In today’s fast-paced digital world, information flows from one place to another at an unprecedented speed. Businesses and governments are running at a fast pace towards automation and digitization in their workflow process.

The government uses advanced technologies, systems, or solutions to keep track of the compliance of rules and regulations, tax collection, and provide effective intimation or notices to businesses in case of any error, discrepancies, fraud, etc. To survive in a competitive market in this digital era along with fulfillment of all the compliance of the government the business needs to bring automation in every process.

Compliance with rules and regulations, tax payment, and reply to intimation or notice from the government is inevitable for businesses. Among all effective notice management is vital for the business to avoid unnecessary penalties or proceedings. In solution, businesses must adopt tech-driven notice management systems and automation solutions to ease the process.

Before we delve into the strategies and benefits of effective notice management in the digital era, let’s have an overview of the meaning of notices and the challenges faced in notice management with legacy systems.

What is GST notice?

A notice or show cause notice (SCN) is a formal document that requires businesses to justify their actions or inactions—often suspected of violating laws—within a specified time, using valid arguments and evidence. Among the types of GST notices, such documents are typically issued by authorities like the tax department, enforcement directorate, or adjudicating authority to avoid penalties, interest, or legal proceedings.

Challenges in Traditional GST Notice Management

Traditional notice management does not involve technology and automation which has made it difficult for businesses to handle such notices in a given time. The following are the challenges faced in the traditional notice management approach.

- Manual Processing- Handling notices manually can be time-consuming and costly. The traditional method requires a lot of human and material resources to produce, print, mail, store, and process notices. It also involves a lot of paperwork and administration, which can increase the risk of errors, delays, and losses. The traditional method can also incur additional costs for postage, courier, or legal fees.

- Data Discrepancies- Keeping track of multiple SCNs across different departments, different authorities, different states, different laws or cases can lead to data discrepancies and difficulties in maintaining an accurate record.

- Lack of Accountability- Legacy systems may lack mechanisms to monitor the progress and response times of SCNs, making it challenging to hold individuals or departments accountable.

- Inefficiency- The manual process can be inefficient in terms of preparation of replies to notices, collection of evidence, calculation of actual liability, submissions of replies, attending personal hearings, follow-up, etc. which may lead to error-prone and misleading cases, as a result of which officer may pass an adverse order and businesses have to suffer monetary as well as reputational loss.

- Security and Privacy- Paper-based notices may be susceptible to security breaches or unauthorized access, compromising sensitive information related to business and cases that can be used against the company and hinder the company’s reputation.

- Compliance Risk- Failure to manage SCNs effectively can lead to compliance issues, regulatory fines, and legal repercussions.

- Reporting and analytics- Generating reports and analytics on SCN trends, response times, and outcomes can be challenging without digital tools.

- Integration Challenges- Integrating notice management with other organizational systems, like document management or case tracking, may be complex in traditional setups.

To address these challenges, businesses can adopt digital solutions, notice management software, and develop various strategies that streamline the notice management process, enhance accountability, and improve data accuracy and security.

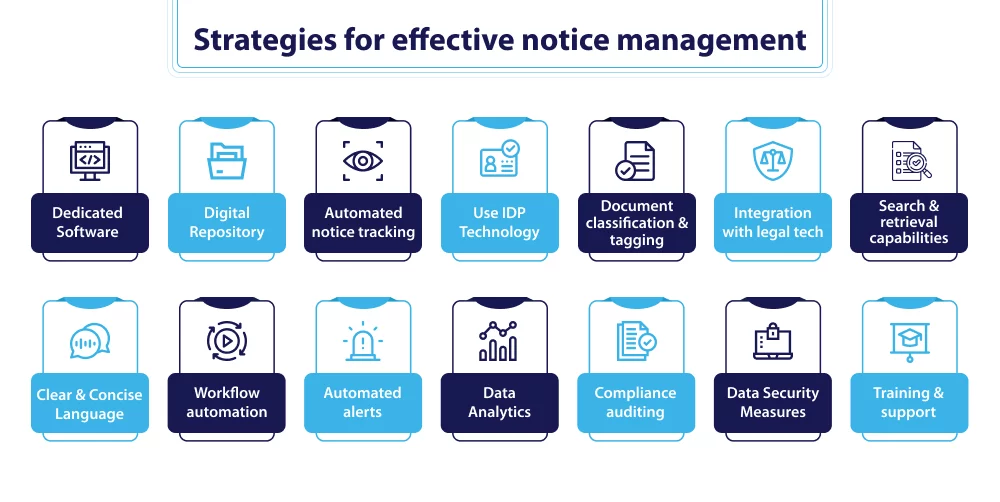

Strategies for effective notice management in the digital era

To have effective notice management, strategies correlated with digital solutions will be considered momentous. Therefore, let’s dive into some of the strategies that can be of great help for businesses to manage notice efficiently in this digital era.

