Imagine a company negotiates and grabs the best procurement contract but struggles with PO-GRN-Invoice reconciliation or fails to process the invoice on time, resulting in loss of the supplier’s trust, delayed deliveries, cash flow issues, etc.

Or suppose a business is rapidly expanding, where purchases are made across departments without a standard process, lacking real-time visibility for leadership, a lack of purchase control, or compliance gaps.

In both cases, sourcing or budgeting is not the concern; it is a lack of a proper Procure-to-payment process. When the P2P process is standardized and the procurement and finance teams are aligned, the spending control gets tightened, and healthier supplier relationships are built.

As per report, Organizations with a typical $10-billion spend observed annual spend savings or cost avoidance of $35M-$45M, underscoring the financial benefits of adopting advanced P2P solutions. P2P solutions enabled 14% cost reduction by steering requesters to compliant purchase channels, leveraging preferred suppliers, and negotiated pricing.

Therefore, an ideal Procure-to-Payment process is not an operational workflow but a foundation that keeps procurement efficient and finances reliable.

What is Procure-to-Payment?

The procure-to-payment is an end-to-end process of acquiring goods and services by the business organization. It starts with the need to purchase goods or services by the organization.

The end-to-end procure-to-pay cycle consists of requisition, supplier selection, purchase order, Goods receipt and verification, invoice processing, and payment.

Key Stages of the Procure-to-pay Cycle

The P2P process starts when an organization has a need to acquire goods or services, which is formalized through an official P2P workflow as follows:

1. Requisition

A formal purchase requisition is created based on the requirement of a particular department, specifying the required information related to acquisition.

The requisition is sent for internal approval to ensure the requirement is aligned with procurement polices and the financial budget.

2. Supplier Selection

After requisition approval, the procurement team selects a suitable supplier after considering various factors, such as price, quantity, quality, delivery time, etc. KPIs set by the organization can help in supplier selection.

3. Purchase Order (PO)

After selecting a supplier, a formal PO is sent to the supplier describing each term and condition, quantity, amount, product or service details, delivery date and time, and other relevant information.

When the supplier accepts the PO, it works as a contract between the organization and the supplier.

4. Goods or services receiving

Upon receiving goods or services, a receipt note is issued to the supplier after verification of the fulfillment of all terms and conditions during delivery. The goods or services are matched by the PO, and any discrepancies or mismatches are addressed.

5. Invoice processing

The invoice is issued by the supplier to the business organization, which is reconciled with the PO and receipt note to ensure accuracy of the goods or services requested and received, with the invoice value.

If the invoice is correct, it will be approved and sent for payment initiation. If the invoice is incorrect, it will be resolved and corrected before approval to ensure payments are released only for accurate invoices.

6. Payment

After invoice verification and approval, accounts payable processes the payment based on agreed-upon terms and conditions. Upon payment to the supplier, the procure-to-pay cycle ends.

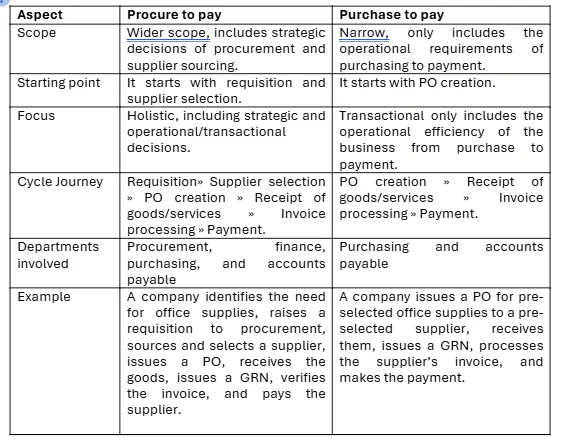

Procure-to-Pay vs Purchase-to-Pay – Are they the same?

Procure-to-pay and Purchase-to-pay are often used interchangeably and considered as related terms. However, in broader terms, purchase-to-pay is a part of the procure-to-pay cycle.

Purchase-to-pay is a transactional subset of the procure-to-payment cycle, which starts with the creation of a Purchase order without requiring procurement decisions and supplier selection, focusing on operational efficiency of purchase and payment.

Key differences

Challenges in a Traditional P2P Process

The following challenges can be faced by businesses in the traditional P2P cycle:

1. Paper-based documents

The traditional P2P process depends on paper-based requisition, PO, and invoices, which can slow the P2P process, increase the risk of document loss, delay approvals and payments, and increase administrative costs and workload.

2. Lack of visibility

The finance and procurement department doesn’t get real-time visibility into the spending, supplier performance, and P2P cycle status across various stages, resulting in difficulties in budget tracking, compliance monitoring, and issue identification, leading to inaccurate and overspending.

3. Non-compliance with policies

With the traditional process, there is a lack of centralized control over the procurement process, leading to maverick spending, i.e., outside the approved contract, leading to non-compliance with polices and contracts, impacting cost and legal risk.

4. Non-integrated process

Disconnected P2P processes can lead to data silos, inconsistent information, and delayed reconciliation of records across the finance, accounts, procurement, and inventory teams.

5. Supplier Mismanagement

Manual or traditional processes don’t have updated supplier details, lack supplier performance evaluation, making negotiation terms difficult, leading to reliance on unreliable suppliers, poor relationships, and missed benefits of negotiation and discounts.

