Audit and litigation don’t wait for the businesses to get tax-compliant ready; they strike when tax authorities demand answers. Even then, the real challenge is not the notices or audit but being unprepared with clean data when it arises.

Businesses rely on scattered systems, spreadsheets, emails, manual tax notice tracking, fragmented data, and notice handling, eventually ending up paying huge penalties, fines, interest, prolonged disputes, and reputational damage.

That is why GST litigation Management software have become important in the current times, when:

Audit scrutiny is intensifying with the use of AI and data analytics tools by tax authorities.

An increasing volume of notices and demands as no compliance gaps left unchecked.

Penalties are not forgiven, even for a minor lapse.

Data overload across departments where manual processes cannot keep pace.

Consequences of Non-compliance with Notices

Heavy penalties and fines– Businesses face penalties and fines when they miss deadlines, provide delayed responses, or do not comply with notices, depending on the severity of the case.

Adverse litigation outcome– Failing to submit a reply or submitting incorrect replies with missed documents can lead to negative or unfavourable outcomes or prolonged disputes.

Reputational damage– With piled-up cases, delayed responses, struggles with compliance, and adverse outcomes, businesses lose trust of investors, stakeholders, or partners.

Cash flow disruption– Increased demands, seized bank accounts, blocked refunds, and recovery actions can disrupt day-to-day liquidity.

Frequent scrutiny– Non-compliance with the law and notices can bring businesses into the radar of tax authorities, leading to frequent audits and notices.

Operational distraction– Management has to divert its focus from core business activities to notice handling, which can impact business outcomes.

Why manual tax notice tracking and management fail, and how the Automated Litigation Management System can fix it

Let’s understand the challenges faced by manual notice management and how an automated litigation management software can help businesses fix these challenges.

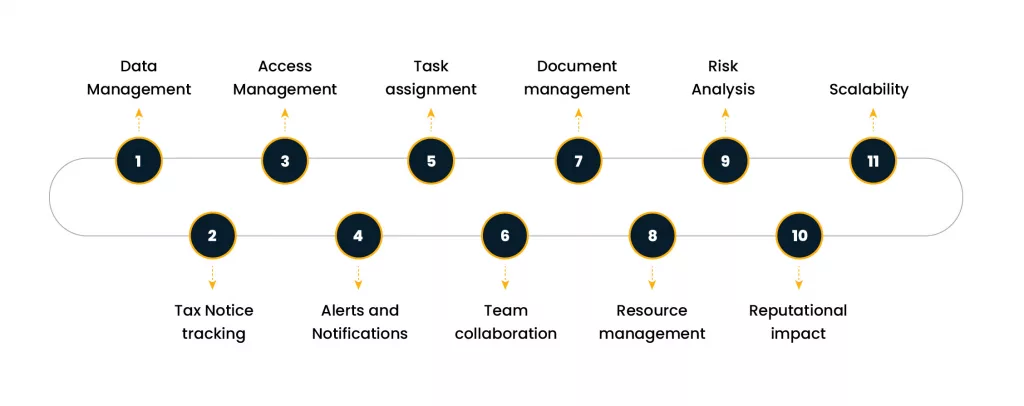

1. Data Management

Challenge: Data spread over emails, different systems, or folders, no timely extraction of notice details from portals, and paper files make it impossible for the business to maintain a single source of truth.

Solution: An automated LMS provides auto-fetching of notices from the portal and emails, and storage of notices and relevant supporting documents at a centralized repository with easy access and retrieval.

2. Tax Notice tracking

Challenge: Manual process doesn’t provide tracking of current notice status and full history of notices, such as the stage of notice, previous responses, orders, appeal details, etc, which can get lost in fragmented and manual notice handling.

Solution: LMS provides real-time tracking of current notice status as well as the entire notice history, helping the team to refer to past responses and create a strong defence without repeating previous mistakes.

3. Access Management

Challenge: There is no security and control over access to critical data or documents maintained manually, and they can be prone to misuse, information leakage, etc, as anyone can have easy access.

Solution: LMS provides role-based access management where only the assigned person can get access to the assigned task.

4. Alerts and Notifications

Challenge: Maintaining manual Excel sheets and email reminders for response submission deadlines or hearing dates can be prone to human errors. A single missed deadline can impact the case adversely, leading to penalties.

Solution: LMS facilitates automated alerts and notifications for cases approaching deadlines or personal hearings, ensuring timely responses and reminders.

5. Task assignment

Challenge: With a manual process, there is a lack of clarity on which department/person has to be assigned which task, or currently who is handling a particular task, and the status of their work completion, etc.

Solution: With automation, task assignments get automated based on predefined logics, and work can be done based on a set internal workflow, which ensures any timely escalation for delays in responses.

6. Team collaboration

Challenge: Often, various departments or individuals from the finance, tax, or legal teams work in silos without knowing the real-time status of each department, sharing updates over emails without maintaining common threads, leading to duplication or confusion.

Solution: With role-based access management, LMS provides seamless collaboration across departments, ensuring everyone works with the same version of data under a shared platform with real-time status.

7. Document management

Challenge: Documents in manual storage or without a central repository are often scattered over various paper files, emails, or system folders, which can be prone to manipulation, misplacement, or duplication.

Teams have to spend hours searching and organizing them, which may lead to inaccurate or incomplete document submission.

Solution: LMS provides tamper-proof, audit-ready, encrypted, and centralized document storage with easy archival and retrieval, ensuring the reliability of documents.

8. Resource management

Challenge: Teams waste hours updating spreadsheets, chasing emails, and manually drafting responses, wasting time that can be utilized for more strategic needs. Further manual processes can increase the risk of human errors and associated costs.

Solution: An automated workflow with LMS ensures routine tasks are automated, such as tracking notice status to drafting replies in predefined templates with the help of AI, which can save significant resources.

9. Risk Analysis

Challenge: Manual processing cannot find the risk associated with ongoing notices, and lacks pattern recognition, which could help in avoiding recurring issues.

Solution: LMS provides analytics and trend reports to recognize repetitive issues and patterns, which can help in preventing the same type of notices.

For ongoing notices, LMS can help with provisioning based on potential outcomes, such as possible, probable, and remote risk likelihood, and support the CFO or tax head in transparent reporting.

10. Reputational impact

Challenge: When notices are mishandled, disputes go on, and orders go against the business, creating a negative reputational impact among investors and stakeholders.

Solution: An LMS helps enterprises stay audit-ready, responsive, and transparent, preserving reputation with tax authorities, regulators, investors, and partners.

11. Scalability

Challenge: Manual notice tracking or handling is non-scalable with growing demands and notices, particularly in current times, where notices are getting piled up.

Solution- An automated LMS can handle a growing number of notices with minimal human intervention and without any errors or mishaps.

How Cygnet’s GST Litigation Management System helps your businesses

For CFOs and tax heads, GST notices aren’t just compliance tasks; they carry financial, reputational, and operational risks. Cygnet’s Litigation Management System (LMS) simplifies this complexity by bringing all notices into a single, centralized system, powered by automation and AI.

It ensures timely responses through smart alerts, enables accurate provisioning with risk classification, and provides real-time visibility into litigation exposure across GSTINs.

With instant audit-ready reports, CFOs can manage disputes proactively, safeguard cash flows, and strengthen stakeholder confidence, all while reducing the heavy costs of penalties and prolonged litigation.

Conclusion

In today’s compliance-driven environment, staying audit-ready is no longer optional; it’s a necessity. A robust litigation management software empowers enterprises to manage tax notices tracking and handling with accuracy, timeliness, and transparency, reducing risks while protecting both financial health and reputation.