Is the invoicing process a daily headache for your business?

Does your employee spend significant time juggling between error corrections, chasing approvals, and endless to and forth with trading partners?

Does this tiring process even slow down your payment release?

To address these e-invoicing challenges and to streamline tax administration and ensure transparency on transactions, the PEPPOL Corner Model UAE has been rolled out by the UAE authority.

PEPPOL-corner Model UAE is not just another mandatory compliance process but a way of standardizing how e-invoices are generated, formatted, exchanged, reported, and stored.

In this blog, we shall understand the UAE e-invoicing framework, the PEPPOL-Corner model UAE, and what the DCTCE-model UAE is about.

What is the Peppol Framework?

The PEPPOL framework, also known as Pan-European Public Procurement Online, was originally developed in Europe to streamline its e-invoicing process. PEPPOL is a global standard framework for secure and standardized electronic exchange of documents such as invoices over a secured PEPPOL network, which operates through PEPPOL Access Points.

Slowly, the PEPPOL framework got traction across the globe, where countries started adopting it and customizing its features and specifications to align with local tax and regulatory requirements.

Explaining the Peppol-Corner Model UAE

- PEPPOL-Corner Model UAE is built on PEPPOL-PINT AE standards based on the UAE’s tax requirements.

- UAE e-invoicing framework will use the AE Data directory, which defines the mandatory and optional fields in UAE e-invoicing to ensure consistency.

- The e-invoice will be issued in PEPPOL standard using XML-based UBL format and will be sent via the PEPPOL network in the UAE. Companies preparing for this model should consider a Peppol-compliant e-invoicing platform that integrates seamlessly with the FTA requirements

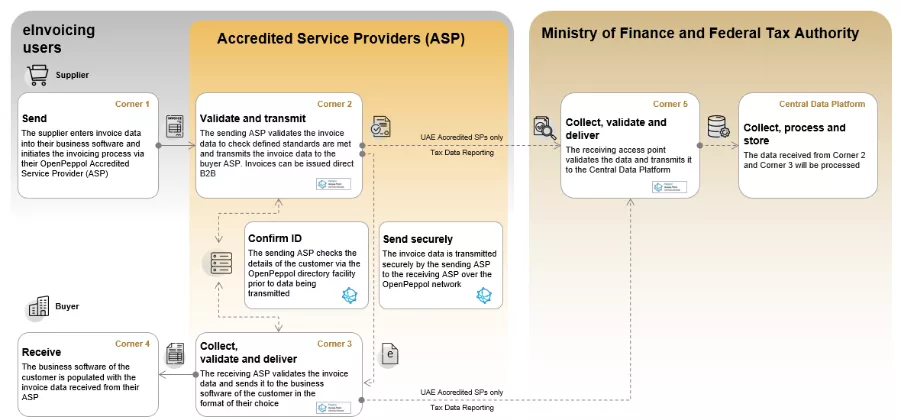

- The FTA announced that the e-invoicing compliance will work on Decentralized Continuous Transaction Control and Exchange, i.e., DCTCE Model UAE, consisting of a 5-corner model.

- The 5 Corner Model will include:

- C1- Supplier

- C2- Supplier’s Access Point

- C3- Recipient

- C4- Recipient’s Access Point

- C5- UAE Authority

- Businesses must work with accredited Peppol service providers to connect to the network, ensuring seamless integration with the FTA for tax compliance.

- This setup ensures invoices are secure, compliant, and interoperable across systems, reducing errors and speeding up processes.

UAE Adaptation and Workflow

UAE planned to announce the UAE e-invoicing legislation by the end of quarter 2 of 2025 and go live with Phase-1 e-invoice reporting by July 2026. While the law is yet to be announced, we shall understand the workflow of the UAE e-invoicing framework for better implementation and compliance.

E-invoicing workflow

As mentioned above, it will be a 5-step model consisting of various steps:

Step 1: C1 will issue an e-invoice in the format agreed upon and submit it to C2.

Step 2: C2 will verify the invoice and convert it into the UAE standard XML format (if not received in this format)

Step 3: C2 will submit the e-invoice to C3

Step 4: Simultaneously, C2 will submit the TDD (Tax Data document) to C5

Step-5: Upon e-invoice validation, C3 will send a successful MLS (Message level status) to C2

Step 6: C3 will submit the e-invoice to C4 in the format agreed upon.

Step 7: Upon successful e-invoice validation. C3 will also send TDD to C5.

If the validation is unsuccessful, C3 will send a negative MLS to C2 as well as to C5, and there will be no reporting of TDD to C5 by C3.

