In the intricate web of taxation, the GST stands as a cornerstone, streamlining the levies on the supply of goods and services. Amidst the complex framework of GST regulations, taxpayers may find themselves at the receiving end of a GST notice – a communication that carries weighty implications for their compliance with tax obligations.

As businesses navigate the labyrinth of GST intricacies, understanding the nature and significance of these notices becomes paramount. This blog aims to unravel the facts and information of what is GST notices, shedding light on the Types of GST notices, Forms under GST notices, why they are issued, what they entail, and how timely responses can play a pivotal role in maintaining a seamless relationship between taxpayers and tax authorities.

What are GST Notices?

GST notices are formal and official documents issued by GST departments to taxpayers about their GST compliances. These notices serve various purposes, including reminders for return filings, scrutiny assessments, demands for outstanding taxes, intimation to reverse Input Tax Credit (ITC), show-cause notice for serious non-compliance, annual returns, audits, and registration suspension or cancellation. Taxpayers must respond promptly and accurately to these notices to avoid penalties and legal consequences.

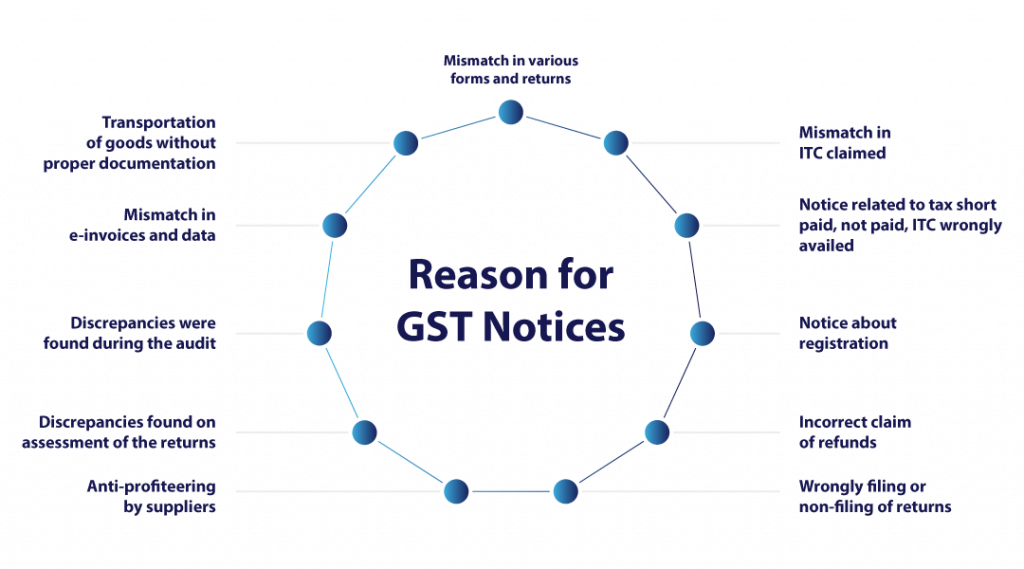

Reasons for GST Notices

There are many reasons based on which GST notices are issued. Here is the intricate but non-exhaustive list of the reasons.

- Mismatch in various forms and returns. Such as GSTR-1 and GSTR-3B.

- Mismatch in ITC claimed in GSTR3B and ITC available in GSTR-2B.

- Notice related to tax short paid, not paid, ITC wrongly availed, etc., either by mistake or fraud.

- Notice about registration. For example, either not providing information or documents, providing incorrect information or documents by mistake, or purposely committing fraud.

- Incorrect claim of refunds

- Wrongly filing or non-filing of monthly/ quarterly or annual returns.

- Anti-profiteering by suppliers by not passing the benefit of reduction in GST rates to its customers.

- Discrepancies found on assessment of the returns or documents available with authority.

- Discrepancies were found during the audit of accounting records.

- Mismatch in e-invoices and data entered in GSTR-1 or non-issuance of e-way bill based on the e-invoices issued.

