The Kingdom of Saudi Arabia (KSA) is working proactively to continue technological advancement and achieve its Vision 2030, focusing on modernizing the tax administration process, diversifying revenue sources, and enhancing compliance through technology.

KSA implemented many significant tax reforms and incentives to create a business-friendly environment and move towards automation and digitization in 2025. Business in KSA has to stay informed about the new updates or amendments pertaining to indirect tax reforms for better operational workflow and compliance.

In 2024-25, ZATCA (The Zakat, Tax and Customs Authority) refined the digital VAT process by mandating the filing of returns via the ZATCA portal, which is a major VAT compliance enhancement.

Further, the e-invoicing mandate was launched in 2021 in 2 phases to digitize invoice processing, reduce tax evasion, enhance transparency, and streamline compliance with VAT obligations. ZATCA is set to make e-invoicing mandatory for all businesses in 2025.

E-invoicing KSA and VAT process digitization are categorized as major steps by KSA ZATCA for their move towards digitization. This blog will explore the VAT Saudi Arabia, e-invoicing KSA, why e-invoicing is critical for KSA’s VAT compliance, and how technology can play a vital part.

Brief on VAT KSA

VAT in KSA was introduced in 2018 under the GCC VAT framework for the levy of tax on the sale of goods or services administered by ZATCA. Here is a brief on VAT compliance requirements.

Scope: VAT applies to taxable supplies of goods and services in KSA, including imports, by VAT-registered businesses.

Rate: Initially, it was 5%, but it increased to the standard rate of 15% on July 1, 2020, to address economic challenges.

Registration:

- Mandatory for businesses with annual taxable supplies exceeding SAR 375,000.

- Voluntary for those with supplies between SAR 187,500 and SAR 375,000.

- Non-residents with no permanent establishment in KSA must register if supplying taxable services, regardless of revenue.

Return Filing:

- Monthly for businesses with annual taxable turnover exceeding SAR 40 million.

- Quarterly for businesses with a turnover below SAR 40 million.

Due date of the Return filing

Returns must be filed electronically via the ZATCA portal, accessible from the first day of the filing period, and the return must be filed on or before the last day of the month following the tax period.

Payment

VAT due must be paid electronically via the ZATCA portal or approved banks by the filing deadline. Refunds for excess input VAT are processed via ZATCA, with specific rules for tourists and international organizations

Record Keeping

Businesses must maintain records (invoices, contracts, etc.) for at least 6 years (15 years for real estate transactions) in Arabic, accessible for ZATCA audits.

Brief on e-invoicing in KSA

VAT-registered businesses must issue tax invoices for B2B transactions and simplified tax invoices for B2C transactions, including details as per ZATCA’s requirement

Since December 4, 2021, e-invoicing (Fatoora) is mandatory for resident taxpayers. The e-invoicing is rolled out in 2 phases, requiring structured electronic invoices in XML or PDF/A-3 format with QR codes for Phase 01.

In Phase 2, since January 1, 2023, ERP’s integration with ZATCA’s Fatoora portal is required for real-time B2B invoice clearance and B2C invoice reporting within 24 hours. The Phase-2 e-invoicing was further rolled out in waves based on the business turnover. In 2025, the following waves will be mandated:

| Wave | Business VAT turnover (Highest in 2022 or 2023 and 2024) | Date of implementation |

| 11 | More than SAR 15 million | 31 January 2025 |

| 12 | More than SAR 12 million | 28 February 2025 |

| 13 | More than SAR 7 million | 31 March 2025 |

| 14 | More than SAR 5 million | 30 April 2025 |

| 15 | More than SAR 4 million | 31 May 2025 |

| 16 | More than SAR 3 million | 30 June 2025 |

| 17 | More than SAR 2.5 million | 31 July 2025 |

| 18 | More than SAR 2 million | 31 August 2025 |

| 19 | More than SAR 1.75 million | 30 September 2025 |

| 20 | More than SAR 1.5 million | 31 October 2025 |

| 21 | More than SAR 1.25 million | 30 November 2025 |

| 22 | More than SAR 1 million | 31 December 2025 |

The need for e-invoicing in KSA, along with VAT compliance

The e-invoicing is required for VAT compliance to ensure accurate VAT reporting and payment. E-invoicing standardizes the invoice format along with mandatory fields, which helps businesses and government authorities to get transaction details in real-time without any errors.

Further, e-invoicing addresses various issues as follows

- Lack of Real-time reporting– Delayed reporting or non-reporting of invoices creates a difference between invoices and VAT returns, resulting in underreporting of sales, missed invoices, or incorrect VAT amount payment.

- Non-Standard VAT process– Inconsistent paper-based or non-compliant electronic invoice format, missing important invoice details, non-standard invoice reporting process, etc, can create VAT calculation and reporting errors, leading to VAT leakage and non-compliance.

