For years, e-Invoicing sat in an uncomfortable middle ground. It was encouraged, sometimes incentivised, but rarely unavoidable. Most organisations treated it as a digitisation upgrade—helpful, but not urgent.

That changed decisively over the last few years.

By the end of 2025, tax authorities across regions had demonstrated that invoice-level data gives them something returns never could: immediate visibility into transactions as they happen. Once that became clear, the direction was inevitable. From 2026 onward, e-Invoicing is no longer an efficiency choice. It is becoming the default compliance mechanism.

This shift matters because it changes how enterprises operate, not just how they invoice. What follows is a grounded look at where mandates are headed, which countries matter most in 2026, and what “being ready” actually looks like in practice.

1. How e-Invoicing changed by 2025—and why 2026 is different

Not long ago, an “electronic invoice” usually meant a PDF attached to an email. That definition no longer holds.

Governments have drawn a clear line between electronic documents and true e-Invoices. True e-Invoices are structured data files, exchanged through regulated systems, validated automatically, and often reported to authorities in real time or near real time.

By 2025, three things had quietly settled across many jurisdictions. First, clearance and real-time reporting models proved workable at scale. Second, common standards such as PEPPOL formats and country-specific XML schemas became enforceable, not optional. Third, invoice data began feeding directly into VAT and GST controls, audit selection, and fraud analytics.

Once these elements were in place, voluntary adoption stopped making sense. From 2026 onward, enforcement—not experimentation—becomes the defining theme.

2. Countries to watch as new mandates arrive in 2026

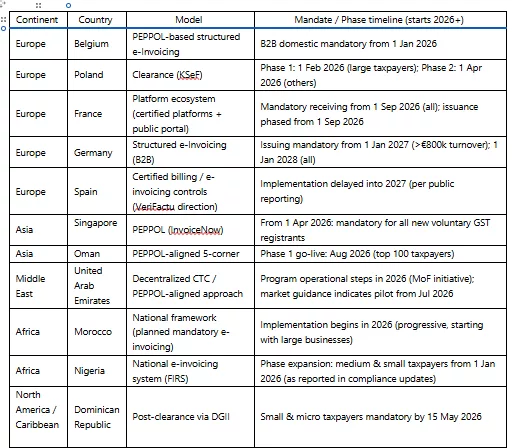

In Europe, Belgium will require structured B2B e-Invoicing for domestic transactions from 1 January 2026. PEPPOL will act as the default exchange framework, leaving little room for informal or document-based invoicing.

For enterprises operating across these jurisdictions, adopting a PEPPOL Accredited E-invoicing solution can simplify onboarding and help standardise compliant exchange.

France follows later in the year. From 1 September 2026, B2B e-Invoicing obligations begin rolling out in phases, starting with larger enterprises. France’s approach combines a central public portal with certified private platforms, adding an extra layer of operational complexity for businesses that assumed a single integration would be enough.

Across Asia, timelines differ but the direction is the same. Singapore’s InvoiceNow network moves closer to being a requirement rather than an option. From 1 April 2026, all new voluntary GST registrants must transmit invoice data electronically to the tax authority, with broader coverage expected over time.

Malaysia continues its MyInvois rollout based on turnover thresholds. As the mandate reaches medium and smaller businesses through 2026, readiness becomes less about awareness and more about execution. Oman, meanwhile, has announced a PEPPOL-aligned five-corner model, with Phase 1 expected around August 2026, initially targeting large taxpayers. The Philippines has extended its structured e-Invoicing deadlines, with 31 December 2026 emerging as a key compliance milestone.

In Africa, Zambia and Kenya provide early signals of what broader enforcement can look like. Zambia’s Smart Invoice regime is already mandatory and increasingly strict. Kenya’s eTIMS framework goes a step further by linking invoice validity directly to expense deductibility, making e-Invoicing part of everyday financial decision-making.

3. Understanding phased rollouts beyond the headline dates

One of the most common planning mistakes is treating e-Invoicing mandates as single dates on a calendar. In reality, most programmes unfold in stages.

Receiving capability often becomes mandatory before issuance. Large taxpayers are typically onboarded first, followed by smaller entities. Certification, sandbox testing, and registration requirements can appear months before legal enforcement begins.

