Trusted by one of the Big4 Consultancy firm

Seamless Financial Statement Analysis

Cygnet’s financial statement analyzer offers detailed insights by examining balance sheets and income statements, validating diverse terminologies and mapping as per dictionary standards with IDP/AI -OCR-based data extraction capabilities.

Parameters obtained with automated Financial Statement Analysis

Financial Performance

Liquidity information

Profitability

Efficiency ratio – Asset

Solvency ratio

Operating cash flow

ROI

Margin statement

Supplier concentration

Balance sheet

P&L details

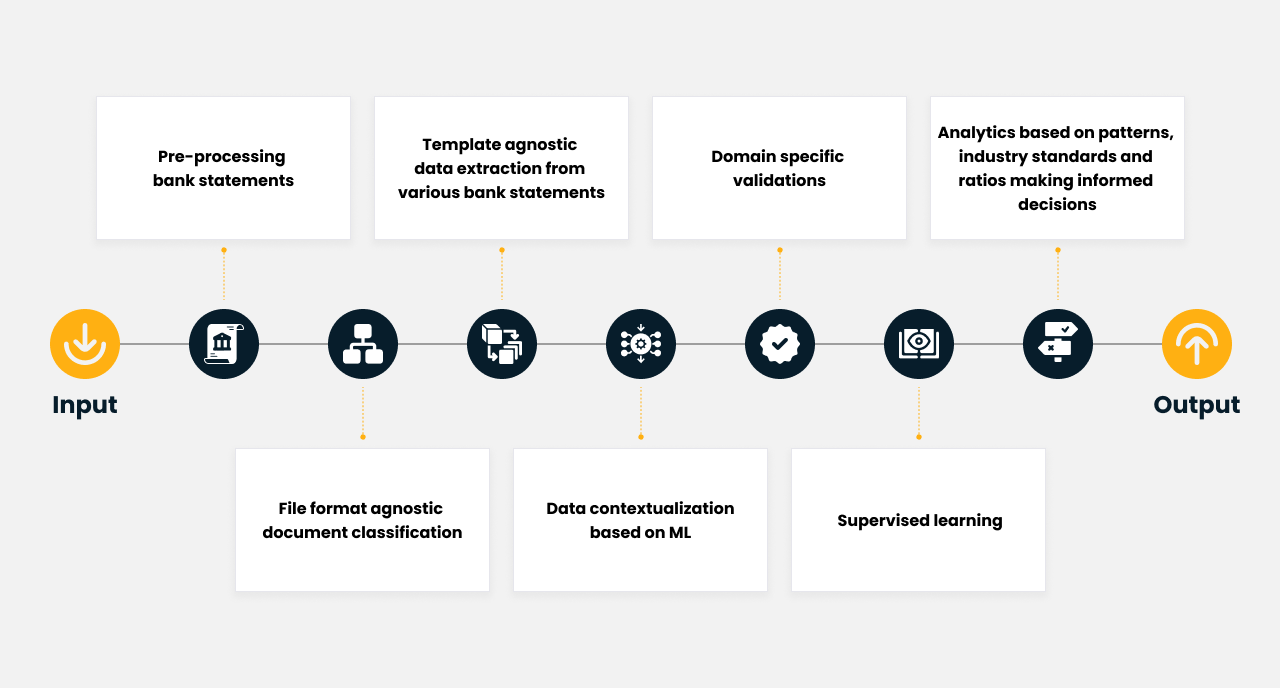

Automation at ease with Bank Statement Analysis

AI-driven bank statement analysis simplifies financial processes by enhancing efficiency, accuracy, and speed. It automates data extraction from various formats, categorizes transactions, and accelerates loan approvals, significantly reducing manual effort and errors. An ML-trained financial statement processor also strengthens fraud detection, offers detailed financial evaluations with customized reports, and enables precise customer categorization and risk analysis. Leveraging AI-driven bank statement analysis boosts competitiveness and meets customer needs in a secure, efficient financial ecosystem.

Tech Fact

Increase your employee productivity by 75% and reduce corporate risk profiling Turnaround Time from 4 to 1 man-hour with Financial Statement Analysis. Trained to understand the accounting rules, our engine can easily read and interpret financial statements.

Learn more about FSA with a success story

FAQ’s

Cygnet’s Financial Statement Analyzer is an AI-driven solution that processes financial statements from various formats, offering in-depth insights into balance sheets, income statements, and other financial documents. The platform uses intelligent document processing (IDP) and AI-OCR technology to streamline financial analysis for credit ratings, audits, compliance, and risk assessments.

Our platform is template-agnostic, meaning it can process various formats and structures of financial statements without requiring a predefined layout. The system reads and interprets the statements, extracting key data points using machine learning and advanced image processing techniques.

