Running businesses along with meeting GST compliance requirements is like hustling in a market full of opportunities with hidden pitfalls of notices and penalties, which can impact even the savviest business.

For business heads and CFOs, notices risk finances and reputation, demanding timely and accurate action and reply to show cause notices under GST with precision. Working on these notices and the root cause of non-compliance will help businesses and CFOs in GST litigation management and prepare proactive strategies to strengthen governance and avoid pitfalls. Litigation management solution can centralize case records, track deadlines, and streamline SCN responses effectively.

Common Triggers for Show Cause Notice GST

Show cause Notices and demands are triggered due to errors or deliberate non-compliance with the GST law. Understanding these common triggers helps businesses and tax heads to address issues and gaps in non-compliance before escalation. Let’s have an overview of these common triggers, inviting a show cause notice under GST.

- Excess or ineligible ITC claim

- Mismatch in returns

- Short-payment or non-payment of GST

- Errors or expired e-way bill

- Mismatch in e-way bill and e-invoices.

- Non-compliance with GST provisions such as e-invoicing, ISD, E-way bill, registration, return filing, and other provisions.

- Incorrect classification and rates applied to the supply of goods and services.

- Non-filing or late filing of various applicable returns

- Fraud or suspension of fact or tax evasion.

- Underreporting of turnover or overreporting of expenses.

- Lack of proper documentation, manipulating ERP records, and non-maintenance of records as required by law.

- Any issues or discrepancies identified during regular government audits.

These triggers often emerge from procedural errors, lack of awareness, or inadequate record-keeping. Businesses can avoid SCNs by maintaining accurate records, reconciling returns regularly, and staying updated on GST rules.

Risks of Mishandling Show cause notice GST

Mishandling of a show-cause notice can have many serious financial and reputational damages to businesses. It can impact a company’s cash flow, operations, seizures of assets, impose fines and penalties, damage reputation, and more.

1. Penalties and fines

Failing to reply to show cause notices on time may result in penalties ranging from 10% of the tax amount or 10000 (w.e., higher) if no fraud or suppression is involved to 100% of the tax amount in case of fraud or suppression.

Additionally, 18% of interest will be payable as per section 50 of the CGST Act on the unpaid tax value per annum, starting from the due date of payment of such tax value till actual payment, which can accumulate quickly, straining finances.

2. Imprisonment

Committing certain offences, namely, supply without issue of invoice, issue of invoice without supply, fraudulently availing ITC, evading tax, falsifying or substituting accounts, or issuing fake documents, etc, may lead to fines and imprisonment not less than six months but extend to five years.

3. Loss of ITC

Mishandling show-cause notices related to ITC will result in the denial of credits, which can increase businesses’ tax liability resulting from the payment of disallowed ITC, along with interest and penalties.

4. Appeals in the Higher Court

Mishandling SCN may lead to unfavourable orders, which will require appeals to the appellate authority, tribunal, or even the High Court or the Supreme Court. The will cost expense related to legal fees, professional fees, and security deposit. Further, this can take a prolonged time, draining the business mentally and financially.

5. Compounding cost of delayed response

A show-cause notice generally provides a certain time (say 60 days as per section 74A) window to pay tax, along with interest, to avoid penalties or imposition of reduced penalties in case of fraud or suppression. Further, delayed response escalates legal and professional costs, additional interest, and fines, affecting working capital.

6. Recovery proceedings

Mishandling notices will result in confirmed tax demands, and the government can start recovery proceedings after non-payment of such demand within 3 months of service of the order by selling goods, freezing bank accounts, or deducting funds from GST credit ledgers, and the person shall be considered a defaulter in case of non-payment of such value served in notice.

7. Operational disruption

Non-reply to show-cause notice on time, missing hearings, and managing legal proceedings can consume significant time and resources, disrupting daily operations.

8. Increased GST department audits

A mishandled notice would invite frequent audits and investigations from the GST department, creating a compliance burden and diverting resources from core operations to handling audits.

9. Reputational Damage

Mishandling or non-resolution of SCN can make your business non-compliant, damaging your reputation with suppliers, customers, and financial institutions. This can lead to lost business opportunities, strained vendor relationships, or difficulty securing loans.

