Today’s consumers are educated and intelligent; customer loyalty has decreased widely in banks. They approach indefinite lenders offering the best interest rate and loan amount. Hence, a person’s bank account could be a one in a different bank from which he has applied for the loan. Banks need to assess their bank statements before considering a loan. Almost 95% of banks use bank statement analysis software to avoid the manual hustle and save person-hours.

The challenges faced by the banking industry in virtue of the absence of automated bank statement analysis are the prospects applying for loan have their existing bank accounts in diversified banks. The current system needs to be fed with a bank name basis which will extract information of bank statement format, which can be termed partially automated bank statement analysis. Also, the extraction capabilities are poor, which leads to data loss and further reporting discrepancies. There is an over-burden of information shared which creates hassle-led experiences for the end-user. All of these lead to poor decisions and disbursal of incompetent credit lending.

Essential Information captured from bank statements

Bank statements are usually the first document that helps us peek into the financials of a potential borrower is the bank statement. The bank statement gives us all the validated financial transactions made to or by our borrower. This gives us the exact information of the borrower’s cash flow and helps summarize inflows and outflows to provide an overview of the financial health of individuals, such as

- What is the average balance that the borrower maintains?

- How much do they earn?

- What is their expenditure?

- How many cheques were submitted that bounced?

- What EMIs are they paying on a regular basis?

While we may get answers to the above from the analysis of the bank statement, the information obtained just highlights a few parts of the overall picture. We do not know many things, such as

- How many EMIs does the borrower have?

- Are they paying off the entire due payment in credit cards?

- Have any of the previous loans been written off?

- Is the salary received inclusive of one-time bonus or other payments?

- Does the income tax return confirm the stated income?

- In case of businesses, does the stated turnover match with GST returns and are the taxes being actually paid on such turnover?

To get a definitive answer, we need more vantage points while analyzing bank statements.

Smart OCR technology for automated bank statement analysis

Accurate bank statement analysis tools can they reduce your turnover time by a drastic amount, generate custom reports and ensure the best ROI by lessening the fraud chances. Bank statement analyzer software generally functions on Artificial Intelligence and Machine Learning-based algorithms driven by a self-learning approach to enhance the model accuracy. Smart OCR can extract data from scanned documents, PDF, or paper-based hardcopies. Collectively, the scattered pieces of technology help you ease your lending marvel.

Automated bank statement analysis reduces the mundane manual process. It enhances overall efficiency with faster processing times. Banking companies and NBFCs consider the financial history of borrowers during credit assessments, and bank statement analysis software plays an integral part. We will discuss what bank statement analysis can help achieve and what to look for when choosing these software solutions.

Key parameters to consider automating your bank statement analysis

While looking at the bank statement analysis software, the key considerations should be the integration of the tool across different banking platforms and superior data ingestion and ERP integration capabilities. Besides, for the software to be able to flag risk-based parameters, it should be able to identify the patterns in the transactions, such as circular transactions and build a risk profile out of it.

