Is your GST compliance process still a cost burden and time-consuming, or a strategic advantage?

This question comes to light because when GST first came into force in 2017, businesses thought it was considered a compliance task that required monthly and annual return filing.

However, as time passed, businesses realized that it is not just about meeting filing deadlines at month or year end, but a continuous process of managing e-invoicing, reconciliations, e-way bill, claiming accurate ITC, timely payments, accurate reporting in various forms and returns, vendor compliance, and real-time audit readiness impacting cash flow, compliance credibility, and business continuity.

Soon, what was considered only a side task became a strategic necessity requiring cost and time management, domain expertise, financial management, automation, ideal GST compliance software, and digitization.

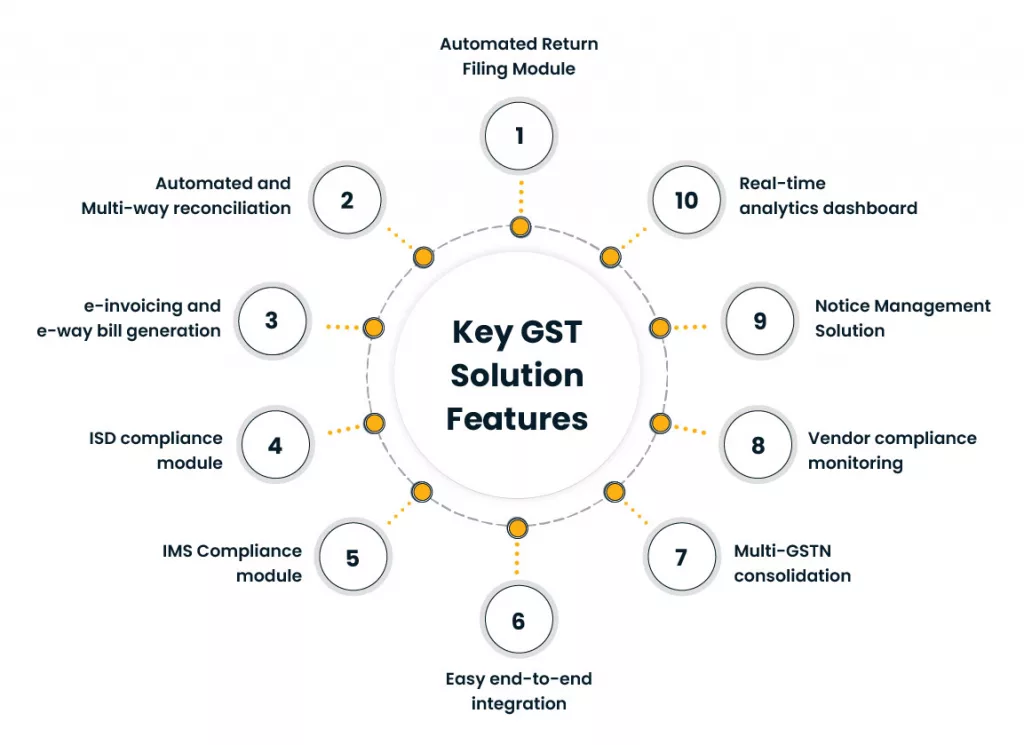

Key GST Solution Features

The key GST solution features businesses should consider are as follows:

Automated Return Filing Module

The GST software should auto-populate the verified data into various returns, such as GSTR-1, GSTR-3B, GSTR-6, GSTR-9/9C, and prepare and submit the return directly to the GSTN portal.

Automated and Multi-way reconciliation

The GST compliance software should provide AI/ML-based automated reconciliations, flagging mismatched data for human review. Further, it should also provide Multi-way reconciliations, including data from e-invoice, e-way bill, sales register, GSTR-1, GSTR-3B, GSTR-2B, purchase register, IMS, etc.

e-invoicing and e-way bill generation

The GST software should generate compliant e-invoices and report to the government with easy generation of Invoice Reference Numbers (IRN) and QR codes in real time, and automate e-way bill creation in a few clicks within the time limit imposed by the government. It should support bulk generation for high-volume transactions.

ISD compliance module

The GST compliance software should comply with ISD requirements, such as ISD invoice generation, ratio, and ITC calculation and distribution to respective units, and reporting in for GSTR-6 within time.

IMS Compliance module

The GST solution feature should have an advanced IMS module allowing bulk view and actions, including built-in reconciliation tools and real-time GSTR-2B previews, helping accurate ITC claims and reversals, and compliance with government IMS requirements.

Easy end-to-end integration

The GST compliance software should have compatibility to integrate seamlessly with any ERP or accounting software and other compliance software, enabling smooth data flow across platforms.