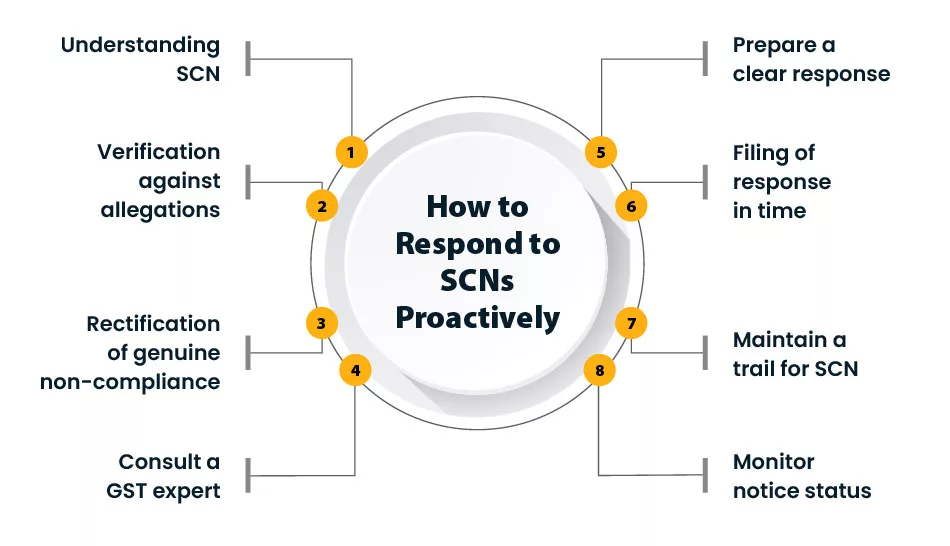

How to Respond to SCNs Proactively

Reply to the show-cause notice under GST must be proactively managed to avoid risk related to mishandling. Here are the steps that can be followed to reply to SCNs proactively:

1. Understanding SCN

Understand the SCN thoroughly, such as allegations mentioned, provisions cited, similar court judgements mentioned, value involved, interest and penalties imposed, deadlines, etc, to avoid delays or misinterpretation errors.

2. Verification against allegations

Evaluate books of accounts, returns, reconciliations, documents, etc, and verify whether the allegations mentioned are correct to ensure whether there is any actual error or discrepancy from the business side or just a clerical error or misinterpretations.

For example, availing blocked credit as per section 17 (5) is genuine non-compliance, while a mismatch in books of accounts and returns can be due to delayed posting in books.

3. Rectification of genuine non-compliance

On the identification of actual non-compliance, the business must take proper actions to rectify such non-compliance by payment of tax or reversal of ITC or whatever the case may be, and pay applicable interest. Businesses can also file DRC-03 for intimation of such payments and mention these actions in reply to the show cause notice.

4. Consult a GST expert

If needed, consult a professional GST expert handling such notices, particularly if the issues are complex, such as a large tax amount or penalties involved, fraud allegations, etc. They can help interpret legal provisions, assess the validity of the notice, and suggest the best course of action.

5. Prepare a clear response

Draft reply to show-cause notice under GST with clear mention of facts, allegations, point-wise response to such allegations, supporting documents, supporting documents for rectification done, reference to GST law, circulars, similar supporting court rulings, etc. Try to avoid vague or emotional language.

6. Filing of response in time

File a reply to the show cause notice on time and ensure you have proof of submission, such as a portal acknowledgment, a courier receipt, a stamped OC copy in terms of physical submission, etc. Further, a request for a personal hearing in case of critical or complex matters.

7. Maintain a trail for SCN

Ensure there are proper logs and records of SCN, reply provided, support annexures and documents submitted, etc, for future reference.

8. Monitor notice status

Track the status of notices on the portal or via emails after reply submission. Ensure you have received the order on time as provided in law; if not, ensure to take proper follow-ups.

Why Enterprises Need a Structured SCN Response Process

Show cause Notices are not just a procedural hurdle but a wide and potential risk for business operations and finances if not handled strategically. The reply to the show cause notice under GST has to be managed in a standard and structured way to:

- Avoid delay in reply to show-cause notices.

- Avoid mishandling of show cause notices

- Avoid financial risk in terms of compounding cost

- Avoid reputational or legal damages

- Ensure collaboration across various departments in handling notices

- Avoid recurring notices

- Optimize resource allocation

- Support GST litigation management and preparedness

Key Strategies for effective and structured GST litigation management

- Integrate a GST litigation management solution like Cygnet’s for a centralized repository, automated handling of litigations, tracking, reply, etc., ensuring efficiency and scalability.

- Define the roles of each department or employee in handling notices, from collecting documents, analyzing notices, verifying allegations, gathering similar favourable judgments, preparing replies, and submissions.

- Conduct regular audits and internal reviews to identify discrepancies before notice gets triggered.

- Engage a GST consultant or have an in-house GST expert team for legal advice and sound responses.

- Leverage end-to-end GST compliance tools to avoid reconciliation or compliance errors to avoid litigations. GST compliance software such as Cygnet Tax helps in managing returns, ITC validations, and GST reporting seamlessly.

Sum Up

In India’s intricate GST framework, show cause notices pose significant risks to businesses, from financial penalties to reputational harm. By understanding common triggers, addressing notices with a structured response process, and leveraging GST litigation management tools, enterprises can mitigate risks and ensure compliance.