Zakat, Tax and Customs Authority (ZATCA Authority) is the governing authority for the Kingdom of Saudi Arabia (KSA) tax regulation. ZATCA has introduced e-invoicing in KSA in 2 Phases. In Phase 1, there was no requirement for any integration of businesses with ZATCA, While in Phase 2, businesses had to integrate with their e-invoicing solutions with ZATCA for reporting e-invoices; therefore, the FATOORA portal was introduced by the ZATCA.

What is the FATOORA Portal?

ZATCA developed the Fatoora portal for the generation of e-invoices. Users must onboard e-invoice generation solutions (EGS Units) by generating new cryptographic stamp identifiers (CSID) or renewing existing CSIDs. Users can also revoke CSIDs and view the onboarded solutions and devices list.

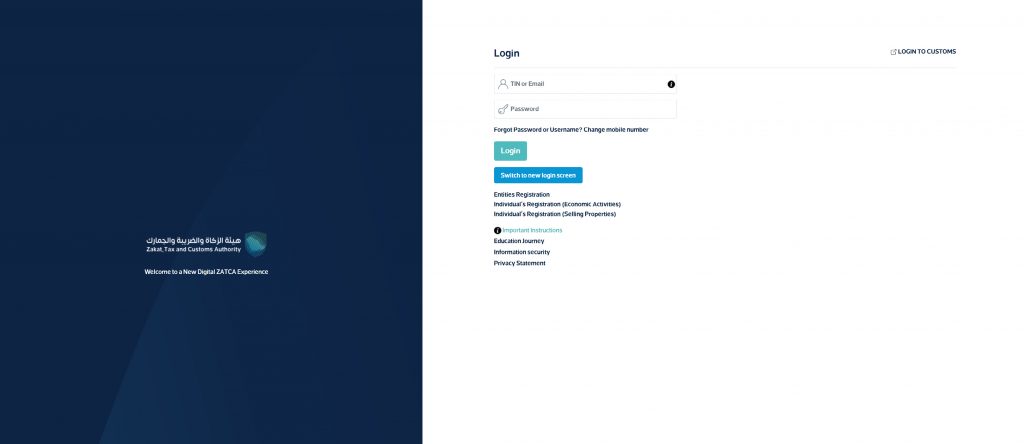

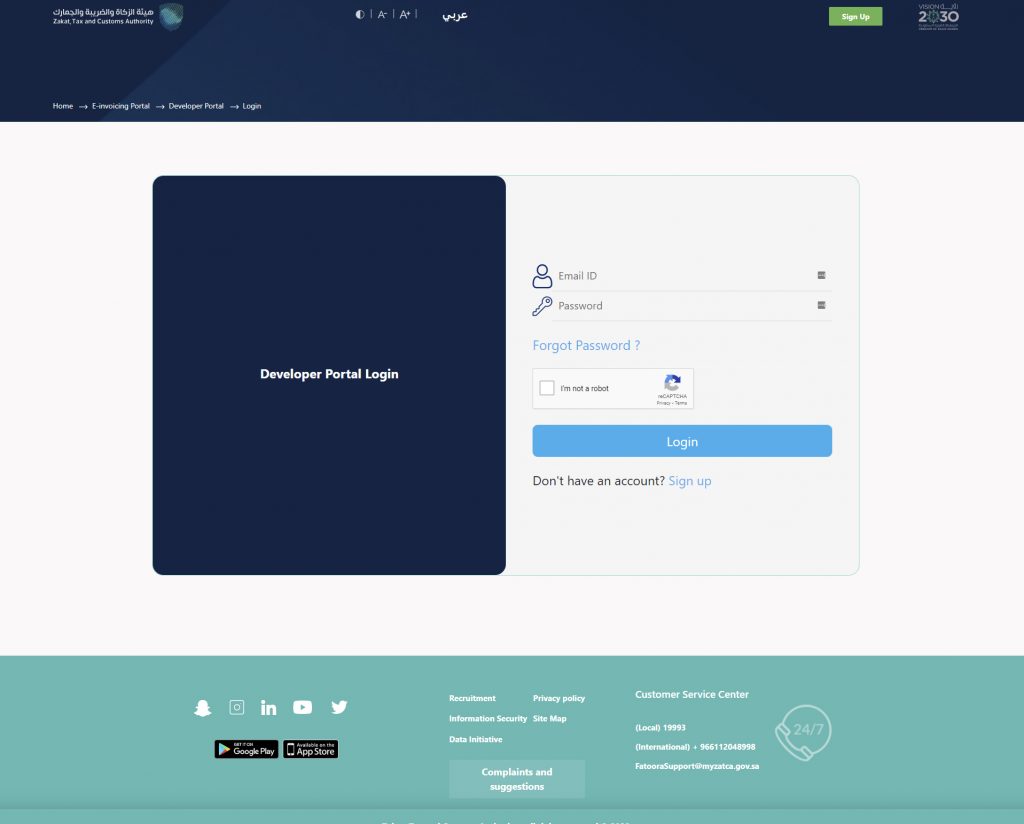

ZATCA’s FATOORA Portal access and Log In

ZATCA’s website can redirect to the Fatoora portal by clicking on Fatoora’s icon and can be accessed by visiting the link.

