In the dynamic business landscape, the availability and efficient working capital management plays a pivotal role in sustaining operations and fostering growth. Operating funds are the lifeblood that keeps day-to-day operations running smoothly. However, businesses often encounter fluctuations in cash flow due to various factors such as seasonality, unexpected expenses, or delayed receivables. This is where the importance of operating loans, trade financing, invoice financing/Discounting, short-term loans, etc., becomes evident.

The Pervasiveness of Invoice Financing in Today’s Market

Out of various available financing options, invoice financing is a flexible and effective option for businesses seeking financing solutions. This method involves leveraging outstanding invoices as collateral to secure immediate cash from invoice financing companies.

Instead of waiting for customers to pay their invoices according to agreed-upon payment terms. companies can access a portion of their accounts receivable upfront, enabling them to address immediate financial needs, optimize their working capital, accelerate cash flow, cover operational expenses, navigate the challenges associated with unpredictable payment cycles, or seize growth opportunities.

The Crucial Need for Tech-driven Invoice Verification in Invoice Financing

Lending money inherently involves risk exposure. Therefore, invoice verification is a cornerstone in the realm of invoice financing, playing a pivotal role in authenticating the validity of invoices submitted by businesses as collaterals seeking funding and in safeguarding the financial integrity of transactions.

The approach to invoice verification varies among financial providers. Typically, providers adhere to traditional methods, such as contacting the borrower’s customer through calls and emails, to validate the authenticity of the invoice and ascertain whether the borrower has delivered the goods or services to its customers.

However, with changing operational dynamics, increased fraudulent activities have compelled financial institutions to adopt more rigorous verification procedures. As a result, technology has emerged as a pivotal element in effectively tackling these challenges.

Tech-driven tools like IDP, ML, AI, etc., enable rapid extraction and analysis of relevant data, allowing financial institutions to assess the authenticity and reliability of invoices accurately. Additionally, technology helps detect anomalies or discrepancies, reduce the risk of fraudulent activities, and enhance the overall reliability of the invoice financing ecosystem.

A central repository may also be developed where the details of all invoices against which a loan has been taken are accounted for. This would mitigate the risk of double funding, where a borrower uses the same invoice from different finance providers to avail funds.

As the demand for seamless and secure financial transactions continues to rise, leveraging technology for invoice verification expedites the financing process and contributes to the transparency and trustworthiness of the entire invoice financing landscape.

Navigating Tech-Driven GST Invoice Verification: Process and data sets for verification

Only 1 or 2 platforms in the market facilitate the module of invoice verification. This module, after obtaining consent from the borrower to have access to their GST compliance data such as GST returns, e-invoices, e-way bills, etc., as available on government portals, analyzes and verifies such data and the invoice provided for financing and helps finance providers access the authenticity and credibility of the data and invoices to mitigate fraud and risk of before providing financial support.

We now understand invoice financing and the need for invoice verification before providing financial support. Let’s look at the documents and areas of concern that can measure the borrower’s credibility.

Overview of how e-invoice, e-way bill, GST returns, and other GST compliance verification work.

The advent of the tech era has brought about widespread benefits for all stakeholders in the business chain, ranging from government and financial providers to companies. The government introducing digitization in GST compliance, monthly and annual returns, e-invoicing, e-way bills, etc., and interoperability and digital exchange for this data have relieved finance providers to authenticate the credibility of the borrowers.

The GST authority validates the invoice generated by the taxpayer, and a unique invoice identification number (IRN) and QR code are generated; these QR codes and IRNs indicate the genuineness of the invoice. Now, based on the information in the e-invoice, an e-way bill is generated automatically for the transportation of goods. Further, this e-way bill can also be reconciled with the FASTag charges deducted at various tolls. This confirms that the e-invoice generated and transaction entered are genuine and accurate.

Further, based on e-invoice information, returns such as GSTR-1 are auto-populated, and tax is being discharged in GSTR-3B. The entries of GSTR-1 are auto-reflected in GSTR-2B of the customer, which helps to avail of ITC in GSTR-3B.

This integration and auto-exchange of information provides accuracy in the transaction. Access to this information can help identify the GST compliances of borrowers and help mitigate the repayment default risk. Therefore, the invoice verification module, which can provide this information, is paramount for the financers. Let’s look at the advantages of invoice verification to invoice financing companies across the funding stages.