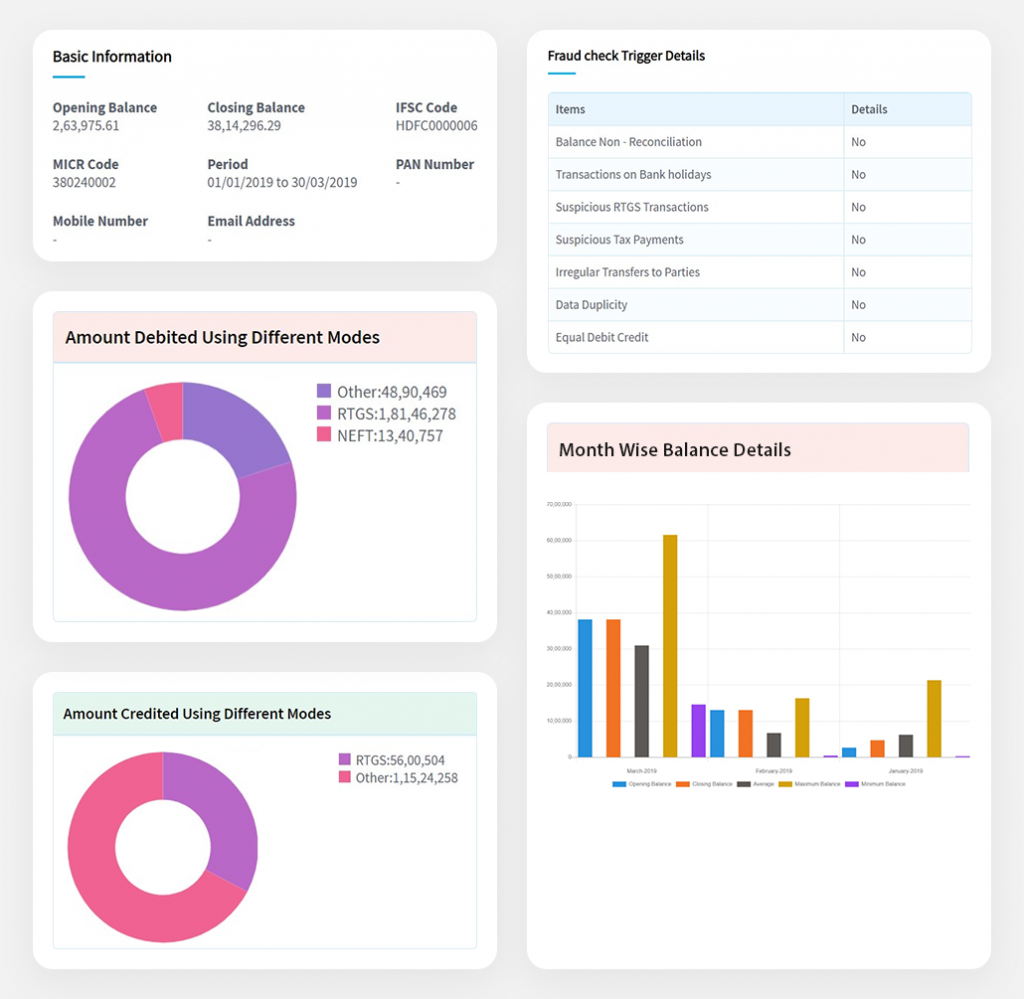

Leading bank statement analyzer software provides the following data based on the analysis of the bank statements:

- Insights about creditworthiness of the potential borrower: The major source of revenue for the banking and finance companies comes in the form of interest on the lending done by them. In case the borrower is unable to pay back the principal or defaults in payment of interest, it adversely affects the profitability of these companies. Bank statement analysis can flag such potential high-risk borrowers who may not have regular sources to service the debt and helps in taking more informed decision based on the risk profile derived from the analysis.

- Insights on the day to day financial transactions: The analysis of the transactions can also flag the cases such as high cash deposits and withdrawals, negative account balance, crossing overdraft limits, bounced cheques that may need further analysis before making a lending decision. AI in bank statement analysis can help to segregate such transactions from routine and reoccurring transactions to give an overview of the financial health of the borrower.

- Identifying banking patterns of customers: Analysis of the bank statements can provide insights on the banking patterns of the potential borrower and can predict deposits and withdrawals as well as monthly income and expenses to an extent to identify who might take longer to pay back.

- Identify discretionary spending power: Discretionary expenses, as against financial expenses, are those that customer can choose to reduce or eliminate. The analysis of the bank statements provides an insight into the discretionary spending done during the period and helps in analyzing the loan application with the regard to the purpose for which it is applied.

- Realtime decision making capabilities: The bank statement analyzer can combine the data from multiple bank statements, identify recurring transactions and the patterns to forecast the inflow and outflow of funds, and balance at a given time to give an overview of the overall financial health of the potential borrower.

- Identification of incorrect bank statements: The analyzers often reads the meta data contained in the financial statements to identify the format of the data. However, this can also be helpful for identifying the forged or manipulated bank statements for the purpose of availing the loans.

- Frauds or irregular transactions: Some of the leading analyzer software also have inbuilt logics to flag irregular transactions, such as in-bank transactions on bank holidays or sudden inflow of funds during the credit evaluation period. Such software can also conduct behavioral analysis to identify change in behavior between the two periods, and make forecast on the basis of the same, such as pre-pandemic and post-pandemic earnings and spending.

Cygnet’s Bank statement analyzer is one such software that can automatically classify the document resemblance based on type. It has capabilities of OCR-based extraction supported by AI/ML model helping to autodetect bank name, generate a consolidated report by merging multiple statements, high-performance analytical engine can derive business income from multiple bank accounts. The engine negates internal and self-transfers within the company to derive actual business credits. With income verification from bank statements, we can identify the regular customers of the company and showcase payment patterns of the customers. It can inspect varied statements with various data points and validations to ensure the authenticity of data values for ensuring data accuracy.