If you’re running a small or medium-sized business in Saudi Arabia, chances are you’ve heard about the e-Invoicing (FATOORAH) regulations from the Zakat, Tax and Customs Authority (ZATCA). It’s everywhere-from business circles to WhatsApp groups-and it’s clear that this isn’t just for the big players anymore.

ZATCA’s e-Invoicing requirements apply to everyone-from large enterprises to local cafés. And while the idea is to make invoicing simpler and more transparent across the board, the journey can feel a bit more daunting for MSMEs.

Let’s face it: when you’re busy running the show-handling customer orders, managing cash flow, dealing with vendors-keeping up with new tax mandates with limited resources and team can feel like just another thing on an already crowded to-do list.

MSME’s often wonders how to get knowledge on compliance requirement and get started, particularly with lack of IT team or infrastructure.

This guide is here to help you navigate that journey, step by step.

KSA e-Invoicing for MSMEs: Why it Matters

This isn’t just about ticking off a compliance requirement. For smaller businesses, e-Invoicing brings tangible benefits:

- Stay on the right side of the law by meeting ZATCA’s Phase 2 requirements

- Speed up your payment cycles with invoices that get validated and accepted instantly

- Say goodbye to paperwork and manual errors

- Build trust with secure, digitally signed invoices

- Be audit-ready with clean digital records, whenever needed

KSA e-invoicing for MSMEs: Steps to Go Digital with e-Invoicing

Here’s how you can make the switch to e-Invoicing without the headaches:

Step 1: Understanding ZATCA’s e-invoicing requirements

e-invoicing is applicable to all VAT-registrant taxpayers, including third parties issuing tax invoices on behalf of taxpayers. Currently wave 23rd of Phase- 2 i,e. integration phase covering taxpayers with annual revenue exceeding 7,50,00 SAR in 2022 or 2023 or 2024 is covered.

Sooner or later all taxpayers will have to integrate e-invoicing system with the ZATCA portal. MSMEs with lower turnovers are included in subsequent waves, with deadlines announced 180 days in advance.

Businesses should evaluate their turnover, understand and ensure their alignment with e-invoicing requirements.

Step-2: Assess your business readiness

Review existing e-invoicing process and the type of invoices issued. Are you sending B2B or B2C invoices? Are they created manually or via Excel? Knowing how your current process works will help you choose the right e-Invoicing tool.

Step-3: Choose a Web-Based, ZATCA-Compliant Solution

Look for a solution that:

- Requires no installation or IT setup

- Works directly from your browser

- Offers both Arabic and English interfaces

Tip: Skip the expensive ERP systems. As an MSME, you need something simple, affordable, and ready to go.

Step-4: Employee training

Ensure your employees are aware of e-invoicing requirements applicable to your businesses and train them with upgraded system and new e-invoicing process to ensure smooth operations.

Step 5: Start Uploading or Creating Invoices

Your e-Invoicing tool should allow you to:

- Upload Excel files in bulk

- Automatically generate ZATCA-compliant XMLs, QR codes, and UUIDs

- Create clean, professional invoice PDFs

Step-6: Handle Digital Signing with Ease

Digital certificates are a must-but they don’t need to be a hassle. With Cygnet.One:

- Digital signatures are built into the platform

- No manual setup or extra purchases required

- Your invoices are signed and ready to submit

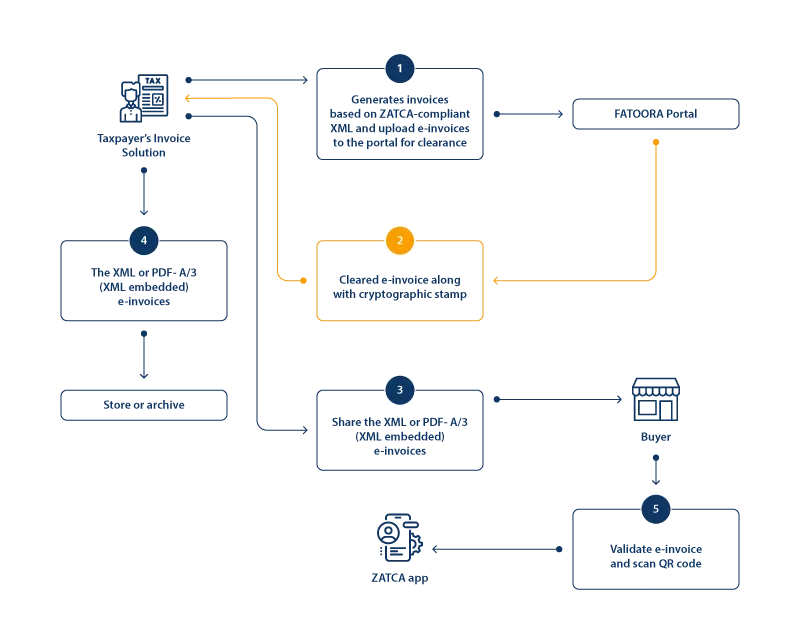

Step-7: Connect to ZATCA Instantly

The system should:

- Submit invoices to ZATCA in real-time

- Provide instant validation

- Notify you of any errors or rejections

Step-8: Stay Informed

ZATCA’s regulations are evolving. Make sure you:

- Know the latest timelines

- Understand the new data fields (like UUIDs, timestamps)

- Are prepared for future reporting and archiving needs

KSA e-invoicing MSME: Checklist

Before getting started, make sure you have:

- Your Commercial Registration (CR) number

- A stable internet connection

- Access to your invoice records

- A partner like Cygnet.One to support your compliance journey

- A reliable, ZATCA-ready platform

Common Challenges MSMEs Face

Switching to e-Invoicing is a step forward, but it’s not always easy. Here are some challenges we hear often:

1. Not Tech-Savvy

Working with XMLs, UUIDs, and digital signatures can feel like stepping into another world when you’re used to Excel or handwritten receipts.

2. No ERP or Digital Systems

Many MSMEs still use manual systems or basic POS tools. Connecting these to ZATCA’s APIs isn’t straightforward.

3. Digital Certificates = Confusion

Setting up certificates, managing private keys-it sounds complex, and for many, it is. There’s fear of doing it wrong and getting penalized.

4. Fear of Getting Fined

Mistakes can happen. But when they lead to financial penalties, even a small error can feel costly.

5. Lack of Support in Arabic

Most resources are technical and in English. MSMEs need straightforward guidance in the language they use every day.

6. Data Quality Issues

Missing VAT numbers, wrong totals, duplicate entries-all of these can get your invoice rejected by ZATCA’s system.

7. Security Worries

Digital invoicing means handling sensitive data. MSMEs need assurance that their customer and business information is secure.

The Bottom Line: Keep It Simple

You don’t need a big IT team, expensive software, or hours of training to get e-Invoicing right. You just need the right tools-and the right partner that understands your business, speaks your language (literally and figuratively), and keeps pace with ZATCA’s evolving requirements.

At Cygnet.One, we’ve helped MSMEs across KSA move to e-Invoicing smoothly and confidently, without disrupting their day-to-day operations. No technical jargon, no guesswork-just a straightforward solution that works for your business.

Whether you’re just starting out or already exploring options, we’re here to make your compliance journey smoother, smarter, and stress-free.