Step 8: Once the TDD is successfully reported, C5 will send MLS to C2 and C3 individually.

Step 9: C2 will forward the exchange MLS of C3 and the TDD reporting MLS of C5 to C1.

C3 forwards the TDD reporting MLS of C5 to C4.

Compliance Requirements for UAE-e-invoicing

As stated, the UAE authority has not yet announced e-invoicing legislation. However, the e-invoicing process, workflow, and data requirements have already been announced. Here is a list of requirements or processes that businesses should start exploring and adopting:

- Businesses should understand the key e-invoicing process and data requirements.

- Businesses should verify their existing EPR and invoicing system and list down pain points and restructuring required.

- Based on business and UAE compliance requirements business should start exploring Accredited service providers

- Evaluate various features and services provided by ASP. A few of the vital requirements are:

- Ensure invoices are issued in a structured and machine-readable format as per the PEPPOL standard.

- Ensure the ASP is capable of providing real-time validation and reporting facilities.

- Ensure ASP is capable of handling MLS errors, negative MLS, failed validation, etc, in real-time to avoid non-compliance

- Ensure all mandatory fields are properly validated before further submission

- The ASP must be capable of handling domestic as well as international transactions based on specific compliance requirements

- While these requirements are aligned with UAE compliance requirements, additional features must be evaluated before choosing an ideal ASP, such as

- seamless ERP integration

- connectivity

- security measures

- 24*7 support

- Cloud options

- archival and retrieval requirements

- Audit logs for each activity, etc.

- Upon selection of ASP, start the pilot phase of e-invoicing solution integration and testing with e-invoice creation, verification, transmission, and submission.

- Ensure e-invoicing compliance is in alignment with VAT law, such as suppliers’ TRN, VAT rates, VAT amount, etc, are as per FTA guidelines.

- Businesses must be fully compliant by July 1, 2026, including system upgrades, Access Point onboarding, and staff training.

- Regular testing with Access Points is recommended to ensure compliance before the mandate deadline.

Strategic Benefits of PEPPOL-Corner Model UAE

The benefits of the PEPPOL-Corner Model UAE are significant for the UAE authorities as well as business organizations. Here are the benefits as follows:

For Businesses

Standardization

The PEPPOL framework brings standardization where invoices are issued in a standard format, language, and required fields, unlike earlier, when businesses had to deal with different formats and missing fields.

Enhanced transparency and compliance

The e-invoicing process includes validation, where the invoice is validated before submission, ensuring compliance and accuracy, resulting in reduced demands and disputes.

Faster payment Release

E-invoices are validated, transmitted, and reported in real-time, reducing errors and accelerating the process, thereby shortening payment cycles, achieving quicker settlements, and ensuring efficient cash flow.

Cost savings

Automation and pre-validations ensure cost savings related to error corrections, labour costs, paper, postage, storage handling, and reduced fines and penalties.

Future-proofing businesses

As PEPPOL is accepted worldwide, businesses already operating in the PEPPOL model will find it easy to do cross-border transactions and business expansion in the future.

For the UAE Authorities

Improved Tax revenue

With real-time reporting, UAE authorities can have a clear view of business transactions, helping them identify gaps and reduce tax evasion.

Ease in compliance monitoring

Standard workflow, e-invoicing format, and validations help authorities to track compliance level and identify errors or fraud.

Automated scrutiny and audits

With automation and data analytics, the authorities can conduct audits and investigations in real time without human intervention or physical audits, ensuring faster and accurate audits, cutting down the lengthy audit process, and early detection of non-compliance.

Data-driven policy making

With clean, structured, and real-time data, authorities get clear visibility on economic trends, sector performance, and market situation, helping them to form better policies and reforms.

Boosting global investments

With PEPPOL standards, UAE businesses and tax administration enhance transparency and build a trustworthy environment, positioning the UAE as a well-regulated business hub and attracting global trade, foreign investment, and multinational companies.

Conclusion & CTA

The UAE’s adoption of the Peppol 5-Corner Model for e-invoicing, effective July 2026, streamlines tax compliance, reduces errors, and enhances business efficiency through standardized, secure, and real-time invoice exchange. By aligning with the PINT-AE standard and integrating with the FTA, businesses can save costs, speed up payments, and prepare for global trade. To ensure compliance, businesses must act now to integrate with certified Peppol Access Points and upgrade systems.

Start preparing today, connect with us to evaluate your e-invoicing needs, test solutions, and ensure seamless compliance by July 2026.

Begin your journey!