GST is one of the historical tax reforms in India. However, tax reforms are not solely about implementation; they represent a continuous process to achieve more compliance, transparency, and tax buoyancy.

Since its introduction, the GST law has progressed further with the adoption of AI-driven GST reconciliation, automated processes, and other advanced technologies.

The invoice management system (‘IMS’) has been introduced by the GSTN as of now as an optional functionality from October 2024 to provide real-time invoice statuses, streamlined GST reconciliation, and most importantly, proper visibility on the Input Tax Credit (‘ITC’) being taken to the department as well as the vendor. It also aims to facilitate the synchronization of business data with the GST portal on a real-time or near-real-time basis.

The IMS requires the recipient of supplies to take one of the following actions on the invoices reported by their suppliers: 1. Accept, 2. Reject, 3. Pending. If the recipient takes no action, the system marks the invoice as “deemed accepted,” which will have the same effect as marking the invoice as accepted. The GSTR 2B, after the introduction of IMS, will be generated based on the actions taken in the IMS.

The manufacturing sector in India is growing leaps and bounds with various government initiatives, including Make in India, PLI schemes, state-level incentives /subsidies, etc. Large companies engaged in manufacturing have complex supply chains and a sizeable volume of transactions which inter alia lead to challenges such digitizing the workflow, managing the single source of truth for the data being reporting with the government, balancing between performing accurate GST reconciliations and maximizing the ITC and at the same time ensuring that the compliance is done within the deadlines for multiple locations facing pressure to meet compliance deadlines.

While it brings challenges, the IMS in manufacturing can also pave the way for the much-needed digitization and automation in the GST reconciliation process for the manufacturing sector, leading to significant control over the reconciliation of invoice-level data and ensuring accuracy in ITC availed. This IMS can be a leap of faith in achieving the much-needed digitization and automation for the manufacturing sector.

The manufacturing sector can be further segregated into FMCG, Textile, Automotive, ancillary, industrial, and heavy machinery. This article, however, explores the IMS in manufacturing, the challenges and opportunities it brings, the best practices for integrating IMS, and some practical scenarios for the manufacturing sector overall.

Broad challenges faced by the manufacturing sector

The manufacturing sector has a rather complex supply chain, and factors such as multiple manufacturing/distribution locations, dealing with numerous vendors and customers across different locations, inter-branch transactions, and job work transactions complicate the entire process of GST compliance, especially the ITC reconciliation.

Failing to address the challenges may lead to two potential consequences: 1. incorrect availment of ITC, resulting in interest and penalty, or 2. Less availment of ITC results in working capital loss or increases overall cost, impacting the margins.

High Volume of Transactions

The players within the manufacturing sector generally deal with a huge volume of transactions pertaining to purchasing raw materials, components, services, job work, capital goods, etc.

Reconciliation of all purchase transactions with IMS / GSTR 2B data on a real-time basis for multiple locations across India from vendors who supply to multiple locations is something that, if performed manually, would not only be time-consuming but also be prone to errors. Therefore, these activities must be performed with the aid of advanced technology.

Conditions for availment of Input Tax Credit Mismatch – more onus on the recipients

Performing reconciliation of ITC in the books with the IMS / GSTR 2B is one step towards availing ITC in compliance with the GST law and regulations, but it is not the only step.

The recipients are also supposed to fulfil, inter alia, additional responsibilities to check if the vendors have discharged the due tax, generated e-Invoices where required, and are not cancelled from a historical date. Noncompliance with any of the requirements at the vendor’s end may lead to denial of ITC, even if reconciled.

Complex Supply Chain

The movement of goods across different registrations (distinct persons) of the taxpayer, such as inter-plant transfers, stock transfers to distribution locations, job work transactions, etc. pose challenges concerning the discharging of tax at a correct valuation, recording transactions about payment of tax, and availment of ITC in the books which are required to be handled appropriately.

Communications of Amendments and Corrections

Amendments or corrections in the original invoices by the vendor or issuance of credit notes, if not communicated well between the parties, can lead to a mismatch in the ITC availed and ITC passed on by the vendor. A proper communication channel to avoid such mismatches and miscommunication is vital for effective business workflow and compliance.

