Eight years have already passed since GST was introduced, and Input Tax Credit GST still remains a topic of discussion, a matter for expert advice, a reason for notices and disputes, and a challenge for cash flow management, making it a core of GST compliance and a high priority in the GST audit checklist.

Input Tax Credit GST allows businesses to set off their inward tax against their outward tax liability, ensuring only the difference value is paid, thereby reducing tax burden, unnecessary cash outflow, and maintaining liquidity. This is important for businesses, particularly for MSMEs having liquidity crunches affecting their operations due to blocked or delayed ITC claims, which would otherwise be used for debt payments, growth, and inventories.

To maximize ITC, businesses must ensure having clean and timely records, automated systems and GST compliance software, regular GST reconciliations, verify vendor compliance, timely IMS actions, etc, to avoid penalties, ensure optimum ITC claims, and maintain a working capital balance.

ITC Rules as per GST Law

Let’s have an overview of the ITC rules to be complied with while availing of ITC

Section 16: Eligibility and conditions for taking Input Tax Credit GST

Every registered person can avail a credit on input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of business, subject to the following condition:

- He is in possession of a tax invoice or debit note issued by the supplier

- The details of such invoice/debit note have been furnished by the supplier in Form GSTR 1/IFF/GSTR-1A and have been reflected in the recipient’s GSTR-2B

- He has received goods or services or both. The goods are said to be received by the recipient if the supplier delivers goods to another person (representative or agent) at the direction of the recipient via the transfer of documents of title of the goods. Similarly, services are said to be received if it is supplied to another person at the direction of the recipient.

- The tax charged on supply is actually paid to the government either in cash or through a credit ledger

- He has filed a return in form GSTR-3B.

Other conditions

- If the goods are received in instalments or lots, ITC can be availed on receipt of the last lot.

- The ITC has to be reversed along with interest by the recipient if he fails to pay to the supplier the value of goods and tax payable within 180 days from the date of issue of the invoice by the supplier. However, the recipient shall be entitled to avail the credit again after payment to the supplier.

- Further, the recipient can only avail ITC in respect of any invoice or debit note till the 30th November following the end of the financial year in which it was issued or the date of furnishing the annual return, whichever is earlier.

- ITC cannot be availed when depreciation is claimed on the tax component of capital goods.

Section 17

- ITC cannot be claimed for goods and services used for anything other than business or for exempt supplies.

- Blocked ITC cannot be availed on supplies as prescribed under section 17(5).

Invoice Management System

Currently, IMS (invoice management system) has been in talks since it became operational in October 2024. Though not mandatory for now, it is essential for businesses to start complying with IMS rules, as eventually IMS will become mandatory, and only accepted or deemed accepted documents will flow to GSTR-2B for the availment of ITC.

For detailed information on IMS and how it works, kindly visit our blogs on What is IMS and Key Implications under GST.

Common Pitfalls in Input tax credit GST Compliance Management

Here are some challenges recipient may face either from their side or due to non-compliance by their suppliers, which may impact their ITC availment and may result in notices, penalties, reversal of ITC, along with interest:

- Mismatches in GSTR-2B and GSTR-3B due to clerical errors, suppliers furnished their GSTR-1 with incorrect details, ITC related to import goods, etc.

- Non-compliance with provisions, by means of fraud or other than fraud, such as

- non-recipient of goods or services

- non-availability of invoices or debit notes

- non-availment of ITC within the time limit,

- Failed to track non-payment to the supplier in 180 days

- Availing ineligible ITCs

- Non-filing of GSTR-3B

- Incorrect ITC distribution under ISD provisions

- Non-compliance with credit notes issued.

- Supplier’s non-compliance affecting recipients’ ITC, such as

- Non-filing of GSTR-1.

- Wrong or erroneous filing of GSTR-1

- Non-payment of tax value by the supplier to the government

Key recommendations to recipients before availing of ITC

- Regular Trainings- Conduct regular sessions and educate respective departments regularly with ITC provisions and any amendments or mandates issued by the government to ensure compliance with law.

