Introduction

Unraveling the world of automated invoice processing is like entering a realm of efficiency and transformation for businesses. Invoice automation eliminates the risk of human errors, accelerates approval workflow with invoice workflow automation, and provides a clear audit trail for enhanced transparency and accountability.

In the not-so-distant past, organizations relied heavily on labor-intensive, error-prone manual processes to handle invoices. This time-consuming process often led to delays, inaccuracies, and inefficiencies. With the advent of automation, this landscape has transformed dramatically. Automated invoice processing leverages cutting-edge technologies like AI, machine learning, IDP, etc. to capture and analyze invoice data swiftly.

This shift has eliminated data entry redundancy and drastically reduced human error, ensuring accuracy and compliance. In today’s digital age, Invoice automation is a key to unlocking greater financial control and operational excellence, providing a glimpse into a future of efficient, data-driven financial management.

What is Automated Invoice Processing?

Automated invoice processing is a tech-driven solution that replaces the manual and paper-based method of handling invoices with streamlined and efficient automation. This process involves using various technologies to extract, categorize, and process invoice data without manual intervention.

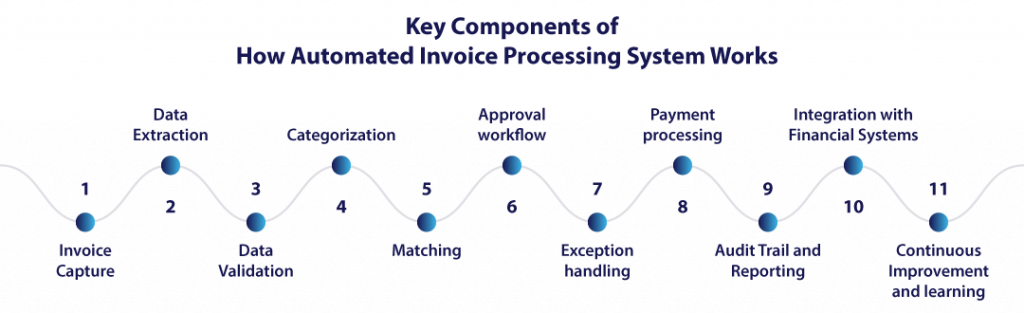

Key Components of How Automated Invoice Processing System Works

- Invoice Capture: Invoices are received through various channels such as email, scanned documents, or electronic data interchange (EDI). All invoices are fetched and collected at a predetermined place for further processing.

- Data Extraction: Automated systems extract relevant information from invoices, such as invoice number data, amount, vendor details, etc. using technology like AI and IDP (Intelligent document processing).

- Data Validation: The system validates the extracted data to ensure accuracy and compliance with predefined rules and standards.

- Categorization: Invoices are categorized based on predefined criteria, such as types of expenses or vendors, to facilitate further processing.

- Matching: The system matches invoices with purchase orders or receipts to ensure the charges are accurate and authorized.

- Approval workflow: Automated approval workflows route invoices to the appropriate personnel for review and approval, with notifications and escalations for pending tasks.

- Exception handling: Automated systems identify and flag exceptions or discrepancies for further manual review, allowing for resolution by designated personnel.

- Payment processing: Once approved, the system initiates payment processes by triggering payments or preparing invoices for payment in the organization’s financial system.

- Audit Trail and Reporting: Detailed audit trails are maintained to track the entire invoice processing journey, providing transparency and accountability, and aiding in compliance, audits, and reporting.

- Integration with Financial Systems: Automated invoice processing systems seamlessly integrate with accounting or ERP systems, ensuring synchronized and accurate data transfer.

- Continuous Improvement and learning: Machine learning components in these systems continuously learn data patterns, enabling improvements in accuracy and efficiency over time.

Automated invoice processing offers several benefits. It is a crucial tool for modern businesses looking to optimize their financial operations and streamline their accounts payable process.