ERAD credentials can be used to log in to the portal, i.e.:

- TIN or email registered with ZATCA

- Password

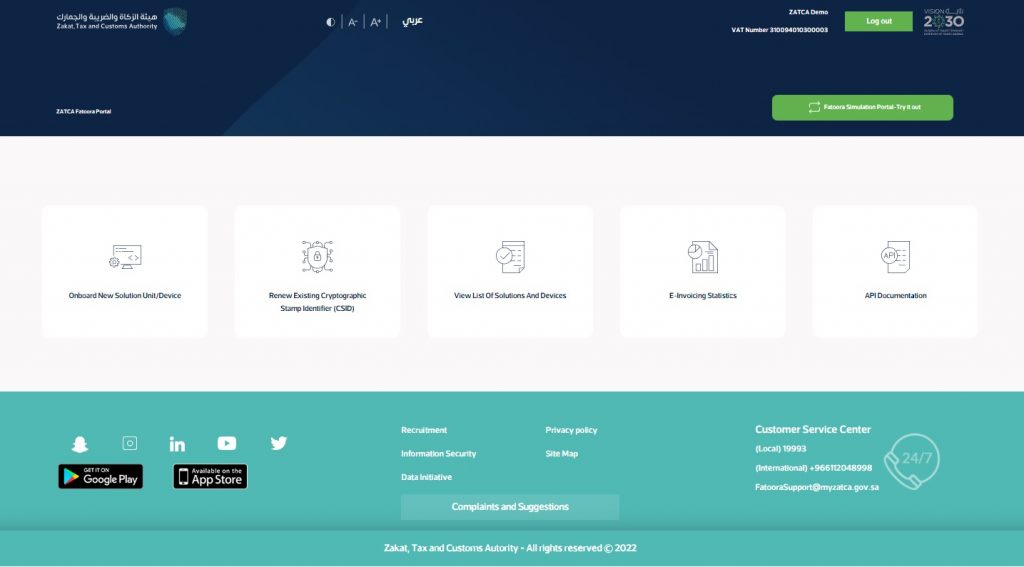

Facilities Available in the Fatoora Portal

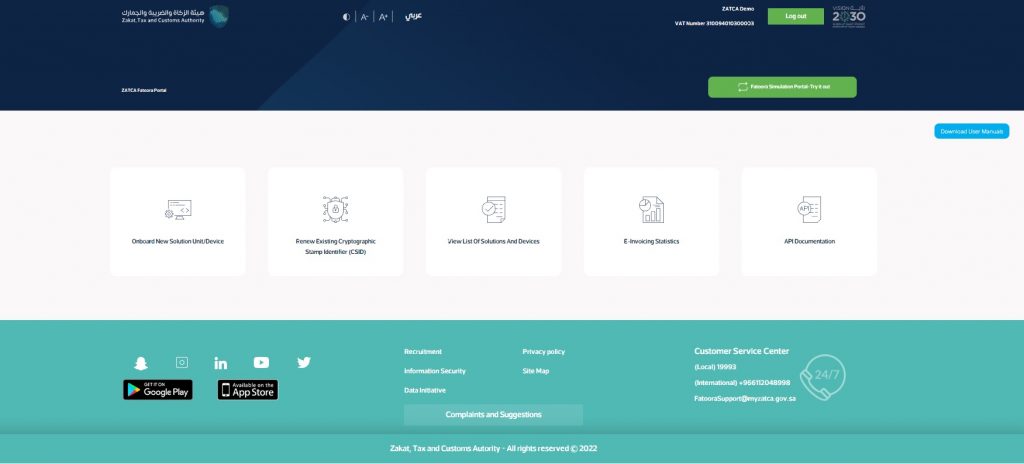

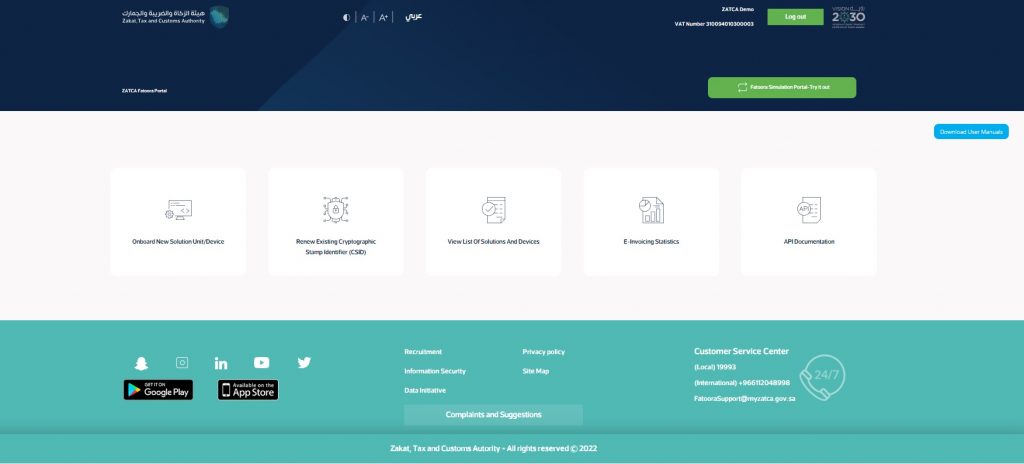

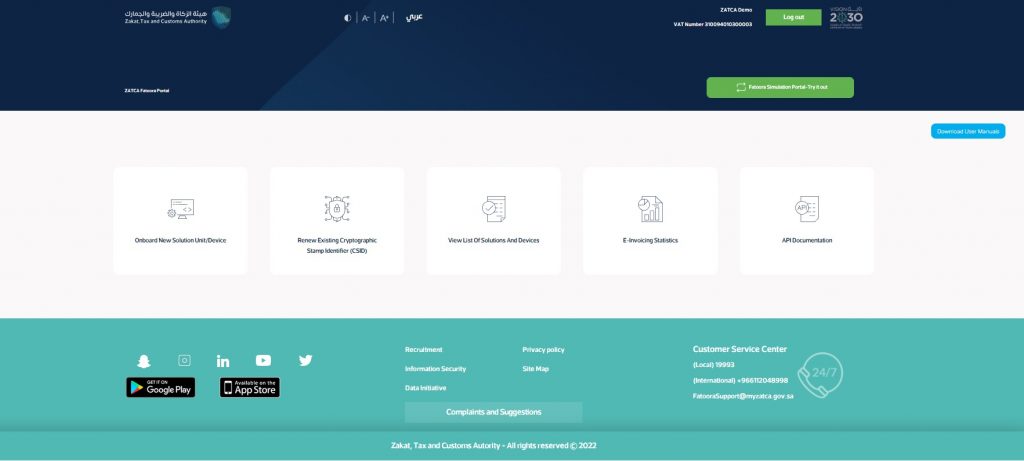

After Login, the following facilities icons are available on the Fatoora portal’s landing page.

- Onboarding new solutions unit/Device

- Renew existing cryptographic stamp identifier (CSID)

- View the list of solutions and devices.

- E-invoicing statistics.

- API Documentation.

Guide to accessing each icon of the Fatoora Portal.

