The filing of GSTR-9 for FY 2023-24 is approaching on 31 December 2024, and the major concern for any business organization is clarity on rules and amendments. Any misinterpretation of the law, misrepresentation, or non-accurate disclosure of information in the annual return may lead to unnecessary penalties, fines, and notices.

To avoid such circumstances, the GST council comes out with different clarifications and advisories as a GSTR-9 filing guide for businesses to file annual returns accurately and on time. Here is one such advisory by the GST department explaining various issues and its reporting in GSTR-9 for the value difference in Tables 8A and 8C of the Annual return.

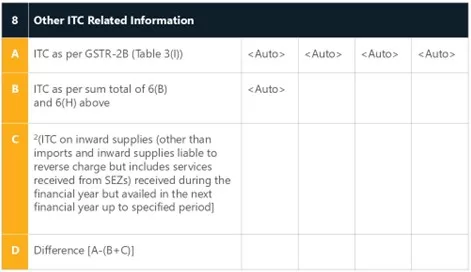

Before diving into the scenarios let’s understand what is Tables 8A and 8C of GSTR-9 to get better clarity on the reason for the value difference in Table 8A and 8C of Annual return.

Table 8A of GSTR-9 – “ITC as per GSTR-2A/2B”

Table 8A of GSTR-9 is an auto-populated field showing the total ITC available for the businesses during the relevant financial year extracted from tables 3 and 5 of GSTR-2A. Since the data is auto-populated the same cannot be edited or changed by the taxpayers.

However, as per the Notification No 12/2024 Central Tax dated 10th July 2024 read with Notification No.20/2024-Central Tax Dated 8th October 2024, for FY 2023-24 onwards, the total credit available for inwards supplies shall be auto-populated in the table 8A of GSTR 9 from table 3(I) of GSTR-2B of the FY 23-24.

ITC included

- All inward supplies (excluding any exceptions)

- Supplies received from e-commerce operators

- Services received from SEZ

ITC Excluded

- Inward supplier liable to reverse charge

- Import transactions

Table 8C of GSTR-9 – “ITC received during the year but availed in next financial year up to specified period”

Table 8C of GSTR-9 requires manual reporting of ITC on inward supply or purchases received during the financial year but availed during the next financial year till the specified date as per section 16(4) of CGST act i.e. 30th November of the subsequent financial year. For FY 23-24, the deadline is 30-11-2024.

For instance, if the inward supply is made between April 2023 to March 2024 but ITC for the same is availed after FY 23-24 i.e. between 1st April 2024 to 30th November 2024 for the same invoice then the reporting of the same will fall under Table 8C of GSTR-9.

ITC included

- All inward supplies (excluding any exceptions)

- Services received from SEZ

ITC Excluded

- Inward supplier liable to reverse charge

- Import transactions.

Issues for value difference in Table 8A and 8C and its reporting

Issue-1

How to report an invoice dated FY 2023-24 in GSTR-9 when the supplier reported it in GSTR-1 after the March 2024 due date, causing it to reflect in the next year’s GSTR-2B, as a result, the amount is not auto-populated in Table 8A of GSTR-9 for FY 2023-24?

Reporting- Taxpayer shall report such ITC in Table 8C and Table 13 as this is the ITC of FY 2023-24. This is in line with the instructions in Table 8C and Table 13 of GSTR 9.

For Instance, An invoice dated 05-02-2024 is reported in GSTR-1 of May 2024 month the said invoice will be reflected in GSTR-2B of FY 2024-25 instead of FY 2023-24 and thereby it will not be auto-populated in Table 8A of GSTR-9 of FY 2023-24 in such case the amount of ITC shall be manually reported in Table 8C and Table 13 “ITC availed for the previous financial year” of GSTR-9. Now if the invoice is reported in GSTR-1 of March 2024 which is filed in 10th April then the said value shall get auto-populated in Table 8A of GSTR-9

Issue-2

How to report an invoice from FY 2023-24 in GSTR-9, where the ITC was claimed and later reversed in the same year due to non-payment within 180 days, but the ITC will be reclaimed in FY 2024-25 after payment to the supplier?

Reporting– This reclaimed ITC shall be reported in Table 6H (Amount of ITC reclaimed (other than B above) under the provisions of the Act) of GSTR 9 for FY 24-25 and hence not in Table 8C and Table 13 of GSTR 9 for FY 2023-24. This is in line with the Instructions to Table 13 given in the Notified Form GSTR 9. Similar reporting is applicable for the ITC reclaimed as per Rule 37A where the vendor fails to pay tax in GSTR-3B.

For instance, ITC was claimed in June 2023 and reversed in November 2023 due to non-payment to the supplier and was reclaimed on July 2024 then the said value shall be reported in Table 6H of GSTR-9 of FY 24-25. Now suppose the same was reclaimed in March 2024 then the value shall be reported in Table 6H of GSTR-9 of FY 23-24.

Issue-3

How to report an invoice from FY 2023-24 in GSTR-9, where ITC was claimed in Table 4A(5) (All Other ITC) of GSTR-3B but reversed in Table 4B(2) (Others) due to non-receipt of goods, and the ITC will be reclaimed in FY 2024-25 till 30th November 2024 as per Circular 170 guidelines?

Reporting- Taxpayer shall report such reclaimed ITC in Table 8C and Table 13 as this is the ITC of FY 2023-24.

For Instance, If the ITC is claimed in GSTR-3B of January 2024 but reversed in February 2024 due to non-receipt of goods then reclaimed in June 2024 such value shall be reported in Table 8C and Table 13 as this is the ITC of FY 2023-24.

Issue-4

How to report an invoice from FY 2022-23 in GSTR-9 of FY 2023-24, when it appears in Table 8A because the supplier reported it in GSTR-1 after the March 2023 due date?

Reporting- This is the ITC of last year (2022-23) and was auto-populated in table 8A of GSTR-9 of FY 22-23. Hence, the aforesaid value need not be reported in Table 8C and Table 13 of GSTR-9 for FY 23-24. This is in line with instruction no 2A given for the notified form GSTR 9 which states that Tables 4, 5, 6, and Table 7 should have the details of the current FY only.

For instance, an invoice of January 2023 is reported in GSTR-1 of May 2024 resulting in a reflection of the same in Table 8A of GSTR-9 of FY 2023-24 therefore in such case value need not be reported in Table 8C and Table 13 of GSTR-9 for FY 23-24.

Issue-5

Where to report the reclaim of ITC for an Invoice that belongs to FY 2023-24, and which is claimed, reversed, and reclaimed in the same year?

Reporting- As already clarified by the CBIC press release on 3rd July 2019, It may be noted that the label in Table 6H clearly states that the information declared in Table 6H is exclusive of Table 6B. Therefore, information on such input tax credit is to be declared in one of the rows only.

Further, as the claim and reclaim are reported only in one row therefore the same should not be reported in the reversal under table 7 of GSTR 9 of FY 23-24.

For Instance, if an invoice reported in May 2023 is reversed in June 2023 and was again reclaimed in December 2023 then it should be reported in either table 6H or 6B, only in one row and it should not be reported in table 7 (Details of ITC Reversed and Ineligible ITC for the financial year) of GSTR-9 of FY 23-24.

Conclusion

In conclusion, businesses need to carefully follow the guidelines provided for the accurate reporting of ITC in GSTR-9 to avoid penalties, fines, or notices. By understanding the correct reporting mechanisms for each issue, businesses can ensure GST return filing in compliance with laws. Properly classifying and reporting reclaimed ITC, whether in the same year or the next, is crucial to avoid errors. Following the specific instructions for each table ensures accurate and timely filing of the annual return.