Cygnet.One is Now a Peppol-Certified Service Provider in the UAE

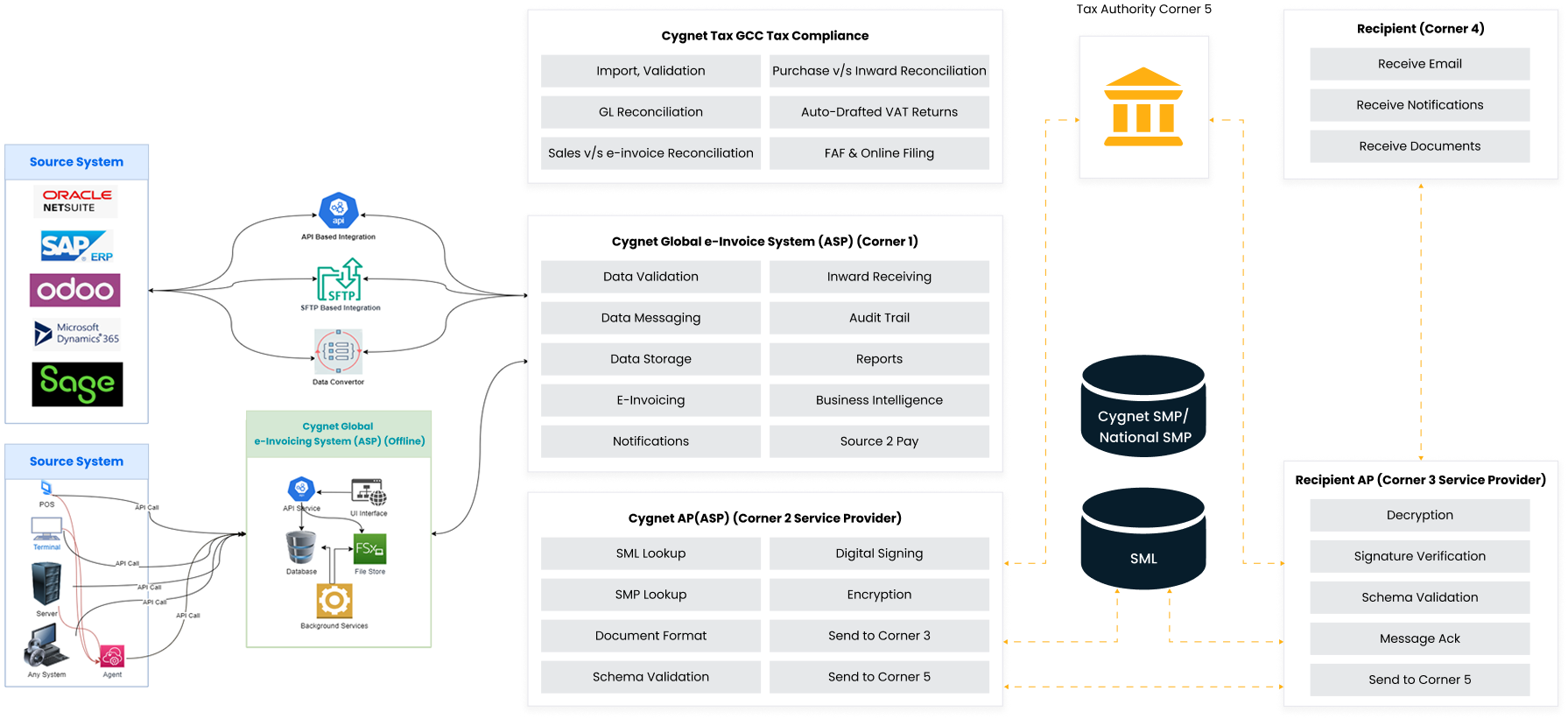

Cygnet Digital IT Solutions LLC, our UAE entity, is now officially recognized by OpenPeppol as a Peppol Certified Service Provider, for both Access Point (AP) and Service Metadata Publisher (SMP) roles.