- Onboard new solution unit/device

To onboard the new EGS unit by the user,

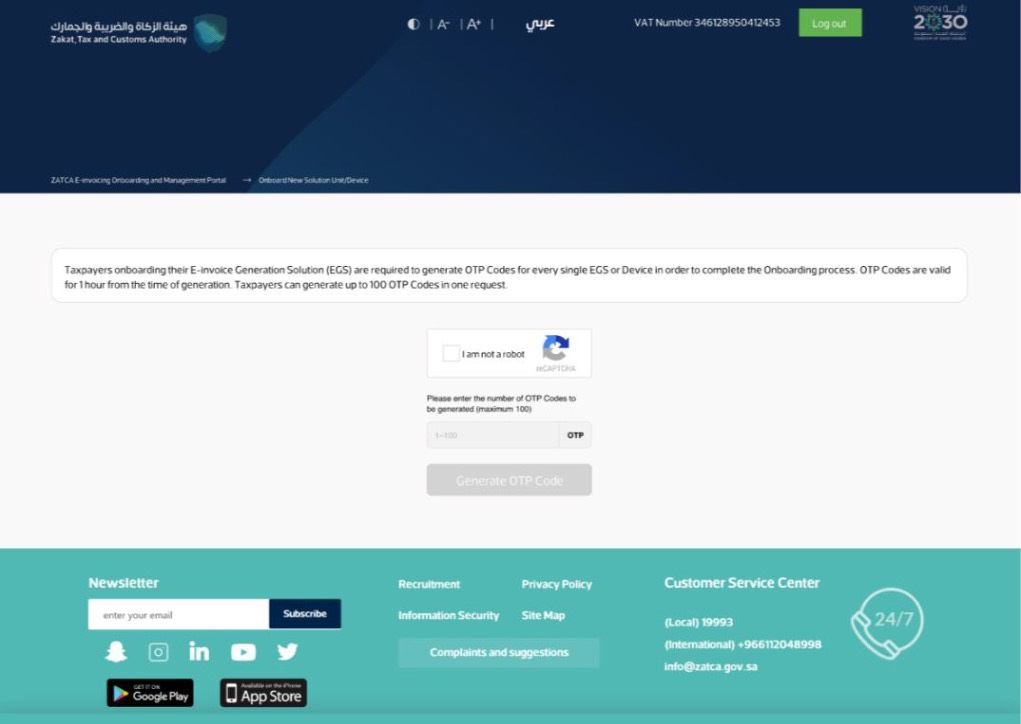

Step-1: click the “onboard new solution unit/device” icon after logging into the Fatoora portal.

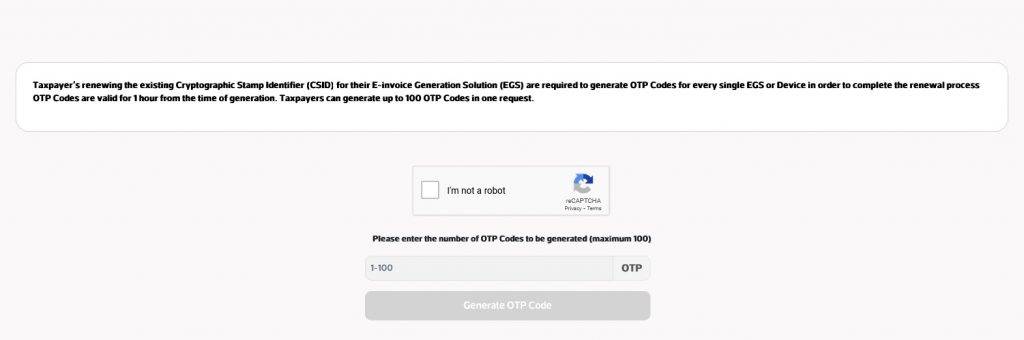

Now, the user has to generate an OTP code. For every EGS unit, there will be a separate OTP code.

Step 2: Enter the number of OTP codes required to be generated based on the number of EGS units to be onboarded.

