In today’s fast-evolving compliance landscape, CFOs in India are facing new mandates around GST reporting, invoice validation, and ITC claims. With digital workflows becoming the norm, integrating an Invoice Management System (IMS) with your ERP isn’t a nice-to-have—it’s essential.

Whether you’re trying to reduce reconciliation errors, speed up working capital cycles, ensure compliance with GST reporting mandates like GSTR-1, GSTR-3B, ensure accurate GST payment or ITC claim or to stay prepared for hard locking of GSTR-3B and potentially GSTR-1 by integrating IMS which may become mandatory in future, , this guide will walk you through how IMS + ERP integration can transform your finance function.

What is an Invoice Management System (IMS)?

An Invoice Management System is a new centralized platform within the GST portal that facilitate recipient to verify invoices and take action (accept, reject, or keep invoice pending) once the invoices details are saved or filed in GSTR-1 by supplier, Invoice management system is a new communication process to efficiently verify and address any amendment or corrections required in invoice with the supplier.

In India, it’s increasingly being used to:

- Pre-validate invoices as soon as the invoice data is saved in GSTR-1.

- Ensure correct ITC values flow to GSTR-2B for availment.

- Manage credit note, debit notes and amendments documents efficiently Communicate actions (Accept / Reject / Pending) to vendors.

- Reduced mismatches between supplier’s GSTR-1 and ITC availment by recipients.

While the IMS dashboard available in GST portal provides limited functionalities, business requiring digital workflows, automated reconciliation, compliance across the purchase and sales transactions, invoice lifecycle tracking must partner with technology provider to ensure integration with advanced IMS module with ERP.

For more information on features of IMS as per GST portal and IMS module provided by technology partner, kindly visit our blog “Key Features of an Invoice Management System Every CFO Should Know”.

How IMS Integrates with ERP Systems

Most enterprise ERPs (SAP, Oracle, Tally, Zoho, etc.) are not natively designed to manage daily GST validation, reconciliation, or government-mandated workflows.

With an tech-driven IMS layer connected to ERP and GSTN, you finance automation and GST compliance gains enhanced real-time visibility and compliance across invoice lifecycle. Key features to be considere by CFOs :

- ERP-agnostic integration via API

- Automated daily sync of purchase/sales data

- Reconciliation of GSTR-2B and invoice data with ERP entries

- Bulk IMS actions based on logic (Accept, Reject, Pending)

- Default setting of actions based on reconciliation buckets

- Automated Vendor communication & audit trail logging

- Real-time tracking of ITC available vs. eligible vs. claimed

- Track counterparty actions with supplier and recipient view

- Role-based access management to avoid unauthorized actions.

- Unlimited invoice view irrespective of the number of invoices.

Example: Cygnet’s IMS solution integrates directly into ERP via API, extracts GSTR-2B, compares it with purchase entries, and flags discrepancies instantly for finance teams.

Why It Matters: Impact on Finance Operations

| Aspect | Without IMS | With IMS |

| Credit Note Handling | Manual tracking | Auto-impact on liability |

| GSTR-3B Filing | Post-facto correction | Locked liability & automated flow of ITC from GSTR-2B |

| Vendor Disputes | Delayed resolution | Real-time vendor alerts |

| Working Capital | Blocked credits | Faster ITC claim lifecycle |

| Audit Readiness | Missing data trails | Action-level history & logs |

| Reconciliation | Manual, slow and prone to errors | Automated, quick with less human interventions |

Compliance Mandates That Make IMS Inevitable

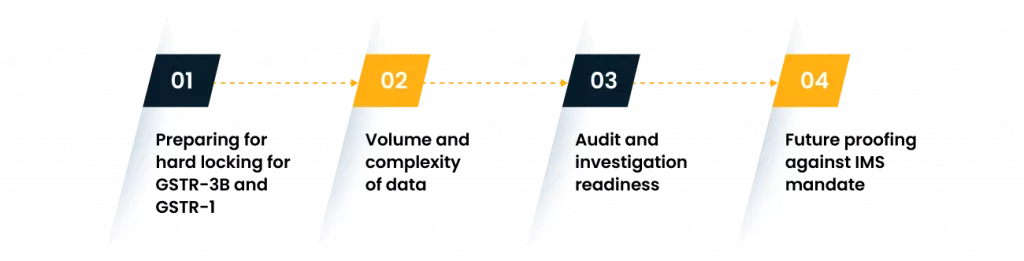

Preparing for hard locking for GSTR-3B and GSTR-1

Hard locking of auto-populated liability in table 3 of GSTR-3B is already implemented from July 2025 tax period onwards and soon GST department may implement hard locking of auto populated ITC as per table 4 of GSTR-3B. Further looking forward it is likely that GST department may also hard lock GSTR-1 values.