6. Invoice and payment errors

Manual data entry and reconciliations of documents and records can increase errors, resulting in inaccurate payments to suppliers. Further, clear visibility on suppliers’ compliance status or performance can lead to payment release to non-compliant suppliers, resulting in input credit losses.

7. Fraud and security concerns

Manual P2P process can lead to fraudulent activities, such as fake invoices or unauthorized purchases, leading to financial losses.

8. Scalability issues

The manual P2P process cannot handle the increased volume of transactions, resulting in inefficiencies and errors, with growing business needs.

Benefits of a Well-Managed P2P Process

A well-managed P2P process backed by automation and an advanced solution can benefit businesses in various ways:

1. Operational efficiency

An automated and streamlined Procure-to-payment process can increase operational efficiency by reducing manual tasks, associated errors, and costs. It can speed up approvals, invoice processing, and payments.

2. Enhanced visibility

A standard and automated P2P process provides centralized and real-time visibility over procurement spend and P2P process status, etc. This provides data-driven decision-making for spend control, forecasting budgets, maverick spending, and saving opportunities.

3. Better supplier relationship

A well-managed P2P process provides better and real-time visibility into suppliers’ performance, evaluates delivery, time, and order fulfilment accuracy, and facilitates fast payment processing.

This builds trust, better relationships, along with contract negotiation and discount availment support based on performance and payment processing time.

4. Strategic procurement

A centralized visibility into the procurement cycle, inventory, and supply chain provides insights for making correct decisions regarding procurement timings, quantity required, suitable supplier, pricing, etc, to ensure an optimum level of inventory is in stock, aligning with business targets.

5. Improved cash flow

With a proper P2P process, the invoice processing gets faster and accurate, which ensures suppliers’ payment and ITC availment are on time, helping to avoid late payment charges and get early payment discounts, supporting budget accuracy and cash flow.

6. Compliance improvement

An automated P2P process helps in contract evaluation, alerts for the spend outside contract, approvals get set based on contract terms and internal polices, along with an audit trail of each activity, providing better compliance and minimizing legal penalties.

Use Cases of Digitized Procure-to-Payment Process

1. PO Management

Automated PO creation, approval, matching, and tracking across relevant departments provides real-time PO status, compliance, budget consumption, vendor acceptance, etc, to make better procurement decisions, flagging unauthorized or overcommitted spend based on contract and PO creation by unauthorized persons.

2. PO/Invoice Matching with GST data

PO and invoice data can be reconciled with GST data through 3-way matching to ensure there is no discrepancy or mismatch among them or any error is flagged and resolved before it escalate, helping in GST compliance and accurate ITC claim.

3. Gate Entry and ASN

Supplier can submit ASN through the P2P portal where system match the ASN with the corresponding PO/invoice, gate entry system pre-validates ASN, matches truck or vehicle details, and generates GRN, eliminating unauthorized gate entry or manual paper work.

4. Supplier Onboarding

P2P platform captures suppliers’ data such as bank details, identity details, GST number, payment preferences, compliance certificates, etc, and validates against government registries in real time, ensuring automated and instant KYC verification

5. Digital Signing

P2P workflows incorporate e-signature capabilities for purchase agreements, contracts, individual POs, etc. Digital signing creates immutable audit trails, ensures legal enforceability, and accelerates approval cycles without paper routing ensuring faster contract and supplier engagement within the P2P system.

Trends of the Procure-to-Payment Process

With emerging technologies such as AI/ML, RPA, etc, the P2P process would evolve around business needs, bringing efficiency, sustainability, and value. Here are a few aspects improving the future of the P2P cycle:

1. Automation and digitization

End-to-end automation of the P2P process from the initial stage of procurement to the final payment, including technologies like

- IDP, which can automatically extract and verify document details.

- AI/ML for predictive analytics, anomaly detection, automated reconciliations, data entry, approvals, etc

- RPA to perform repetitive and routine tasks.

- Blockchain for immutable documents for security and transparency.

- Automated workflow and integration with ERP, CRM, supply chain management platform, etc, for creating a unified business infrastructure.

2. Mobile and cloud-based P2P solutions

Cloud-based P2P platform which provides scalability, preference of type of cloud selection, real-time access, etc, and a mobile solution offering remote access to ensure timely approvals and tracking.

3. Data-driven and real-time analytics

Integrating Big data, IoT, etc, would provide real-time data analytics and dashboards for real-time visibility, procurement cycle status, spend details, supplier performance evaluation, and cash flow to make informed decisions.

4. Personalized supplier experience

An advanced P2P platform offers a supplier’s self-service portal. Here, the supplier can track payment status, upload relevant documents like invoices, and chatbots for quick reply to queries, and other support that can enhance the supplier relationship and user experience.

Conclusion

In summary, the Procure-to-Payment process serves as the backbone of efficient procurement and financial operations, transforming potential challenges into opportunities for cost savings, compliance, and strategic growth. By standardizing the P2P cycle, organizations can build stronger supplier relationships, optimize cash flow, and drive sustainable business value.

Choosing Cygnet.One for your P2P cycle empowers businesses with end-to-end automation, real-time analytics, and seamless ERP integration, delivering cost savings, enhanced supplier relationships, and scalability to meet evolving needs.