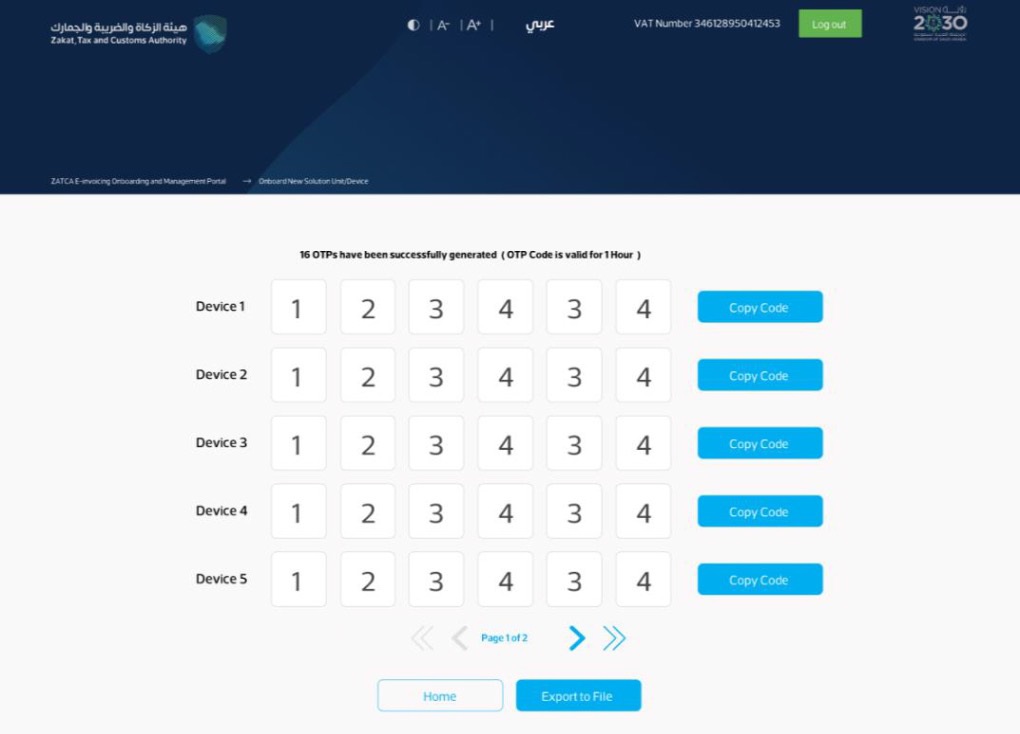

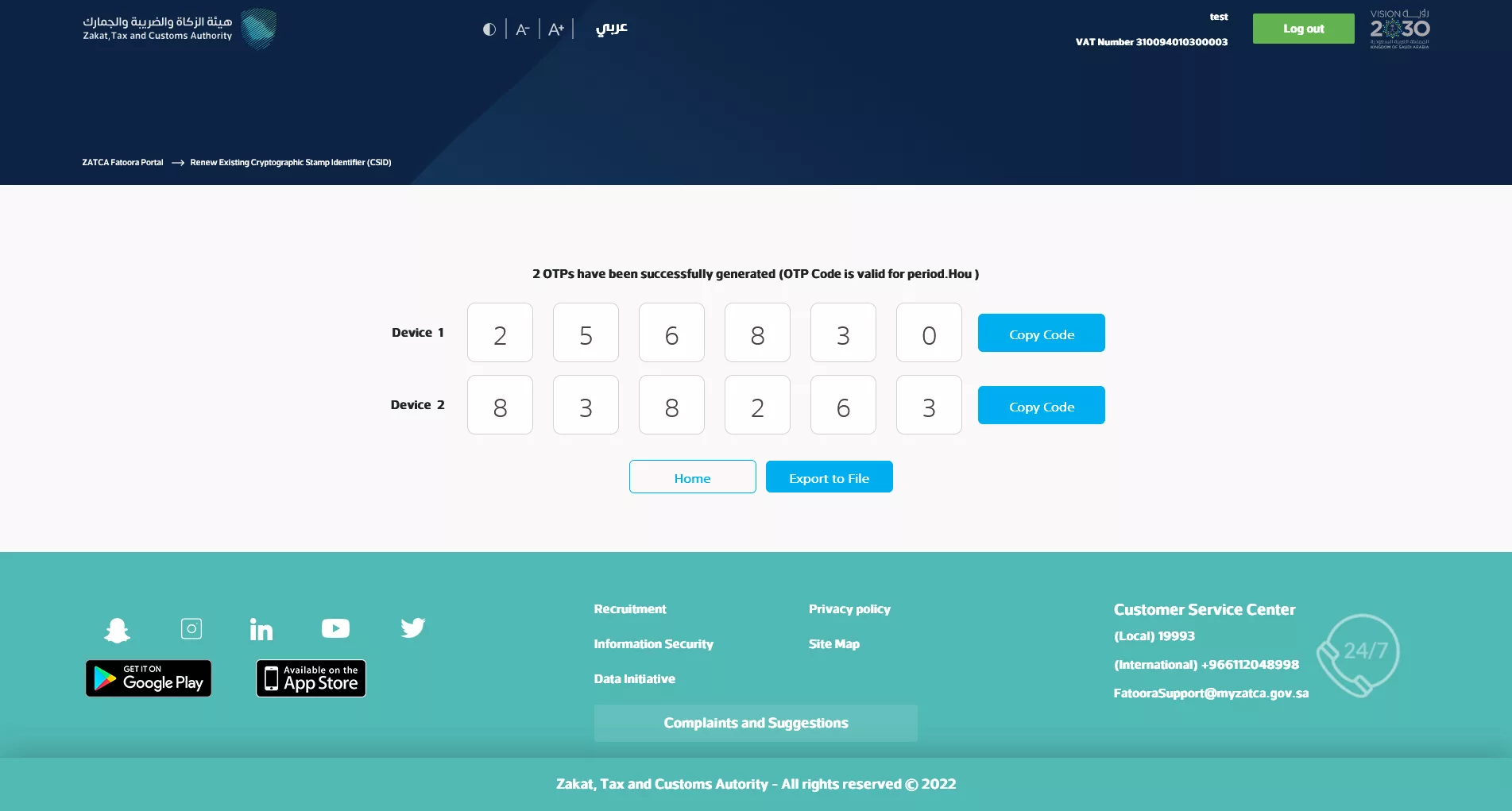

The Fatoora portal will generate the required OTP codes, which will be displayed on the portal. These OTP codes are valid till 1 hour after their generation.