- Audit Risk– Manual and inconsistent processes increase the risk of errors being detected during ZATCA audits, such as discrepancies between invoices, ERP data, and VAT returns, or failure to archive records for the required period can lead to fines, penalties, and notices.

- Reconciliation errors– Reconciliation errors are due to manual data entry, a lack of proper integration between invoices, ERP systems, and VAT returns, particularly when dealing with a large volume of transactions, lack of reconciliation clarity, etc. leading to mismatched transactions, incorrect output/input VAT reporting, unrecorded transactions, or duplicated invoices.

- Errors in VAT payment– Incorrect VAT calculations or delayed payments can result from a lack of clarity on VAT compliance and invoicing rules, such as applying the wrong rate or missing deadlines. VAT rules for mixed supplies (standard, zero-rated, exempt) or cross-border transactions can be complex, leading to errors in tax classification. These errors can lead to overpayment or underpayment of VAT.

- Wrong credit availment– Businesses may claim input VAT credits incorrectly on ineligible expenses, such as exempt supplies or personal expenses, due to incomplete or inaccurate invoice information or a lack of knowledge leading to wrong availment of credits.

- Handling a large volume of transactions- Businesses with high transaction volumes, such as retailers or large enterprises, struggle with non-standard and manual invoice processing, leading to missed invoices, delayed reporting, or incorrect totals in VAT returns.

- Inaccurate or missing invoice information- Human errors like typos, incorrect VAT amounts, or intentional manipulation can occur without standard invoice processing and real-time reporting.

Further, without mandatory requirements, the chances of errors in invoice information, such as VAT number, transaction date, or buyer/seller information, etc, are high, leading to non-compliant invoices.

E-invoicing supports standard processes and formats, providing mandatory information, real-time reporting to ZATCA, etc., which provides validation of transactions and VAT payments beneficial for both businesses and ZATCA in VAT compliance and reduction of VAT leakage, respectively.

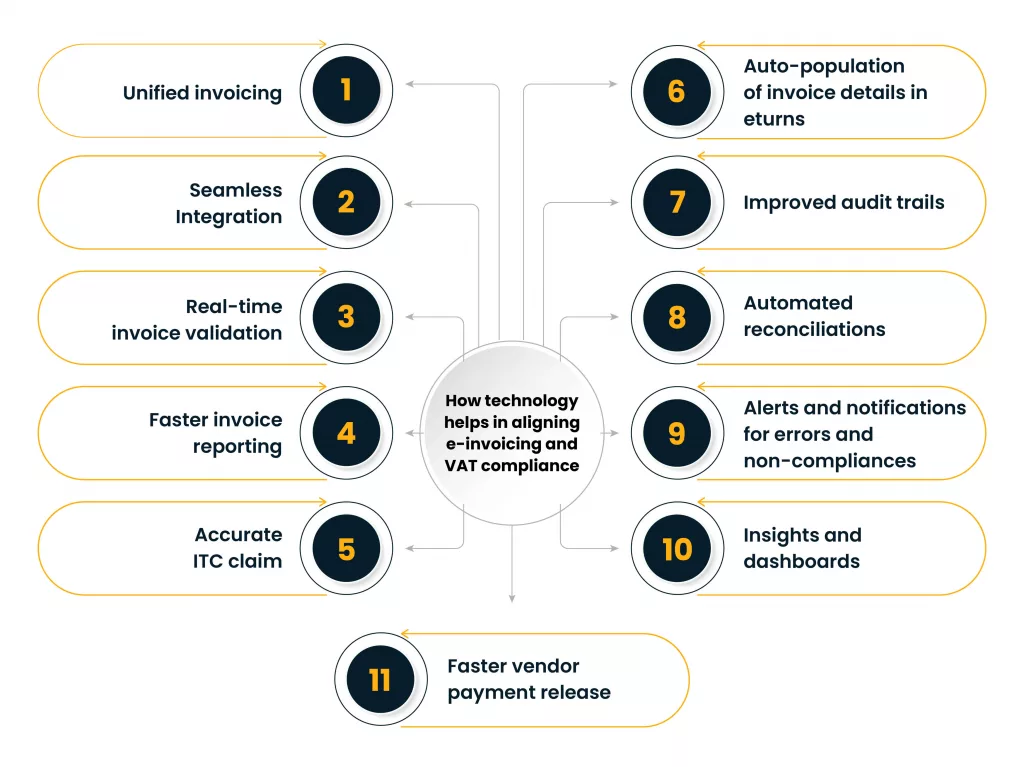

How technology helps in aligning e-invoicing and VAT compliance

Technology plays a vital role in aligning e-invoicing with VAT compliance in KSA, addressing the above challenges. Leveraging automation, integration of systems, real-time update and reporting, streamlined process, etc., ensures adherence to the ZATCA requirements.