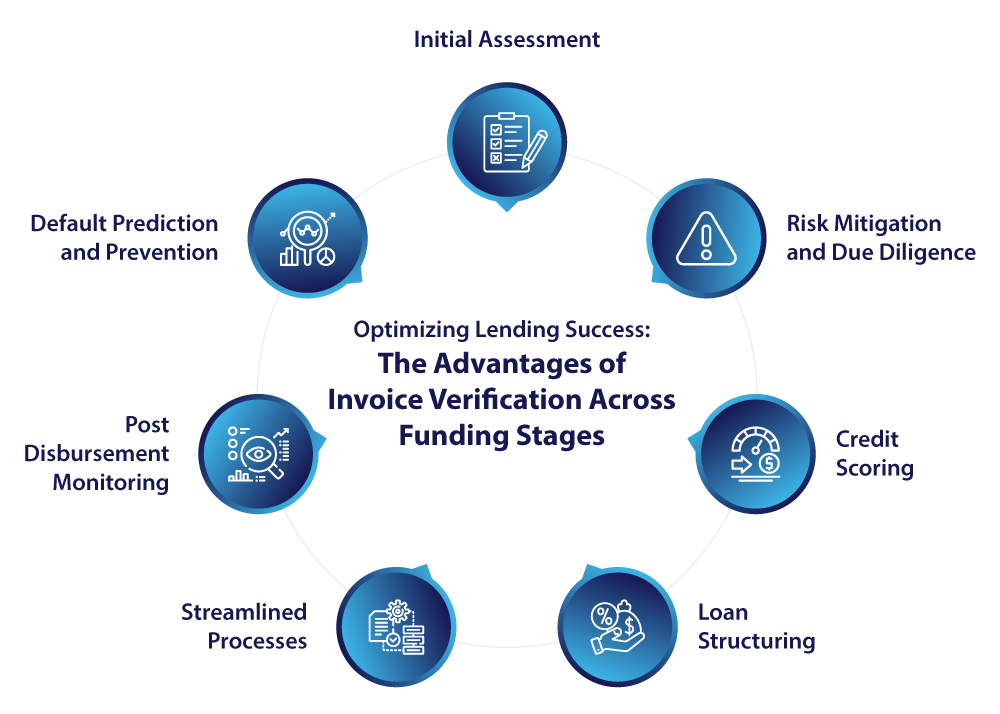

Optimizing Lending Success: The Advantages of Invoice Verification Across Funding Stages

Invoice verification presents numerous advantages for lenders, strategically benefiting them at various stages of the funding process:

Initial Assessment- Finance providers can ensure data accuracy and authenticity of invoice information using invoice verification modules. It can also verify e-way bills to ensure that the goods are provided and that the transaction incurred between the borrower and the customer is genuine.

Risk Mitigation and Due Diligence: By leveraging invoice verification, lenders conduct robust due diligence, identifying potential risks and mitigating financial uncertainties before committing to funding.

Credit Scoring: Integration of verified invoice data into credit scoring models enables lenders to make well-informed decisions during the credit approval stage, enhancing the accuracy of credit assessments. Further, various modules also provide GST scoring, where a score is given based on accurate and timely compliance with GST requirements. A higher score indicates a better financial and compliance position for the company.

Loan Structuring: Verified invoices assist invoice financing companies in structuring loans with terms, interest rates, and repayment schedules that align with the financial stability and compliance of the borrowing business.

Streamlined Processes: Automated verification streamlines the entire invoice financing process, reducing manual efforts and paperwork and leading to increased operational efficiency for both finance providers and borrowing businesses.

Post Disbursement Monitoring: With the use of tech-driven solutions, the information of invoice filled in returns such as GSTR-1 and GSTR-3B can be verified, and based on that, it can be ensured that the transaction is genuine, and the tax has been discharged on the same. This can contribute to overall verification and monitoring functions.

Default Prediction and Prevention: By incorporating verified invoice data into predictive models, finance providers can enhance their ability to predict defaults, allowing for proactive risk mitigation strategies.

By integrating invoice verification modules across the funding process, finance providers can benefit to a great extent. However, there is always a window for drawbacks and loopholes, which can be challenging at times.

Challenges in GST Invoice Verification: Potential Drawbacks and Considerations

Though tech-driven invoice verification modules have been a relief to invoice financing companies, various challenges still have to be addressed. Let’s understand them in detail.

- Currently, e-invoicing is not applicable for B2C transactions and businesses with less than five crores turnovers. Therefore, the information related to transactions incurred in this category is not auto-populated by the portal, and therefore, such transactions can be less accurate.

- Credit notes are issued against the invoices at a later stage, which at times cannot be directly correlated. As a result, the invoice presented as collateral cannot be considered reliable.

- Even though the details of the e-invoice and e-way bill are auto-populated in GST returns, the authority facilitates the modification of those figures manually, which results in a mismatch of data among the compliance areas. In such cases, it would be difficult to identify which information is accurate and correct.

- E-way bills can only be issued for the transportation of goods. In the case of services, no such bill is issued. Therefore, when an invoice related to a service is provided as collateral, it is difficult to determine whether the services are provided or the transaction is genuine.

A practical example of successfully enabling invoice verification is demonstrated in the case study of a leading snacks company. By utilizing managed services, the company effectively implemented invoice verification for ITC unblock, showcasing the tangible benefits of adopting such technology.

The list of these advantages and challenges is not exhaustive. Lenders can identify potential drawbacks during monitoring. They can revalidate the funded transactions, check whether the transaction is modified, and identify a trend where borrowers periodically modify the transactions. This may differ from case to case. If we look at the broader picture, the benefits are much more than the drawbacks, and with the advancement of technology, these drawbacks can be tackled. More focus is being put on advancing the solution, which can give accurate results and help minimize risk factors.

Conclusion

Looking ahead, the continuous evolution of technology holds promising prospects for further advancements in accuracy and precision. The integration of AI, blockchain, and predictive analytics stands on the horizon, promising even more significant strides in minimizing fraud risks, ensuring compliance, and providing lenders with unparalleled insights into the financial health of businesses. As technology advances, the synergy between innovation and financial processes is poised to redefine the landscape of invoice financing, offering a future characterized by heightened efficiency, reduced risks, and optimal decision-making for lenders and businesses