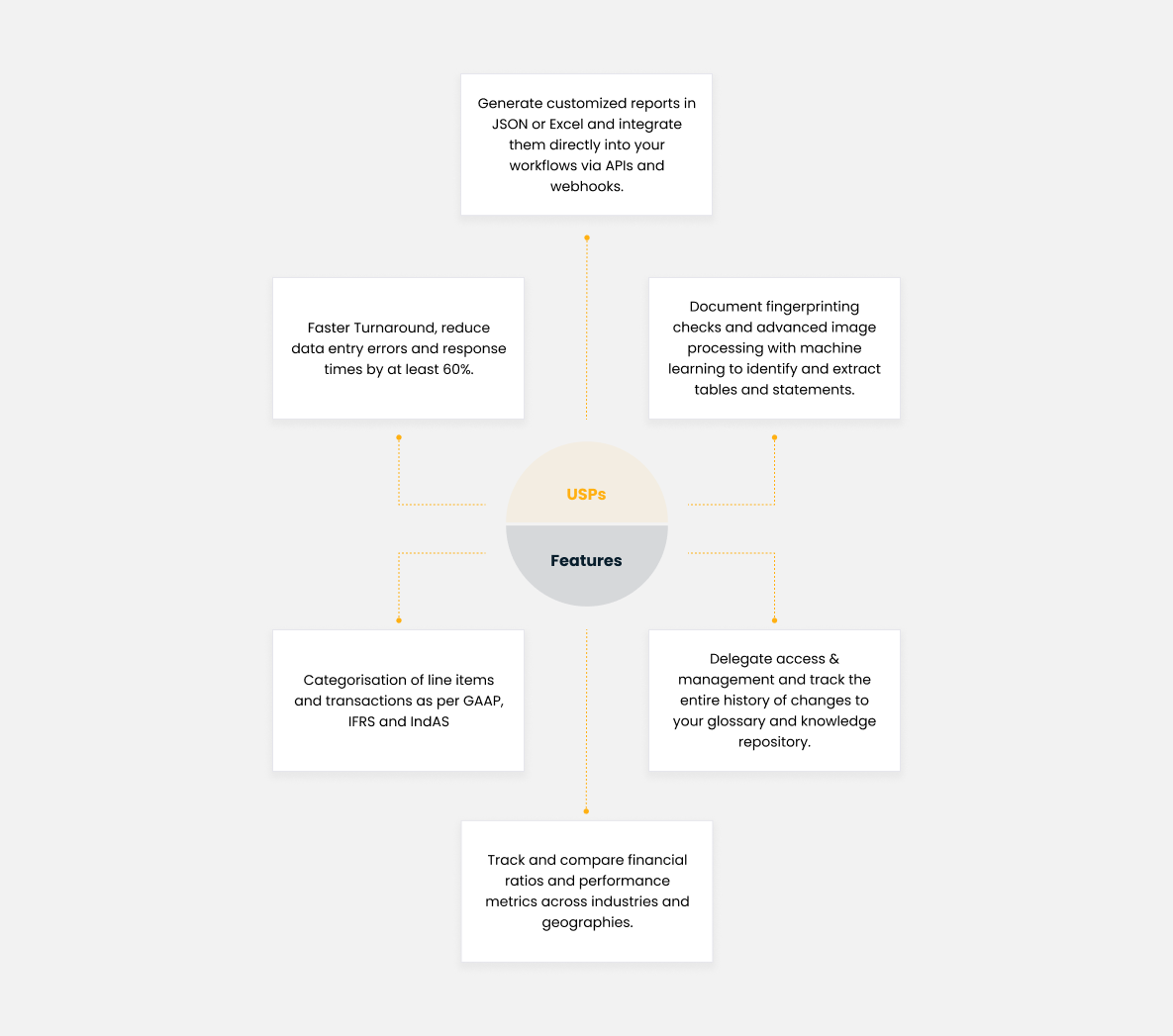

The system generates customized reports in formats such as JSON and Excel. These reports include financial ratios, key performance metrics, and other analytics that help make informed decisions. The solution also allows for direct integration of these reports into workflows via APIs and webhooks.

The Financial Statement Analyzer categorizes line items and transactions according to multiple accounting standards, including GAAP, IFRS, and IndAS. This allows for seamless global compliance and standardization.

- Faster turnaround time, reducing manual data entry and response times by 60%.

- Accurate extraction of tables and statements with machine learning.

- Seamless generation of reports that can be integrated into your workflows.

- Tracking and comparison of financial ratios across industries and geographies.

Cygnet’s financial statement analysis platform ensures data privacy and compliance with industry regulations. The system has built-in security protocols to protect sensitive financial information during processing and storage.

Yes, the platform is designed for easy integration via APIs and webhooks, allowing it to fit seamlessly into your current workflows without the need for significant changes to your IT infrastructure.