Introduction

A GST Notice went unnoticed – in mail or not retrieved from Portal- by the time it was discovered, the response deadline already passed.

By the time anyone realizes, it’s too late. The credit gets blocked, and penalties start stacking up. The email was ignored. There wasn’t a single place to track these notices by priority or deadlines.

As GST notices increase in volume and complexity, most companies still depend on scattered, outdated tools such as emails, spreadsheets, and multiple portal logins. This raises serious compliance risks and threatens finance teams with huge penalties.

The Litigation Management System (LMS) serves as a complete framework for managing the entire litigation lifecycle.

It brings structure, clarity, and accountability from the initial receipt of a notice through to its resolution, ensuring seamless coordination and control at every stage.

What is a Litigation Management System for GST?

A Litigation Management System (LMS) for GST allows companies to track, manage, and handle GST tax and legal notices issued by government platforms like GSTN.

Instead of scattered information and workflow, LMS brings all notice related task from centralized repository for all notices and relevant documents, notice parsing, grounds identification, finding court judgements and assisted response drafting, court hearing calendars and alerts to easy tracking and dashboards into a single platform.

Litigation management system handles all type of direct and indirect tax notices, from handling registration notices and correcting e-Invoicing mistakes to fixing mismatched returns or managing refunds.

LMS makes managing notices related tasks smoother and more organized. It gives finance, tax, compliance, and legal teams clarity, control & confidence.

Why CFOs and Finance Heads Must Prioritize GST Litigation Management

- Missed Notices = Real Financial Loss

GST input credits can get blocked if replies are not filed in time. Even a minor error can trigger reverse tax liability, interest, or fines. Notices are no longer rare—they’re automated, frequent, and strict on timelines.

- Accurate Provisioning is a Must

With rising scrutiny, CFOs need visibility into ongoing disputes to provision accurately. Over-provisioning affects working capital; under-provisioning triggers audit risks. LMS tools help classify cases (PPR: Possible, Probable, Remote) for better provisioning.

- Audit Trails Are Getting Stricter

During statutory audits, companies are expected to provide proper documentation for every pending GST notice—actions taken, internal discussions, and closure status. GST audit preparation steps can be made smoother with an LMS that maintains centralized records and evidence trails.

- GST Litigation Complexity is Growing

Tax authorities use advanced technologies and data analytics tools, which widens the scope of litigation, including mismatch notices, e-Invoice rejections, errors in GST payments or ITC availment, registration suspensions, refund holdbacks, etc, covering every corner of compliance requirements. Managing these manually isn’t sustainable.

Key Features to Consider While Choosing a Litigation Management System for handling GST notices

An effective LMS isn’t just a filing cabinet for GST notices. It should actively support finance, tax, and legal teams in managing the lifecycle of each case—from intake to closure. Here’s what to look for:

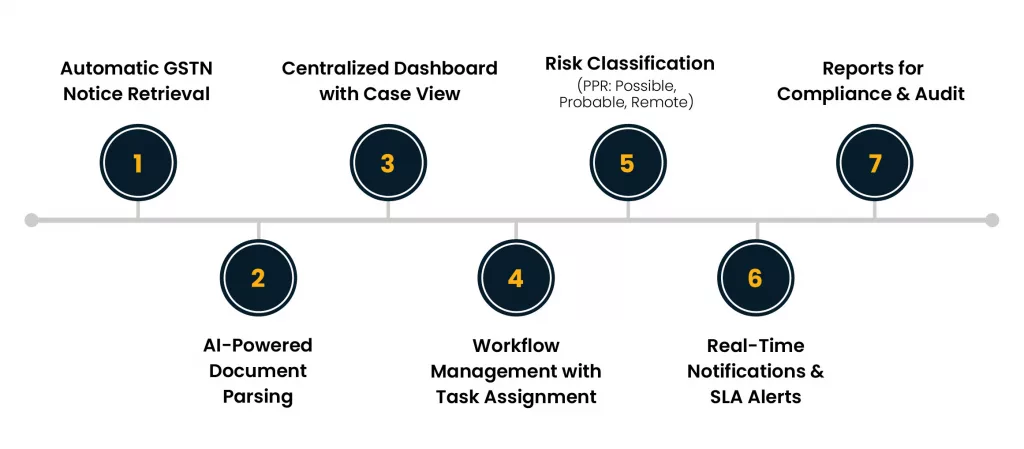

1. Automatic GSTN Notice Retrieval and centralized repository

LMS should be able to connect directly with the GSTN portal or emails and pull notices as soon as they are issued, in real time, and store them at a specified central location

Why this matters: No more waiting for email alerts or manually logging into multiple GSTIN accounts. GST Notices are logged in real time, ensuring timely responses.

