Introduction

VAT penalties are administrative and financial sanctions imposed by tax authorities on businesses or taxpayers failing to comply with VAT regulations, disrupting the company’s financial position and market reputation. These can affect business operations, cause poor credit, making them ineligible for future financial aid, and create trust issues among stakeholders.

VAT penalties can be levied due to various non-compliance reasons like late registration, late filing of VAT returns, late payment of VAT liabilities, incorrect claim of input tax, non-reply to notices, breach of any other regulation, etc.

To ensure compliance with VAT regulations and avoid penalties, companies should know VAT law, penalties, and their impact on the company. This guide is for UK small business owners handling company regulatory requirements, finance teams, accountants, and tax heads to understand UK VAT penalties better.

Understanding VAT Penalties in the UK

What triggers VAT penalties?

UK VAT penalties are triggered by the following reasons, as sampled below:

- Late registration under VAT

- Non-filing or late filing of VAT returns

- Non-payment or late payment of the VAT amount

- Non-compliance with record-keeping requirements

- Incorrect VAT rate charging

- Incorrect filing of VAT returns

- Incorrect or ineligible VAT claim on inputs.

These are just a few examples that can attract UK VAT penalties; however, businesses must thoroughly gain knowledge of the UK VAT compliance requirements to avoid penalties.

Type of VAT penalties and how HMRC calculates penalties

HMRC has several penalties for VAT non-compliance in the UK. Below is a detailed explanation of the main penalty types and their calculation:

- For Late registration

Penalty is calculated based on the percentage of VAT due from the date the business should have registered till registration. The threshold of the minimum penalty is £50.

| Delay in registration | Percentage penalty |

| Not more than 9 months | 5% |

| More than 9 months but less than 18 months | 10% |

| More than 18 months | 15% |

- For Late filing of VAT returns

For each late submission of return, businesses will receive penalty points, and upon reaching the penalty points threshold, companies will be liable for a £200 penalty and receive a further penalty of £200 for each subsequent late submission.

The penalty point threshold based on the accounting period is as follows

| Accounting period | Penalty point threshold |

| Annually | 2 |

| Quarterly | 4 |

| Monthly | 5 |

Penalty points on reaching thresholds

It will not automatically expire on reaching the threshold; businesses must meet VAT filing requirements by submitting all returns before deadlines and any other previous returns for the last 24 months continuously for the prescribed period before the points get reset:

| Accounting period | Period of compliance | Total returns to file |

| Annual | 24 months | 2 |

| Quarterly | 12 months | 4 |

| Monthly | 6 months | 6 |

Individual penalty points not reaching the threshold

If the business doesn’t reach the threshold, the penalty points will expire depending on the due date of return

If the deadline for your return was:

- not the last day of a month — a penalty point expires on the last day of the month, 24 months after this

- The last day of a month — a penalty point expires on the last day of the month, 25 months after this

- For late payment of the VAT amount

- Payment overdue for less than 15 days – No penalty

- Payment overdue for 16 to 30 days – First penalty of a fixed rate of 2% on VAT due.

- Payment overdue for 31 days or more- First penalty of fixed rate of 2% on VAT due on day 15, plus 2% for outstanding VAT on day 30. In total, 4% of the penalty

From day 31, the business will pay a second penalty daily, calculated @ 4% per annum for the outstanding amount.

Interest on overdue VAT or overpaid VAT

Late payment Interest to be paid- At the base rate of the Bank of England plus 2.5%

HMRC pays interest on overpaid VAT- At the base rate minus 1% with a minimum rate of 0.5%

- Penalties on Inaccuracies

Penalties imposed for VAT errors resulting in a loss to HMRC’s revenue are as follows.

| Nature of Penalty | Unprompted disclosure | Prompted Disclosure |

| Careless error | 0-30% | 15-30% |

| Deliberate error | 30-70% | 35-70% |

| Deliberate and concealed error | 70-100% | 50-100% |

The penalty is a percentage of the Potential lost revenue (PLR). PLR is the amount that arises as:

- a result of correcting an inaccuracy in a return or document

- an incorrect repayment

- an incorrect claim

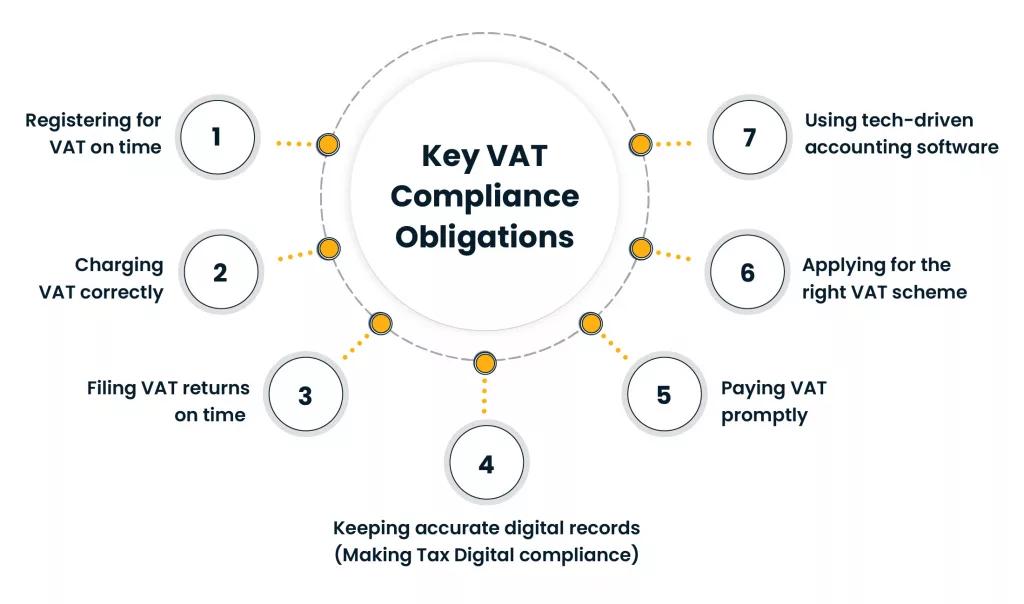

Key VAT Compliance Obligations

- Registering for VAT on time: Businesses have to compulsorily register for VAT if their taxable turnover for the last 12 months exceeds or is likely to exceed £90000 in the next 30 days. Businesses have to register within 30 days of exceeding or likely to exceed the threshold to avoid penalties based on delay.

- Charging VAT correctly: The standard rate of VAT is 20%, and the reduced rate is 5% or a zero rate per VAT regulations. Penalties of VAY errors can range from 15-30% of the value of VAT errors. Businesses must ensure no misclassification or error in charging applicable rates to avoid penalties.

- Filing VAT returns on time: Taxpayers have to file VAT returns monthly or quarterly on or before the completion of 1 month and 7 days from the end of the reporting period.

Taxpayers can receive penalty points for non-filing or late returns on the due date. Upon reaching the penalty point threshold, the business will be liable for a £200 fine, and after this, an additional penalty of £200 for every missed filing deadline.

- Keeping accurate digital records (Making Tax Digital compliance): Under Making Tax Digital (MTD), businesses must maintain digital VAT records for at least 6 years or 10 years if the business uses the VAT OSS scheme or the VAT MOSS scheme to avoid fines of up to £400 per return.

- Paying VAT promptly: Businesses must pay the VAT amount by the same deadline as the return to avoid penalties and interest as stated above.

- Applying for the right VAT scheme: Businesses should evaluate and select a suitable VAT scheme, such as Flat Rate Scheme, standard accounting, Cash accounting, Annual accounting, or a specific scheme for retailers or second-hand product dealers, etc., based on turnover, cost structure, and administrative capacity.

The type of VAT scheme has different eligibility criteria and requirements; therefore, selecting the proper scheme is important as it can directly impact VAT calculations, cash flow, and compliance.