- Expert Advice: Consider taking advice from in-house or third-party experts before availing ITC for any complex and special case to avoid misinterpretational issues.

- Regular communication with supplier: Ensure suppliers file GSTR-1 timely and correct errors in GSTIN or invoice details.

- Payment withholding: Ensure withholding of payments to the supplier until they correctly comply with provisions.

- Monitor Deadlines- Keep track of deadlines and ensure all ITC pertaining to that year has been availed on time.

- Maintain Documentation- Maintain robust documentation of all invoices, credit notes, debit notes, and other relevant documents justifying ITC availment and GST reconciliation mismatches.

- Ensure effective GST reconciliation- Ensure an effective GST reconciliation process for GSTR-2B, GSTR-3B, the purchase register, and invoices received are in place. Consider automating the reconciliation process to avoid errors.

2B vs 3B GST Reconciliation: Is it enough for accurate ITC availment?

Till now, reconciliation of GSTR-2B and GSTR-3B is essential for businesses to ensure:

- Only accurate, eligible, and legitimate ITC reflected in GSTR-2B is availed.

- Suppliers have not failed to comply on their part.

- Any mismatch between GSTR-2B and GSTR-3B is addressed before availing ITC.

- Maximizing cash flow and ITC optimization by fully availing of ITC without delays.

- Avoiding ITC reversals, interest, penalties, and notices.

However, with evolving GST compliance structure and with the introduction of IMS and hard-locking of GSTR-3B, GST reconciliation only at a later stage will not be effective and accurate because:

- Eventually GST council will mandate IMS, and only accepted or deemed accepted ITC will flow to GSTR-2B.

- Further, outward liability of GSTR-3B is already locked by the government, thereby, sooner or later, the ITC part of GSTR-3B will also get hard-locked once the IMS is mandated.

Impact

The invoice data will automatically flow from IMS to GSTR-2B and from GSTR-2B to GSTR-3B, and no changes will be allowed to be made in GSTR-3B.

Therefore, any GST reconciliation or error correction has to be done before taking action in IMS, which will make only the reconciliation of GSTR-3B vs GSTR-2B ineffective.

Businesses will have to ensure real-time GST reconciliation as soon as the invoices are received and recorded in the books of accounts to avoid ITC availment and GST reconciliation errors.