With this certification, Cygnet.One joins an elite group of just five UAE-based companies authorized to facilitate secure, real-time e-invoice exchange across the Peppol network. Our platform is engineered to handle large volumes of transactional data with enterprise-grade security, ensuring full alignment with the UAE’s 5-corner e-invoicing model.

The Compliance and Scalability Edge with Cygnet.One

Regulatory Compliance Assurance

By leveraging Cygnet’s certified AP/SMP, enterprises can be confident that their e-Invoices are transmitted and validated in line with UAE PINT specifications and the FTA’s compliance requirements.

Future-Proof Integration

This certification ensures readiness not only for the UAE mandate, but also for other Peppol-based frameworks globally, making it easier for multi-country enterprise groups to scale with consistency.

Our Accreditations

With tax authorities across the globe

e-Invoicing Milestones & Implementation Timeline

Q4 2024

Development Service Providers’ certification requirements and procedures.

April 2025

Introduction of PINT AE & Testbeds.

December 2025

Pilot Phase begins for UAE e-Invoicing implementation.

On the Horizon

Potential inclusion of Business-to-Consumer (B2C) transactions.

March 2025

Lunching of Dedicated portal for accreditation of Service Providers for UAE e-Invoicing.

Q2 2025

Introduction of e-Invoicing legislation.

July 2026

phase 1 – go live reporting for B2B & B2G e-Invoicing

How Cygnet.One Simplifies MLS Handling

End-to-End MLS Flow Management

Cygnet’s platform is engineered to support bi-directional MLS exchange across all corners of the Peppol model. Whether it’s an acceptance, rejection, or delay, our platform captures, interprets, and stores each MLS event with full traceability and timestamp logs.

ERP Workflow Integration

MLS isn’t just a status, it’s a trigger. Our solution

integrates MLS outcomes directly into your ERP or AP systems, allowing you to:

- Automatically post approved invoices

- Put rejections on hold

- Trigger vendor revalidation flows

- Update GRN/3-way matching processes in real time

No manual downloads or offline file checks, every MLS response is synced into the ERP as part of your digital compliance lifecycle.

Real-Time Alerts & Dashboards

Stay informed with proactive alerting on:

- Missing or delayed MLS responses

- Rejected invoices and failure reasons /li>

- Invoices stuck between AP and FTA

Cygnet’s dashboard gives your tax, finance, and IT teams a single pane of glass to monitor MLS flows, track exceptions, and take corrective actions instantly. Our UAE e-Invoicing software gives you the visibility needed to prevent bottlenecks and accelerate processing.

Secure Archival & Audit Trail

Every MLS message is archived alongside the invoice and FTA acknowledgment, helping you maintain end-to-end audit readiness. These records are searchable, timestamped, and accessible via role-based controls for internal or third-party audits.

Redundancy & Auto-Retry Logic

In cases of temporary outages or transmission failures between corners (e.g., C2 to C3 or FTA), Cygnet’s platform initiates automated retries and fallback queues to reduce the risk of missed MLS and ensure complete delivery.

Support for Complex Scenarios

From multi-entity configurations to cases involving non-Peppol buyers, Cygnet’s MLS engine is designed to handle:

- Split routing logic based on business unit

- Conditional posting triggers

- Buyer-specific response handling

- Deferred validation via testbed environments during pilot rollout

Cygnet.One’s UAE e-Invoicing solution incorporates MLS workflows by design, making it one of the most reliable UAE e-Invoicing software choices for automation-first enterprises.

Challenges & How We Solve Them

Common e-Invoicing Challenges

- Invoice data availability

- Lack of single source of truth

- Data validations

- Data hosting options

- Sync with local authorities

- Different providers for ASP, AP, SMPs

- Dependence on MLS acknowledgments

Cygnet.One’s Solution

- Automated tax compliance Eliminates manual errors & ensures regulatory adherence

- End-to-end integration Seamless connectivity with existing ERP, legacy & accounting systems

- Real-time tracking & reporting Ensures accuracy & transparency

- Robust data security & privacy Encrypted storage & secured data handling

- Archiving & audit compliance Minimum 5 years of legally compliant data retention