VAT compliance has become one of the most intricate parts of running a business today. With every country tightening its tax reporting and audit requirements, finance teams are under constant pressure to get filings right — every single time. Manual spreadsheets and fragmented systems are no longer enough. Managing Value Added Tax across multiple jurisdictions creates substantial challenges for modern enterprises.

Manual VAT processes introduce calculation errors, missed filing deadlines, and compliance risks that can result in significant penalties. According to the European Commission, VAT gaps exceeded €93 billion in 2021 across EU member states, with compliance failures contributing substantially to this loss and avoiding VAT penalties in the UK has become a top priority for enterprises under the MTD regime.

That’s where VAT compliance software steps in. The right solution can automate validations, generate accurate returns, and keep pace with every policy update — whether it’s the UAE’s EmaraTax system, the UK’s Making Tax Digital (MTD) framework, or the upcoming EU’s VAT in the Digital Age (ViDA) initiative. For enterprises managing operations across regions, an automated VAT compliance solution ensures consistency, accuracy, and scalability across every jurisdiction.

For enterprises working across regions, it’s not just about filing faster; it’s about filing correctly, consistently, and confidently. Organizations implementing these solutions typically achieve 60-70% reduction in time spent on VAT processes and accuracy rates above 99%. This guide provides a structured approach to implementing VAT automation tools in your enterprise.

Project Planning: Building Your Implementation Foundation

Successful VAT software deployment begins with thorough groundwork that determines whether implementation takes weeks or months.

1. Assess Your Current VAT Landscape

Start by documenting existing processes;

- Which transactions trigger VAT obligations?

- How many jurisdictions does your organization operate in?

- Which parts of your VAT process actually need fixing or automation?

Map your current workflow from invoice creation through tax determination, reporting cycles, and filing procedures. Identify specific pain points—manual reconciliation between systems, difficulty staying current with rate changes across multiple countries, or struggling with jurisdiction-specific requirements.

Companies operating in the EU face particularly complex demands.

- Germany mandates e-invoicing using structured XML formats from 2025.

- Italy operates via FatturaPA.

- Spain’s SII requires invoice data submission within four days. (Source: European Commission, National VAT Directives Database, 2024)

These shifting requirements make VAT management strategies essential for maintaining compliance across diverse reporting models.

2. Secure Stakeholder Commitment

Gather your internal stakeholders from finance, tax, and IT — and define a roadmap. Set measurable targets such as reducing filing turnaround time, cutting manual effort, or achieving system-driven validations. Budget appropriately for licensing fees, implementation services, integration costs, and ongoing maintenance.

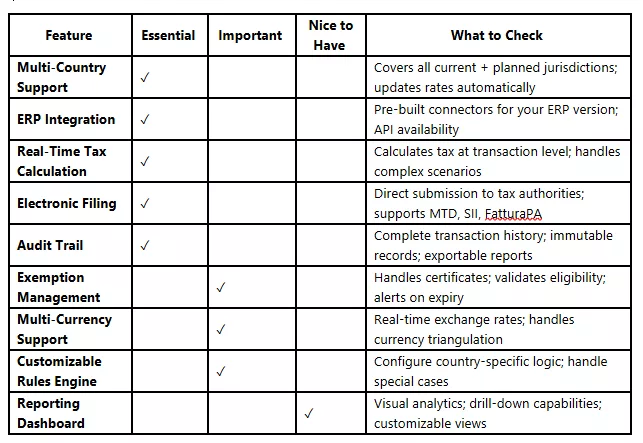

When evaluating a software platform, focus on Multi-country coverage, integration capability, scalability and security.

Cygnet.One, for instance, provides a unified compliance platform already integrated with EmaraTax and certified under PEPPOL, enabling enterprises to manage multiple VAT jurisdictions through one dashboard.

VAT Software Selection: Feature Comparison

Connect and Align Your Data Sources

Most implementation challenges arise not from the software itself, but from disconnected data.

Before integrating, review your master data. Check if:

- Tax codes and rates are aligned across systems

- Customer and supplier details are standardized

- Invoices and credit notes follow the same naming conventions

Next, set up connectors or APIs between your ERP and the VAT software. This ensures every sale, purchase, and adjustment is transferred automatically — reducing errors and repetitive entries.

During one of Cygnet.One’s projects for a UAE-based conglomerate, connecting SAP and Oracle data into a single compliance dashboard cut manual reconciliation efforts by almost 90%. Clean data made every subsequent return faster and more accurate.

Data Integration & Setup: Connecting Your Tax Engine

Integration determines whether your VAT software becomes seamless or requires manual data transfers.

1. Map Your Data Flows

Diagram how transaction data moves through your systems—from sales order creation through tax determination, invoice generation, payment processing, GL recording, and return preparation. Your VAT software intersects at multiple points in this flow.