This eliminates silos, reduces manual data entry, and aligns GST compliance with existing business processes, ensuring operational efficiency.

Multi-GSTN consolidation

Manages multiple GSTINs under a single PAN, consolidating data for unified reporting, reconciliation, and compliance across branches or locations.

Vendor compliance monitoring

The GST compliance software should track vendor compliance and provide automated alerts and seamless communication for any queries and non-compliance. It should integrate with accounts payable to withhold payments for non-compliant vendors to reduce ITC risk, enhance vendor accountability, and help in informed decision-making.

Notice Management Solution

The GST software should have a dedicated GST litigation management solution that can retrieve notices, categorize them, use AI for notice analysis, and ensure timely submissions. GST litigation management software enables businesses to automate SCN handling, reply drafting, and case tracking.

Real-time analytics dashboard

Provides customizable dashboards with real-time insights into compliance status, tax liabilities, ITC claims, and financial metrics. It should generate detailed reports for CFOs and finance teams to make informed decisions.

This is a list of major features and their overview that any GST compliance software should have. However, what’s more important is a unified platform, or say a single source of truth, for end-to-end compliance requirements without juggling between different software and service providers.

Let’s see how we can evaluate a suitable GST software and service provider for GST compliance requirements.

Evaluation Tips for Choosing Ideal GST Software

Market reputation and expertise

Have a detailed research on the service provider’s credibility, recognitions, awards, client testimonials, years of experience in serving various sizes, market reach, etc, while selecting ideal GST compliance software.

Integration Methods

Learn about various integration methods, such as API and SFTP, for real-time data transfer and automation, and evaluate the type of integration method SP provides and ensure its compatibility with your EPR, accounting, and financial software.

Domain Expertise

Select the service provider having a suitable team of domain experts with deep knowledge and understanding of GST laws, amendments, industry-specific needs, and IT requirements. Evaluate SP’s partnership with CA firms and tax experts to stay updated on regulatory changes.

Updates & Security

Evaluate if SP offers regular security and compliance updates for data safety and alignment with GST law, respectively. Assess features like VAPT, secure API, and certificates such as ISO 27001 or data encryption standards, along with data backup and recovery mechanisms.

User-friendly interface

Select GST software with an intuitive design to minimize training and the learning curve. Test the interface before selection. Ensure clear navigation, minimum clicks for tasks, and accessibility on multiple devices such as mobiles and desktops.

User support and training

Evaluate GST software that provides 24*7 support over email, phone, or chatbots and has the ability to resolve technical issues promptly during deadlines. Check training resources like tutorials, webinars, or hands-on onboarding assistance for smooth onboarding.

Minimum Turnaround time

Evaluate GST software providing a streamlined process to reduce operational turnaround time with auto-population of returns, automated reconciliation, on-click e-invoice or e-way bill generation, bulk actions, minimum manual entries, real-time alerts, etc, to free up resources for core business activities.

Evaluate cost and ROI

Compare initial setup costs, subscription fees, and ongoing maintenance expenses with ROI by estimating time saved, penalties avoided, ITC claims, and hidden savings, such as reduced manual labor, lower compliance risks, and improved cash flow. Consider the pricing flexibility options that scale with your business size and needs.

Single source of truth

As stated above, the most important thing any SP should provide is a one-stop solution for the entire GST compliance requirements to ensure businesses don’t struggle with various software. Unified GST compliance software such as Cygnet Tax provides a single source of truth for all requirements.

Cloud-support

The GST compliance software should have cloud support for data storage, scalability, and security. It should provide a preference to choose private, public, or hybrid cloud based on specific business requirements.

How GST Compliance Software Helps

With Ideal GST compliance software, businesses can benefit in terms of

- Reduced operational and compliance costs.

- Time savings from compliance tasks.

- Optimized cash flow and working capital

- Audit logs and accurate records for audit-readiness.

- Strategic insights for better decision-making

- Regulatory confidence with evolving GST law.

- Enhanced data security and role-based access management.

How Cygnet can be the right choice for your GST compliance software?

Cygnet.One provides a unified and automated platform that handles everything from e-invoicing and e-way bill generation to GSTR filings, real-time reconciliation, ITC optimization, and audit preparedness all under one roof.

It is built for scale and integrates seamlessly with ERPs, supports high-volume transactions with security, and predictive analytics with CFO-ready dashboards. Cygnet.One transforms GST from a compliance chore into a strategic advantage.

Conclusion

Choosing the right GST compliance software turns a complex, time-consuming process into a strategic advantage, driving cost savings, efficiency, and regulatory confidence. By prioritizing key features like automation, integration, and real-time analytics, businesses can streamline compliance and focus on growth.