- Using tech-driven accounting software: Businesses should use tech-driven accounting software for their VAT compliance. Accounting software automates VAT calculations, reconciliations, invoicing, expense categorization, data validation, tracks transactions, and ensures seamless integration with HMRC’s system.

Businesses must select software that aligns with their business operation, VAT scheme, and requirements. Software supporting automated data flow, regular updates as per HMRC compliance, and secured cloud storage can be beneficial.

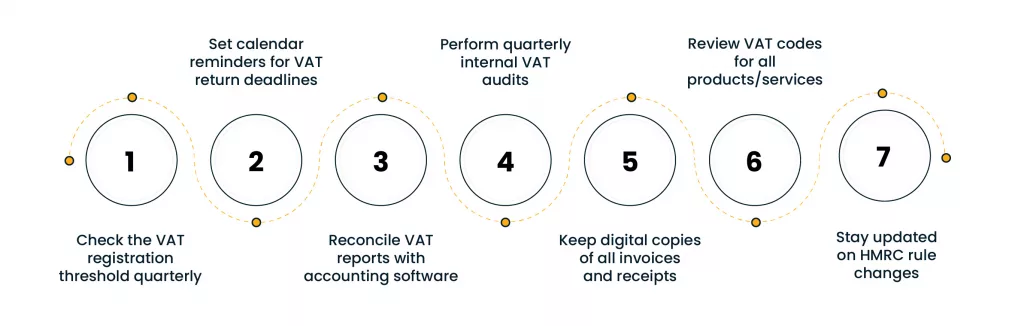

Your VAT Compliance Checklist

The VAT checklist UK for your compliance requirement is as follows:

Check the VAT registration threshold quarterly

- Quarterly, check the VAT registration threshold of £90000 to ensure it is not exceeding or likely to exceed the threshold.

- Apply for registration within 30 days to avoid penalties on the VAT due for the unregistered period.

- Use accounting tools that facilitate taxable turnover checks and set an alert for nearing the threshold, ensuring proactive monitoring.

Set calendar reminders for VAT return deadlines

- Businesses have to file a VAT return before the deadline to avoid penalty points and interest.

- Companies should use suitable accounting software to set calendar reminders for deadlines and get notified well in advance to get proper time to prepare and review returns before submission accurately.

Reconcile VAT reports with accounting software

- Businesses should reconcile VAT returns with inward and outward invoices, bank records, VAT liabilities paid, sales, purchases, expenses, etc.

- Companies can integrate MTD compliant accounting software to automate reconciliation and VAT calculation, avoiding manual errors and saving time.

- Accounting software can flag discrepancies such as mismatched data for human intervention.

- Regularly perform reconciliations to ensure HMRC audit readiness to avoid compliance risk and penalties.

Perform quarterly internal VAT audits

- Businesses should conduct an Internal VAT audit on a quarterly basis.

- A VAT checklist should be prepared to cover all compliance checks.

- The checklist should cover VAT rate checks, VAT calculations, correct invoicing, evaluation of VAT returns and reconciliation, and verification of compliance with MTD requirements.

- Use audit software for automated checking, reconciliations, and transactions.

- Consider consulting an expert for complex cases to ensure full compliance with HMRC regulations.

- Prepare audit report, evaluate errors and findings, and ensure any non-compliance is corrected along with interest or penalty payments.

- Ensure proper documentation of audit report, findings, and compliance rectification.

Keep digital copies of all invoices and receipts

- MTD rules require businesses to store all records, including receipts and invoices, for at least six years.

- Companies should choose accounting software that supports MTD and VAT requirements of digital record maintenance to avoid penalties

- Storing digital copies with cloud-based software ensures files stay secure and can be retrieved during an HMRC audit and assessment.

- Sort records by date and type, such as purchases or sales, to make data retrieval faster.

- Back up all data to avoid losing information. Include details like VAT numbers and correct tax rates on all invoices to avoid non-compliance risk

Review VAT codes for all products/services

- Businesses should review VAT codes of all products and services supplied regularly and ensure their alignment with HMRC’s classification of 20%, 5%, zero-rated, or exempt.