Step 3: Copy the OTP code or download it in the file.

Step 4: Enter the OTP code in your EGS unit to be onboarded within 1 hour of its generation. The EGS unit will be onboarded on the Fatoora portal upon entering the valid OTP.

2. Renew existing cryptographic stamp identifier (CSID)

To renew existing cryptographic stamp identifiers,

Step 1: click the “renew existing cryptographic stamp identifiers (CSID)” icon after logging in to the Fatoora portal.

Now, the user has to generate an OTP code. There will be a separate OTP code for every EGS unit that requires renewed CSIDs.

Step 2: Enter the number of OTP codes required to be generated based on the number of EGS units that require renewed CSIDs.

The Fatoora portal will generate the required OTP codes, which will be displayed on the portal. These OTP codes are valid till 1 hour after their generation.

Step 3: Copy the OTP code or download it in the file.

Step 4: Enter the OTP code in your own EGS unit that requires renewed CSIDs within 1 hour of its generation.

Upon entering the valid OTP, the CSIDs of the EGS unit will be renewed on the Fatoora portal.

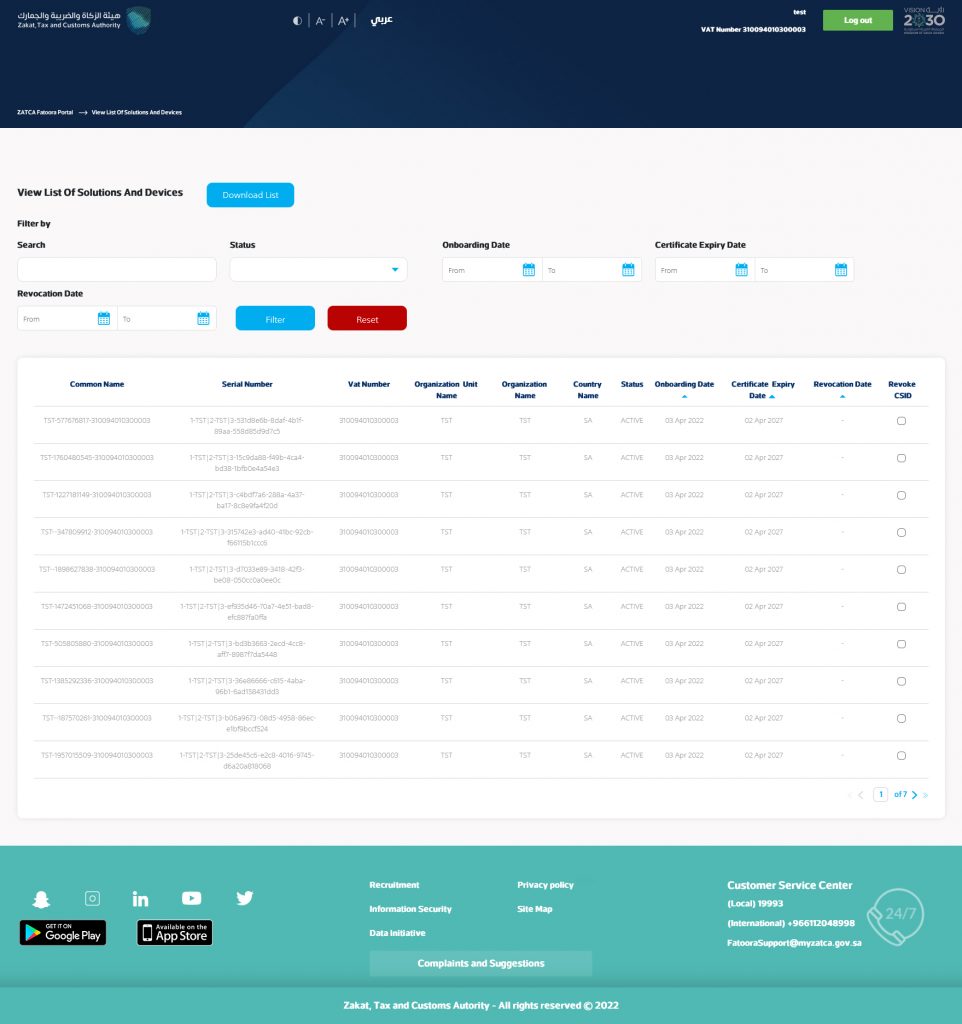

3. View the list of solutions and devices.

To view the list of solutions and devices,

Step 1: Click the “view the list of solutions and devices” icon after logging into the Fatoora portal.