Businesses must integrate a ZATCA-recognized e-invoicing platform for their e-invoicing process. Businesses, particularly those dealing with a large volume of transactions, must also evaluate additional features provided by a third-party technology partner in e-invoice processing for optimum and accurate VAT compliance.

Here is the detailed analysis on how technology plays its part.

Unified invoicing

With e-invoicing, there is standardization in the process and format of invoices. E-invoicing solutions enforce ZATCA’s standardized formats (XML or PDF/A-3) with mandatory fields and security requirements such as Hash, QR code, UUID, etc, ensuring consistency and compliance across businesses.

Seamless Integration

E-invoicing solutions integrate with ERP systems, Point of Sale (POS) systems, and ZATCA’s Fatoora portal via APIs to ensure seamless invoice data transfer across the e-invoicing workflow. Further, Cloud-based platforms provide easy storage and retrieval as per compliance requirements.

Real-time invoice validation

E-invoicing systems validate invoices in real-time before invoice data is transferred to the Fatoora portal. Invoices are checked for mandatory fields, cryptographic stamps, and UUIDs, ensuring compliance before clearance or reporting.

Faster invoice reporting

Automated e-invoice processing ensures compliance with ZATCA requirements of real-time clearance of B2B e-invoices and reporting of B2C invoices within 24 hours, replacing manual or unstructured processes and delayed reporting.

Accurate ITC claim

An e-invoicing solution prevents wrong credit claims by validating invoice details, including supplier VAT numbers and tax amounts, against ZATCA rules, ensuring accurate credit claims. Further, real-time invoice clearance ensures that only compliant invoices are used for claims

Auto-population of invoice details in returns

Since the entire business workflow gets integrated, invoice data can be automatically transferred to ERP for data entry and VAT return preparations, auto-populating VAT return fields using data from validated e-invoices.

Auto-population of data reduces manual entry errors, ensuring VAT returns reflect accurate transaction data, streamlining filing processes, minimizing discrepancies, and supporting compliance with ZATCA’s deadlines.

Improved audit trails

E-invoices are stored digitally with cryptographic stamps and UUIDs, creating tamper-proof audit trails. Records are archived for 6 years (15 for real estate) in ZATCA-compliant formats, accessible via the Fatoora portal, simplifying ZATCA audits and reducing the risk of non-compliance penalties.

Automated reconciliations

E-invoicing systems automate reconciliation between invoice data and ERP records and VAT returns. The VAT and e-invoicing compliance solutions provide various reconciliation options, such as ERP data with e-invoice data, VAT return with e-invoices, ERP with VAT return data, tax rate reconciliations, cross-border transactions reconciliations, GL reconciliations, e-invoice with VAT payments, etc.

Automated reconciliations eliminate manual reconciliation errors and ensure consistency between invoices, ERP records, and VAT returns, thereby supporting accurate VAT compliance.

Alerts and notifications for errors and non-compliances

E-invoicing solution flags the errors or non-compliance and alerts for human intervention for proactive corrections to avoid fines and penalties.

Insights and dashboards

E-invoicing platforms offer dashboards with insights into transaction volumes, VAT liabilities, compliance status, etc, helping businesses monitor compliance, identify errors, support strategic tax planning, and reduce non-compliance risks.

Faster vendor payment release

E-invoicing speeds up invoice processing and validation, enabling quicker approvals and electronic payments, ensures timely VAT and invoice settlements, reduces penalties for late payments, and fosters customer-supplier relationships.

Why trust Cygnet for your e-invoicing KSA and VAT Return preparation?

Cygnet’s e-invoicing solution is a ZATCA-approved e-invoicing platform that ensures compliance with KSA’s e-invoicing mandate. It helps VAT-registered taxpayers generate, validate, store, transfer, and report e-invoices in a structured format with mandatory fields that meet ZATCA’s requirements.

This platform offers features like seamless integration, QR code generation, cryptographic stamps, and UUIDs, as well as seamless integration with ZATCA’s Fatoora portal, allowing real-time B2B invoice clearance and B2C invoice reporting within 24 hours. It also provides offline B2C invoice creation for retailers or businesses with connectivity issues.

It provides tamper-proof data security and includes 24/7 Arabic and English support. By automating VAT return preparation and e-invoicing compliance, Cygnet helps businesses avoid penalties and meet VAT compliance.

Cygnet also provides VAT return compliance solutions that can seamlessly integrate with e-invoice platforms, ERP systems, POS systems, and the Fatoora portal, allowing businesses to transfer data without manual errors and ensure VAT process automation, seamless import-export transaction management, real-time GL reconciliations, and compliance monitoring to ensure seamless automation and compliance of VAT and e-invoicing across the business.