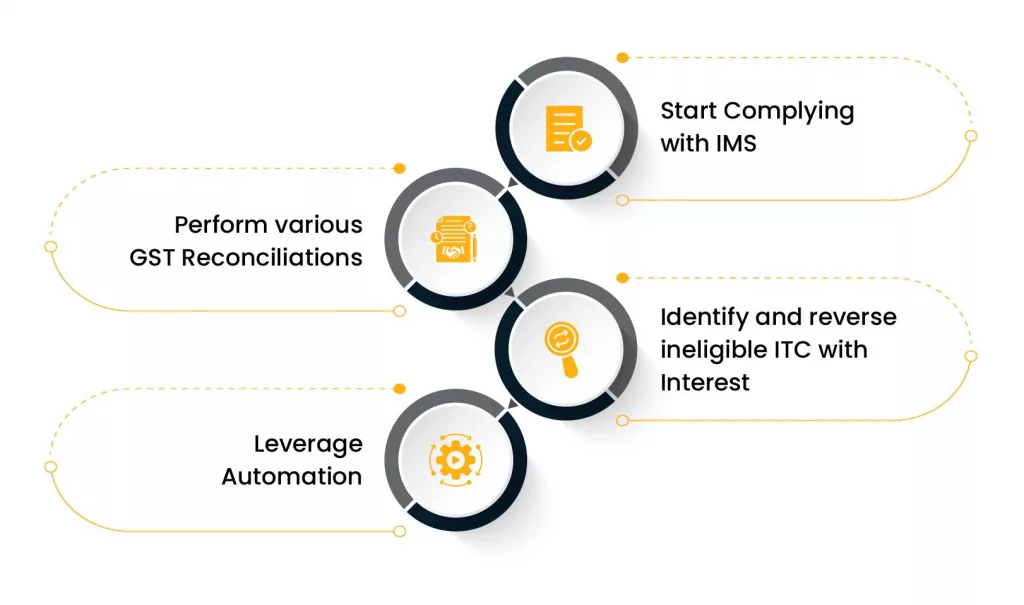

Strategies a business should have for Audit Preparedness and ITC compliance

Start Complying with IMS

Though IMS is not mandatory yet, businesses should start integrating IMS into their GST compliance process to stay prepared in advance. This will help them to

- prepare for the mandate

- provide a streamlined process for accurate ITC availment and error handling,

- increase supplier communication and relationship

- provide real-time insights on ITC status

- Ensure no ITC is missed from availment

- Get control over ITC

- Audit trail for ITC availment

- Easy tracking of errors, amendments, pending actions, and rejected

Perform various GST Reconciliations

Early and real-time reconciliation and data verification provide clean data for businesses, helping them to stay prepared for internal, statutory, or government audits.

Here is are list of reconciliations a business should have in its GST compliance workflow:

- Reconcile the inward invoice received with the PO, GRN, RFP, etc.

- Ensure purchase is booked on receipt of invoice.

- Verify and reconcile invoice data with the purchase register.

- Reconcile the purchase register and the invoice received with IMS data.

- Finally have a 6-way reconciliation from PO to invoice to purchase register to IMS data to GSTR-2B and GSTR-3B data.

These reconciliations will ensure that the invoice data is accurately verified, clean, and reconciled from start to end of the invoice journey. Any errors or anomalies can be addressed on time before availing of ITC.

Identify and reverse ineligible ITC with Interest

ITC ineligible for availment shall be reversed either temporarily or permanently, as required, along with interest. Such voluntary payments made to the GST council shall be intimated to the GST department via DRC-03 and reported in returns.

Further, detailed documentation of ITC reversal calculation, interest calculation, supporting documents, payment challan, intimation, and reporting documents is maintained and archived properly.

Leverage Automation

Automation is key to GST compliance efficiency. Businesses must ensure an integration of ITC ITC-compliant automated solution that ensures:

- Processing of thousands of invoices in minutes via real-time integration.

- Real-time and automated GST reconciliations based on buckets and algorithms.

- Flagging of errors and non-compliance for human review

- High scalability of handling large-scale data effectively.

- Incorporation of all amendments and updates in real-time with minimum TAT to ensure compliance

- Facilitating IMS and ISD automation.

While this automation ensures effective management of input tax credit GST, integrating an end-to-end GST compliance solution, litigation management solution, purchase invoice digitization, or accounts payable management, etc, can be more effective for businesses to ensure thorough GST compliance with less time and effort and more accuracy.

Conclusion

Maximizing ITC under GST requires robust reconciliation, automation, and audit preparedness to ensure compliance and optimize cash flow. By integrating IMS, performing real-time multi-level reconciliations, reversing ineligible ITC promptly, and leveraging automation, businesses can minimize errors, avoid penalties, and streamline ITC availment. These strategies not only enhance compliance but also strengthen financial efficiency and audit readiness in the evolving GST landscape.

Cygnet.One can be your one-stop solution

Cygnet.One provides a comprehensive solution for your entire GST compliance needs from IMS, ISD, and reconciliations to e-invoicing, e-way bill, and timely return filing, ensuring seamless transparency in ITC mechanisms, reducing errors with ERP integrations, automated data flow, and empowering businesses to avoid penalties while optimizing working capital.

Cygnet also provides a Litigation Management System (LMS) to automate GST notice tracking, replies, and dispute resolution, keeping businesses audit-ready and penalty-free. Additionally, solutions like purchase invoice digitization and accounts payable automation streamline data entry, payment processing, and financial workflows for enhanced efficiency and cash flow management. This ensures end-to-end automation of business processes and compliance requirements.