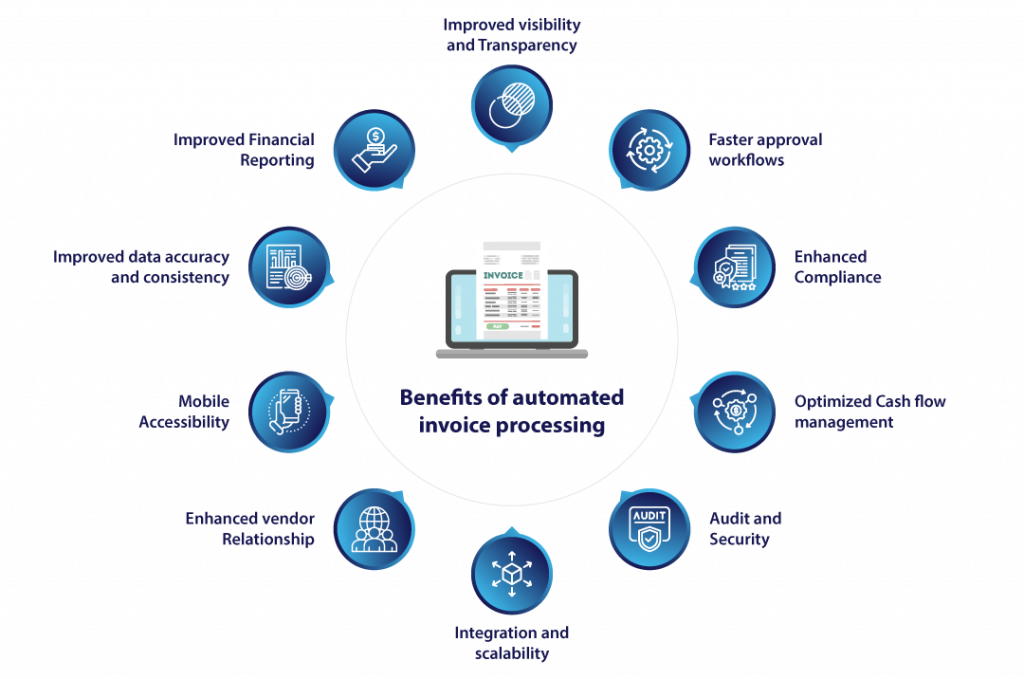

Benefits of Automated Invoice Processing over Manual Processing

Invoice Automation offers numerous advantages over manual processing, contributing to increased efficiency and accuracy in financial operations.

- Improved visibility and Transparency: Automated systems provide real-time visibility into the status of invoices, enhancing transparency and making it easier to track and manage financial data.

- Faster approval workflows: Invoice workflow automation streamlines the approval process, ensuring invoices move swiftly through the necessary channels for review and approval.

- Enhanced Compliance: Invoice automation helps enforce compliance with organizational policies, regulatory requirements, and vendor agreements by applying consistent validation rules.

- Optimized Cash flow management: Quicker processing and payment cycles contribute to improved cash flow management, allowing businesses to better manage their financial resources.

- Audit and Security: Automated invoice processing systems maintain a detailed audit trail, providing a transparent record of all actions taken during the processing of invoices for compliance and auditing purposes.

- Integration and scalability: Automated systems can seamlessly integrate with other financial and enterprise systems, ensuring a cohesive flow of data across different departments. Further, it can easily scale to accommodate increasing invoice volumes, making it suitable for growing businesses.

- Enhanced vendor Relationship: Faster and more accurate payment cycles resulting from automation contribute to improved relationships with vendors and suppliers.

- Mobile Accessibility: Many automated systems offer mobile accessibility, enabling users to review and approve invoices on the go, promoting flexibility, and responsiveness.

- Improved data accuracy and consistency: Automated systems enforce standardized data entry and validation, ensuring consistency and accuracy across the entire invoicing process.