- Transportation of goods without proper documentation.

Types of GST Notices, time limit and how to respond to the notices, and Consequences in failure to respond to GST notices.

- For Assessment Notice

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST ASMT-02 | Notice for seeking additional information/ clarification/ Documents for provisional assessment. | 15 days from the date of service of this notice | Reply to notice seeking additional information vide FORM GST ASMT-03 | Application for provisional assessment applied in FORM GST ASMT-01 can get rejected without any further reference |

| GST ASMT-06 | Notice for seeking additional information/ clarification/ Documents for final assessment. | 15 days from the date of service of this notice | Provide a reply to the notice seeking additional information | A final assessment order via FORM GST ASMT-07 can be passed without considering the taxpayer’s argument. |

| GST ASMT- 10 | Notice for intimating discrepancies in the return after the scrutiny. | Within the time prescribed in SCN, it should not exceed 30 days from the date of service of notice. | Provide a reply giving reasons for discrepancies in FORM GST ASMT-11 | It will be presumed that the taxpayer has no explanation for discrepancies, and the proceedings in accordance with the law shall be initiated. |

| GST ASMT- 14 | Show Cause Notice for assessment under section 63 (the person who has failed to obtain registration or whose registration got cancelled u/s 29(2) and is liable to Tax and Interest) | Within 15 days from the date of service of notice | Provide a reply and appear before the authority for a personal hearing | Assessment order u/s 63 in FORM GST ASMT-15 shall be passed demanding tax, interest, and penalties |

- For Audit related notice

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST ADT-01 | Notice for conducting Audit | Within the time prescribed in the notice | To be presented in person as specified in the notice or produce the records demanded in the notice | It shall be presumed that the taxpayer is not in possession of such records, and the proceedings in accordance with law shall be initiated. |

- Notice for the registered person under the composition levy.

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST CMP-05 | Notice for denial of option to pay tax under section 10. | Within 15 working days from the date of service of notice. Appear for a personal hearing on the date specified in the notice. | Provide a reply with a proper reason in FORM GST CMP-06 | The decision will be taken ex-parte, i.e., without considering the arguments from the taxpayer’s side, based on records available to them and penalty can be levied as mentioned under Section 122 |

- Demand and Recovery Notice

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST DRC-01A | Intimation of liability of tax, interest, or fees before issuing notice under Part-A of FORM GST DRC-01 | Within the time prescribed in the intimations. | Payment of liability and intimation of same in FORM DRC-03 if demand is accepted in full. If partially accepted, then the reason for non-acceptance is to be filed in Part B of FORM GST DRC-01A. | Failure to respond will invite notice under FORM GST DRC-01. |

| GST DRC-01B | Intimation of difference in liability reported in statement of outward supplies and that reported in return | Within a period of seven days from receipt of intimation | Payment of differential liability through FORM GST DRC-03 or explain the difference in Part-B of FORM GST DRC-01B. | The differential amount can be recovered as per the Section 79 of CGST Act, 2017. |

| GST DRC-01C | Intimation of difference in ITC availed in GSTR-3B and ITC available as per GSTR-2B | Within a period of seven days from receipt of intimation | Payment of differential amount through FORM GST DRC-03 or explain the difference in Part-B of FORM GST DRC-01C. | Taxpayer’s next month GSTR-1 or IFF will be blocked. |

| GST DRC-01 | Summary of Show cause notice- Demand for the tax short paid or not paid, etc. It also provides a statement of liability in FORM GST DRC-02. | Within 30 days of receipt of the notice. | Provide a reply to the notice seeking additional information | Order can be passed with penalty and prosecution. It can be done within three years from the due date of the annual return of a particular FY for which demand was initiated, |

| GST DRC-10 and 17 | Notice for auction of immovable/movable property | As may be specified in the notice before the sale. Consider that the last day of the bid or the last day of the auction cannot be before 15 days from the date of issue of the notice. | Pay the amount of demand as per GST DRC-09 | E-auction or sale can be done. |