For multinational groups, the challenge is rarely one deadline. It is the accumulation of many—each with different technical rules, networks, and documentation expectations. This is why readiness needs to be continuous, not reactive.

4. What actually breaks inside ERP and finance teams

When e-Invoicing projects struggle, it is rarely because the ERP cannot create an invoice. The problems surface after that point.

Master data issues are usually the first to appear. Buyer details, tax registrations, addresses, and classifications that once passed internal checks suddenly fail external validations. In a structured regime, these are not warnings. They are hard stops.

Invoice lifecycles also change in ways many teams underestimate. An invoice is no longer simply issued or paid. It is validated, accepted, rejected, corrected, resubmitted, and sometimes versioned. Each step affects accounting entries, tax reporting, and cash flow.

On the technical side, document exchange gives way to API-driven integration with portals or certified platforms. That introduces monitoring, retries, and failure handling—areas that typically fall outside traditional finance operations.

The cumulative effect shows up during close cycles. Rejected invoices delay recognition, trigger disputes, and create reconciliation gaps. At that point, e-Invoicing is no longer a compliance topic. It becomes a financial operations issue.

5. What real readiness looks like in practice

Being ready for e-Invoicing is less about passing a go-live test and more about surviving the first few months of production without chaos.

It starts with clarity around scope. Enterprises need a precise view of which entities, transaction types, and counterparties fall under which mandate. This is especially important where shared services or intercompany billing is involved.

Data standardisation follows. Organisations that establish a consistent internal invoice data structure find it far easier to adapt to local rules without repeatedly modifying ERP logic.

Master data governance then becomes unavoidable. Tax identifiers, legal names, addresses, and classifications stop being “admin data” and start functioning as compliance controls.

Equally important is exception handling. Rejections and corrections are not rare events during early adoption. Teams need ownership models, SLAs, and escalation paths before—not after—issues arise.

Finally, visibility matters. Dashboards, alerts, and reconciliation views are what allow teams to manage compliance rather than constantly chase it.

6. Where implementations commonly go wrong

Most failures are predictable.

Some organisations treat e-Invoicing as a file-format conversion exercise. Others underestimate how long onboarding, certification, and approvals will take. Many wait until rejections appear in production before defining correction workflows.

Another recurring issue is building one-off solutions for each country. These may work in isolation, but they accumulate technical debt and make the next mandate harder, not easier.

The underlying problem is perspective. When e-Invoicing is treated as a series of local projects, complexity compounds. When it is treated as a global capability, it becomes manageable.

7. Preparing for 2026 and beyond without repeated disruption

Enterprises that handle upcoming mandates well tend to share a few traits.

They track regulatory change centrally rather than relying on fragmented updates. They separate internal invoice data from country-specific compliance logic. They invest in integration layers that are monitored like any other critical system.

Just as importantly, they document operational playbooks for corrections, disputes, and audits, so compliance does not depend on individual knowledge. And they keep tax, finance, and IT aligned—not through one-off workshops, but through ongoing ownership.

With this approach, new mandates stop feeling like surprises. They become another configuration step in an already stable compliance environment.

Strategic takeaway for enterprises

By 2026 onward:

- More than 80 countries will either mandate or tightly regulate e-Invoicing

- Enterprises will operate multiple models simultaneously

- ERP-only approaches will not scale

- A global compliance layer becomes essential.

Closing thought

From 2026 onward, e-Invoicing is less about following rules and more about how enterprises structure trust in a digital economy. The organisations that adjust early will experience fewer shocks. The rest will learn the hard way—one rejected invoice at a time.

FAQs

1. What qualifies as a true e-Invoice under global mandates?

A true e-Invoice is a structured, machine-readable invoice exchanged electronically through a regulated network or certified platform. PDFs and scanned invoices generally do not qualify.

2. Are e-Invoicing mandates limited to B2B transactions?

Most initial mandates focus on B2B and B2G transactions, but several countries are gradually expanding scope to include B2C reporting.

3. Which region is moving fastest—Europe or Asia?

Europe is accelerating domestic B2B mandates, while Asia is integrating e-Invoicing directly with GST/VAT administration through phased onboarding and real-time reporting.

4. How early should enterprises start preparing?

Preparation should begin 12–18 months before the legal mandate, particularly where certification, sandbox testing, or PEPPOL onboarding is required.