2. AI-Powered Document Parsing

Uses Intelligent Document Processing (IDP) to extract relevant fields—such as GSTIN, notice date, section, issue type, and due date—from uploaded PDFs.

Why this matters: Avoid manual errors in reading and recording critical details like due dates, amount involved, GSTN details, or notice types, saving hours of effort during peak filing periods.

3. Centralized and Interactive Dashboard with Case View

Each notice should be tracked as a unique case ID, with a timeline view, attached documents, historical communication, and an activity log.

Why this matters: Whether it’s a vendor mismatch, registration issue, or refund-related objection, your team can see the full issue and grounds of GST notices and context of actions taken by an authorized person, supporting audit traceability.

4. Workflow Management with Task Assignment

Notices should be auto-assigned based on logic, such as GSTIN, region, or issue category. Tasks should move and be tracked through stages like “received,” “in progress,” “awaiting response,” and “closed.” strategies for effective notice management help ensure timely allocation and closure, reducing the risk of penalties or missed deadlines.

Why this matters: Helps allocate work to the right team, set internal SLAs, and ensure timely escalation if responses are delayed.

5. Risk Classification (PPR: Possible, Probable, Remote)

Each case should be provisioned, based on its potential outcome, and internal review for risk likelihood

Why this matters: Supports CFOs in provisioning and disclosure planning. GST Notices with a probable financial outflow can be tracked more closely for closure before statutory audit deadlines.

6. Real-Time Notifications & SLA Alerts

The system must notify the concerned user before a deadline approaches—and highlight overdue actions.

Why this matters: GST timelines are tight. Delay in responding, even by a day, could result in credit blockage, higher tax liabilities, piled-up interest, penalties, or additional scrutiny.

7. Reports for Compliance & Audit

Your LMS should generate standard and custom reports by notice issue type, GSTIN-wise, region, or legal status.

Why this matters: Whether for board reviews, audit documentation, or internal tracking, reports should be ready without chasing different teams.

How a GST-specific litigation management system benefits Teams, reduces risks, and stays compliant

A well-designed LMS for finance teams helps to handle regulations more efficiently, providing better control and visibility over their tasks. Here’s how it helps:

- Avoid Input Credit Loss: Timely responses prevent cash flow disruptions arising due to blocked ITC, fines, and penalties.

- Prevents Deadline Overlooks: Automated reminders and schedules ensure teams never miss important notices or deadlines.

- Streamlines audit readiness: Centralized records and tracking simplify internal, tax, and statutory audits, making the process faster and less overwhelming.

- Boosts team collaboration: Teams from legal, tax, and finance come together on one shared platform. This eliminates issues like lost emails, misplaced or scattered files, and duplicate efforts.

- Enhances better financial planning: CFO’s get better risk visibility for notices across GSTNs or regions using PRP tagging, which helps them plan and align financial strategies and cash flow management.

- Scalability with Compliance: Handles the increasing volume of GST litigation automatically.

Final Thoughts

GST litigation is no longer a legal back-office task—it’s a strategic finance and compliance priority. Companies that still rely on manual tools will face growing risks in the coming years.

A litigation management system helps CFOs and finance teams:

- Mitigate compliance risks

- Strengthen internal controls

- Improve response turnaround

- Prepare better for audits and provisioning

With notices rising in both number and complexity, using a GST-specific Litigation Management System is no longer optional—it’s essential.

Explore Cygnet’s Litigation Management Solution

Using tools like Cygnet LMS, companies can move away from just responding to legal issues. Instead, they can focus on risk management by connecting their tax, finance, and compliance teams.

Visit cygnet.one/solutions/litigation to view a demo or learn more.