| GST DRC-11 | Notice to the successful bidder- to ask for full payment | Within 15 days from the date of the auction | Pay the total bid amount | Re-auction can be done |

| GST DRC-13 | Notice to third person- for recovery of outstanding tax | – | Pay the amount specified in the notice and reply in FORM GST DRC-14. | In case of failure to pay to the government, The third person shall be deemed a defaulter, and proceedings shall be initiated as per law. In case the third person pays to the said taxable person instead of the government after the service of notice- The third person shall be personally liable to the extent of liability discharged or to the extent of liability of taxable person w.e. is less. |

| GST DRC-16 | Notice for attachment, sale of immovable/ movable goods, and share. | – | The taxpayer is prohibited from transferring or creating a charge on the said goods in any way, and any transfer or charge created by you shall be invalid. | Invite prosecution and penalties. |

- Notice for GST Practitioner

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST PCT-03 | Show cause notice for disqualification. – due to misconduct by the practitioner. | Within the time prescribed in show cause notice. Appear for a personal hearing on the date specified in the notice. | Provide a reply with a proper reason. | Suppose a person fails to furnish a reply within the stipulated date or fails to appear for a personal hearing on the appointed date and time, then an officer can order for cancellation of the license as a GST Practitioner. |

- Notice by Revisional Authority

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST RVN-01 | Notice to the taxpayer by the revisional authority before passing the revision order of appeals, giving the opportunity to be heard. Order of revision is usually passed to fix errors for appeals passed under section 108. | Within seven working days from the date of service of notice. Appear for a personal hearing on the date specified in the notice. | Provide a reply with a proper reason. | Suppose a person fails to furnish a reply within the stipulated date or fails to appear for a personal hearing on the appointed date and time. In that case, the case will be decided ex parte based on available records and merits. |

- Notice for rejection of refund

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST RFD-08 | Show cause notice for rejection of application for refund. | Within 15 days from the date of service of notice. Appear for a personal hearing on the date specified in the notice. | Provide a reply with a proper reason in FORM GST RFD-09. | Suppose a person fails to furnish a reply within the stipulated date or fails to appear for a personal hearing on the appointed date and time, then officer will refund rejection order in FORM GST RFD-06. |

- Notice under Returns

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GSTR -3A | Notice to return defaulter u/s 46 for not filing of return or for not filing a final return on cancelation of registration | Within 15 days from the date of service of notice. | File the required return, i.e., GSTR-1 or GSTR-3B or GSTR -4 or GSTR-8, along with late fees, tax applicable, and interest on late payment. | The penalty of Rs. 10,000 or 10% of the tax due, whichever is higher, will apply. The judgment will be passed based on the relevant material available from this office. |

- Notice under Registration

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| GST REG-03 | Notice for Seeking Additional Information / Clarification / Documents relating to Application for Registration, Amendment, and Cancellation. | Within a period of 7 working days from the date of receipt of noticeAppear for a personal hearing on the date specified in the notice. | Provide a reply to the notice seeking additional information, clarification, and documents in FORM GST REG-04 | Application is liable for rejection. |

| GST REG-17 | Notice for cancellation of registration. | Seven days from the date of service of this notice.Appear for a personal hearing on the date specified in the notice. | Provide a reply to the notice with the reason for not cancelling the registration in FORM GST REG-18 | Suppose a person fails to furnish a reply within the stipulated date or fails to appear for a personal hearing on the appointed date and time, then officer can pass rejection order in FORM GST REG-19. |

| GST REG- 23 | Show Cause Notice for rejection of application for revocation of cancellation of registration. | Seven days from the date of service of this notice.Appear for a personal hearing on the date specified in the notice. | Provide a reply giving reasons in FORM GST REG-24 | Suppose a person fails to furnish a reply within the stipulated date or fails to appear for a personal hearing on the appointed date and time. In that case, the case will be decided ex parte based on available records and merits. |

| GST REG- 27 | Show Cause Notice for cancellation of provisional registration. | – | Provide a reply by applying through FORM GST REG- 26 and appear before the authority for a personal hearing. | Issue cancelation of provisional registration in FORM GST REG-28 |