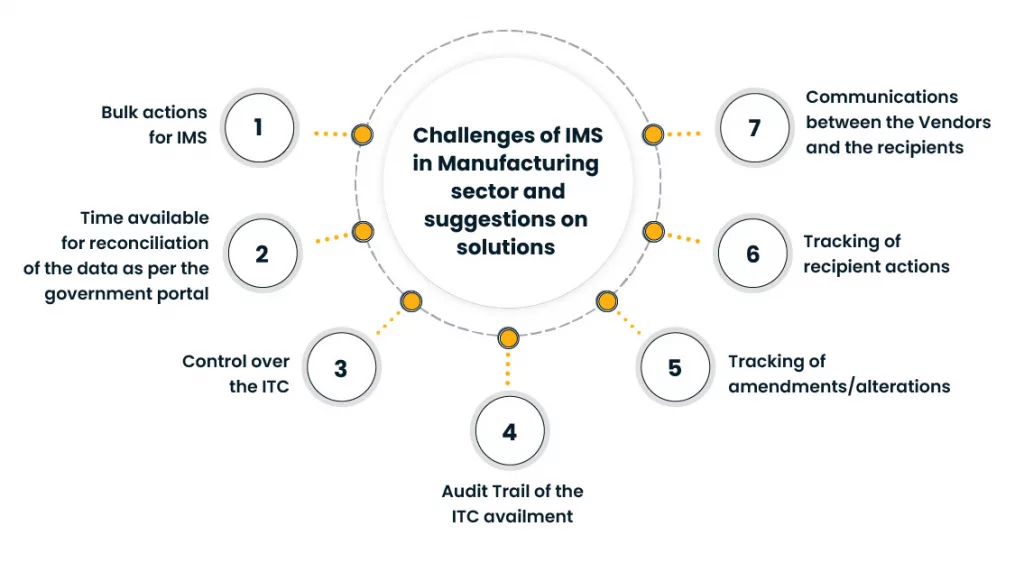

Challenges of IMS in Manufacturing sector and suggestions on solutions

1. Bulk actions for IMS

As stated earlier, the IMS requires recipients to act on the invoices raised by their vendors. Such actions are primarily based on the GST reconciliations between the books and the details on the IMS portal. Such actions are essential to ensure that the GSTR 2B contains accurate credit.

Considering the manufacturing sector’s volumes, taking action, unless done in bulk by using technology, poses a challenge.

Solution: Given the peculiar challenges of the Manufacturing Section, technology solutions that can facilitate taking actions of accepting, rejecting, or keeping pending invoices in bulk are something that can save a considerable amount of time for the industry.

Further, a technology solution that can automate the IMS actions based on various reconciliation criteria, e.g., accept transactions that are matching, mark as pending where there is a mismatch of amounts above a certain tolerance, or if the invoice is not available in PR, can convert the IMS action into a more robust mechanism of availing ITC.

2. Time available for reconciliation of the data as per the government portal

Normally, the GST reconciliation exercise is carried out on or after the 14th of the subsequent month, i.e., after the GSTR 2B is generated. This practice effectively gives the industry 4-5 working days to reconcile and finalise the GSTR 3B for the month.

In case of IMS, as soon as an e-Invoice is generated (the invoice data saved and filed in GSTR-1/IFF – in case of vendors not covered under e-Invoicing), it will flow to the IMS. This might result in chaos if a proper mode of reconciling the pre- and post-IMS is adopted.

Solution: Since the data is available near real time basis on the IMS and the fact that the GSTR 2B shall be generated based on actions taken on the IMS, this presents an opportunity to validate the invoices and reconcile the same as soon as such invoices are booked in the books of accounts without waiting for the GSTR 2B generation.

There is also an opportunity to notify vendors about mismatches/errors on a real-time basis (possibly even before they file their GSTR 1) to ensure that the necessary rectifications/adjustments/amendments are carried out well in time. The right solutions can automate the entire process of reconciling and communicating with vendors.

3. Control over the ITC

In terms of disclosure of ITC availment, Circular 170 of the government prescribes a rather complex mechanism where if a particular invoice is there in the GSTR 2B and the recipient does not intend to avail the ITC on the same, the recipient is required to avail the ITC [in table 4(A)(5)] and also a show the said amount as a temporary reversal[in table 4(B)(2)].

