Introduction

With the growing economy, organizations have to expand their business, resulting in the emergence of growing vendors to supply goods or services for their crucial operations. While there is a practice in business jargon to always trust and buy from regular vendors working for years, there is a high need to explore the world to get better discounts and better quality at a competitive price and in the required time.

However, partnering with the verified vendor is a different challenge. Knowing their background, financial status, market reputation, quality of goods or services, etc., is difficult but very important. Partnering with the default vendor can lead to vendor theft or procurement fraud, resulting in financial losses, compliance issues, and reputational damage.

According to ET, a survey conducted by KPMG found that 72% of respondents identify reputational damage as the most severe consequence of fraud. The survey also found that regulatory changes have not reduced fraud, with 79% of respondents identifying no reduction. Key areas prone to fraud include procurement (50%), sales and distribution (30%), e-commerce (11%), manpower (6%), and inventory (3%).

With this percentage, it is pretty clear that a company faces approx. 50% of procurement fraud. This is why vendor validation before onboarding is not just a formality ensuring your business is safeguarded against potential risks is vital. While vendor validation is essential, it is more important to digitize and automate it to reduce human errors and time consumed in the verification process. This can be clearly seen in the above survey, in which 61% of respondents said they wanted to implement tech-based early warning signal mechanisms.

Vendor Validation: Comprehensive Understanding

The vendor validation process verifies and assesses the legitimacy, reliability, and compliance with vendor industry standards and regulations before onboarding it for a business relationship. This includes verifying the vendor’s background, financial stability, tax compliance, legal standing, ethical practices, credibility, and overall capacity to meet the contract demands.

Need for automated vendor validation Process

Now that we understand vendor validation is crucial, it is equally important to have automated and digitized vendor validation before onboarding vendors.

What is the Automated vendor validation process?

Automated vendor validation refers to using technology and vendor management software to streamline the process of evaluating and verifying vendors for the vendor onboarding process. This would identify a vendor’s financial stability, reputation, compliance, etc., in seconds without much human intervention and manual effort. Let’s see how automated vendor validation processes are required for business organizations:

- With a growing business, vendor collaboration and partnership also increase, requiring organizations to automate the vendor validation process, facilitating scalability and faster vendor processing and management.

- Automated vendor onboarding rapidly increases the onboarding process by significantly reducing the time required in the manual process to validate and onboard new vendors.

- Automated validation integrates seamlessly with existing procurement and supply chain management systems, creating a smooth and efficient workflow from vendor selection to onboarding.

- Automated vendor validation process removes human errors, inconsistencies, and anomalies that occurred due to manual processing.

- Automated tools can continuously analyze real-time data from multiple sources, providing up-to-date insights into a vendor’s status and helping organizations make informed decisions.

The risk of avoiding vendor validation

Onboarding vendors without proper validation is not ideal for business organizations. Skipping vendor validation will expose the business to various market risks as follows:

Operational Risk

An unreliable vendor may delay or fail to deliver required goods or services, which will result in the organization’s failure to meet customer demands on time. Further relying on 1-2 unvetted vendors may also cause delays in fulfilling market demands, leading to heavy operational loss.

Compliance Risk

If a vendor does not meet compliance needs like filing returns, paying taxes, and more. Businesses will not be able to avail credits on such procurements, and above that, the vendor may cause the organization to face fines, legal actions, and penalties. Further, if vendor mishandles their data as per regulatory requirements, the sensitive data of the organization will be prone to be leaked.

Financial Risk

If vendor’s financial practices are not transparent and scrutinized, they may inflate prices and include hidden fees. Further, if the vendor is financially unstable, there is a high chance that it may go bankrupt, and the organization will scramble for alternate options. A financially unstable vendor may charge high prices and provide low-quality goods or services, making an organization a victim of fraud.

Reputational Risk

Vendor involved in unethical practices such as environmental harm, non-payment to their vendors or bank, labor exploitation, and providing substandard quality products can damage an organization’s brand’s reputation if associated with your business.