Now, the taxpayer can view the list with a summary of all EGS Units that have been onboarded. In addition, taxpayers can filter, sort, and search based on specific inputs available in the list of solutions and devices.

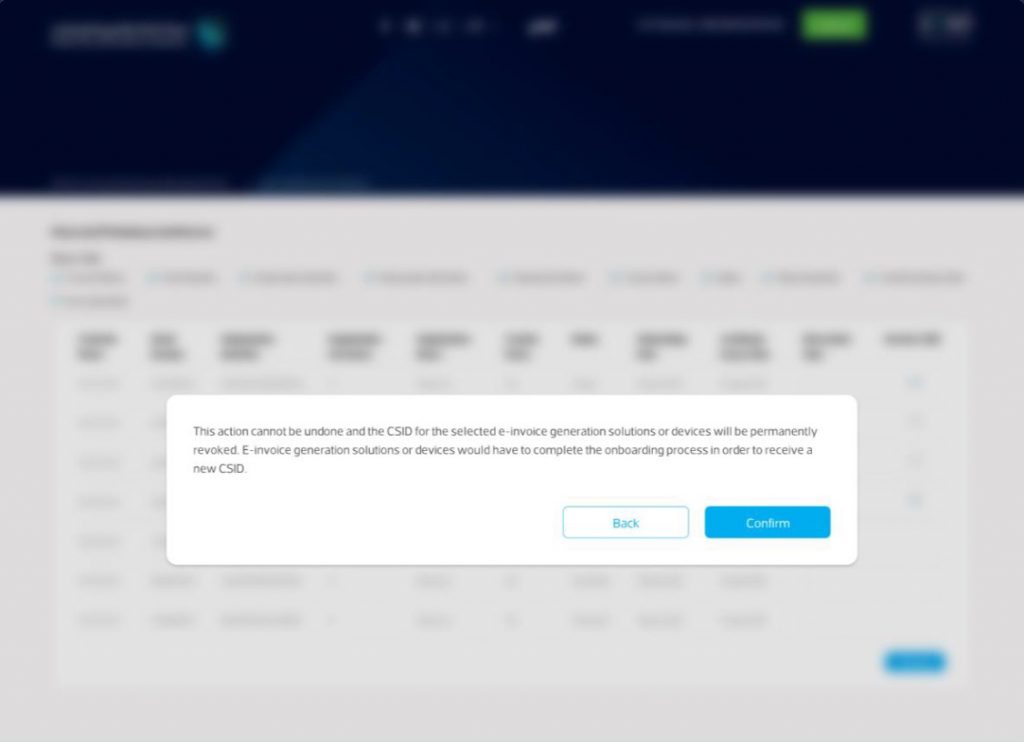

Revocation of device: Taxpayers can also revoke any listed devices by clicking ” revoke ” on the device name.”

The user will get prompted for confirmation before the actual revocation of the device.

Once the user confirms, the CSIDs are revoked, and the EGS will get inactive.

Note: To activate the EGS or CSID again, the same process followed for 1st time activation will be followed for reactivation.