- In the case of Anti-profiteering measures.

| Form | Notice Description | Time limit to respond | How to Respond? | Consequences for not responding. |

| – | Notice of inquiry by the Directorate General of Anit-profiteering. | Within the time specified in the notice and appear before the authority on the specified date. | Respond to the notice with reasons for whether the benefit of ITC or reduced GST rates was passed to the consumer. | Suppose a person fails to furnish a reply within the stipulated date or fails to appear for a personal hearing on the appointed date and time. In that case, the case will be decided ex parte based on available records and merits, and the person shall be liable to pay a penalty equivalent to ten percent. of the amount so profiteered: |

How to reply to GST Notices: A Quick Overview

Responding to a show cause notice is crucial in addressing any concerns or allegations raised against you. Here are some general guidelines on how to respond effectively:

- Understand the Notice– Carefully read and understand the contents of the show cause notice. Identify the specific allegations or concerns raised against you.

- Gather Information– Collect all relevant information, documents, and evidence that can support your case. This may include emails, accounting and financial records, contracts, or other pertinent documents.

- Meet the Deadline: Respond within the stipulated timeframe mentioned in the notice. Failure to respond within the given deadline may result in unfavourable consequences.

- Professional Tone: Maintain a professional and respectful tone in your response. Avoid being defensive or aggressive, even if you disagree with the allegations.

- Structure Your Response: Organize your response clearly and logically. Consider addressing each allegation separately to ensure that your response is comprehensive.

- Acknowledge the Allegations: Acknowledge each allegation and provide a detailed response. If there are any misunderstandings, provide clarification.

- Provide Evidence: Support your response with relevant evidence. Attach copies of documents or refer to specific instances that validate your position.

- Be Concise: Keep your response concise and to the point. Avoid unnecessary details that may distract from your main arguments.

- Express Willingness to Cooperate: Demonstrate your willingness to cooperate with any investigations or actions required to address the concerns raised in the notice.

- Seek Legal Advice: If the matter is complex or legal, consider seeking advice from a legal professional. They can guide you in structuring your response and navigating the situation.

- Proofread: Before submitting your response, carefully proofread it to ensure no grammatical errors or typos. A well-written response enhances your credibility.

- Submit via the Appropriate Channel: Follow the specified procedure for submitting your response. This may involve sending it through a designated email or submitting it on the GST portal.

Opt for Cygnet Digital

Cygnet’s cutting-edge Show Cause Notice Management Solution is a revolutionary platform designed to streamline and enhance your organization’s compliance and legal processes. Our solution empowers businesses to efficiently create replies, track notices, and manage show-cause notices with unprecedented ease. Transform how you handle show cause notices, ensuring compliance with precision and agility. Stay ahead of regulatory challenges and elevate your organizational efficiency with our Show Cause Notice Management Solution – your key to proactive and strategic compliance management.

In Conclusion

The realm of GST notices underscores the significance of vigilance and responsiveness in the ever-evolving tax landscape. The diverse array of GST notices, ranging from scrutiny and assessment to show cause, demand, and input tax credit-related notices, underscores the multifaceted nature of compliance challenges. Successfully navigating these intricacies demands notice management mastery with effective strategies of notice management in a digital era, a profound understanding of the specific notice, and a strategic and well-documented response.

Businesses must be attuned to the nuances of each notice type, addressing concerns promptly and transparently. Seeking professional guidance can prove invaluable in deciphering complex issues and formulating effective responses. By fostering a proactive and cooperative approach with tax authorities, businesses can resolve potential discrepancies and fortify their compliance framework, contributing to a resilient and legally sound business environment under the GST regime.