- Misclassification of products or services, such as treating a taxable item as exempt, can lead to penalties and interest.

- Use accounting tools that facilitate automated classification and verification of each product or service code.

- Stay updated with any rate changes and apply the revised rate to avoid penalties.

- Consult VAT code classification experts in complex cases to maintain compliance.

Stay updated on HMRC rule changes

- HMRC often updates VAT rules. These updates might include thresholds, schemes, or MTD rules. Updates like these can alter compliance requirements, and non-compliance can lead to penalties.

- Check HMRC’s VAT notices, such as Notice 700 for general VAT rules, and Notice 700/21 for MTD on the GOV.UK website, and subscribe to HMRC’s email for real-time updates.

- Join industry forums or consult with a tax advisor regarding any queries related to the new rules.

- Businesses should ensure their accounting software is updated based on amendments and updates from HMRC.

Tools and Resources for Staying Compliant

VAT compliance can be ensured by integrating ideal accounting tools, HMRC VAT notices clarity, HMRC VAT helplines, and collaboration with experts for correct advice.

Various accounting tools such as Xero, QuickBooks, Freebook, Zoho Books, FreeAgent, etc., support MTD requirements, enabling digital VAT returns submission to HMRC, providing automated VAT calculations, Invoicing, bank reconciliations, expense tracking, cloud facilities, seamless integration capabilities, timely reporting, etc.

Businesses can also gain knowledge through VAT notices, HMRC help, video, webinars, support email update services, make VAT-related inquiries to the HMRC via HMRC digital assistance, and various other services, such as phone calls.

What to Do If You Get a VAT Penalty

Request a review or appeal to the tribunal

If you believe that the VAT penalties charged are unfair or incorrect, the business may challenge it through the review process or appeal to the tribunal:

Request a review

- HMRC offers a review of the penalty decision letter.

- Companies must contact HMRC within 30 days to accept the review offer or appeal to the tax tribunal.

- Review takes approx. 45 days.

- After review completion, the officer may:

- Uphold or vary the decision (the taxpayer can agree and pay)

- Cancel the decision (nothing is required to be paid)

- If taxpayers disagree with the decision, they may appeal to the tax tribunal within 30 days of the date on the review result letter.

Reasonable excuse examples

A reasonable excuse is something that stopped you from meeting a tax obligation for a valid reason, for example:

- Your partner or another close relative died shortly before the tax return or payment deadline

- You had an unexpected stay in the hospital that prevented you from dealing with your tax affairs

- You had a serious or life-threatening illness

- Your computer or software failed while you were preparing your online return

- Issues with HMRC online services

- A fire, flood, or theft prevented you from completing your tax return

- Postal delays that you could not have predicted

- delays related to a disability or mental illness you have

- You were unaware of or misunderstood your legal obligation

- You relied on someone else to send your return, and they did not

The following will not be accepted as a reasonable excuse:

- Your cheque bounced or payment failed because you did not have enough money

- You found the HMRC online system too difficult to use

- You did not get a reminder from HMRC

- You made a mistake on your tax return

Seeking professional help

For complex penalties or large sums of VAT due or deliberate errors, professional assistance from VAT experts and Tax advisors who specialize in VAT compliance and appeals is required. They offer tailored advice and negotiation with HMRC.

Call HMRC’s VAT Helpline at 0300 200 3700 for straightforward queries or use the online chat via GOV.UK. While free, this is less effective for complex disputes.

Conclusion

To avoid costly penalties, interest, and reputational damage, proactive VAT compliance is essential for UK businesses. Businesses can minimize risks by adhering to key obligations like timely registration, accurate filings, prompt payments, and digital recordkeeping.

Regularly using MTD-compliant tools, staying updated on HMRC regulations, and conducting internal audits ensures financial stability and trust with stakeholders. Taking swift action, such as appealing penalties with reasonable excuses or seeking professional help, can mitigate issues, keeping your business compliant and penalty-free.