- Dedicated Software

Invest in specialized notice management software to centralize and automate the process which can integrate with the government portals and emails to fetch the notices issued by the government and collect them at a single location.

- Digital Repository

Create a centralized repository to store and organize all SCNs, making them easily accessible to authorized persons.

- Automated notice tracking

Implement an automated tracking system to monitor notice receipts, deadlines, responses, and status updates.

- Use IDP Technology

Use a system or solution that uses IDP, AI, Machine Learning, etc. to convert available scanned paper notices or in any other form into searchable digital text.

- Document classification and tagging

With the use of AI and machine learning notices should be classified based on the law under which it is issued, the amount of recovery mentioned, and the person to whom the notice will be assigned.

- Integration with legal tech

Integrate with legal technology tools for case management, legal research, and compliance tracking.

- Search and retrieval capabilities

Implement robust search and retrieval functions, making it easy to find similar SCNs for past periods of the same company or another company which can be used as a reference in present cases.

- Clear and Concise Language

Businesses must use various software that can check clarity, correctness, grammar, etc. while drafting a reply to avoid mistakes, miscommunication, and confusion so the notice can be drafted using clear and concise language.

- Workflow automation

Create an automated workflow for the review, approval, and response process, reducing manual handling and ensuring timely actions.

- Automated alerts

Set up automated alerts and reminders to notify relevant personnel of upcoming deadlines and response requirements.

- Data Analytics

Employ data analytics to identify patterns and trends in notices and the part of compliance standards that remains unfulfilled by the business thereby resulting in the issue of notice, enabling data-driven decision-making and proactive risk management.

- Compliance auditing

Conduct regular compliance audits to ensure notice management processes align with legal and regulatory requirements.

- Data Security Measures

The notices, their replies, documents, and evidence are vital for the organization. Any information leak can affect a company’s reputation and legal proceedings. Ensuring robust data security measures, including encryption and access controls, to protect sensitive information is a must.

- Training and support

Provide training and ongoing support to employees to ensure they are proficient in using the digital notice management systems.

By combining these tech-driven strategies, organizations can enhance their notice management, reduce errors, and maintain compliance with legal and regulatory obligations.

Benefits of tech-driven effective notice management

The tech-driven notice management provides several benefits to the business. Let’s have an overview of a few benefits that organizations can achieve.

- It streamlines the entire notice management process, reducing manual tasks and saving time. This leads to quicker response times and more efficient handling of notices.

- It minimizes the risk of human errors, ensuring that notice responses are accurate and complete, reducing the likelihood of compliance issues.

- This process follows predefined workflow and templates, maintaining consistency in the way notices are handled and responded to.

- Automated alerts and reminders ensure that deadlines are met, reducing the risk of missing personal hearing or response deadlines and potential legal consequences.

- All notices are stored in a centralized digital repository, making it easy to access, search, and reference past notices, improving organization and information retrieval.

- Automation allows for real-time monitoring of notice-related compliance requirements, ensuring that the organization stays in line with legal and regulatory requirements.

- By reducing manual labor and minimizing the risk of non-compliance penalties, automated notice management can lead to cost savings in the long run.

- Tech-driven systems can easily scale with the growing volume of notices, ensuring that the organization can handle increased demand without adding significant overhead.

- Employees spend less time on administrative tasks related to notice management, allowing them to focus on more strategic and value-added activities.

- Automated systems often generate an audit trail of all actions taken during notice management, facilitating transparency and accountability.

- With automated backup and cloud-based solutions, organizations can ensure business continuity even in the event of data loss or system failure.