When the recipient wants to avail the ITC later, the same must be again availed [in table 4(A)(5)] and a disclosure of re-availment is to be shown [in table 4(D)(1)]. Maintaining a monthly record of each invoice, divided into various sections for different months, is practically difficult.

Solution: The IMS presents an opportunity to resolve these disclosure complexities by giving an option to mark invoices as pending. Invoices marked as pending do not flow in the GSTR 2B, thereby eliminating the need to temporarily reverse the ITC and later avail. The invoices marked as pending stay in the IMS until accepted or rejected.

4. Audit Trail of the ITC availment

While circular 170 prescribes treatment for each line item in GSTR 2B, the same is not reflected on a line-item basis in GSTR 3B, where the actual ITC availment is done. The calculation remains with the taxpayer, and the onus is always on the taxpayer to reconcile and match the figures in case of an audit.

The IMS, per se, does not resolve this issue. It poses another challenge: the invoices marked as accepted and rejected move out of the IMS records once the relevant GSTR 2B is generated and the corresponding GSTR 3B is filed. Again, this poses a challenge to the recipient to preserve the records of acceptance, deemed acceptance, and rejection for future reference.

Solution: Technology can play a crucial role in maintaining an audit trail. A tool that helps preserve the actions taken on each invoice, along with the reconciliation status and the final status of ITC availment of such invoice in the GSTR 3B, would serve as a single source of truth, making the audit process, so far as the ITC portion is concerned, completed without objections.

5. Tracking of amendments/alterations

The IMS guidelines say that if the details of an invoice are altered before the GSTR 1 has been filed, the action, if already taken on such invoice, would revert to the default, i.e., “no action”.

This can pose a challenge where the actions are taken on the invoices as and when they are uploaded. The recipient will have to keep a tab of the invoices, specifically where rejected or pending actions are taken, to see if the details of the invoices are changed before filing the GSTR 1 by the supplier.

Solution: Similar to the above, if a technology solution is implemented that also provides alerts concerning invoices that have undergone alteration before upload, it would help the recipient make an informed decision without going through the hassle of checking the invoices regularly.

6. Tracking of recipient actions

Apart from taking actions as recipients, it is also equally essential for the suppliers to understand the actions taken by the recipients, specifically the reject actions and more particularly reject actions on credit notes considering that that rejection of credit notes by a recipient result in addition of the amount (reduced by way of the credit note) to the liability of the vendor. To check the status, a supplier must log in to each of the GSTINs, which is a cumbersome exercise for a taxpayer with multiple registrations across the country.

Solution: Again, a technology solution that provides a view of all the invoices raised by a supplier across locations which can be filtered based on various criteria including the action status of the recipient would resolve this issue and would equip the supplier to engage into discussions with the recipient to resolve issues in connection to the action taken by them particularly pending and reject actions.

7. Communications between the Vendors and the recipients

As mentioned above, the IMS facilitates two views: the recipient view, where the recipient can take actions on the invoices reported against them, and the supplier view, where the supplier can view the actions taken by their recipients on the invoices raised by them.

There is no communication channel, however, available that facilitates resolution of discrepancies between the buyer and seller i.e. to say there is no direct functionality available for the recipient to communicate to the vendor as to why a particular document has been kept pending or has been rejected nor there is a facility for the supplier to seek clarification on the action taken by the recipient.

Solution: An automated system that triggers communication with the vendor via email and through the notification module of GSTN, communicating the fact that a document has been rejected/kept pending, along with the reason for the same.

Similarly, on the supplier side, proactive communication with the recipient, providing the details of the credit notes and the corresponding invoices, would enable the recipient to make an informed decision before accepting or rejecting any document.

Conclusion

The IMS in manufacturing is a game changer and can be viewed as the wild card that seeks to enable the government to return to the proposed GSTR 1, 2, and 3 filing at the introduction of the GST. The accept, reject, and “hold” (now pending) were at the core of the ITC availment, which the IMS seems to bring back.

The IMS in manufacturing has, no doubt, brought with it, its own set of complications and challenges, however, at the same time it has also brought with it an opportunity to optimise and streamline the entire supply chain process right form making the supply and raising the invoice to booking of invoice by the recipient, undertaking the reconciliation and availing the ITC.

At the core of this optimisation will be an efficient technology solution that brings in all the capabilities, automation, and intelligence in one place and provides a single source of truth with an efficient audit trail.