Credibility Risk

When an organization faces financial risk, reputational risk, operational risk, compliance risk, and other such risks, it is directly or indirectly trashing its credibility. This affects its ability to secure loans from financial institutions, resulting in difficulty in working capital or cash flow within the organization.

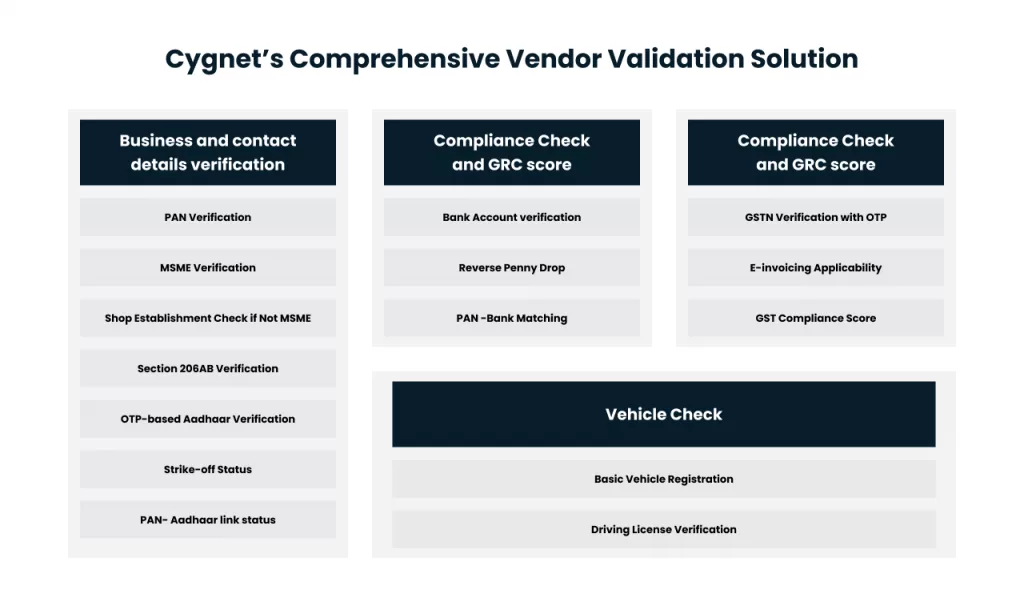

Cygnet’s Comprehensive Vendor Validation Solution

Cygnet provides automated vendor validation solutions for business ease, covering background checks, financial status, operational needs, compliance checks, and other such verifications to safeguard business and ensure a smooth vendor onboarding process. Let’s explore the areas Cygnet covers during verification to provide maximum security to businesses before vendor onboarding.

Business and contact details verification

PAN Verification- To check and validate the vendor’s identity and tax registration to ensure authenticity and reduce the risk of fraudulent activities.

MSME Verification– This verification confirms whether the vendor has MSME registration and identifies the benefits of tax procurement preferences and compliance with government regulations for vendors having MSME status.

Shop Establishment Check if Not MSME- Verifies the vendor’s registration under the local Shop and Establishment Act, which governs commercial establishments, including shops, offices, and other places of business, to ensure vendor’s registration under specific jurisdiction.

Section 206AB Verification– To check whether the vendor is complying with the Income Tax Act or not and, accordingly, whether it is liable for higher TDS deduction u/s 206AB or falls under normal provisions of TDS.

OTP-based Aadhaar Verification- To confirm the vendor’s identity using a one-time password process where OTP is sent to a mobile number linked with Aadhaar, ensuring secure and authenticated verification.

Strike-off Status- To verify whether the vendor’s company is listed as “struck off” by the Registrar of Companies to ensure the vendor is actively registered and legally allowed to operate and avoid partnerships with defunct and dissolved entities.

