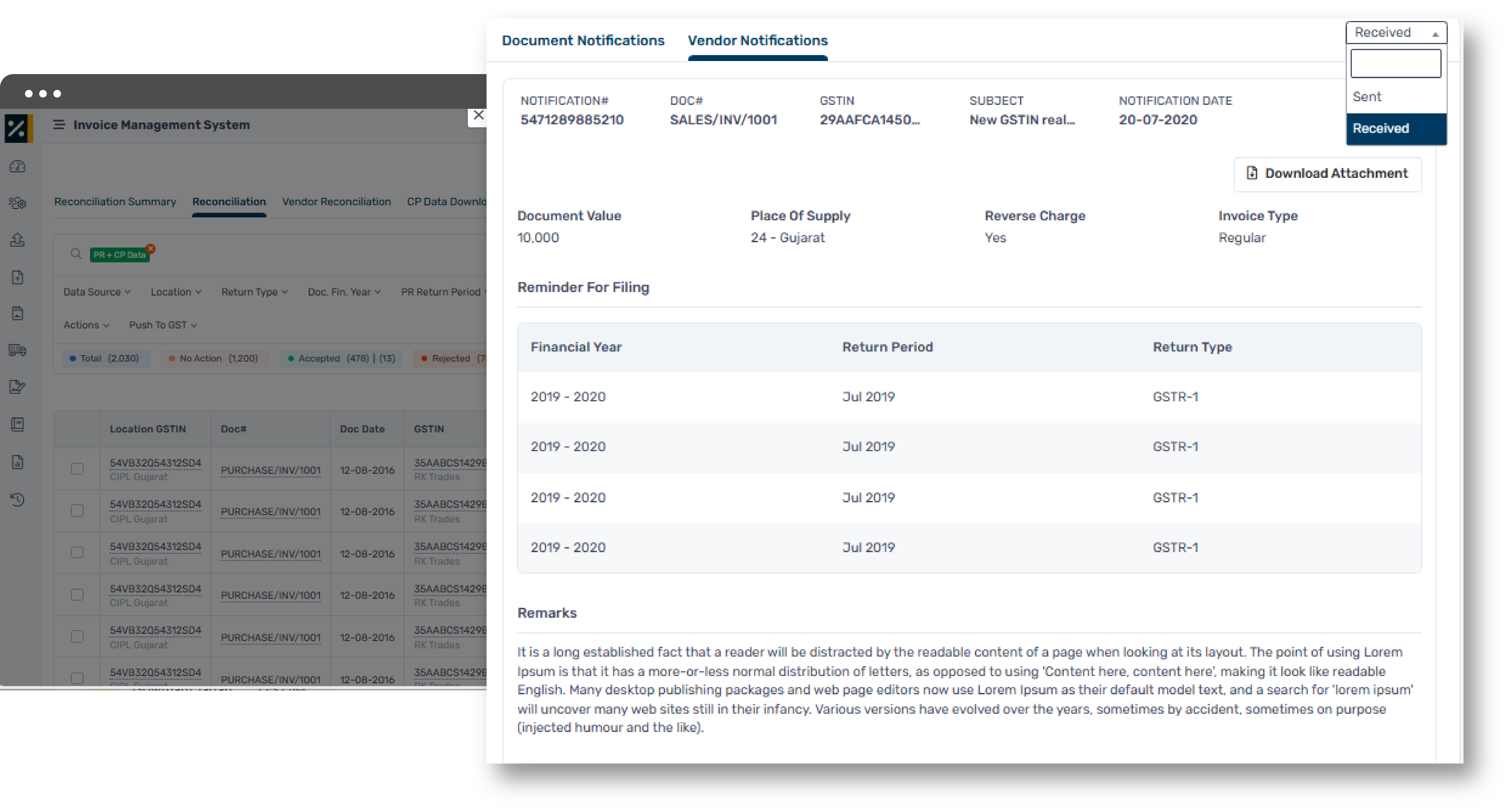

Trigger instant notifications to vendors based on real-time IMS actions

Ready to simplify your GST compliance? Contact us today to learn more about IMS and how it can benefit your business.

Built on years of indirect tax automation expertise

Developed by GSTN-certified tax tech engineers

Recognized by GSTN, used by leading Indian conglomerates

Built with secure APIs, audit trails, and strong SLAs

Access Resources

Invoice Management System (IMS)

Get answers to common questions about Invoice Management Systems (IMS). Improve your invoicing process with key insights.

What is an Invoice Management System under the GST

Read this blog to know everything about Invoice Management System, a vital feature in the GST framework.

FAQ

Yes, IMS will encompass all the fields necessary for identifying and taking action on invoices.

No, if IMS is not used, all invoices, credit notes, and debit notes will be automatically deemed accepted and populated in GSTR-2B.

Currently, there is no option to provide a reason for rejecting an invoice. Vendors may contact you to inquire about the rejection.

Yes, the RCM auto-populated values in GSTR-3B can be edited up until the return is filed.