India has entered a new phase of indirect tax reform. As announced by the GST Council, from 22 September 2025, revised GST rates have come into effect. The goal is simplification, to reduce tax anomalies, to ease the burden on essentials, to help MSMEs, and to give relief to consumers.

Some key changes:

- The GST rate slabs have been narrowed down / rationalised. The focus is now on two main standard rates: 5% and 18%, and certain goods/services such as food, education items, household essentials, and medicines are moved to a NIL-rated or 5% rate slab.

- Some items moved into nil GST, including certain food staples (roti, paratha, paneer, khakhra, etc.), UHT milk, certain notebooks/exercise books, and life & health insurance policies.

- Others have had their rate increased (in a few cases), for example, clothing above certain value thresholds (above ₹2,500), etc.

- The revised rate structure does not change GST registration thresholds.

- Input Tax Credit (ITC) rules are preserved for purchases made before the change, provided the earlier rates were correctly paid.

- For supplies that straddle the date (advance payments, invoicing, etc.), “time of supply” rules will decide whether old or new rates apply.

Higher Rate @40%

- Rates on luxury goods and sin items, such as luxury cars, private aircraft, yachts, aerated drinks, tobacco, and pan masala, have increased to 40%.

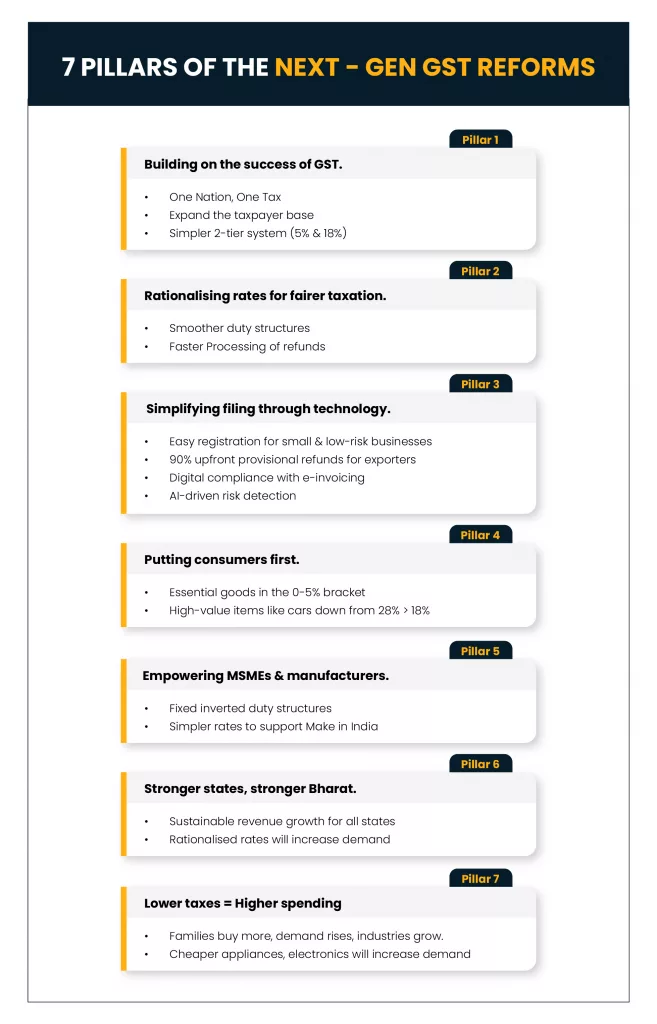

7 Pillars of Next-Gen GST reforms and how they impact consumers, Businesses and Macro Economics

How It Affects Consumers

- Affordable prices for many essentials and goods: Households and essentials such as several staple food items, dairy products, basics, and everyday items are now taxed at a Nil Rate or 5%. Consumers will see reduced GST components in bills. For example, items like roti, paneer, khakra, UHT milk, etc., are now more affordable.

- Higher rates on luxury items and other products: Items that had previously benefited from lower GST rates of 12% may see GST increases to 18%. For example, clothing over ₹2,500 has moved from 12% to 18%. Further, some luxury goods such as SUVs will hit 40% GST, making it more expensive.

- Simplified tax impact: With fewer slabs, GST is easier to understand for consumers; less confusion about what rate applies. This helps with transparency.

- Potential spillover to inflation: Price reductions in essential categories may help contain inflation or ease cost-of-living pressures. But items becoming dearer may press upward on inflation in specific sectors (higher value clothing, luxury goods, etc.).

- Behavioral changes in consumption: With changes in tax rates, consumers may shift their buying preferences: more spending on items that are now cheaper, more price sensitivity on items whose tax has increased. Substitution effects are expected (e.g., choosing a lower-taxed alternative).

Impact on Businesses

- Compliance simplification: Fewer slabs and less complexity in determining applicable GST rate can reduce compliance costs, legal/ accounting overheads, disputes, and misclassifications. GST compliance platforms allow MSMEs to handle invoicing, reconciliations, and filings more efficiently.

- Repricing & supply chain adjustments: Businesses will need to revise prices, update billing/invoicing, and possibly re-negotiate supply contracts. Products that moved to lower GST will see price cuts; for higher taxed items, the opposite.

- Inventory & accounting effects: Items stocked before the change but supplied after may have a different tax incidence. Care needed in accounting & inventory valuation. ITC on previous purchases remains, but for items now nil-rated, related ITC may need reversal.

- Impact on profit margins: Some sectors will benefit (those dealing largely in goods/services moved to lower rates), others will feel pressure (luxury, high-end clothing, premium non-essentials). Pricing strategy becomes important.

- Business planning & product mix: Businesses may reorient their product mix; more focus on lower-taxed essentials for volume; premium segments might be priced differently or repositioned.

