About KSA e-invoicing

Transparent and streamlined compliance, way better efficiency!

KSA continues to embrace digitalization and e-invoicing has become an integral part of the country’s efforts to streamline processes, enhance transparency, and promote compliance.

Empower your business systems for Phase 2 of e-invoicing implementation in Saudi Arabia with Cygnet Digital’s electronic invoicing solution. Our ZATCA-approved e-invoicing software helps businesses automate and streamline e-invoicing generation with minimal effort and adhere to tax laws for improved security.

How does it ensure compliance?

A comprehensive end-to-end solution encompassing the many features

Real-time invoice submissions

Enabled POS systems to generate e-Invoices

Tamper-proof system with detailed audit logs

ZATCA-compliant solution features to ensure business continuity

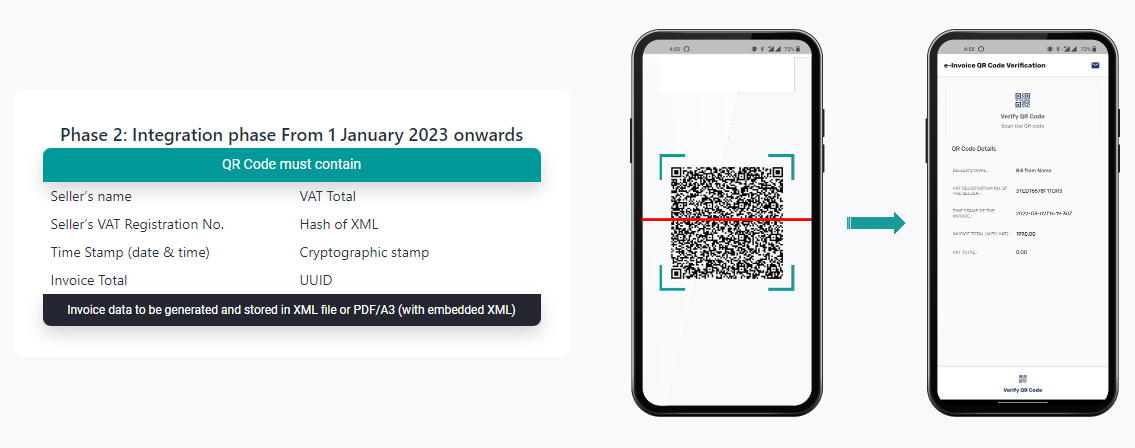

Technical requirements of Phase 2 of e-invoicing

How will it benefit you?

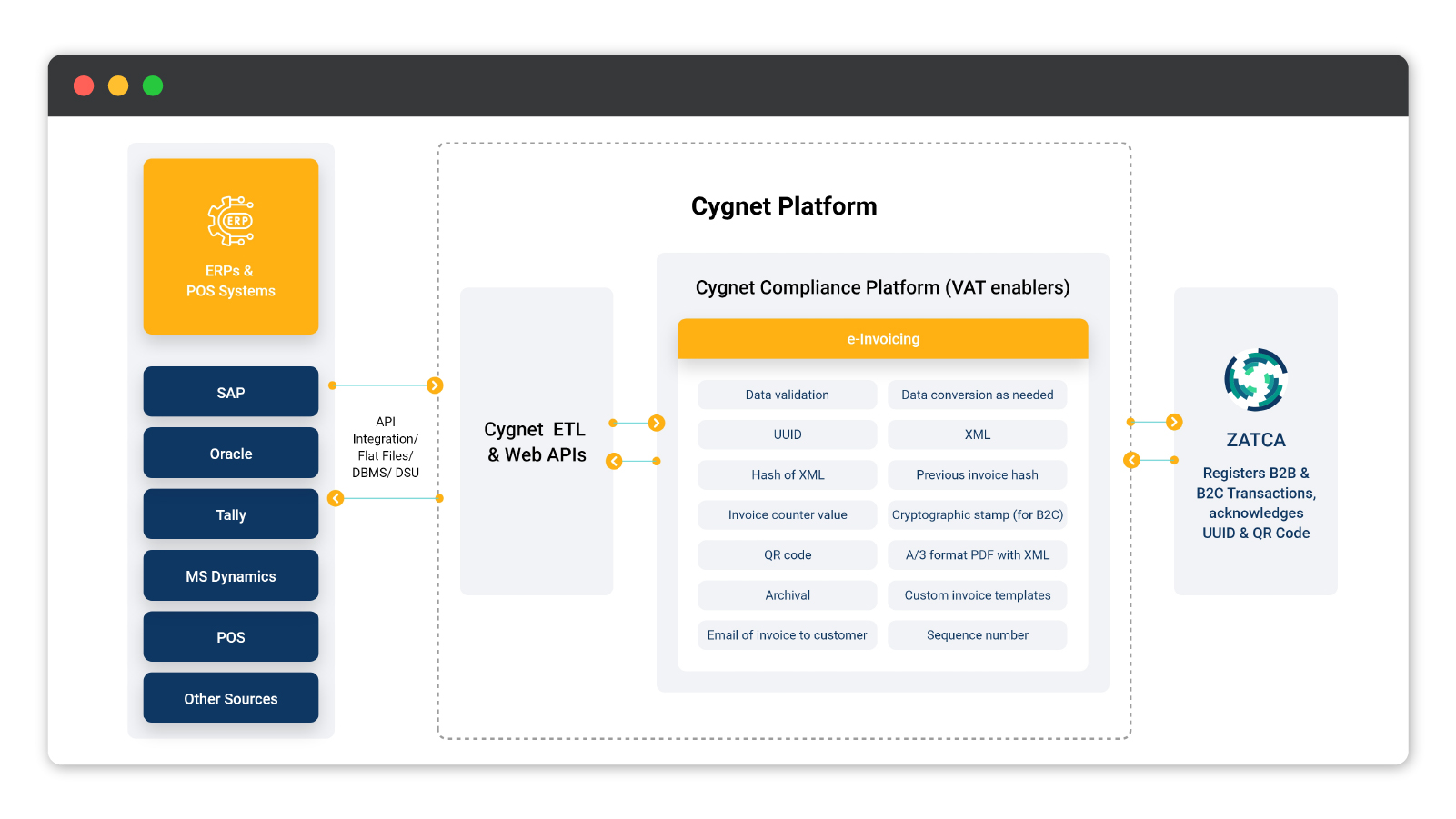

Integrate with any business system

Ready connectors for SAP, Oracle, other ERPs & accounting systems.

Offline Utility

Enables retailers and distributors to generate B2C e-Invoices without internet connectivity

ZATCA Integration

Get ready for Phase-2 implementation by integrating your system with ZATCA via API

Generate requisites for invoices

Generate XML, the hash of XML, UUID, QR Code & get cryptographic stamp back from ZATCA for seamless generation of e-Invoices

Support multiple languages

Generate e-Invoices in Arabic as well as the English language