- Improved Financial Reporting: There is a critical role for purchase invoices in financial reporting. Automating purchase invoices can benefit by streamlining processes and reducing manual errors. Automation enhances accuracy in recording and categorizing expenses, leading to more precise financial reporting. It also accelerates the reconciliation of purchase transactions, ensuring accuracy and timeliness in financial reporting.

Selecting the Right Automated Invoice Processing Software

Selecting the right invoice automation solution is pivotal for businesses seeking to streamline their financial operations effectively. A comprehensive selection process involves considering several key factors. First, understanding the organization’s specific needs and existing workflow is crucial. This includes evaluating the volume of invoices, the complexity of processing, and integration requirements with other financial systems.

Additionally, assessing the system’s capability to handle various invoice formats, its accuracy in data extraction, and its adaptability to evolving regulatory and compliance standards is essential. Integration capabilities with existing software and compatibility with the organization’s infrastructure are critical considerations.

Moreover, ensuring the system’s scalability to accommodate business growth, along with its user-friendliness and the level of support offered by the provider, are vital. Security features and maintaining a clear audit trail should not be overlooked.

The right system should align with the organization’s goals, offering a balance between efficiency, accuracy, compliance, and ease of integration. Making an informed decision involves thorough evaluation and testing to ensure the selected system meets the organization’s specific needs while paving the way for improved financial management and operational excellence.

Implementation Strategy for Automated Invoice Processing

Implementing automated invoice processing demands a strategic approach that aligns technology integration with organizational objectives. To begin, a thorough assessment of current processes is essential, identifying pain points and establishing clear goals for automation. The selection of a suitable technology, considering factors like IDP capabilities and machine learning, is pivotal.

Simultaneously, a well-structured change management plan, including training programs and stakeholder collaboration, ensures a smooth transition for employees.

Adopting a phased implementation approach, starting with a pilot project, allows for real-time adjustments and issue resolution. Prioritizing data security through encryption measures and access controls is paramount to ensure compliance.

Post-implementation, continuous monitoring of key performance indicators facilitates ongoing refinement and optimization, ensuring that the automated system evolves in tandem with organizational needs.

Compliance and Security in Automated Invoice Processing

Ensuring compliance and security in automated invoice processing is paramount. Stringent measures, including encryption protocols and access controls, safeguard sensitive financial data, aligning with regulatory standards. Regular audits and monitoring mechanisms verify adherence to compliance requirements, minimizing risks and potential legal consequences.

The integration of secure authentication methods further fortifies the system against unauthorized access. By prioritizing compliance and security measures, organizations not only safeguard sensitive information but also instill trust in stakeholders, fostering a robust foundation for automated invoice processing.

Empowering Decision-making with Automated Invoice Analytics

Empowering decision-making through automated invoice analysis revolutionaries financial insights. By leveraging advanced analytics, organizations gain a comprehensive view of spending patterns, vendor performance, and potential cost-saving opportunities. Real-time data interpretation allows for agile response to market change, while historical analysis facilitates informed financial planning. Detecting discrepancies through automated analysis enhances compliance and risk management. Ultimately, this data-driven approach equips decision-makers with actionable intelligence fostering strategic choices that drive efficiency and financial success.

Overcoming Common Challenges in Automated Invoice Processing

Overcoming challenges in automated invoice processing requires a strategic approach. Addressing issues such as data inaccuracies and exceptions may involve continuous refinement of machine learning algorithms to enhance accuracy.

Implementing a robust exception-handling mechanism and incorporating user feedback contribute to system optimization.

Furthermore, effective change management ensures seamless integration, overcoming resistance to new processes. Regular updates and staying abreast of evolving technologies also play a pivotal role in navigating challenges and ensuring the sustained success of automated invoice processing systems.