Director or Partner’s verification- To verify whether a particular partner or director is still working at its position or has been debarred by the entity to reduce the risk of fraud.

PAN- Aadhaar link status– This verification is for the sole proprietor or self-employed person to ensure the authenticity of the business and ensure the business is validly registered.

Compliance Check and GRC score

GSTN Verification with OTP- To verify the vendor’s GST registration, an OTP-based process is to ensure the vendor’s registration is active and valid.

E-invoicing Applicability- To verify whether the vendor falls under the e-invoicing limit or not and, accordingly, whether the vendor is following e-invoicing-related compliance to avoid an ITC block.

GST Compliance Score- This verification provides a score on compliance such as return filing, tax payment, and ITC claim by the vendor, and based on this score, we can identify that we are not partnering with a non-compliant vendor.

Bank Details Verification

Bank Account verification – Check bank account details to ensure smooth business continuity. Check the bank account name with the legal or trade name of the business.

Reverse Penny Drop- Validates the vendor’s bank account by depositing a minimal amount and confirming the receipt, ensuring thebank details are correct and active.

PAN-Bank Matching- Matches the vendor’s PAN with their bank account details to ensure that the vendor’s PAN is correctly linked to the specified bank account, reducing the risk of fraud or misallocation of payments.

Vehicle Check

Basic Vehicle Registration- To ensure the vehicles used for business purposes are properly registered, check under whose name the vehicle is registered and who is operating the vehicle.

Driving License Verification- It confirms the validity of the driver’s licenses and ensures the drivers operating vehicles for the vendor are legally licensed and qualified, enhancing safety and compliance.

Benefits of Vendor Validation Process

The vendor validation process is critical for businesses that want to maintain a robust and reliable supply chain and avoid potential risks. Here are the key benefits of implementing a thorough vendor validation process:

Fraud detection

By Validating vendors, businesses safeguard themselves from fraudulent and illegitimate vendors by verifying financial status, background checks, compliance status, etc.

Compliance check

It is vital for the vendors to follow compliance procedures such as payment of tax, issuance of the correct invoice, and filing of returns, which are verified during the vendor validation process to avoid availment of ineligible ITC by organizations resulting in fines and penalties.

Enhanced Security

Vendor validation portals or solutions ensure security by complying with regulatory requirements and avoiding leakage of sensitive information of business organizations. It also provides robust access management, restricting access to verification processes and information only by authorized personnel.

Continuous Monitoring

More than 30-40% of suppliers modify information every year, which makes it mandatory for businesses to verify their information continuously. An automated vendor verification process ensures smooth monitoring of such information change.

Streamlined vendor Onboarding management

Automating vendor validation speeds up the onboarding process, allowing businesses to engage with new vendors more quickly and efficiently. At the same time, standard criteria are provided to verify each vendor’s access fairly and consistently.

Improved decision-making

Vendor validation provides businesses with valuable insights about their suppliers, enabling informed decisions based on the vendor’s financial health, compliance, and operational capabilities.

Enhanced Brand Reputation

A validated and genuine vendor ensures timely delivery of goods or services with better quality, helping organizations meet their deadlines and reduce supply chain failure, product recalls, or compliance failures, resulting in the enhancement of brand recognition.

Improved Supplier Relationships

A verified and validated vendor helps gain trust, leading to stronger and better long-term relationships that are mutually beneficial to both parties.

Looking Forward

In today’s fast-paced market, a vendor validation process is essential as an integral part of the business. Vendor compliance services ensure the vendor’s legitimacy as a protective barrier, shielding your business from risks such as fraud, compliance issues, financial instability, and reputational damage. Vendor onboarding management is not just an ideal practice but a necessity in today’s world.

Cygnet’s comprehensive vendor validation solutions offer businesses the peace of mind that comes from knowing they are partnering with legitimate, compliant, and capable vendors who can meet their needs. In the end, robust vendor validation is not just about safeguarding your business today—it’s about securing a successful and sustainable future.