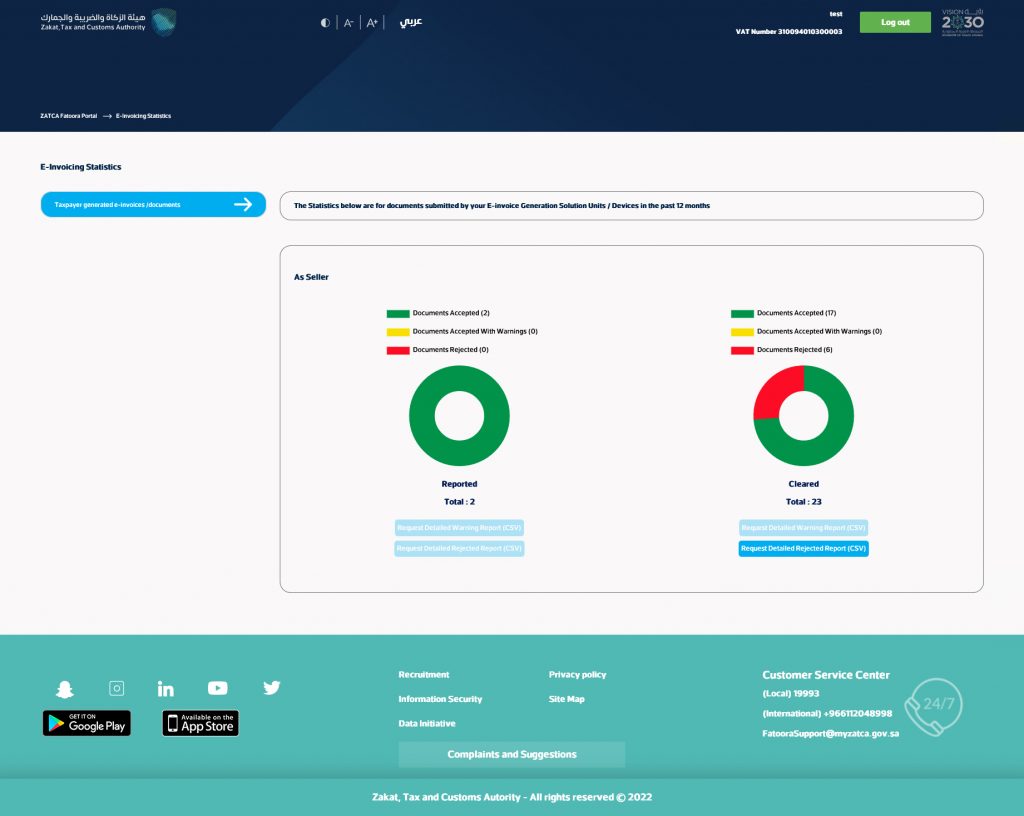

4. E-invoicing statistics

To view the E-invoicing statistics,

Step 1: Click the “E-invoicing statistics” icon after logging into the Fatoora portal.

Taxpayers can view summarized statistics of documents submitted for reporting and clearance for the past 12 months. They can also be divided into “Accepted documents,” “Accepted documents with warnings,” and “Rejected documents.” A taxpayer can request detailed CSV files of the error and warnings for the documents accepted with warnings or rejected.

5. API Documentation.

To view the API Documentation

Step 1: Click the “API Documentation” icon after logging into the Fatoora portal.

The taxpayer will be redirected to the Developer portal.

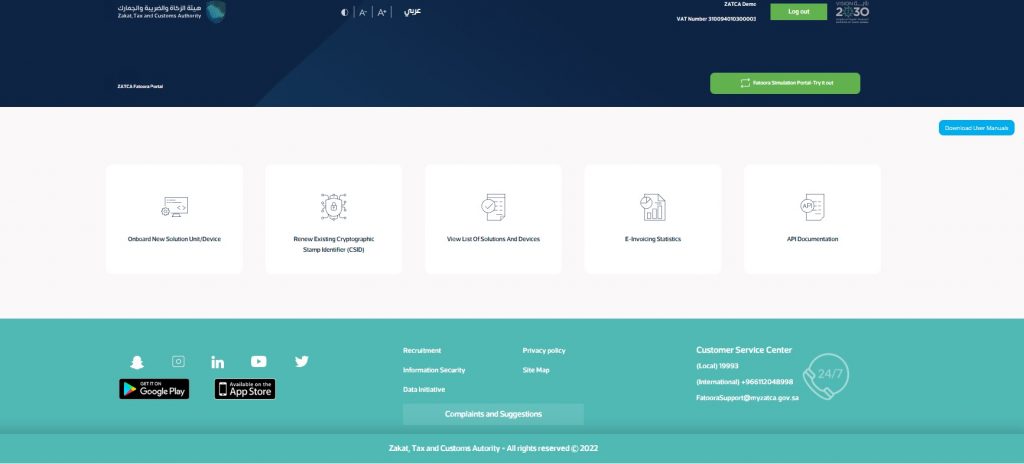

Fatoora Simulation Portal

The Fatoora Simulation Portal is a replica of the Fatoora portal that provides an environment to test and experience the portal before actually working on the main portal. All the processes and steps are the same as the Fatoora portal’s. Taxpayers can access this portal by clicking on the “Fatoora Simulation Portal” icon on the right side of the Fatoora portal. It is used only for testing purposes with dummy or past data. The response of this portal cannot be considered an official response for clearance of the Invoice. All the invoices have to be cleared only on the Fatoora portal.

Conclusion

As the Kingdom of Saudi Arabia continues to embrace digital transformation, the fatoora portal emerges as a cornerstone, propelling the nation towards a more technologically advanced and digitally integrated future in the field of taxation. The Fatoora portal is one such initiative vital for the reporting and clearance of e-invoices in phase 2 of e-invoicing implementation in KSA. Therefore, it is crucial to have a detailed understanding of this portal.