Measuring Success: KPIs and ROI in Automated Invoice Processing

Measuring the success of automated invoice processing is pivotal for organizations aiming to enhance efficiency and financial outcomes. Key performance indicators (KPI) and Return on investment (ROI) serve as crucial metrics in this evaluation.

| Key areas for evaluation | KPI | ROI |

| Accuracy of data extraction | Percentage of accurately extracted data | Reduction in errors and associated costs from manual data entry |

| Processing Time | Time taken to process an invoice from receipt to approval | Operational cost savings due to faster processing times. |

| Invoice cycle time | The average time taken for the entire invoicing cycle. | Improved cash flow and potential discounts for early payment. |

| Cost per invoice | The cost associated with processing each invoice. | Reduction in operational costs related to invoice processing. |

| Automation adoption rate | Percentage of invoices processed through automated systems. | Cost savings from decreased reliance on manual processes. |

| Error rates | Frequency and type of errors in the automated process. | Reduction in cost correction and reconciliations. |

| Vendor Satisfaction | Feedback and satisfaction scores from vendors. | Improved vendor relationships and potential for better terms. |

| Compliance and audit preparedness | Adherence to regulatory requirements and audit success rates. | Mitigation of financial risks and potential legal consequences. |

| Scalability | The ability of the system to handle increasing invoice volumes. | Accommodating business growth without proportional increases in costs. |

| Resource Utilization | Efficiency of human resources involved in the process. | Optimizing human efforts for higher-value tasks, contributing to overall productivity. |

Future Trends in Automated Invoice Processing

Anticipated Future Trends in automated invoice processing include increased adoption of artificial intelligence (AI) and machine learning for better data extraction accuracy and document understanding. Robotic Process Automation (RPA) is expected to play a larger role in streamlining end-to-end invoice workflows.

Integration of machine learning and natural language processing algorithms tailored for mobile platforms could enhance data extraction accuracy.

Mobile-based approval workflows may become more sophisticated, enabling seamless collaboration among stakeholders.

Integrating blockchain for enhanced security and using advanced analytics to gain valuable insights from invoice data. Additionally, there may be a shift towards more seamless integration with other business systems, further reducing manual intervention in the invoicing process.

Cloud-based solutions may become more prevalent, offering flexibility and scalability.

The focus will likely be on improving efficiency, accuracy, and the intelligence of automated systems in handling invoices.

Pertinent FAQs about Automated Invoice Processing

- How secure is automated invoice processing?

Automated invoice processing is secure when implemented with robust encryption, access control, and adherence to data protection standards.

- What are the cost implications of implementing automated invoice processing?

The cost implication of implementing automated invoice processing includes initial setup expenses, software licensing fees, and potential savings in operational costs over time.

- Can automated invoice processing be tailored for specific industries?

Automated invoice processing can be tailored by customizing the software to meet a particular sector’s unique needs and regulatory requirements.

- What training is required for employees to use automated systems?

The training required for employees to use an automated system varies but typically involves familiarization with the software interface, understanding workflow changes, and learning how to interpret system outputs; it can range from basic orientation to more in-depth training based on the complexity of the automated processes.

- How does automated invoice processing adapt to changing tax regulations?

Automated invoice processing can adapt to changing tax regulations through regular software updates that incorporate the latest tax rules. The system can be designed to dynamically adjust data extraction and validation processes to align with evolving tax requirements, ensuring compliance and accuracy in handling taxation aspects of invoices.

Conclusion: Embracing the Future of Finance with Automation

In conclusion, embracing the future of finance through automation signifies a transformative journey toward increased efficiency, accuracy, and strategic decision-making. As technologies like automated invoice processing, machine learning, and analytics become integral components of financial operations, organizations position themselves to thrive in an era of rapid technological advancement.

The synergy of human expertise and automated capabilities not only streamlines routine tasks but also unleashes the full potential of financial professionals to focus on strategic initiatives. As we navigate this dynamic landscape, the symbiosis of human insight and technological prowess will undoubtedly shape a future where the finance domain becomes not just automated but truly intelligent and forward-thinking.