IMS ensures that only verified and accepted invoices, DN, CN, amended documents flow to GSTR-2B for accurate ITC availment. Similarly, any reject invoice communicated to supplier on real-time ensures immediate correction and amendment before filing of GSTR-1. Thereafter, any amendment can only be initiated through GSTR-1A.

Volume and complexity of data

Businesses handling large volumes of invoices, CN, DN, amendments find difficulty in manual invoice data management, risking ITC compliance requirements.

IMS provides single platforms for all supplier and recipient actions, unlimited view to all transactions, bulk action option, automated reconciliations, ensuring a single source of truth for document management and GST compliance.

Audit and investigation readiness

IMS logs each action taken by the user with a time stamp, provides a structured invoice history, and maintains a clear audit trail to stay prepared for government or statutory audits.

Future proofing against IMS mandate

Though IMS is operational but not mandated yet. However sooner or later IMS will be mandated, Adopting IMS now will help businesses to stay ahead of the learning curve, avoid last minute transition and ensure tested IMS workflow for compliance needs.

Success Metrics for CFOs to Monitor Post-Integration

To measure the impact of IMS-ERP integration, CFOs should track these key metrics:

- Invoice Processing Time: Measure the average time from invoice receipt to payment. Automation should reduce this by at least 50%.

- Error Rate: Track the percentage of invoices with errors. Aim for a reduction to below 0.5% post-integration.

- ITC Claim Accuracy: Monitor the percentage of ITC claims accepted without reversals. A well-integrated IMS should achieve near 100% accuracy.

- Working Capital Efficiency: Calculate the working capital ratio (current assets ÷ current liabilities). Integration should improve liquidity by reducing blocked funds.

- Days Sales Outstanding (DSO): Track the average time to collect payments. A lower DSO indicates faster cash flow cycles.

- Compliance Rate: Ensure 100% compliance with GST reporting deadlines, especially the 30-day e-invoicing rule for high-turnover businesses.

Pro Tip: Use ERP dashboards to visualize these metrics in real time. Tools like Unit4 or HighRadius offer customizable dashboards for CFOs to monitor performance.

Common Challenges and How to Overcome Them

While IMS-ERP integration offers significant benefits, challenges may arise:

- Learning Curve: Finance teams may need training to adapt to IMS workflows. Solution: Invest in user-friendly ERP systems and provide hands-on training.

- System Compatibility: Version mismatches or customizations can disrupt integration. Solution: Use cloud-based integration platforms and test thoroughly before going live.

- Data Silos: Disconnected systems can cause mismatches. Solution: Implement APIs or middleware like Tipalti to ensure seamless data flow.

Check out our case study on overcoming ERP integration challenges.

“IMS is not just a compliance tool—it’s a strategic layer to protect margins, preserve ITC, and digitize vendor management.” — CFO, Manufacturing Client Using Cygnet IMS

From Reactive to Proactive: Real Workflow Example

Scenario: You receive a GSTR-2B file with 200 invoices.

- IMS instantly compares it with ERP data

- 120 matched → auto-accepted

- 60 mismatched → flagged for review

- 20 duplicate entries → rejected

- Vendor gets instant notification for resolution

All this happens before your team touches the GSTR-3B draft.

Conclusion: Don’t Wait for Notices—Act Today

ERP on its own cannot handle compliance-grade automation.

CFOs need to shift from post-facto corrections to pre-validated submissions. With IMS integrated into ERP, your team gains a unified cockpit to manage GST filings, credit notes, and ITC tracking—seamlessly and at scale.

FAQs

No. Even mid-size companies with vendor volume >200/month benefit from automated reconciliation and ITC tracking.

It minimizes risk of incorrect ITC claim as only verified, reconciled and accepted invoices, CN, DN flows to GSTR-2B for ITC availment and to GSTR-3B.

Typically 2–4 weeks for ERP-integrated go-live, depending on your data volume and system readiness.