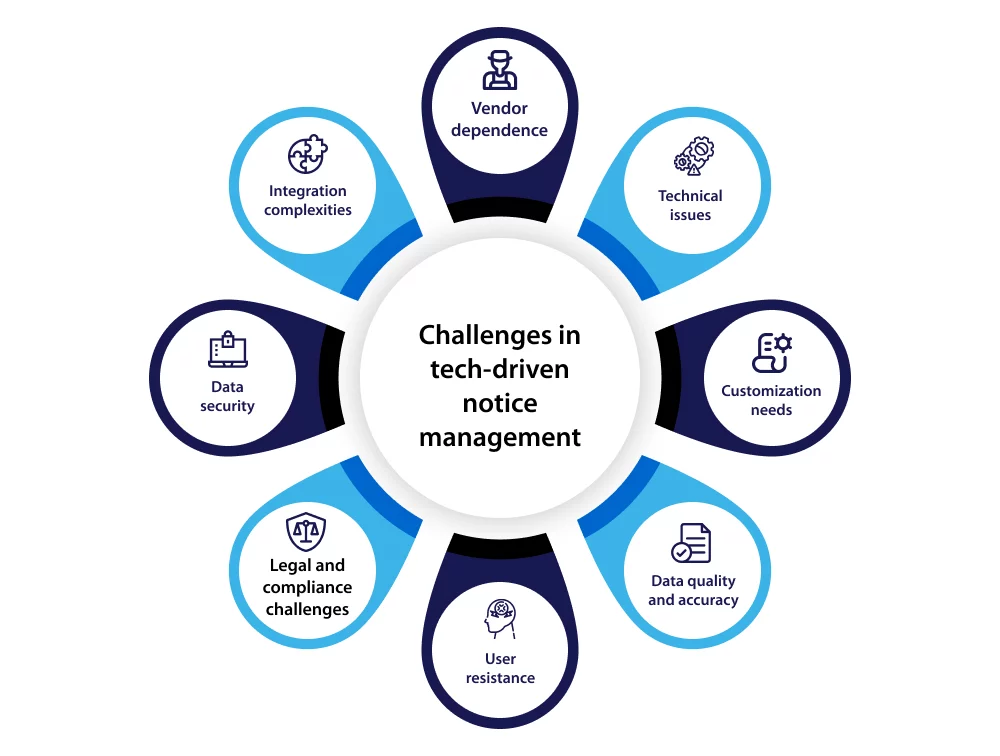

Challenges in tech-driven notice management

While tech-driven notice management offers numerous benefits, it also comes with its fair share of challenges. Some common challenges include:

- Integration complexities: Integrating notice management systems with existing software and databases can be complex and may require customization to ensure seamless data flow.

- Data security: Storing sensitive notices digitally increases the risk of data breaches and cyberattacks.

- User resistance: Employees resist adopting new technologies, requiring comprehensive training and change management affairs.

- Initial implementation costs: The initial investment in tech-driven notice management systems can be substantial, which can be a barrier for smaller organizations.

- Legal and compliance challenges: Tech-driven notice management systems must keep pace with evolving legal and compliance requirements, requiring continuous adjustments and updates.

- Data quality and accuracy: Automated systems are only as good as the data they rely on. Inaccurate or incomplete data can lead to errors and inefficiencies.

- Customization needs: Each organization may have unique requirements for notice management, necessitating significant customization in some cases.

- Technical issues: Technical glitches or system downtime can disrupt the notice management process and require quick resolution.

- Vendor dependence Relying on third-party software means the organization is dependent on the vendor’s performance, updates, and support.

To address these challenges, businesses must carefully plan and execute their tech-driven notice management strategies, invest in the right tools and technologies, and stay vigilant in monitoring and adapting to changes in the regulatory landscape and technological advancements.

How can Cygnet Help in GST Notice Management

Cygnet Tax simplifies notice management and aids to de-risk business processes. Through a meticulous evaluation of tax positions and comprehensive compliance checks, Cygnet detects lapses in e-Invoice and e-Way bill generation. Cygnet further aids in data extraction, multi-year reconciliation, and the preparation of supporting workings for timely and accurate notice responses, ensuring all compliance needs are met seamlessly. With Cygnet, businesses navigate the complexities of tax regulations, minimizing risks and promoting operational efficiency.

To Sum-up

By embracing strategies such as stated, organizations can overcome the challenges posed by this fast-paced digital landscape. However, it’s important to note that technology cannot replace human expertise and judgment in responding to SCNs. Automated systems can only assist businesses in managing the SCN process more efficiently. It’s still important for businesses to seek legal advice and assistance in preparing a response to an SCN.

To conclude, with organizations around the world continuously implementing various forms of technology into their everyday lives and operations, effective notice management solutions along with human expertise are a fundamental aspect in maintaining compliance requirements at top-notch.