- Effect on imports & exports: IGST on imports will follow the new rate structure unless specific exemptions exist. For exporters, cheaper input costs (if inputs moved to a lower rate or nil) may improve competitiveness.

Macro-Economic Implications

- Stimulus to demand: Lower taxes on many widely consumed goods increase disposable income, boosting consumption. This is expected to stimulate aggregate demand.

- Relief to lower and middle-income groups: Since essentials are taxed at a lower / Nil Rate, households spending a greater share on such items will feel more benefit. This helps reduce regressivity.

- MSME and manufacturing boost: Reduced cost of inputs, lower compliance burdens, and clearer rate structure will benefit small businesses and manufacturers, potentially increasing production and investment.

- Inflation control: By lowering tax on essential items, inflation pressures may ease. But some upward pressure remains from items whose GST increased. Overall net effect likely to be disinflationary, or at least less inflationary, depending on how businesses adjust prices.

- Revenue implications for government: Short-term revenue loss in sectors moving to lower rates / Nil rates. But that may be partly offset by increased volume of consumption and lower tax evasion due to a simpler structure. Over time, it may even lead to better compliance and stable revenue streams.

- Encouragement for Swadeshi / domestic supply: Lower GST on domestic manufacturing inputs may make local goods more competitive vs imports. This aligns with the Atmanirbhar Bharat goals.

- Effect on inflationary expectations & monetary policy: With expected easing in consumer inflation owing to rate cuts, this may give the Reserve Bank of India more room in monetary policy (if inflation is under control).

Challenges & Things to Watch

- Transitional issues: Businesses will need to manage the changeover; invoicing, stock, pricing, and IT systems need updates. Mistakes may lead to compliance risk. GST compliance management software streamlines invoicing updates and helps businesses stay audit-ready during transitions.

- Awareness: Consumers must be made aware of which items got cheaper/higher tax; otherwise, expectations may lead to dissatisfaction.

- Implementation delays: For some items, the effective date of the new rate is subject to conditions (e.g., compensation cess, etc.). The Times of India

- Cost passthrough: Whether businesses reduce consumer prices fully in line with GST reductions depends on competitive dynamics, input costs, etc. Sometimes, businesses might retain margins.

GST Reforms 2025: Overview of major rate changes

| Sector | Category | Previous Rate | New Rate | Remarks / Impact |

| Food and household sector | Indian breads (roti, khakhra, paratha), labelled Cheena or paneer | 5% | Nil | Major relief for households and Everyday essentials products |

| UHT milk & buttermilk | 5% | Nil | ||

| Pre-packed namkeens, Bhujia, sauce, chocolates, pasta, coffee, preserved Meat | 18-12% | 5% | ||

| Household goods (soap, shampoo, bicycles, toothpaste, toothbrush, tableware) | 18% | 5% | ||

| Consumer durables (TVs- LED/LCD> 32’, ACs, Dishwashers) | 28% | 18% | ||

| Education sector | Exercise books, notebooks, erasers, pencils, crayons, and sharpeners | 12% | Nil | Relief for students & education |

| Geometry boxes, school cartons, trays | 12% | 5% | ||

| Health and life insurance | Life & health insurance premiums | 18% | Nil | Expands insurance affordability & penetration |

| Service Sector | Hotel stays up to ₹7,500/day | 12% | 5% | Affordable access to wellness and hospitality |

| Gyms, salons, barbers, yoga | 18% | 5% | ||

| Apparel and textile | Textiles & garments ≤ ₹2,500 | 12% | 5% | Affordable clothing improves the competitiveness of the textile industry in exports and corrects the inverted duty structure. |

| Textiles- manmade fibre | 18% | 5% | ||

| Textile- Manmade Yarn | 12% | 5% | ||

| Toys and handicrafts | Handicraft idols, statues, Paintings, sculptures, Wooden/Metal/textile dolls & toys | 12% | 5% | Promote rural economic growth, support artisan livelihoods, and preserve Indian cultural heritage. |

| Footwear sector | Footwear ≤ ₹,2500 | 12% | 5% | Affordable footwear cheaper |

| Automobile Sector | Small passenger cars, two-wheelers less than or equal to 350 CC | 28% | 18% | Affordable car and two-wheeler segment boost Push for sustainable transport |

| Buses, trucks, three-wheelers, and all auto parts | 28% | 18% | ||

| Home building and materials | Cement | 28% | 18% | Making Housing projects/ ownership affordable |

| Marble, Granite blocks, sand-lime bricks, Bamboo flooring, packing cases, and pallets | 12% | 5% | ||

| Medical Sector | Life-saving drugs, diagnostic kits, and other medicines such as Ayurveda, Unani, and Homeopathy | 12% | Nil | Affordable medical treatments and life-saving drugs for better treatment of the lower/middle class |

| Spectacles and corrective goggles | 28% | 5% | ||

| Medical oxygen, surgical instruments, and thermometers. | 12-18% | 5% | ||

| Dental, Medical, and Veterinary Devices | 18% | 5% |

Conclusion: A New GST Era

The reforms mark a significant step in tax policy in India, streamlining GST, reducing slab complexity, easing the burden on essentials, and making the system more equitable.

For consumers, especially in lower/middle-income brackets, the reforms bring welcome relief. For businesses, while there are costs in adjustment, the long-term benefits in transparency, reduced compliance overhead, and predictable tax liabilities are substantial. Economically, this can push up consumption, temper inflation, and spur investment, especially in local manufacturing and MSMEs.

India’s GST 2.0 isn’t just a tax tweak; it’s a structural move aimed at reinforcing growth, fairness, and simplicity. If well implemented, it could be a turning point in how everyday economic life works: more affordable, more inclusive, more efficient.