2. Establish System Connections

Modern VAT platforms offer pre-built connectors for major ERPs, API integration for customized systems, or file-based exchange for batch processing. Choose the approach that balances real-time needs with technical capabilities. Configuration involves mapping fields between systems—your ERP’s “customer_tax_id” becomes the VAT software’s “vat_registration_number.”

3. Migrate and Align Master Data

Tax accuracy depends on clean master data. Your tax codes and rates must map correctly between systems. When Germany temporarily reduced its VAT rate from 19% to 16% during COVID-19, organizations with proper mapping updated one table rather than changing hard-coded values throughout systems.

- Align tax rates across systems.

- Use tools like the European Commission’s VIES to validate customer VAT IDs.

- Configure entities, user permissions, and workflows.

Case Example:

In Spain, companies with over €6M in annual revenue must report invoices within four days via the SII platform. Automated integration helps achieve this without human input.

Pilot Testing and Configuration: Proving the Solution Works

Testing identifies problems while they’re still easy to fix. A parallel run provides confidence before full commitment.

1. Design Your Pilot Program

Select a representative subset of operations for testing—one legal entity in 2-3 countries, processing diverse transaction types. Run the pilot for at least one complete VAT reporting cycle, preferably two, to capture month-end processes, return generation, and filing workflows.

Execute Parallel Processing

Maintain your existing process while the new system runs simultaneously. Compare outputs side by side and document every variance. Your reconciliation might reveal incorrect tax code mappings, customer classification errors, exchange rate differences, or timing discrepancies.

2. Configure Country-Specific Rules

Each jurisdiction has unique requirements. Germany requires sequential invoice numbering per legal entity. France applies reduced rates to numerous products (20% standard, but 10%, 5.5%, or 2.1% depending on items).

Test each configuration thoroughly using sandbox environments where available. Create test scenarios for exemptions and special cases—intra-community supplies, export sales, reverse charge purchases, distance selling, and electronic services to consumers.

A Dutch electronics company tested VAT automation across 75 countries before full deployment, using sandbox environments to validate intra-group and reverse-charge transactions — achieving a 100% audit pass rate post go-live.

User Training & Change Management: Ensuring Adoption Success

Technology delivers value only when people use it effectively.

1. Develop Role-Based Training

Finance teams need training on reporting, return preparation, and filing workflows. Tax professionals require deep dives into configuration and rules management. AP/AR processors need transaction-level guidance. IT staff require technical training on integration points, error handling, and system monitoring.

Create hands-on exercises using realistic scenarios. Document new processes with clear procedures, screenshots, and quick reference guides accessible through knowledge bases.

2. Address the Human Side of Change

Explain business reasons for the change, demonstrate how the software makes work easier, involve users early in testing and configuration, designate super-users as go-to resources, and celebrate implementation milestones.

A French retailer implemented VAT compliance software across 12 European countries with country-specific training in local languages, hands-on workshops using actual transaction data, and networks of tax champions supporting local users during transition.

3. Go-live and post-implementation: Switching to Production

Choose a go-live date that minimizes risk. Avoid the last week of reporting periods. Consider a phased rollout—starting with one entity or country—rather than switching all entities simultaneously if you lack confidence in specific configurations.

4. Execute the Transition

Conduct final data synchronization before go-live. Monitor transactions closely during the switch. Track key metrics including transaction volume processed, calculation time, and error rates. Have tax and IT teams on standby to address problems immediately.

Generate returns well before deadlines. Reconcile to source systems, compare to prior periods, review exception reports, obtain tax expert approval, and file through appropriate channels.

5. Establish Ongoing Support

Create tiered support structures for user questions, technical issues, and vendor escalations. Monitor system health through error rates and processing times. Maintain content updates as VAT rates and rules change. Conduct regular reviews with tax, finance, and IT teams to discuss performance and identify improvements.

Measure success against initial objectives—filing accuracy, timeliness, efficiency gains, audit readiness, and scalability. A global FMCG manufacturer reported standardizing tax technology across operations in over 60 countries improved compliance while reducing resources dedicated to routine tax processing, though their implementation required approximately 18 months from planning through full deployment.

Conclusion: Your Path to VAT Compliance Success

Implementing VAT compliance software demands careful planning, thorough testing, and commitment to change management. Organizations following structured approaches minimize disruption while maximizing technology value. Most enterprises complete deployment in 6-18 months, with investments typically generating returns within 2-3 years through improved efficiency, reduced compliance costs, and avoided penalties.

As regulatory requirements intensify globally, with electronic invoicing mandates, real-time reporting obligations, and digital tax administration becoming standard—robust VAT technology transitions from optional to essential. By approaching implementation systematically, you position your enterprise to meet current obligations confidently while remaining agile as requirements evolve.